- The Peel

- Posts

- Trump Ends Canada Talks

Trump Ends Canada Talks

U.S. President Donald Trump plans to terminate all trade negotiations with Canada.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Wall Street cheers return of economic data

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Ares

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

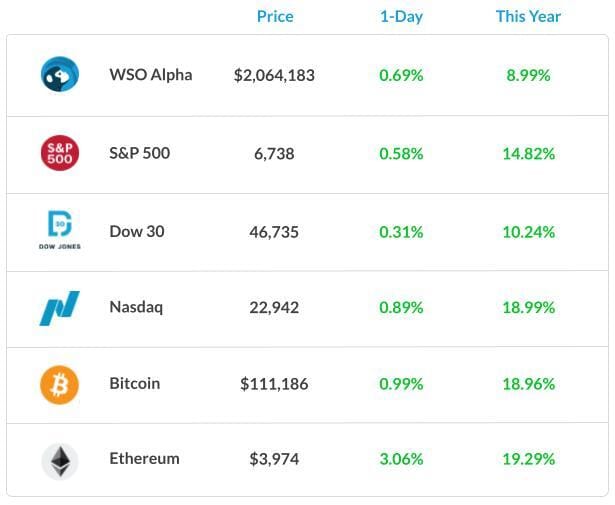

Market Snapshot

📉 Banana Bits

U.S. President Donald Trump plans to terminate all trade negotiations with Canada.

Oil is set for an uptrend after Russia’s sanctions.

U.S. Initial Jobless Claims rose last week, state data suggest.

Macron tells the EU to weigh using the strongest trade tool on China.

California Dreamin’: California billionaires faced a 5% tax on wealth.

Target to slash 8% of workforce, 1800 roles.

Binance’s token surges after founder CZ got pardoned by President Trump.

Market Recap

Finally Some Data

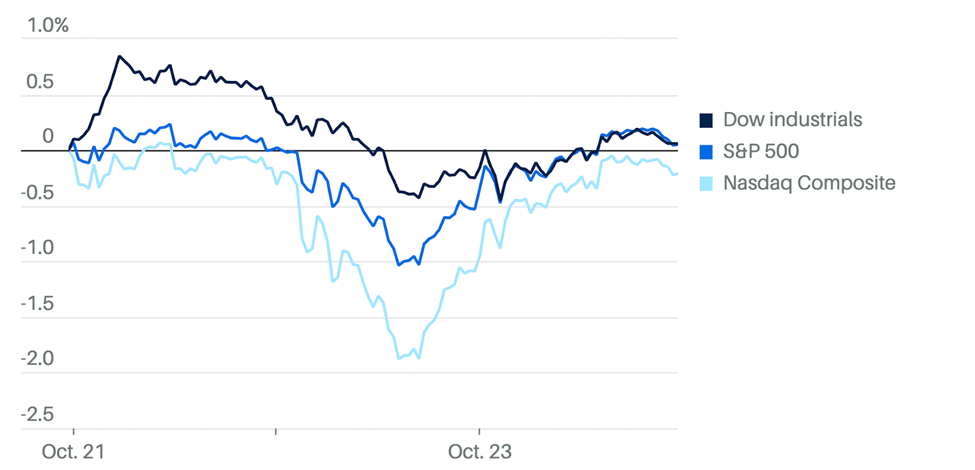

The stock market fared well yesterday, with major indexes advancing throughout the trading session. The Nasdaq Composite wrapped up the day up 0.9%. The S&P 500 was up by about 0.6%. The Dow Jones Industrial Average rose 144 points, or 0.3%.

All three major indexes approached their highest closing levels on record during the day. The uptrend is powered by Tesla, which helped drive today’s surge, clawing back all of its post-earnings losses from yesterday.

Finally, the market is about to see a miracle after the 24-day shutdown of the federal government. Investors, Fed watchers, and economists finally get government data.

Tomorrow, we finally get the September edition of the Consumer Price Index, thanks to the Social Security Administration’s need to have complete third-quarter inflation data to calculate inflation-adjusted benefit payments. Economists by FactSet forecast that the CPI rose 0.4% month over month in September, translating to annual growth of 3.1%.

What's Ripe

D-Wave Quantum Inc. (QBTS) 13.8%

QBTS soared 13.8% after The Wall Street Journal reported the Commerce Department was considering taking equity stakes in the companies in exchange for federal funding.

Peers such as IONQ and Rigetti Computing also rose 7.1% and 9.8% respectively.

Dow Inc. (DOW) 13.0%

DOW jumped 13% as the commodity chemicals producer reported an adjusted loss in the third quarter of 19 cents a share on net sales of $10 billion, versus Wall Street expectations that called for a loss of 31 cents on sales of $10.2 billion.

The operating profit of $180 million fell from $461 million a year earlier.

What's Rotten

Molina Healthcare Inc. (MOH) 17.5%

MOH tumbled 17% after it again cut its full-year guidance and reported lower third-quarter earnings because of underperformance in the healthcare-services provider’s marketplace business.

Net income of $79 million, or $1.51 a share, declined from $326 million, or $5.65 a year earlier. Adjusted earnings of $1.84 a share missed forecasts of $3.90.

Moderna Inc.(MRNA) 2.2%

Moderna fell 2.2% after saying it would stop development of a vaccine designed to prevent birth defects caused by cytomegalovirus, or CMV, once among its most-watched experimental programs.

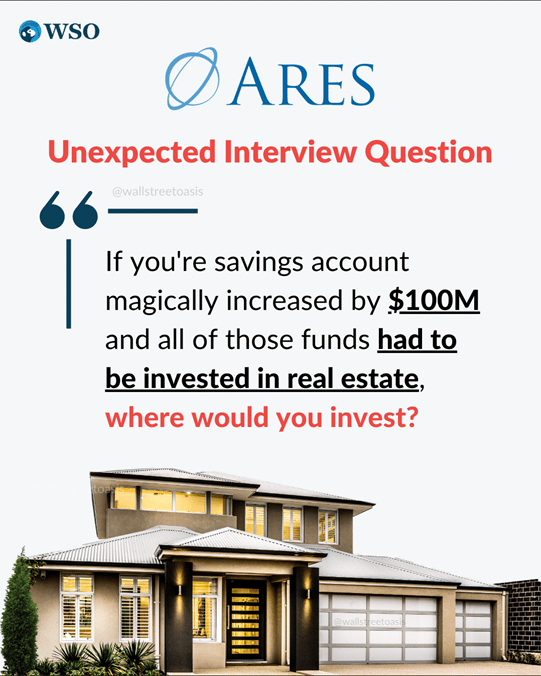

🧠 Technical Trip

Interview Q&A from Ares

👉 Want 1-on-1 recruiting help from Ares bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Meituan plans debut dim sum bonds in up to $1.4 billion sale.

Record $38 billion debt sale nears for Oracle-tied data centers.

Versant Media Group raises $2 billion ahead of Comcast spinoff.

OpenAI partner Crusoe is valued at $10 billion in a new funding round.

OpenAI acquires an AI startup founded by former Apple employees.

Google, Anthropic announce cloud deal worth tens of billions.

Cr*pto M&A surges 30-fold as niche firms shift to mainstream.

📊The Daily Poll

Cali’s new 5% wealth tax on billionaires , what's your take? |

Previous Poll:

The Dow just popped +200 points on day one of earnings season. How long does the optimism last?

A week tops: 31.1% // Through earnings: 33.3% // Until the Fed talks: 26.8% // Forever (we manifest): 8.8%

Banana Brain Teaser

Previous

A dealer originally bought 100 identical batteries at a total cost of q dollars. If each battery was sold at 50% above the original cost per battery, then, in terms of q, for how many dollars was each battery sold?

Answer: 3q/200

Today

The total cost for Company X to produce a batch of tools is $10,000 plus $3 per tool. Each tool sells for $8. The gross profit earned from producing and selling these tools is the total income from sales minus the total production cost. If a batch of 20,000 tools is produced and sold, then Company X’s gross profit per tool is?

Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick