- The Peel

- Posts

- Trade Talks Head to Malaysia

Trade Talks Head to Malaysia

U.S.-China trade talks set for Friday in Malaysia.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks slip as investors flee to safety

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with D.E. Shaw & Co.

Deal Dispatch: M&A, IPOs, and other transactions

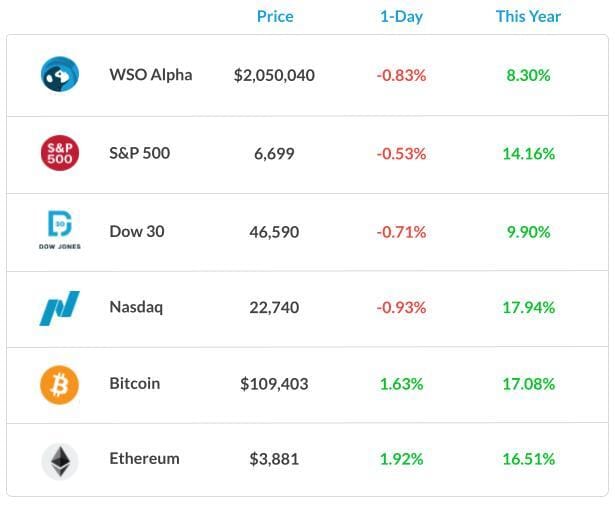

Market Snapshot

📉 Banana Bits

U.S.-China trade talks set for Friday in Malaysia.

Singapore’s core inflation rebounds as the cost of transport and healthcare inches up.

Meta is cutting roughly 600 AI jobs as the company aims to move faster.

BOJ watchers push back rate hike call after Takaichi takes helm.

Gold extends pullback after the biggest ETF drawdown since May.

Emerging Asia’s real yields surge vs nominal yields.

Oil jumps as Trump steps up pressure on Russia with sanctions.

Kering’s sales fall less than expected as new CEO takes over.

The AI Paradox in M&A: What's Next for Dealmaking?

UpSlide is hosting an exclusive webinar, bringing together thought leaders from KPMG, Forvis Mazars, Nomura, and Model ML to explore the real impact of AI on M&A workflows.

They’ll cover how the largest M&A teams are using AI to reshape the dealmaking experience from analysts to MDs. Plus, they’ll share insights on:

How AI is currently used across the deal lifecycle—and where it’s falling short

What’s missing from today’s strategies—and what could unlock fundamental transformation

The long-term vision: could one prompt generate an entire pitchbook?

You’ll gain actionable insights to streamline workflows, reduce costly review loops, and prepare your team for the next wave of automation—all while having your questions answered live.

Save the date:

📅 November 5th

⌚ 10:00 am ET

⌛ 45 minutes

Market Recap

Another Rough Day for the Markets

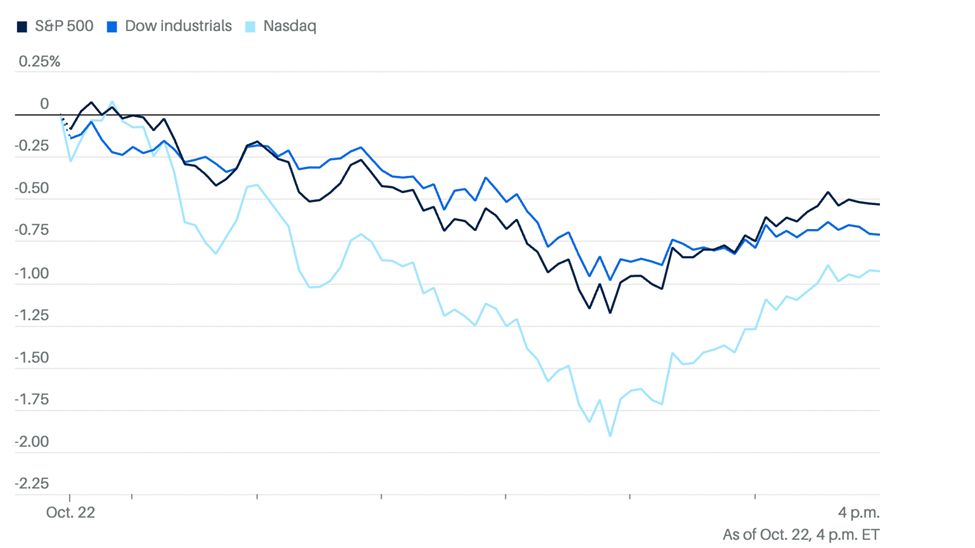

Wall Street was in risk-off mode during Wednesday’s trading, as investors scooped up consumer staples stocks and Treasury bonds while selling off tech shares.

The Nasdaq 100 lost 1% after a disappointing outlook from Texas Instruments Inc. and a 10% slump in Netflix Inc. In late hours, Tesla Inc. slid as earnings missed estimates despite a sales surge..

It led to broader indexes heading lower. The Nasdaq Composite dropped 0.9%. The S&P 500 fell 0.6%. The Dow Jones Industrial Average dropped 334 points, or 0.7%. The yield on the 10-year Treasury note fell to its lowest level since Oct. 3, to 3.95%.

The 2-year yield was down to 3.44%. Energy stocks also rallied as WTI crude oil futures perked up after a recent skid.

What's Ripe

Winnebago Industries Inc. (WGO) 28.5%

WGO surged 29% after the motor home manufacturer swung to a fourth-quarter profit as sales rose 7.8% to $777.3 million.

The company said the gains were “primarily due to favorable product mix and targeted price increases, partially offset by higher discounts and allowances.

Intuitive Surgical Inc. (ISRG) 13.9%

ISRG jumped 14% after the maker of robotic surgery systems posted third-quarter earnings that topped analysts’ estimates.

The company also said it expects growth of its da Vinci robotic surgical system of between 17% and 17.5% this year, higher than its prior forecast for growth between 15.5% and 17%

What's Rotten

Netflix Inc. (NFLX) 10.1%

NFLX declined 10% after the company reported third-quarter earnings that missed Wall Street estimates.

Netflix posted adjusted earnings of $5.87 a share, below expectations of $6.96, blaming an unexpected tax dispute in Brazil. Revenue of $11.5 billion matched expectations.

Texas Instruments Inc. (TXN) 5.6%

TXN fell 5.60% after the semiconductor company issued a disappointing earnings forecast for the fourth quarter.

Texas Instruments said it expects profit in the period of between $1.13 and $1.39 a share, which at the midpoint was below the Wall Street consensus of $1.41.

🧠 Technical Trip

Interview Q&A from D.E. Shaw & Co.

👉 Want 1-on-1 recruiting help from D.E. Shaw & Co. bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Genting Hotel’s $561 million Muni bond sale delayed over merger.

Polymarket is seeking funding at a valuation of up to $15 billion.

Prediction market Kalshi fields investor offers at $10 billion valuation.

Chinese humanoid robot maker raises $200 million ahead of IPO.

China chipmaker Yangtze Memory is said to consider an IPO next year.

Banana Brain Teaser

Previous

In an increasing sequence of 10 consecutive integers, the sum of the first 5 integers is 560. What is the sum of the last 5 integers in the sequence?

Answer: 585

Today

A dealer originally bought 100 identical batteries at a total cost of q dollars. If each battery was sold at 50% above the original cost per battery, then, in terms of q, for how many dollars was each battery sold?

Diversification is for those who don’t know where the risks really are.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick