- The Peel

- Posts

- Tariff Truce Extended

Tariff Truce Extended

President Donald Trump extends the tariff truce between the U.S and China an additional 90 days.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Monday Market News

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Q&A from Goldman Sachs

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

President Donald Trump extends the tariff truce between the U.S and China an additional 90 days.

The Trump Administration is narrowing down their search for the new Fed chair.

Citigroup oversaw over $1 billion worth of transactions for a Delaware trust, U.S authorities say, a “sanctioned Russian oligarch held a concealed stake in.”

Oil prices have hit their lowest in two months in anticipation of the Trump-Putin meeting in Alaska.

Shares of Western lithium producers soared today after it was announced that a major Chinese mine would suspend production.

Brazil intends to “prioritize economic aid” in response to the 50% U.S tariff.

How Trump’s tariffs are potentially jeopardizing the dominance of the dollar.

American tech companies and financial institutions are buying back their shares at a record high.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Market Recap

Inflation In The Spotlight

The markets dropped slightly on Monday in anticipation of inflation data set to be released Tuesday at 8:30 ET. Even when Trump announced a 90-day tariff truce with China to further iron out trade talks, the markets barely reacted.

As earnings season is coming to a conclusion, investors are keeping a closer eye on economic data that will likely be the primary driver of overall investment decisions.

Many Wall Street firms are predicting a significant swing in either direction for the S&P 500 in response to the CPI news. For example, J.P. Morgan is predicting as much as a 2% increase in the S&P 500 if CPI comes in at or below expectations.

They also predicted a potential 3% decline in the S&P 500 if CPI comes in higher than expected. Economists are expecting a 2.8% YoY increase in inflation, and many analysts believe CPI will come in higher than expected as they believe the inflationary effects of tariffs are beginning to show.

Despite the expected uptick in inflation, some Wall Street Banks are actually more bullish on the major indices. For example, Citigroup upgraded their year-end price target for the S&P 500 from 6,300 to 6,600.

Something else to keep in mind is that stock valuations are definitely trading at a premium as a result of the recent rally, which could have significant implications on investor sentiment in the coming months.

What's Ripe

TEGNA Inc. (TGNA) 29.8%

TEGNA’s stock soared yesterday after reports emerged that they are in “advanced acquisition talks” with Nexstar Media Group, the largest U.S local TV operator.

The media company has also seen recent financial success, beating Q2 earnings and revenue expectations.

SoundHound AI (SOUN) 17.3%

Sound Hound’s stock jumped yesterday after absolutely obliterating Q2 earnings, with revenue growing to $42.7 million, growing 217% YoY, and well above the expected $10 million.

The voice AI company also increased their revenue guidance for the full year, further propelling investor sentiment.

What's Rotten

Monday.Com Ltd. (MNDY) 29.8%

Monday’s stock plummeted yesterday despite a narrow earnings beat, with revenue only beating estimates by 1.8%, the lowest margin since its IPO.

Additionally, MNDY is currently trading at a 176x P/E ratio, implying that investors were pricing in an earnings beat, thus causing the stock to decline.

Duolingo (DUOL) 8.0%

Duolingo’s stock fell sharply yesterday, which was mostly attributable to profit-taking after Duolingo beat earnings last week.

Despite the fact that the stock jumped post-earnings earnings beat, Duolingo’s gains were erased yesterday, as the stock is down 11% in the past 6 months.

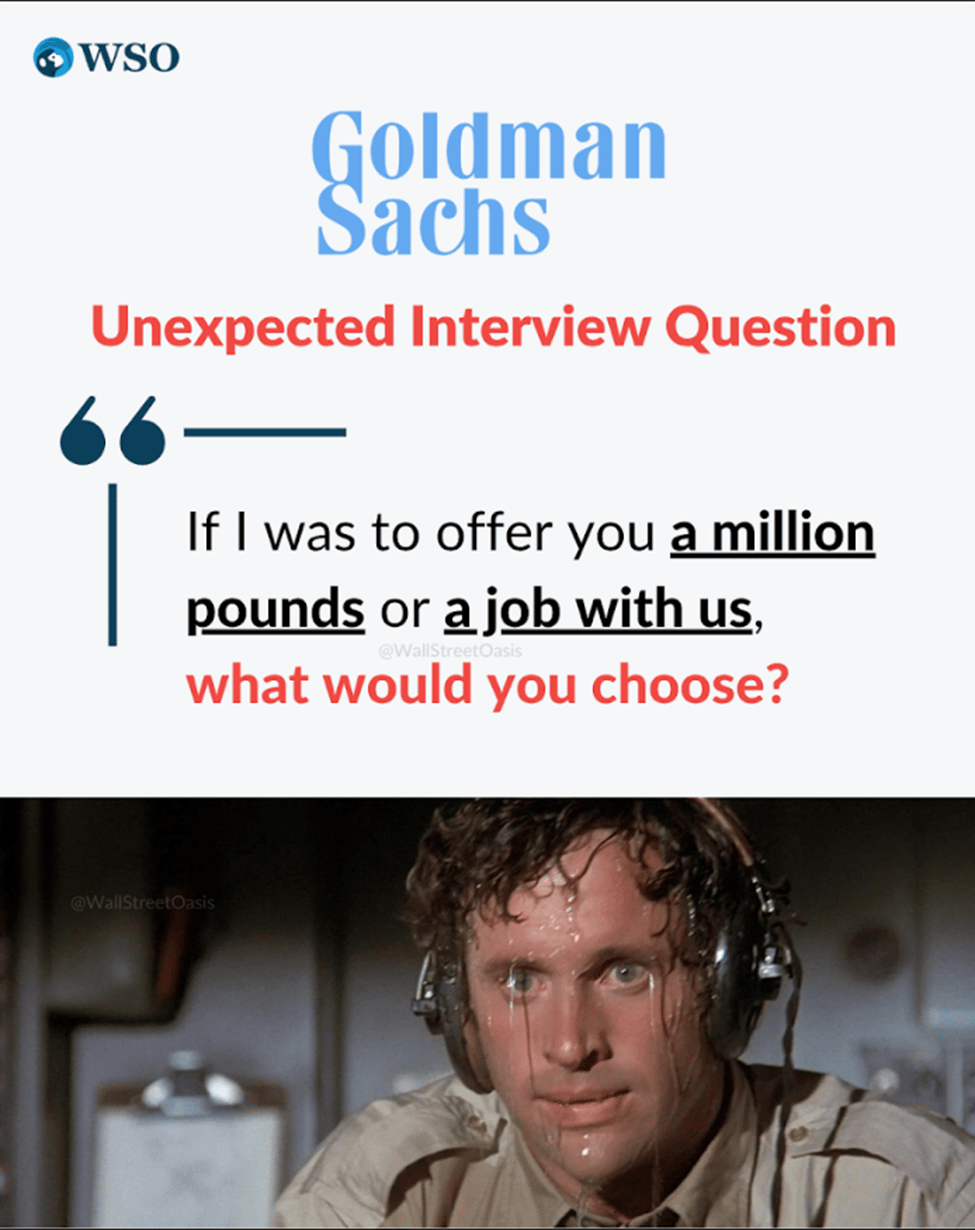

🧠 Technical Trip

Interview Q&A from Goldman Sachs

👉 Want 1-on-1 recruiting help from Goldman Sachs bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal News

M&A, IPOs, And Other Notable Transactions

Vulcan Elements, a U.S.-based maker of rare earth magnets, raised $65 million in a Series A funding round at a $250 million valuation.

Paramount is set to pay $7.7 billion to TKO Group for media rights to the UFC for 7 years.

Rumble is considering an offer to purchase Northern Data for $1.17 billion in an all-stock deal.

TEGNA is in talks to be potentially acquired by rival Nexstar Media Group.

Advertising agency S4 says they are currently in talks to potentially be acquired by PE firm MSQ Partners.

Bain Capital is currently weighing an exit strategy for portfolio company Ahlstrom, potentially taking the company public.

Bain Capital is also weighing the possibility of taking Bob’s Discount Furniture public in an IPO offering.

Banana Brain Teaser

Previous

A fruit salad mixture consists of apples, peaches, and grapes in the ratio 6:5:2, respectively, by weight. If 39 pounds of mixture is prepared, how many more pounds of apples than grapes does the mixture include?

Answer: 12

Today

Of the 300 subjects who participated in an experiment using virtual reality to reduce their fear of heights, 40% experienced sweaty palms, 30% experienced vomiting, and 75% experienced dizziness. If all of the subjects experienced at least one of these effects and 35%$ of the subjects experienced exactly two of these effects, how many of the subjects experienced only one of these effects?

You make most of your money in a bear market, you just don’t realize it at the time.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick