- The Peel

- Posts

- Too Much Crude

Too Much Crude

Oil tumbles to five-month low on report of a “large surplus.”

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks mixed as gold shines and oil slips

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with DE Shaw & Co

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

TACO trade back in Spotlight as U.S. stocks reverse earlier losses.

U.S. stocks gain ground as Wall Street brushes off rising trade tensions with China.

Dow rises 200 points, Nasdaq erases some early losses after Powell says Fed balance sheet trimming could soon end; JPMorgan, Citi, and Goldman kick off earnings season.

The S&P 500 is edging up while the Nasdaq is lower as big banks report earnings and Fed Chair Jerome Powell speaks.

UK economy at risk of ‘bumpy landing’; JPMorgan’s Dimon warns of ‘more cockroaches’ after collapse of First Brands and Tricolor, as it happened.

Oil tumbles to five-month low on report of a “large surplus.”

Wells Fargo shares surge the most since 2016 after raising ROTCE target to 17-18%.

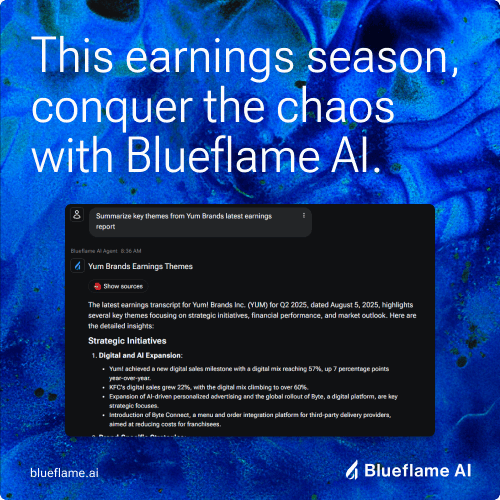

It’s Earnings Season: Cut Through the Noise with AI

It’s earnings season, and that means information overload. Blueflame AI delivers instant access to 70,000+ transcripts and SEC filings to help you spot key insights in less time.

With Blueflame AI you can:

Summarize earnings calls and financial reports

Ask questions across thousands of transcripts and filings

Compare performance across sectors and indices

Run automated workflows to identify key themes and trends over time

Analyze 100+ financial metrics across income statements, balance sheets, and cash flows

Whether you're tracking current investments or searching for new opportunities, Blueflame AI helps you uncover the insights that matter, faster.

Market Recap

A Balanced Trading Day

Stocks finished mixed today. The Dow gained, while the S&P 500 was roughly flat and the Nasdaq slipped as some big tech names cooled.

Traders weighed U.S.-China headlines against hopes that the Fed stays supportive. AP and Yahoo Finance both described the day as a back-and-forth session that steadied into the close.

Gold kept making news, driving records as investors looked for safety and bet on more rate cuts. That move pulled some attention away from riskier parts of the market.

Oil, meanwhile, eased after warnings about a potential supply glut. Reuters highlighted gold above $4,100/oz and crude settling lower on the day.

Overseas, Asia set a cautious tone after Japan’s market fell on political uncertainty and U.S.-China headlines. U.S. traders also faced limited economic data because of the government shutdown, so Fed commentary and earnings did more of the driving there.

Heading into tomorrow, attention remains on any new policy hints and whether the metals surge continues to affect equity segments.

What's Ripe

Wells Fargo (WFC) 7.2%

Wells Fargo rose after reporting a Q3 earnings beat and lifting its medium-term return on equity target to 17%-18%, which investors read as a stronger profitability outlook.

Investors liked signs that growth could accelerate now that the Fed’s asset cap has been lifted.

Domino’s Pizza (DPZ) 3.9%

The stock rose as sales and EPS topped estimates, which was helped by value deals and new times, which kept U.S. demand solid.

Coverage showcased that promotions and delivery/app improvements supported order volumes, boosting confidence in near-term growth.

What's Rotten

Arista Networks (ANET) 5.9%

The stock slipped as reports that Nvidia’s Spectrum-X is gaining traction with Meta and Oracle raised competitive pressure in AI data-center networking.

Investors fear that if big customers diversify toward rival platforms, Arista’s growth with hyperscalers could slow.

Intel (INTC) 4.3%

Shares fell after Bank of America downgraded the stock, saying the rally had gone “too far, too fast.”

The downgrade brought back worries about Intel’s pace in AI chips and the clarity of its roadmap.

🧠 Technical Trip

Interview Q&A from DE Shaw & Co

👉 Want 1-on-1 recruiting help from DE Shaw & Co bankers & 2,000+ top mentors? Apply to WSO Academy

2025 IB Working Conditions Survey

We Want Your Input!

Are you in investment banking? Take 2 minutes to share your experience on hours, compensation, and work-life balance in our 2025 survey. Your insights help shed light on real working conditions across the industry.

All responses are 100% anonymous, so you can be honest about your experience.

📝 Click here to participate and join others who are turning their experience into a voice for change in IB.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Rayonier and PotlatchDeltic agreed to an all-stock merger of equals to create a leading land-resources REIT.

BTG Pactual launches bid to buy the rest of Banco Pan, sending shares surging.

Accenture acquires Decho to expand Palantir and gen-AI services for public-sector clients.

BioCryst to acquire Astria Therapeutics, strengthening its hereditary angioedema portfolio.

Civista Bancshares and The Farmers Savings Bank received regulatory approvals for their proposed merger.

Banana Brain Teaser

Previous

If x(2x + 1) = 0 and [x + (1/2)] (2x - 3) = 0, then x = ?

Answer: -1/2

Today

Water consists of oxygen and hydrogen, and the approximate ratio, by mass, of hydrogen to oxygen is 2:16. Approximately how many grams of oxygen are required in 144 grams of water?

Live within your income and save so you can invest. Learn what you need to learn.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick