- The Peel

- Posts

- Trump Plans Mass Firings

Trump Plans Mass Firings

Trump plans to fire thousands of federal employees amid the shutdown.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Global stocks rally as Japan tech joins AI boom

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with BlackRock

Student Spotlight: A+ Equity Research Report

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

Trump plans to fire thousands of federal employees amid the shutdown.

Hitachi shares soared after a collaboration with OpenAI.

Japan’s jobless rate edged up to the highest in over a year.

Brazil and China to create a $1 billion investment fund.

Elon Musk hates Netflix and told his followers to cancel subscriptions.

Tesla deliveries rose 7% amid the expiration of the EV tax credit.

Taiwan rejects the U.S. proposal for ’50-50′ chip production, and should focus on tariffs.

Bitcoin hits $120,000 for the first time since attaining a record high.

Market Recap

A Global Rally

The optimism in the stock market is not limited to the U.S. market. In Thursday trading, MSCI’s world index gained 0.1% after a slew of Japanese tech companies had announced significant partnerships with big U.S. peers.

Hitachi Ltd. soared 9% after announcing the collaboration with OpenAI, while Fujitsu Ltd. soared 5% on a partnership with Nvidia.

Even though the AI rally is so 2023, investors are still optimistic that billions poured into capex will translate into profits and extend gains in tech shares.

The S&P 500 and Nasdaq continue to set fresh records, with government shutdown risks failing to dampen market risk appetite. The rally underscored how bullish momentum in the sector is overshadowing concerns about the shutdown.

What's Ripe

USA Rare Earth Inc. (USAR) 23.4%

USAR soared 23.4% after CEO Barbara Humpton told CNBC that the rare earth miner is “in close communication” with the White House.

This comes after the U.S. government acquired a 5% stake in Lithium Americas and a 15% stake in MP Materials.

Stellantis (STLA) 7.8%

STLA soared +7.8% after the company announced plans to sell its car-sharing business Free2Move.

This comes after CEO Antonio Filosa looks to turn around the ailing automaker.

What's Rotten

Occidental Petroleum Corp. (OXY) 7.3%

The stock declined almost 7% in Thursday's trading after it announced plans to sell its OxyChem petrochemical unit to Berkshire Hathaway Inc.

The deal is worth $9.7 billion in cash, below the $10 billion threshold expected.

Edison International (EIX) 3.2%

Shares of power provider Edison International tumbled after the Trump administration canceled a federal grant to upgrade California’s electric grid.

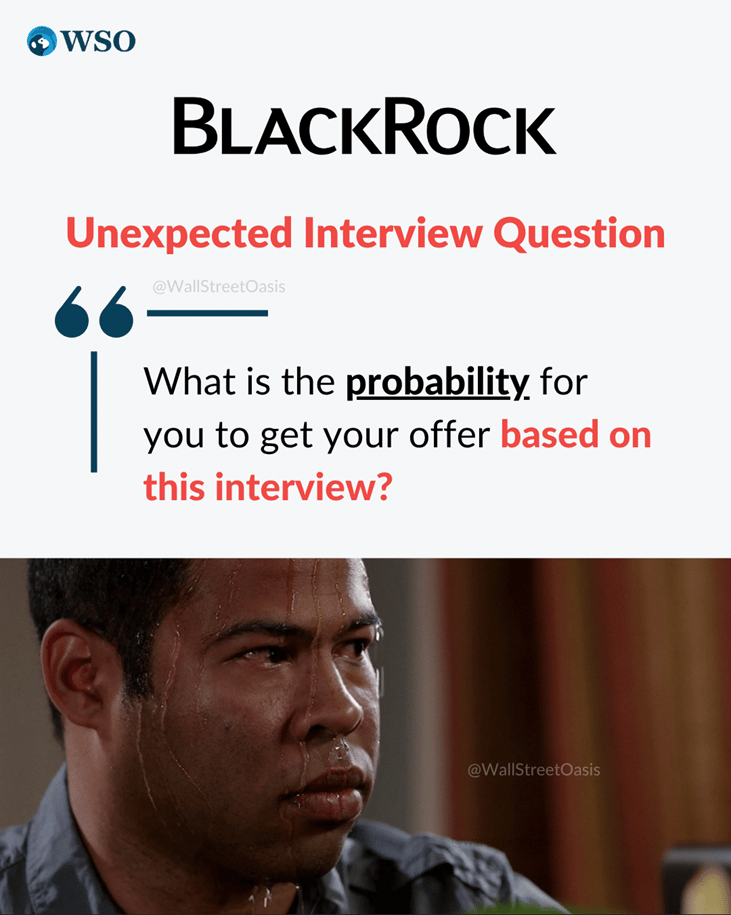

🧠 Technical Trip

Interview Q&A from BlackRock

👉 Want 1-on-1 recruiting help from BlackRock bankers & 2,000+ top mentors? Apply to WSO Academy

🌟 Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Nivedita Bishnoi, put together an impressive deep dive on e.l.f. Beauty, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

GIP nears $40 billion deal to buy aligned data centers in a bet on AI.

AI is dominating 2025 VC investing, pulling in $192.7 billion.

Blackstone hits $10 billion Asia buyout fund goal amid PE chill.

Dubai’s Binghatti said in talks with Citi, Morgan Stanley on IPO.

Alphabet plans sale, spinoff of Verily Unit, Executive Says.

📊The Daily Poll

Trump’s plan to fire thousands of federal workers is… |

Factory activity down 7 months straight =

Recession risk: 53.8% // Slow but steady: 24.3% // Market shrug: 17.1% // Overblown: 4.8%

Banana Brain Teaser

Previous

A certain characteristic in a large population has a distribution that is symmetric about the mean m. If 68% of the distribution lies within one standard deviation d of the mean, what % of the distribution is less than m+d?

Answer: 84%

Today

60% of the members of a study group are women, and 45% of those women are lawyers. If one member of the study group is to be selected at random, what is the probability that the member selected is a woman lawyer?

The investor’s chief problem—and even his worst enemy—is likely to be himself.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick