- The Peel

- Posts

- UK Jobless Rate Climbs

UK Jobless Rate Climbs

UK unemployment rises and wages cool, spurring rate cut bets.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Investors await bank earnings with optimism

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Moelis

Deal Dispatch: M&A, IPOs, and other transactions

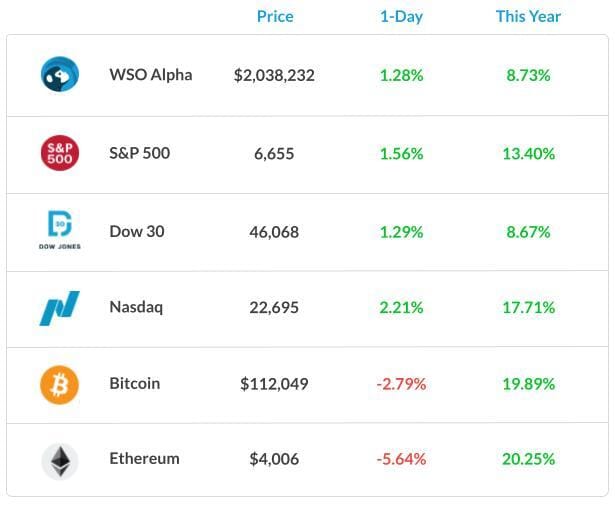

Market Snapshot

📉 Banana Bits

UK unemployment rises and wages cool, spurring rate cut bets.

Pop Mart soared as Tim Cook’s visit to the Labubu exhibition sparked interest.

RBA says monthly CPI and steady jobs backed the case to hold the rate.

Dollar rallies as traders brush off tariff worries.

Cr*pto slumps persist as China hits back against the U.S.

Most of China’s biggest defaulted developers are looking for restructuring.

OPEC keeps oil outlook unchanged as supply boosts.

Goldman sees U.S. consumers paying more than half of the tariffs.

Your upper hand

In a highly competitive market, deep knowledge of deal terms trends can be a powerful tool in moving to the next level. Build that knowledge with the 2025 SRS Acquiom M&A Deal Terms Study.

This isn’t a regurgitation of publicly available information or a lengthy list of things you and your boss(es) already know. No, every data point and insight comes from SRS Acquiom, the private-target M&A expert. This data draws on more than 2,200 private-target deals, valued at more than $505 billion, that closed between 2019 and 2024. This is invaluable deal terms intelligence from a proprietary private-target dataset you won’t find elsewhere.

Trends in valuations and earnouts, impacts of heightened due diligence, the prevalence of walk-away indemnity structures: It’s all here. So, if you’re looking for a ticket to knowing what’s market on private target deals—the kind of stuff that makes your clients and bosses take notice—this is the closest you’re going to get.

Market Recap

An Excited Earnings Ahead

Some are worried about Trump’s tariffs on China, while others are worried about the federal government shutdown.

Investors, on the other hand, are getting excited about the third-quarter earnings kickoff next week and why these earnings might be something to get excited about.

Banks will set the stage for earnings and can be an indicator of a good economy, with JPMorgan Chase, Wells Fargo, and Citigroup reporting earnings on October 14th.

This year might be different because normally, analysts start to get nervous about their third-quarter earnings per share forecasts, leading to downward revisions that can contribute to a September selloff. Yet this year, we experienced a green September.

In fact, analysts normally would have cut between 3% and 4% since the end of June, but this was the first year since 2023 that that didn’t happen.

What's Ripe

Bloom Energy Corp. (BE) 26.5%

Bloom Energy soared 27% after the company agreed to a $5 billion partnership with Brookfield Asset Management to construct factories to supply computing capacity and energy for artificial intelligence.

Broadcom Inc. (AVGO) 9.9%

Another win for AI companies. AVGO soared 9.9% in Monday Trading after announcing a partnership with OpenAI to develop and deploy 10 gigawatts of custom artificial-intelligence accelerators.

OpenAI, the maker of ChatGPT, will design the accelerators, while Broadcom will provide Ethernet and other connectivity solutions.

What's Rotten

Fastenal Co (FAST) 7.5%

The fastener maker reported third-quarter earnings of 29 cents a share, missing analysts’ estimates of 30 cents, but revenue of $2.13 billion matches expectations.

General Mills Inc (GIS) 2.4%

General Mills’ stock reached a 52-week low, touching $48.29, reflecting a challenging period for the $25.79 billion food manufacturer.

This downturn highlights the pressures and market conditions affecting General Mills, as it navigates through a competitive landscape and evolving consumer preferences.

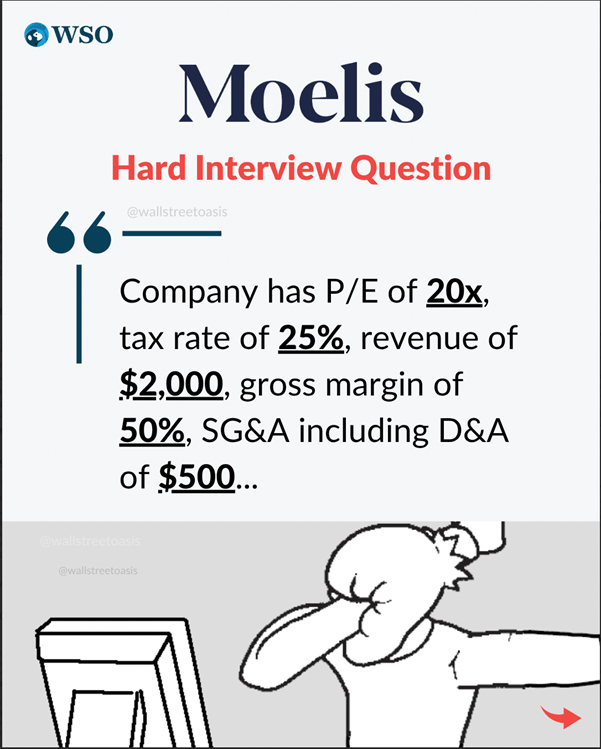

🧠 Technical Trip

Interview Q&A from Moelis

👉 Want 1-on-1 recruiting help from Moelis bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Huawei’s EV partner Seres said to gauge interest for $2 billion listing.

JPMorgan seeks to double its Asia assets to $600 billion by 2030.

LG India jumps 53% in trading debut after $1.3 billion IPO.

Gina Rinehart-backed Brazilian rare earths raises $78 million.

Grindr jumps the most in 15 months after report of buyout talks.

Most U.S. IPOs remain in limbo despite the SEC’s shutdown fix.

Standard Bank is said to be in talks to acquire Kenya’s NCBA.

Goldman buys Industry Ventures for as much as $965 million.

Banana Brain Teaser

Previous

For the positive numbers, n, n+1, n+2, n+4, and n+8, the mean is how much greater than the median?

Answer: 1

Today

If x(2x + 1) = 0 and [x + (1/2)] (2x - 3) = 0, then x = ?

Knowing what you don’t know is more useful than being brilliant.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick