- The Peel

- Posts

- Tax Leak Fallout

Tax Leak Fallout

Trump says he’ll sue the IRS over leaked tax return data, seeking $10B.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Equities rebound while metals slump

What’s Ripe / Rotten: The tastiest and most disgusting stocks today

Technical Trip: Interview Q&A from Ares

Lesson from the Library: Learn the frameworks and thinking styles that help you ace every case.

Deal Deep Dive: M&A, IPO, and transaction breakdowns

The Daily Poll: See how you stack up

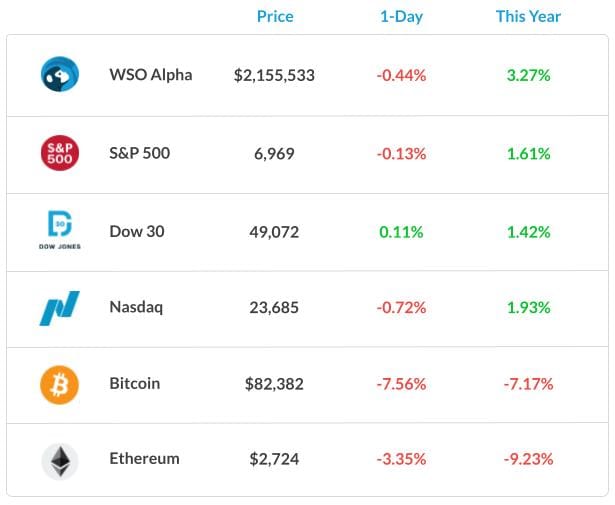

Market Snapshot

📉 Banana Bits

A new Fed leadership pick could be named as soon as Friday.

Trump says he’ll sue the IRS over leaked tax return data, seeking $10B.

Trump threatened tariffs on countries that continue trading with Cuba.

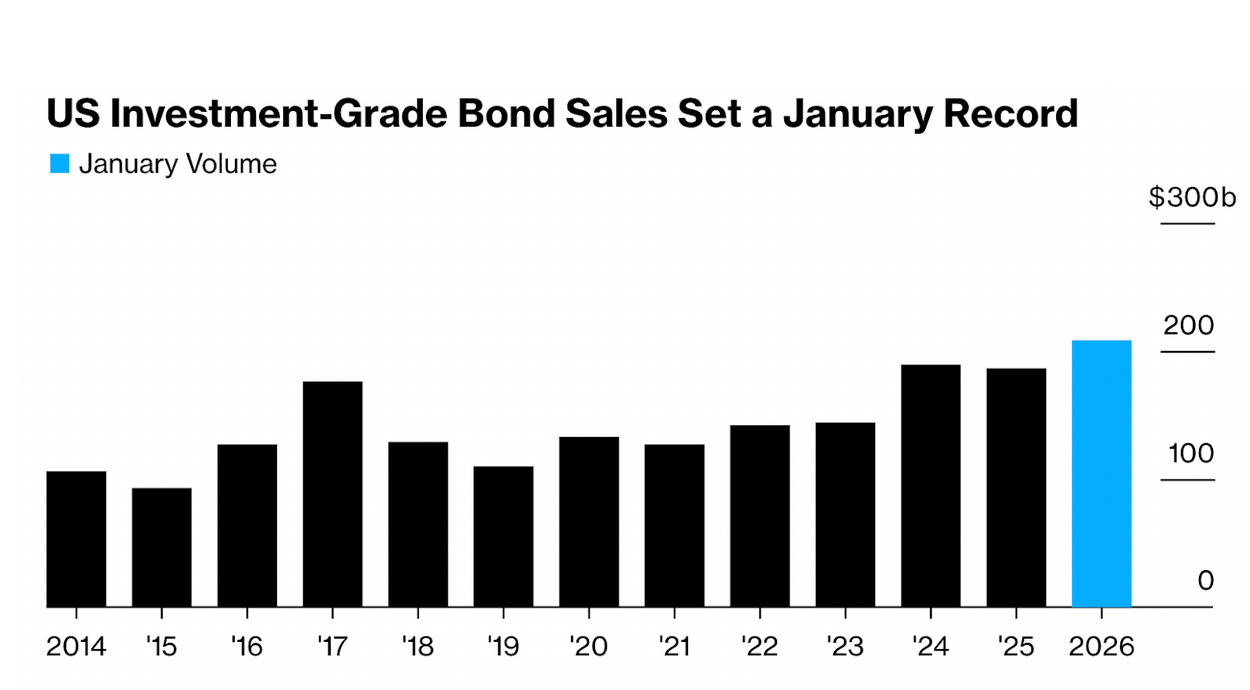

U.S. investment-grade bond issuance has already hit $200B.

Tesla is leaning into robotaxis and robots as EV sales cool.

The U.S. trade deficit nearly doubled despite aggressive tariff efforts.

Market News

Equities Rebound while Metals Slump

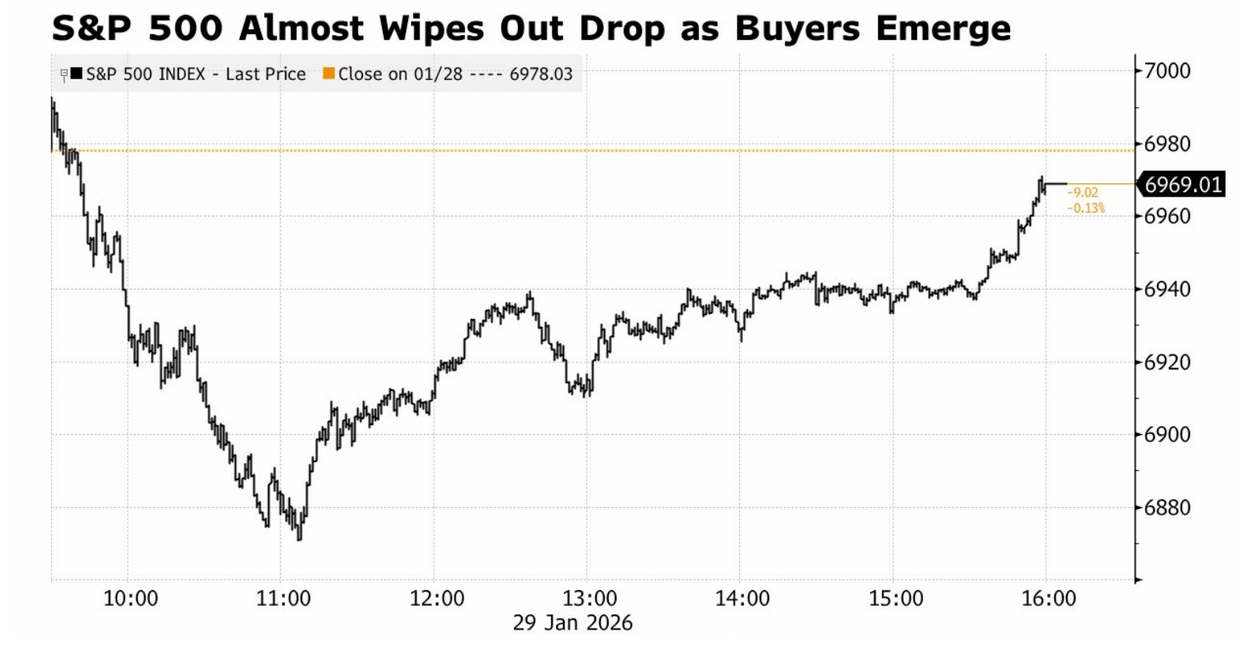

Equities rebounded after the “Magnificent 7” companies showed strong momentum, regaining investors' appetite for the industry.

Meta Platforms Inc.'s solid outlook eased worries about its spending plans. Microsoft Corp. tumbled the most since 2020 on concern it could take a while for AI investments to pay off.

Late in the day, Apple Inc. reported strong results. Amazon.com Inc. was reported to be in talks to invest up to $50 billion in OpenAI. Wall Street has also been gearing up for a “borrowing bonanza” with all the AI shopping spree.

International Business Machines Corp. sold dollar and euro bonds, kicking off what’s expected to be a flood of borrowing from the tech sector in 2026.

Moving on with equities, President Donald Trump said he would announce his nominee to chair the Fed “next week,” and reiterated his expectation that the central bank’s new leader will lower interest rates, with Kevin Warsh as a possible candidate.

The yield on 10-year Treasuries slid one basis point to 4.23%. The dollar barely budged as it headed for its worst month since the April tariff-fueled meltdown. Gold reversed an earlier rally that took the precious metal to a record above $5,500. Brent crude settled above $70 as Trump warned Iran to make a nuclear deal or face military strikes.

What's Ripe

Meta Platforms Inc. (META) 10.4%

META jumped 10%. The parent company of Facebook and Instagram posted fourth-quarter earnings and revenue that beat Wall Street estimates.

Meta also issued first-quarter revenue guidance that was better than expected and said capital spending could reach up to $135 billion in 2026, about 20% higher than Wall Street expectations and nearly double from a year earlier.

International Business Machines Corp. (IBM) 5.1%

IBM climbed 5.1%. IBM beat analysts’ targets for fourth-quarter profit and revenue as sales in the company’s software segment rose 14% to a stronger-than-expected $9 billion

Separately, the company unveiled the latest results of a hybrid quantum computing experiment.

What's Rotten

SAP SE (SAP) 15.2%

SAP plunged 15%. The German software company topped earnings estimates but missed on revenue for the fourth quarter, with cloud revenue also falling short of expectations.

ServiceNow Inc. (NOW) 9.9%

NOW slumped 10%. Although fourth-quarter earnings and revenue were better than anticipated, investors were likely concerned about a series of deals the enterprise software company has made as it seeks to better position itself in AI.

🧠 Technical Trip

Interview Q&A from Ares

👉 Want 1-on-1 recruiting help from Ares bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

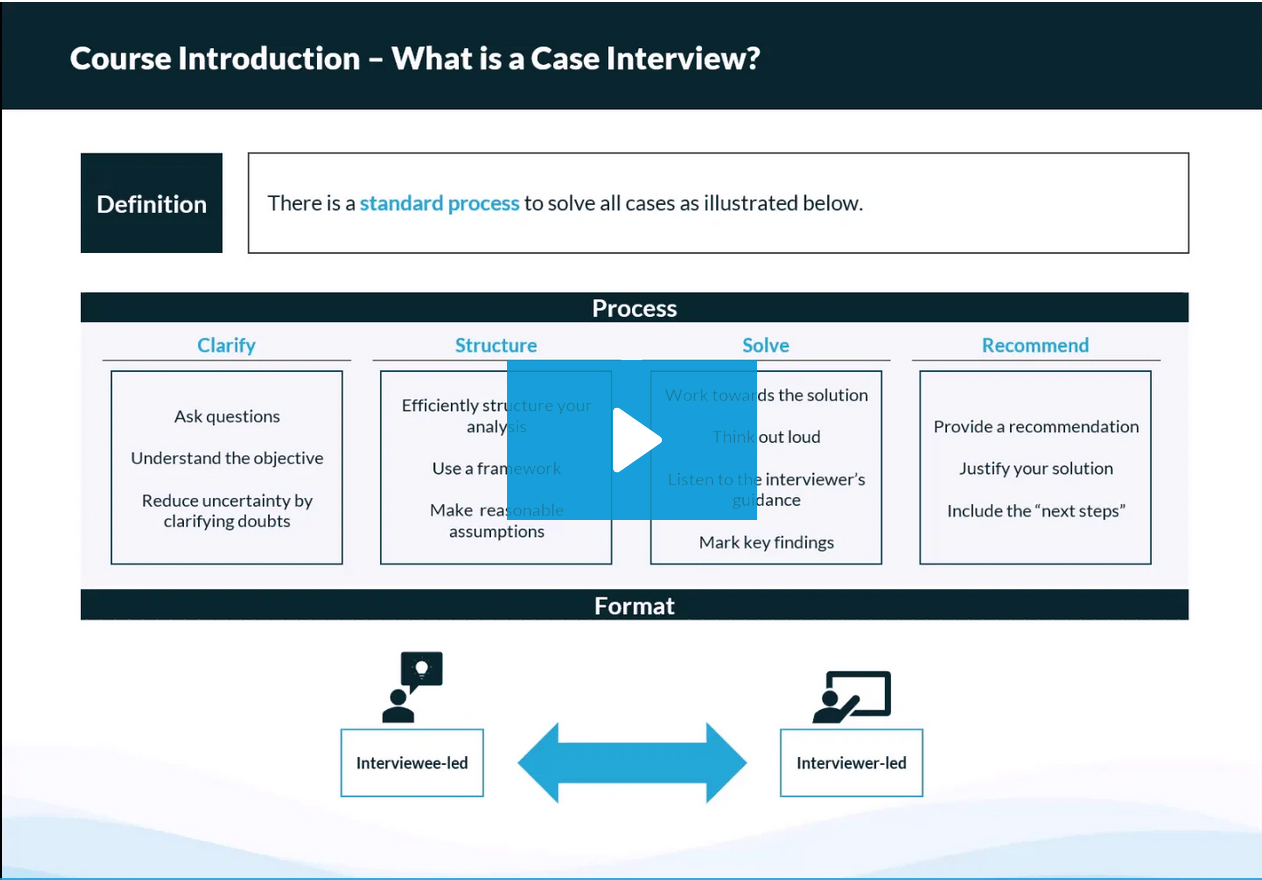

🎥 Consulting Case Interview Course

Learn the frameworks and thinking styles that help you ace every case.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Indo-MIM is said to be targeting up to $700M in an India IPO.

SpaceX is in merger talks with other Musk firms ahead of its IPO.

Microsoft signed a $750M cloud deal with AI startup Perplexity.

NVIDIA and Mercedes-Benz are pushing ahead with their robotaxi plans.

South Park Commons is planning a $500M fund for its “anti-accelerator” model.

📊The Daily Poll

What is the main goal of US tariff threats tied to Cuba dealings? |

Previous Poll:

What supports India’s 7% growth outlook despite trade risks?

Domestic demand: 30.5% // Government spending: 23.7% // Services strength: 20.3% // Investment inflows: 25.5%

Banana Brain Teaser

Previous

When processing iron ore into stainless steel, high-purity oxygen is blown through, removing 1.5% of all impurities. Then, only 30% of the remaining metal alloy can be used to create rust-free stainless steel. If 5 kg of stainless steel is desired, how much starting iron ore is needed?

Answer: 17kg

Today

Yesterday’s closing prices of 2,420 different stocks listed on a certain stock exchange were all different from today’s closing prices. The number of stocks that closed at a higher price today than yesterday was 20% greater than the number that closed at a lower price. How many of the stocks closed at a higher price today than yesterday?

If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick