- The Peel

- Posts

- Tech Rally Loses Steam

Tech Rally Loses Steam

Tech stocks are continuing to fall after a record run as investors take profits.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Recap: The Fed’s double dissent

Technical Trip: Interview Q&A from Ares

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

Tech stocks are continuing to fall after a record run as investors take profits.

The recently released Fed minutes show a team that is divided on pretty much everything.

Despite technically beating earnings reporting EPS of $2.05 vs. $2.03, Target’s sales dropped from last year, and they fired their CEO.

Lowe’s reported EPS of $4.33 vs. $4.24, beating estimates, and announced an acquisition.

OpenAI had its first of many $1 billion revenue months.

The Government has snapped up nearly $100 million in bonds so far this year.

Will we ever see mortgage rates below 6% again? Here’s what economists are saying.

Sony is hiking PlayStation 5 prices by $50 in the US to get ahead of tariffs.

100× Analyst Insights with Excel & AI

Move faster than the competition with AI that works like 100 analysts—tireless, consistent, and tuned to how your firm operates. Patterns connects Excel, SQL, and Python into one intelligent research engine that never forgets.

Extract financials, run models, find comps, and generate deal memos in minutes. Every query, spreadsheet, and analysis compounds into a living institutional memory—so no insight is lost and no work is wasted.

Whether you’re diligencing a $10M Series A or pushing a billion-dollar transaction across the line, Patterns gives you scalable research power once reserved for the biggest firms. Generate alpha, build conviction faster, and free your team to focus on strategy—not grunt work.

Market Recap

A Divided Fed

Stocks slid again on Wednesday, led by a second straight day of losses in big tech. The Nasdaq dropped about 0.7%, the S&P 500 slipped 0.2%, and the Dow barely moved.

Investors are cashing in after a huge rally (some tech names have surged 80% since April), and that profit-taking is hitting Nvidia, AMD, and the mega-caps like Apple, Amazon, Alphabet, and Meta.

Meanwhile, Target fell 6% after reporting a sales drop YoY and firing their CEO, while Lowe’s gained slightly after strong earnings and announcing an acquisition.

The Fed’s latest meeting minutes show that officials are split down the middle on what to do next with interest rates. Most members are still focused on fighting inflation, especially since new tariffs could keep prices higher for longer.

Some, however, think the effects of tariffs will fade quickly and worry more about slowing job growth. This split even led to two Fed governors publicly dissenting and calling for an immediate rate cut, something that hasn’t happened this year. Trump even called for the removal of Lisa Cook.

Despite the cautious tone, investors are still betting the Fed will cut rates in September (85% odds), especially after weaker labor market data. All we know is there is more drama to come from the Jackson Hole meetings this week!

At the same time, political pressure is heating up, with President Trump pushing for lower rates and even targeting specific Fed officials.

Overall, the Fed is caught between keeping inflation under control, supporting jobs, and navigating political noise, and their next move will depend heavily on how the data comes in over the next few weeks.

What's Ripe

Analog Devices (ADI) 6.3%

Analog Devices beat on earnings and forecasted $3.0 billion for next quarter’s revenue, ahead of estimates for $2.8 billion. They also forecast $2.22 EPS versus $2.03 expected.

The beat was driven by the Industrial segment (45% of the company’s total revenue), which grew 23% and the Automotive segment, which grew 22%.

Medtronic (MDT) 3.7%

Medtronic reported revenue of $8.6 billion, increasing 8.4% YoY. They also raised FY26 EPS guidance and reiterated FY26 revenue growth guidance.

The beat was driven by Cardiac Ablation Solutions, which increased nearly 50%, including 72% in the US, on the strength of pulsed field ablation (PFA) products.

What's Rotten

Target (TGT) 6.3%

Although Target beat earnings, they had a pretty low bar to cross. The company reported EPS of $2.05 vs. $2.03 and revenue of $23.97 billion, which was right in line.

Sales decreased from last year, and they also announced the firing and replacement of their CEO after the company’s stock declined 64% in the past 4 years.

Dell (DELL) 5.0%

Dell shares came under pressure ahead of Q2 earnings on August 28, making investors nervous about whether the company’s AI momentum can outweigh short-term volatility.

The drop mirrors a wider slide in mega-cap tech and semiconductor stocks, from Oracle to Nvidia, on AI growth concerns.

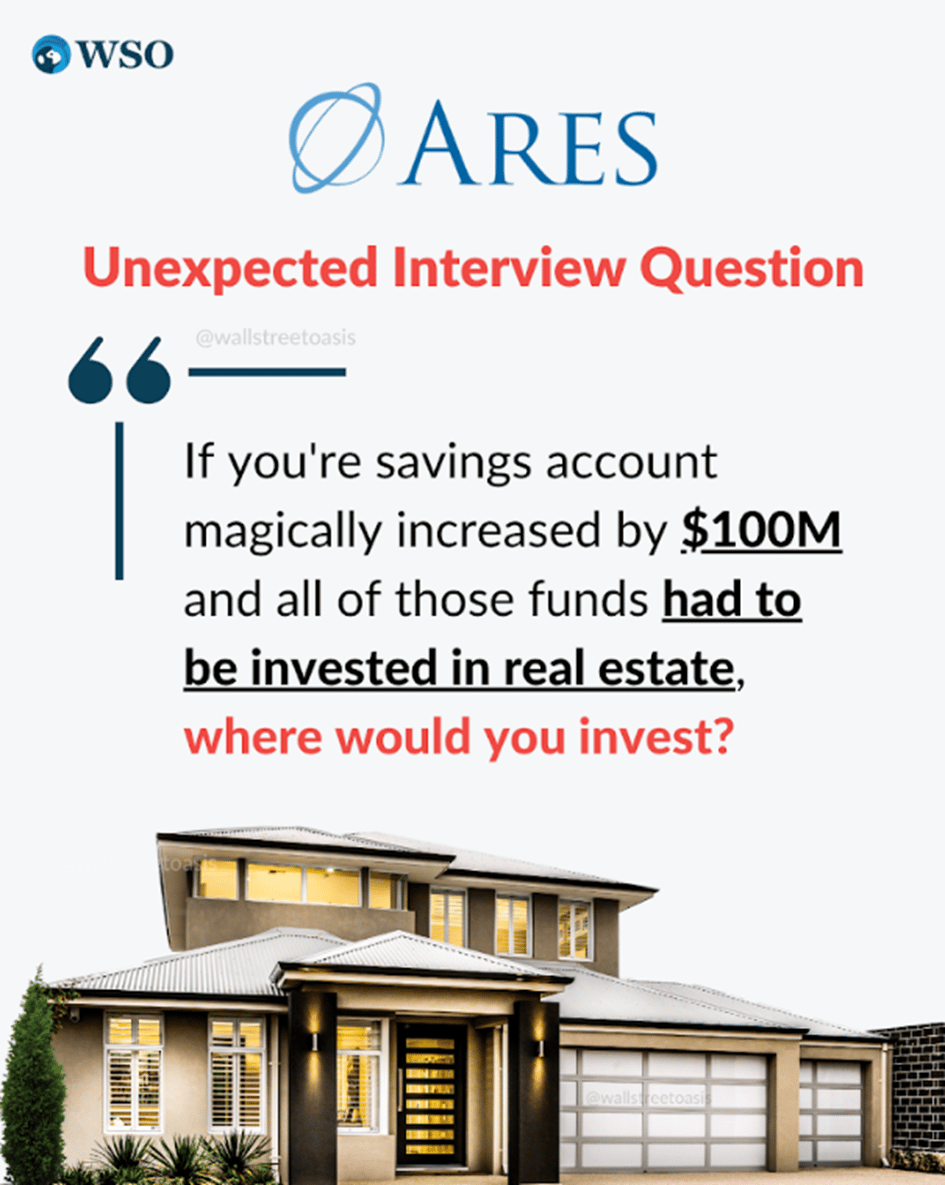

🧠 Technical Trip

Interview Q&A from Ares

👉 Want 1-on-1 recruiting help from Ares bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Lowe’s is set to acquire Foundation Building Materials for $8 billion, beating out Home Depot’s bid.

Nabors sold Quail Tools to Super Energy for $600 million.

Blackstone’s Verdun Perry sees private market secondaries transaction volume hitting $400 billion in the next five years.

Honeywell-backed company Quantinuum is considering raising capital at a $10 billion valuation.

Guess? Inc. is going private in a $1.4 billion deal with Authentic Brands. Shareholders will get $16.75 a share in cash, a 26% premium.

PE firm Thoma Bravo is in advanced talks to buy Dayforce Inc. for $70 a share, giving Dayforce an equity value of about $11.2 billion.

Lowe’s is acquiring Foundation Building Materials for about $8.8 billion in cash to accelerate its push to serve more professional customers.

Asian healthcare-focused private equity firm Quadria Capital is considering selling pharmaceutical company Encube for $2 billion.

Banana Brain Teaser

Previous

A border of uniform width is placed around a rectangular photograph that measures 8 inches by 10 inches. If the area of the border is 144 square inches, what is the width of the border, in inches?

Answer: 3

Today

If n = (33)^ 43 + (43)^ 33, what is the units digit of n?

Investors cash in small, easy‑to‑take profits and hold their losers. This tactic is exactly the opposite of the correct investment procedure.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick