- The Peel

- Posts

- Trump Turns to Rubio

Trump Turns to Rubio

Trump asked Rubio to lead a Venezuela reset after Maduro’s arrest.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Markets start 2026 on a cautious note

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Jane Street

Lesson from the Library: Step onto the trading floor — learn how real desks move markets, manage risk, and stay ahead of the curve.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

Trump asked Rubio to lead a Venezuela reset after Maduro’s arrest.

Nvidia says demand for its H200 chips in China remains strong, with supply holding up.

UK food inflation picked up again, adding fresh pressure on shoppers.

Nvidia rolled out new AI tools for self-driving cars and robotics.

Companies have already raised $37B from debt markets early in 2026.

Trump’s tax stimulus is expected to keep the U.S. economy humming next year.

Xi and South Korea’s Lee reaffirmed ties at their second summit in two months.

Market News

Markets Are Up Despite Escalating Geopolitical Tensions

Markets are up in Monday trading as investors snapped up tech shares even while the capture of Venezuela’s President Nicolas Maduro fanned worries over geopolitical risk. Oil prices and gold prices rose.

The Nasdaq 100 Index jumped 0.8%, with tech-focused megacaps such as Amazon.com Inc. and Tesla Inc. among the gainers. The benchmark S&P 500 Index followed suit, rising 0.6% as shares of energy companies and financials rallied, while the Dow Jones Industrial Average hit a new record.

The bullish case for equities remains intact,” according to Adrian Helfert, chief investment officer at Westwood. “Broader market leadership should look past Venezuela entirely unless cascading geopolitical events emerge.”

What's Ripe

Novo Nordisk A/S (NVO) 5.2%

ADR was 5.2% higher after the drugmaker launched a pill version of its blockbuster weight-loss drug Wegovy.

A starter dose of oral semaglutide will cost cash-paying customers $149 a month.

Chevron Corp. (CVX) 5.1%

Shares of Chevron, the last U.S. oil major still operating in Venezuela, climbed 5.1%. President Donald Trump said the U.S. has the “greatest oil companies in the world” and will be “very strongly involved” in the future of Venezuela’s oil industry.

The country remains a marginal contributor to Chevron’s production and cash flow for now.

Other oil-related stocks also rose. ConocoPhillips jumped 2.6%, Baker Hughes added 4.1%, Valero Energy gained 9.3%, Marathon Petroleum advanced 5.9%, and Phillips 66 was up 7.2%.

What's Rotten

CoreWeave Inc. (CRWV) 3.1%

CRWV fell 3.1% to $76.86, reversing earlier gains after a longtime skeptic on Wall Street upgraded the stock to Neutral from Underperform. The analyst in question, D.A. Davidson’s Gil Luria, raised his price target on the shares to $68 from $36.

Advanced Micro Devices Inc. (AMD) 1.1%

AMD fell 1.1%. The chip maker’s CEO, Lisa Su, is set to deliver the keynote address at the annual CES trade show on Monday, which could provide investors with a clearer view of how demand for artificial intelligence has been holding up.

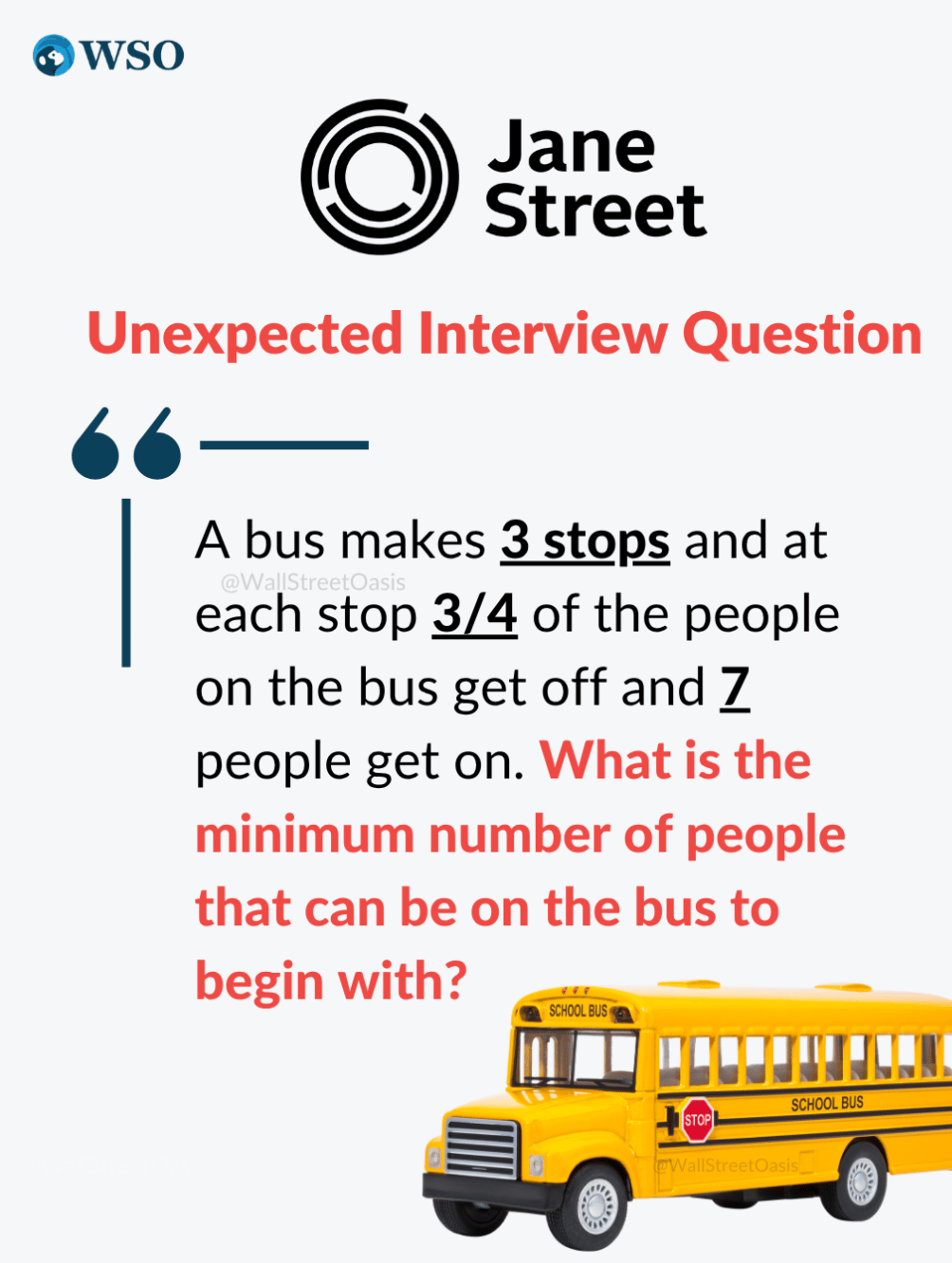

🧠 Technical Trip

Interview Q&A from Jane Street

👉 Want 1-on-1 recruiting help from Jane Street bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

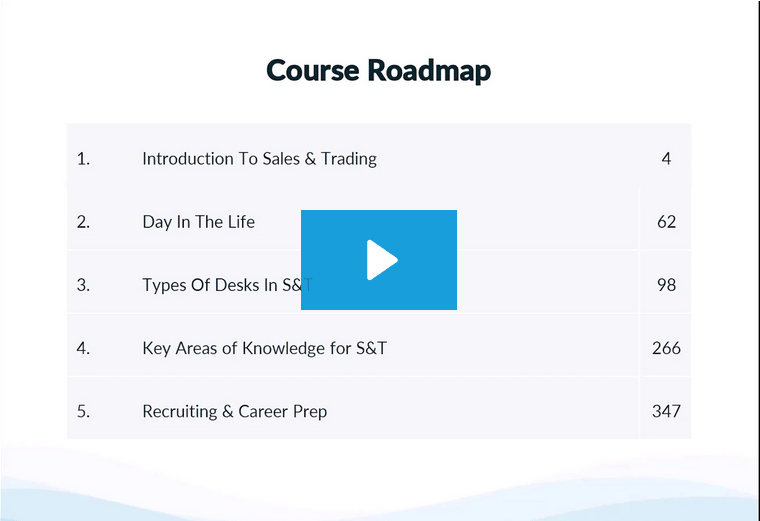

🎥 Sales & Trading: Inside the Markets

Step onto the trading floor — learn how real desks move markets, manage risk, and stay ahead of the curve.

🌟 Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Pratyay Gajbhiye, put together an impressive deep dive on Target Corp, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones.

🌟 WSO Academy Q4 Update

🎤 WSO Academy Speaker Series

We’ve now hosted four Speaker Series events with great guests across Investment Banking, Hedge Funds, and Asset/Wealth Management, and plenty more are in the works. Students can watch these past events on their dashboard:

Scott L. Bok – Chairman & CEO of Greenhill & Co.

Michael Harris – Vice Chairman & Global Head of Capital Markets at the New York Stock Exchange

Zach Levenick – Founder, THG Securities Advisors

John Morgan – Chief Investment Officer, Morgan Capital Family Office

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

The CEO of the maker of Salonpas, Hisamitsu, is moving to take the $2.9B firm private.

AI video advances sent Kuaishou shares soaring 84%.

Under Armour jumped after Fairfax disclosed a 22% stake.

Brazil’s PicPay filed for a U.S. IPO with Claure set to invest.

Aktis Oncology is targeting $212M in a Nasdaq IPO.

Universal Music is buying a 30% stake in India’s Excel Entertainment.

Big-name IPOs could land in 2026, with SpaceX, Anthropic, and OpenAI in focus.

📊The Daily Poll

Strong China demand for Nvidia chips tells you: |

Previous Poll:

If the U.S. uses oil pressure on Venezuela, who feels the hit first?

Venezuela: 44.4% // U.S. refiners: 25.6% // Global consumers: 16.7% // No one immediately: 13.3%

Banana Brain Teaser

Previous

Of the 150 houses in a certain development, 60 percent have air-conditioning, 50 percent have a sunporch, and 30 percent have a swimming pool. If 5 of the houses have all three of these amenities and 5 have none of them, how many of the houses have exactly two of these amenities?

Answer: 55

Today

How many of the integers that satisfy the inequality [(x + 2)*(x + 3)]/(x - 2) ≥ 0 are less than 5?

Special situations are simple in hindsight and terrifying in real-time.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick