- The Peel

- Posts

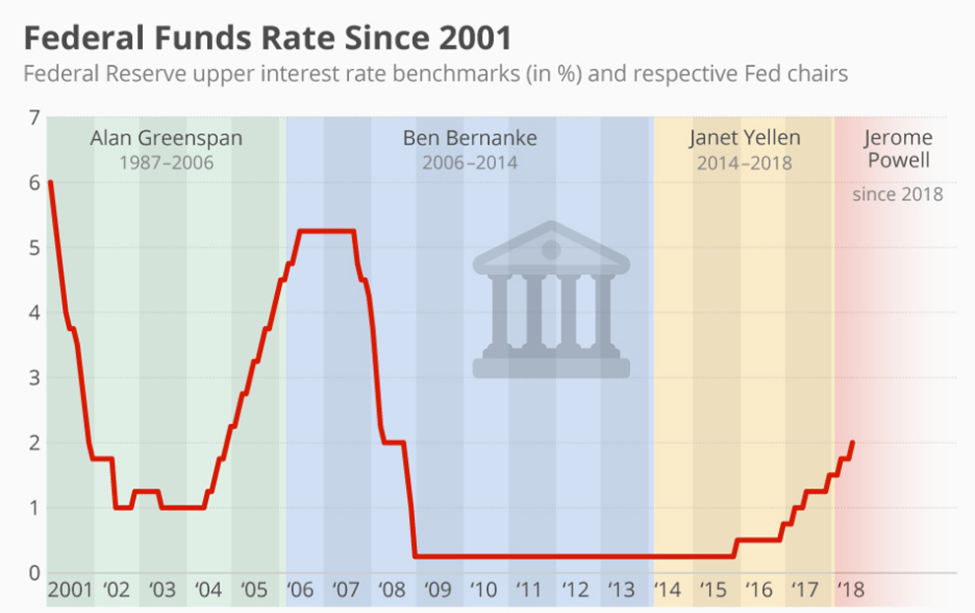

- Trump Pays the Fed a Visit

Trump Pays the Fed a Visit

🤵President Trump met with Jay Powell at the Federal Reserve’s headquarters.

In this issue of the peel:

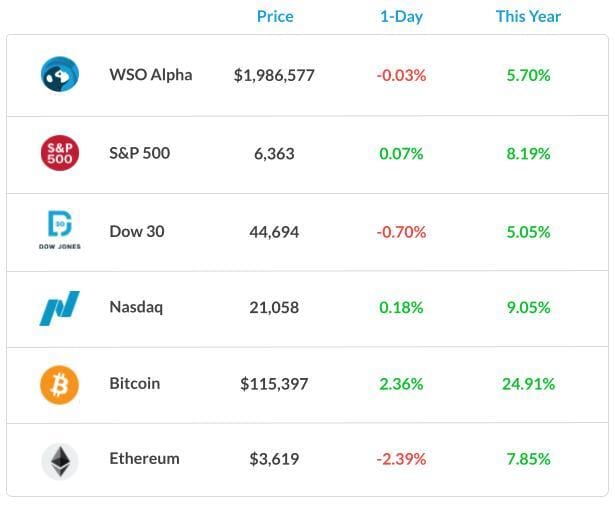

♭ Markets ended flat on the day as investors continue working through a busy earnings season.

🌯Chipotle’s stock got crushed after a lousy earnings report and guidance cut.

🤵President Trump met with Jay Powell at the Federal Reserve’s headquarters.

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Sebastian Morar, put together an impressive deep dive on Flywire Corp, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

Intel quietly reported a not-so-terrible earnings report yesterday.

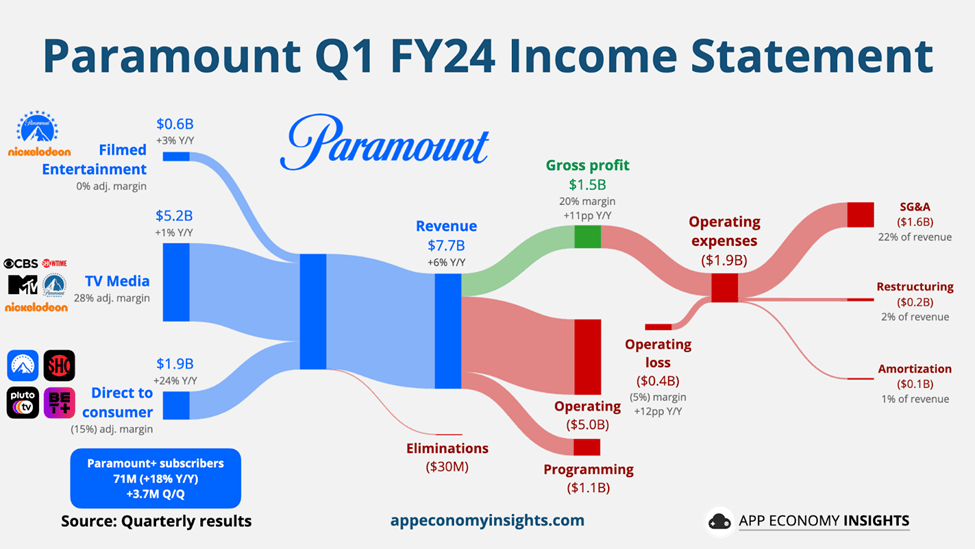

FCC finally approved a proposed $8bn merger between Paramount and Skydance.

The ECB left interest rates steady at 2% at their latest meeting yesterday.

Apparently, Apple is at the 26th iteration of iOS, which is being touted as the most significant in the company’s history.

The DOJ is launching an investigation into UnitedHealth’s billing practices.

Krispy Kreme is officially the newest meme stock on Wall Street.

The Daily Poll

Livestream FOMC meetings — |

Previous Poll:

Is finance going fully digital soon?

Yep: 38.5% // Slowly: 38.5% // Not Really: 17.3% // Never: 5.7%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

The Powell Trump Showdown

In a headline that feels like it was ripped from a Netflix political drama, Donald Trump rolled up to the Federal Reserve on Thursday for a rare face-to-face meeting with Fed Chair Jay Powell. The main topic? Interest rates. The main vibe? Drama.

It’s the meeting that everyone has been waiting for. After throwing jabs at the Fed Chair for years, demanding a 300 basis point cut immediately, and threatening to fire Powell if he didn’t follow through, let’s just say people had high expectations for an in-person meeting.

All in all, it was pretty uneventful besides an absolutely hilarious TikTok moment between the two arguing over the cost of renovations for the Federal Reserve building, not much happened.

The President brought up the idea to make the Fed’s internal policy meetings (aka FOMC meetings) fully public, as in, livestreamed-for-everyone public.

Right now, those FOMC meetings are closed-door affairs. Markets wait on Powell's post-meeting pressers and carefully worded statements to read between the lines. Trump’s proposal would crack that wide open, allowing the public to get a front row seat at the table, which doesn’t actually sound like a bad idea.

And it’s not just Trump pushing the transparency angle. A new lawsuit filed this week is trying to force the Fed to make those meetings public, arguing that the FOMC’s current format violates the Federal Advisory Committee Act. Translation: If you're deciding the economic fate of the country, maybe let the country in the room.

The Takeaway?

So what happens next? Nothing really. The Fed’s still independent, and Powell’s got a few more meetings on the calendar before November’s election. But with lawsuits, politics, and rate cuts all colliding together, the calendar will be nothing short of entertaining.

Career Corner

Question

One of the responses I received from a cold email was essentially, "If you're interested in the position, send me your CV." This is definitely positive, but I think a phone call would still help me learn more about the bank and allow me to discuss it in an interview. Should I simply say yes, I'm interested, and send him my CV, or should I ask for a quick phone call again?

Answer

You should definitely respond with your CV, and you can follow up by saying you would still love to chat if they have time.

Head Mentor, WSO Academy

What's Ripe

Bloom Energy (BE) 22.9%

Bloom Energy stock jumped on news that it landed a partnership with none other than Oracle. Just one of the largest database/cloud software companies in the world, if you’re keeping count.

Under the partnership, Oracle will leverage Bloom’s fuel cell technology to power its own data centers. The deal positions Bloom as a real player in both the clean energy solutions market and the AI data center market.

Nasdaq Inc. (NDAQ) 5.9%

No, not the exchange, but the actual company behind the exchange. Just in case you were confused. Nasdaq reported earnings, and to put it very simply, they crushed it.

Q2 EPS of $0.85 beat consensus by 6.3% and improved 24% YoY. The gain was driven by a better environment for IPO listings, along with the exchange recording 94 new company listings.

What's Rotten

Chipotle (CMG) 13.3%

Chipotle’s earnings report dropped yesterday, and the company took several Ls. Revenue came in at $3.06bn vs $3.11bn expected, and same-store sales decreased 4% as the company had lower foot traffic. They also cut sales guidance, estimating flat growth for next quarter versus low-single-digit growth in the prior estimate.

On the bright side, the company says that sales trends have been turning around since June, with customers slowly coming back for that new Adobo Ranch Dip.

Tesla (TSLA) 8.2%

Not sure there’s much I can say that you couldn’t have already figured out yourself. Musk’s dive into the political sphere is hurting Tesla in the short run. Q2 earnings missed analysts’ expectations, and sales declined for the second straight quarter, down 12% YoY. The culprit? The Big Beautiful Bill scraps EV tax credits, of which Tesla was a major beneficiary.

Investors will need to be patient, according to Musk, who stated that there will be “a few rough quarters.”

Thought Banana

A Hollywood Love Story

It’s official: the FCC just gave the go-ahead for the $8 billion Paramount–Skydance merger, and now we’re all about to get a front row seat to one of the messiest media takeover sagas in recent memory.

The deal has dragged on for years and involved painful edging, terminations, and major beef between members of the Redstone family. Skydance looks to be set to take the reins of the Paramount empire.

Here’s the backstory if you haven’t been following: Skydance, the production studio behind hits like Top Gun: Maverick and Mission: Impossible, has been eyeing a bigger seat at the Hollywood table.

Its billionaire backer, David Ellison (yep, Oracle founder Larry Ellison’s son), wanted to acquire National Amusements (the company that controls Paramount) and then merge the two media businesses into one. After a ton of back and forth, Shari Redstone, the longtime shot-caller at Paramount, finally agreed to the deal earlier this month.

Now that the FCC has signed off, the merger is expected to close by the end of September.

What does that mean? Basically, Skydance takes creative and operational control of a legacy media giant that’s been bleeding viewers, revenue, and relevance in the streaming wars. Paramount+ has been hanging on by a thread, and traditional TV assets like CBS and MTV aren’t exactly thriving in the TikTok era.

Skydance is hoping to inject some fresh energy into the studio, like:

AI-driven production tools

Franchise focus

A shift away from bloated legacy assets

The deal also puts a tech-savvy exec (Ellison) in charge at a time when legacy media desperately needs innovation to stay alive.

The Takeaway?

After a years-long back-and-forth of “will they, won’t they,” the deal seems to finally have the green light to close. But don’t expect overnight changes. The streaming business is still brutal, advertising is soft, and cable is dying slowly. This merger is more of a long-game bet: consolidate content, cut fat, and maybe, just maybe, turn Paramount into something Gen Z actually wants to watch.

The Big Question: Can Skydance reboot Paramount into a streaming-era powerhouse, or is this just a legacy studio on life support?

Banana Brain Teaser

Previous

The probability is ½ that a certain coin will turn up heads on any given toss. If the coin is to be tossed three times, what is the probability that on at least one of the tosses the coin will turn up tails?

Answer: 7/8

Today

What is the difference between the 6th and the 5th terms of the sequence 2, 4, 7, … whose nth term is n + (2)^(n - 1)?

Send your guesses to [email protected]

When most people say they want to be a millionaire, what they might actually mean is ‘I'd like to spend a million dollars.’ And that is literally the opposite of being a millionaire.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick