- The Peel

- Posts

- Tariff Tensions Cool

Tariff Tensions Cool

Next week will witness another U.S.-China talks as Trump plays down tariff.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Strong bank earnings overshadow regional loan woes

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Moelis

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

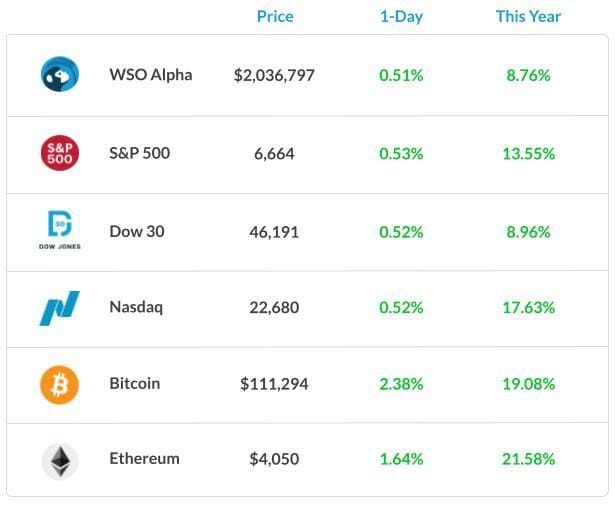

Market Snapshot

📉 Banana Bits

China’s economy grows 4.8% in the third quarter, but investment slides.

China’s coal and steel production shrinks as demand weakens.

Newer Apple models outsell previous ones by 14% in the U.S. and China.

South Korea's newly launched stock exchange has already grabbed a third of the activity.

Japan’s Nikkei heads for new high on LDP-Ishin coalition hopes.

Two dead after cargo jet skids into the sea at Hong Kong airport.

Cr*pto miners are riding the fomo in AI and leaving behind.

Federal employees filed the most jobless claims since the last shutdown.

Next week will witness another U.S.-China talks as Trump plays down tariffs.

Market Recap

When Big Banks Bully Back

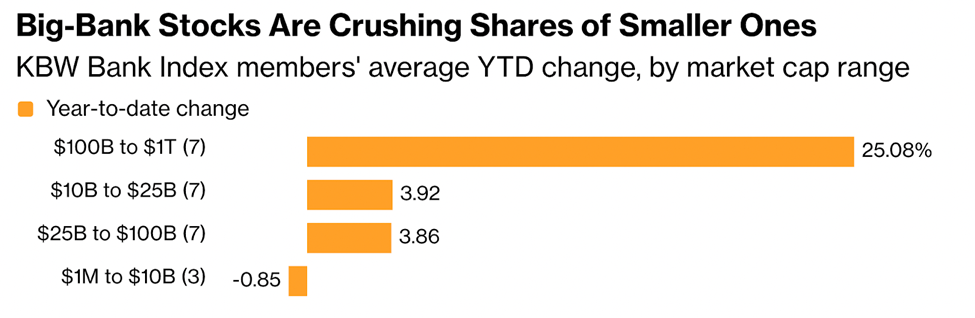

The bank's earnings are in season, while investors are happy cashing in their chips on bets that big banks are doing well.

Indeed, they are not wrong with J.P. Morgan reporting a 16% increase in EPS and 9% rise in revenue. Bank of America, on the other hand, showed a significant increase of 23% in net income while EPS was up 31%.

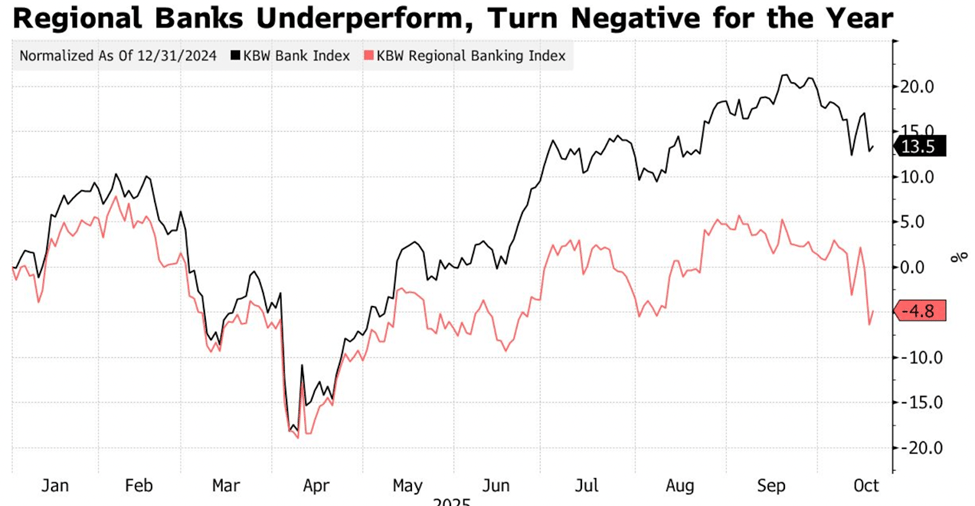

However, it is not all rosy for regional banks. Shares of Zions Bancorp and Western Alliance Bancorp plunged after it was revealed that they were victims of loans to funds that invest in distressed commercial mortgages. The disclosures sent the KBW Bank Index to its worst day since April’s tariff tantrum.

As if it couldn’t get any worse. On an investor conference call, JPMorgan Chase & Co. CEO Jamie Dimon discussed “cockroaches” in the credit market during the bank’s earnings conference call on Tuesday. He was referring to the implosions of auto lender Tricolor Holdings and car-parts supplier First Brands Group.

What's Ripe

American Express Co. (AXP) 7.3%

AXP soared 7.3% after the credit card giant reported third-quarter earnings that beat analysts’ estimates as revenue rose 11% to $18.43 billion, topping forecasts of $18.05 billion.

Amex also raised the lower end of its full-year guidance range on profit and revenue.

Jefferies Financial Group Inc. (JEF) 5.9%

JEF climbed 5.9% to $51.70 after tumbling nearly 11% on Thursday.

Analysts at Oppenheimer on Friday upgraded the stock to Outperform from Perform with a price target of $81.

What's Rotten

Kenvue Inc. (KVUE) 13.0%

KVUE ended Thursday’s session as the worst-performing stock in the S&P 500.

The lawsuit filed Tuesday in the U.K. High Court alleged Johnson & Johnson, which spun off Kenvue in 2023, knowingly sold baby powder that was contaminated with asbestos, a carcinogen.

Novo Nordisk A/S (NOVO.B) 6.38%

NOVO fell 3.1% after Trump suggested the price of its blockbuster diabetes and weight-loss drugs Ozempic and Wegovy could be reduced to $150 a month.

The current list price for the medicines is around $1,000.

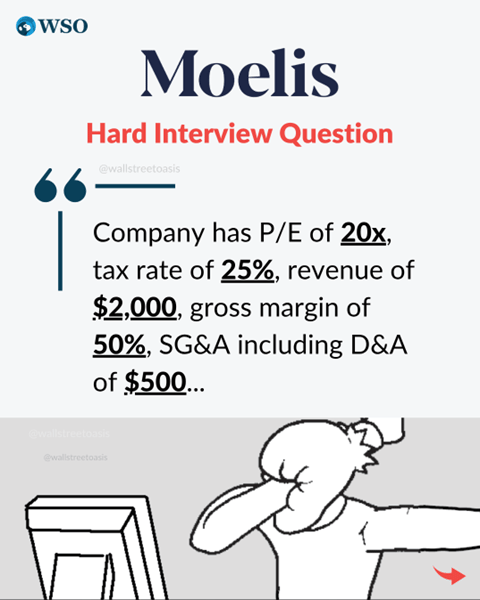

🧠 Technical Trip

Interview Q&A from Moelis

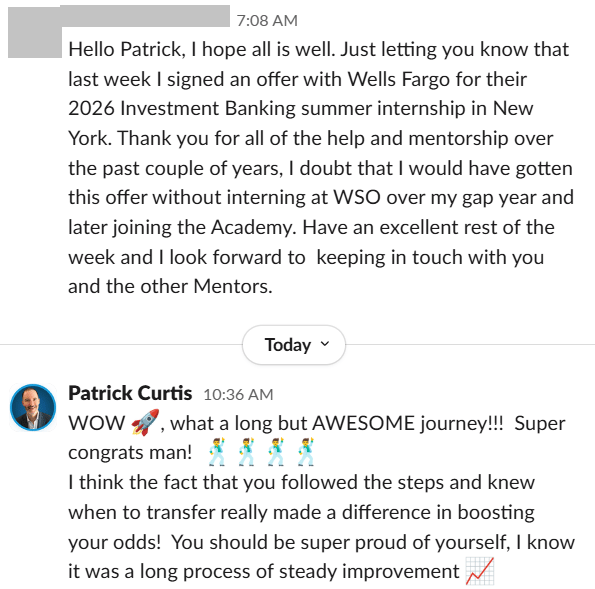

👉 Want 1-on-1 recruiting help from Moelis bankers & 2,000+ top mentors? Apply to WSO Academy

2025 IB Working Conditions Survey

We Want Your Input!

Are you in investment banking? Take 2 minutes to share your experience on hours, compensation, and work-life balance in our 2025 survey. Your insights help shed light on real working conditions across the industry.

All responses are 100% anonymous so you can be honest about your experience.

📝 Click here to participate and join others who are turning their experience into a voice for change in IB.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Holcim agrees to buy Xella in $2.2 billion roofing and walls deal.

Sany Heavy Industry seeks $1.6 billion in Hong Kong listing.

Kering sells beauty division to L’Oreal in $4.7 billion deal.

Revolut, backers near the end of $3 billion fundraising spree.

Partners Group said to launch sale of £300 million London office.

Apple wins Formula One U.S. streaming rights, beating ESPN.

Vista taps Goldman to bundle fund stakes in $1 billion deal.

📊The Daily Poll

Big bank earnings show… |

Previous Poll:

Bank stocks rising shows?

Sector resilience: 36.6% // Earnings relief: 34.1% // Value rotation: 12.2% // Dead cat bounce: 17.1%

Banana Brain Teaser

Previous

When positive integer x is divided by positive integer y, the remainder is 9. If x/y = 96.12, what is the value of y?

Answer: 75

Today

A store reported total sales of $385 million for February this year. If the total sale for the same month last year was $320 million, approximately what was the percentage increase in sales?

The best real-estate deal is often the one you don’t do.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin & Patrick