- The Peel

- Posts

- Trump Warns Canada

Trump Warns Canada

Trump threatened Canada with a 100% tax if it deepens trade ties with China.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

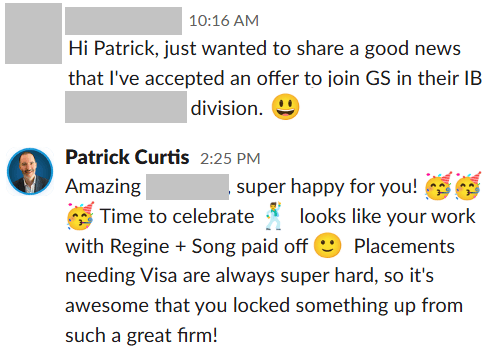

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: S&P posts its first two weeks' losses since June

What’s Ripe / Rotten: The tastiest and most disgusting stocks today

Technical Trip: Interview Q&A from PJT

Lesson from the Library: Discover how VCs pick winners, fund innovation, and turn bold ideas into billion-dollar exits.

Deal Deep Dive: M&A, IPO, and transaction breakdowns

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

Asian mining stocks climbed as investors leaned into uncertainty hedges.

Emerging-market currencies rose as the dollar kept sliding.

A new U.S. shutdown risk is brewing as Republicans threaten to block DHS funding.

Earnings season is coming for the “Magnificent 7” — time for Big Tech to prove it.

Trump threatened Canada with a 100% tax if it deepens trade ties with China.

The Fed isn’t expected to cut rates again until at least June, per surveys.

Market News

S&P Posts Its First Two Weeks' Losses Since June

Despite Friday’s green trading move, S&P still sustains a loss for the week, given this week’s uncertainty. The gauge erased Friday’s drop amid solid consumer sentiment and gains in most megacaps.

NVIDIA Corp. climbed 1.5% as China told tech firms they can prepare orders for H200 AI chips. Intel Corp. sank 17% on a tepid outlook. Small caps trailed the U.S. equity benchmark after beating it for 14 days.

The S&P 500 hovered near 6,915. A gauge of megacaps climbed 1%. The Russell 2000 fell 1.8%. The yield on 10-year Treasuries slipped one basis point to 4.23%. The dollar lost 0.7%. The yen jumped the most since August on speculation Japan could intervene to halt its slide.

While equities get a beating, commodities shine, with oil rallying amid the possibility of American military action in Iran and a massive winter storm in the U.S. Gold hit all-time highs. Silver topped $100. Copper rallied above $13,000.

Next Week will also be critical for the stock market as the “Magnificent 7” are set to release earnings. This will be a test of the gauge of their massive Capex spending. S&P 500 companies expect a 20% earnings growth.

What's Ripe

Booz Allen Hamilton Holding Corp. (BAH) 6.8%

BAH jumped 6.8%. The defense contractor posted fiscal third-quarter earnings of $1.77 a share on sales of $2.6 billion. Wall Street was looking for $1.27 and $2.7 billion.

Efforts to cut back on government spending have weighed on investor sentiment.

Fortinet Inc. (FTNT) 5.2%

FTNT rose 5.2% to $81.64. TD Cowen upgraded shares to Buy from Hold with a $100 price target, writing that negative sentiment and concerns over rising memory prices were “overblown.”

What's Rotten

Intel Corp (INTC) 17.0%

INTC slumped 17%. The company beat analysts’ estimates for fourth-quarter adjusted earnings and revenue, but issued a disappointing outlook for the current quarter.

Intel guided for first-quarter revenue of $11.7 billion to $12.7 billion. The midpoint of that range is below the consensus call of $12.6 billion.

The disappointing forecast looked set to snap a stellar run for Intel shares, which as of Thursday’s closing bell had risen 47% already in 2026.

Capital One Financial Corp. (COF) 7.6%

COF tumbled 7.6%. The credit card company said late Thursday that it had agreed to buy fintech platform Brex for $5.15 billion in cash and stock.

Separately, Capital One posted adjusted fourth-quarter earnings of $3.86 a share, well below the $4.14 analysts were expecting.

🧠 Technical Trip

Interview Q&A from PJT

👉 Want 1-on-1 recruiting help from PJT bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Venture Capital: From Idea to IPO

Discover how VCs pick winners, fund innovation, and turn bold ideas into billion-dollar exits.

🦈 Deal Dispatch

China’s Eastroc Beverage is seeking up to $1.3B in a Hong Kong IPO.

Blackstone and Carlyle are eyeing stakes in top Indian cricket teams.

China is deepening its review of Meta’s $2B Manus acquisition.

Highlands Coffee may pursue a $400M IPO in Vietnam.

DayOne is said to be targeting a $20B valuation in a US IPO.

Blackstone-backed Leica Camera is weighing a €1B sale.

📊The Daily Poll

What would a 100% tariff threat on Canada aim to achieve? |

Previous Poll:

What is driving energy stocks to record levels?

Geopolitical risk: 58.1% // Supply constraints: 11.6% // OPEC discipline: 7.0% // Speculative flows: 23.2%

Banana Brain Teaser

Previous

One hour after Yolanda started walking from X to Y, a distance of 45 miles, Bob started walking along the same road from Y to X. If Yolanda’s walking rate was 3 miles per hour and Bob’s was 4 miles per hour, how many miles had Bob walked when they met?

Answer: 24

Today

Coins are to be put into 7 pockets so that each pocket contains at least one coin. At most 3 of the pockets are to contain the same number of coins, and no two of the remaining pockets are to contain an equal number of coins. What is the least possible number of coins needed for the pockets?

If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick