- The Peel

- Posts

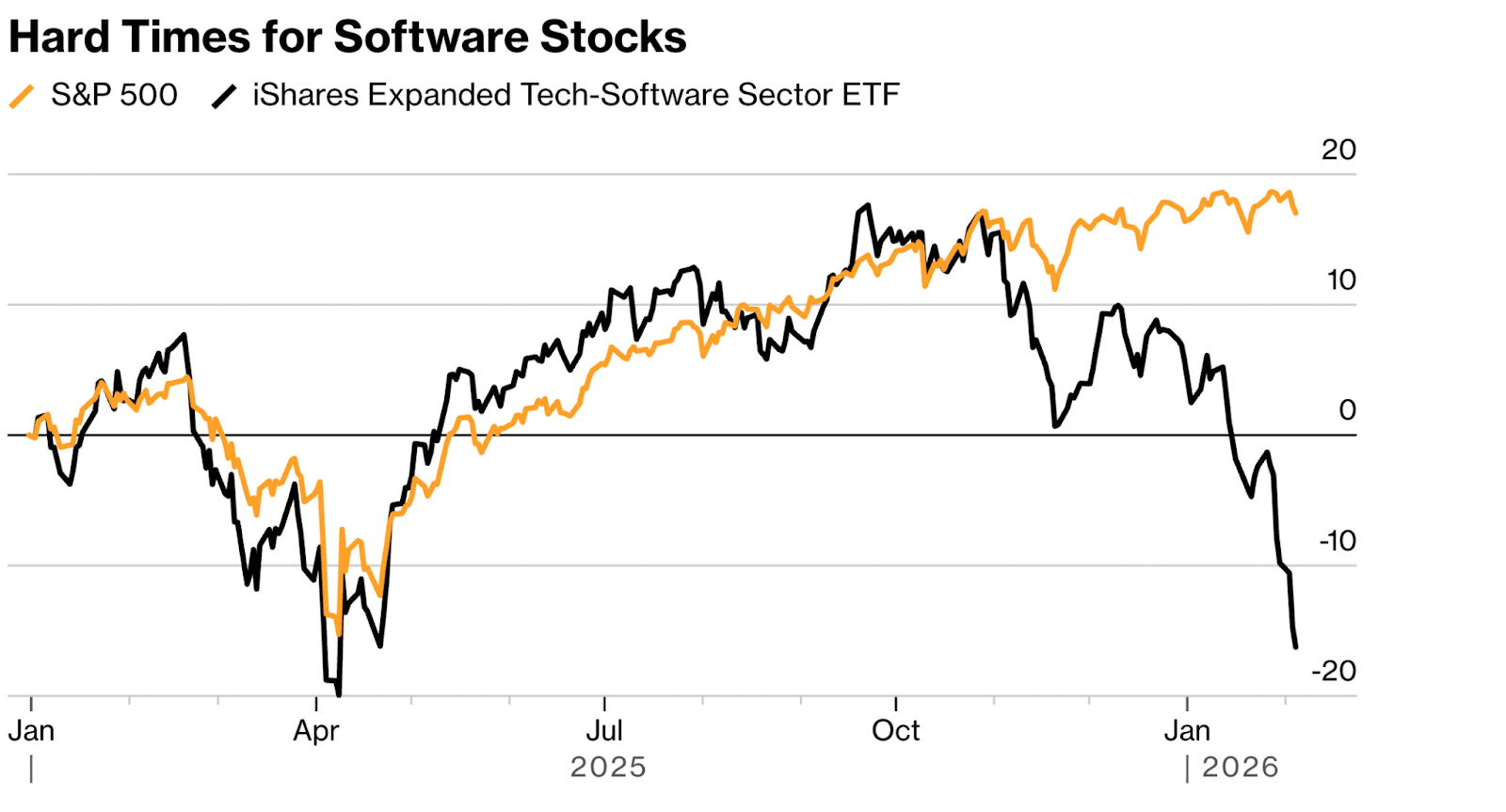

- The SaaS-pocalypse Hits

The SaaS-pocalypse Hits

The “SaaS-pocalypse” erased hundreds of billions in market value.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: ‘SaaSpocalypse’ is on the hunt for complacent software companies

What’s Ripe / Rotten: The tastiest and most disgusting stocks today

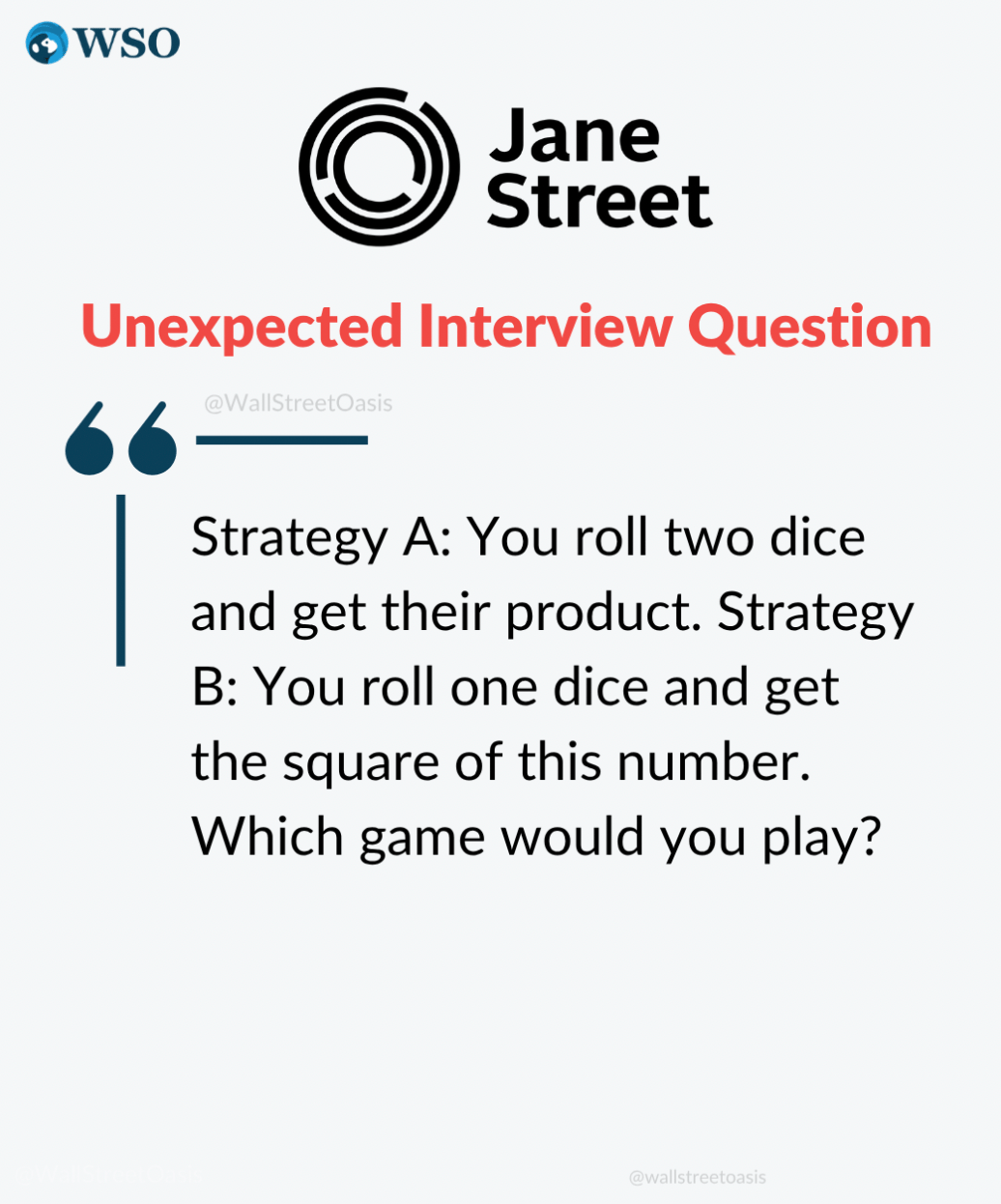

Technical Trip: Interview Q&A from Jane Street

Lesson from the Library: Build clean, defensible DCF models from forecasts to valuation.

Deal Deep Dive: M&A, IPO, and transaction breakdowns

The Daily Poll: See how you stack up

Student Success Corner: He quit with no offer; now he’s joining a top M&A team

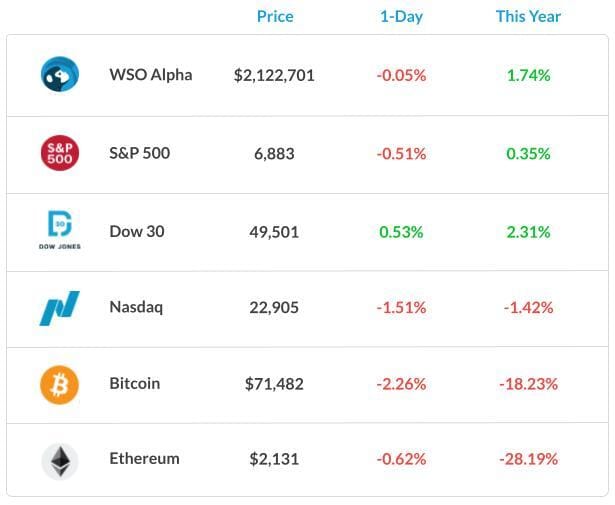

Market Snapshot

📉 Banana Bits

China is pausing Panama-related deals after port operations were halted.

Banks and hedge funds are hunting traders who can profit from volatility.

Weak memory-chip pricing is still squeezing company margins.

The “SaaS-pocalypse” erased hundreds of billions in market value.

Prediction markets got the green light after the CFTC dropped its ban proposal.

Market News

‘SaaSpocalypse’ Is on the Hunt for Complacent Software Companies

Equities have pared some losses in Wednesday Trading after the U.S. and Iran had made a deal on nuclear talks.

The S&P 500 suffered mild losses, while the tech-heavy Nasdaq 100 fell sharply. Investors are currently cautious about software firms, as new AI tools could disrupt their business models.

Yesterday, however, chipmakers also got a beating after Alphabet Inc. reported solid revenue, but said it plans to spend far more than investors expected in 2026. Qualcomm Inc. gave a tepid outlook. Arm Holdings Plc’s forecast fails to satisfy skeptical investors.

The S&P 500 fell 0.5%. The Nasdaq 100 saw its worst two-day rout since October and breached its 100-day moving average. The iShares Expanded Tech-Software Sector ETF slid 1.8%. The gauge of chipmakers slipped 4.4%. Advanced Micro Devices Inc. sank 17% on a disappointing forecast.

B*tcoin slumped 4.6% to $72,627, with prediction traders betting the world’s most-popular cr*ptocurrency will drop below $65,000. The yield on 10-year Treasuries advanced one basis point to 4.28%. The dollar added 0.3%, oil rose, while gold remained at $5,000.

What's Ripe

Silicon Laboratories Inc. (SLAB) 48.9%

SLAB soared 49% to $203.41 after Texas Instruments confirmed it would buy the chip designer for $231 per share in cash, representing an enterprise value of about $7.5 billion.

Eli Lilly & Co. (LLY) 10.3%

LLY jumped 10% after the drugmaker posted fourth-quarter earnings that blew past Wall Street’s expectations.

Revenue of $19.3 billion also topped estimates of $17.9 billion. Lilly issued a better-than-expected forecast for 2026.

What's Rotten

Boston Scientific Corp. (BSX) 17.6%

BSX slumped 18%. The medical-device maker topped fourth-quarter earnings expectations but offered a gloomy outlook for the current quarter.

Advanced Micro Devices Inc. (AMD) 17.3%

AMD fell 17%. Shares slumped even after the chip maker posted fourth-quarter earnings and revenue that topped analysts’ estimates and issued better-than-expected guidance.

The decline in shares may be due to profit-taking.

🧠 Technical Trip

Interview Q&A from Jane Street

👉 Want 1-on-1 recruiting help from Jane Streetbankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 DCF Modeling Course: Valuing Cash Flow, Not Hype

Build clean, defensible DCF models from forecasts to valuation.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Malaysia plans to focus on fewer, larger IPOs this year, the bourse chief said.

Power equipment maker Forgent raised $1.5B in its IPO.

AI startup ElevenLabs more than tripled its valuation to $11B.

SpaceX opened IPO pitch talks to non-U.S. banks.

Wall Street broker Clear Street is seeking $1.05B in an IPO.

Bob Iger built Hollywood’s biggest brands through $100B in M&A.

📊The Daily Poll

What’s hurting chip companies the most right now? |

Previous Poll:

Why did Indian markets jump so hard?

U.S.-India deal: 62.5% // Foreign money: 5.9% // Short squeeze: 4.8% // All of it: 26.8%

Student Success Corner

He Quit With No Offer — Now He’s Joining a Top M&A Team | IB Success Story

👉 Check out more on WSO YouTube

Banana Brain Teaser

Previous

Of the 300 subjects who participated in an experiment using virtual-reality therapy to reduce their fear of heights, 40% experienced sweaty palms, 30% experienced vomiting, and 75% experienced dizziness. If all of the subjects experienced at least one of these effects and 35% of the subjects experienced exactly two of these effects, how many of the subjects experienced only one of these effects?

Answer: 180

Today

Last year, the price per share of Stock X increased by k%, and the earnings per share of Stock X increased by m%, where k is greater than m. By what percent did the ratio of price per share to earnings per share increase, in terms of k and m?

Real innovation is hard to copy because the competition doesn’t understand why it works.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick