- The Peel

- Posts

- SpaceX Fuels xAI Dreams

SpaceX Fuels xAI Dreams

🤖 SpaceX pumps billions into xAI to power Grok and future Tesla bots, merging rockets, chatbots, and Muskian ambition.

In this issue of the peel:

📉 Recession odds fall as job growth and cooling inflation fuel optimism despite Trump’s looming tariff hikes.

🛩️ Kratos Defense soars after the Pentagon lifts restrictions, boosting domestic drone production amid defense concerns.

🤖 SpaceX pumps billions into xAI to power Grok and future Tesla bots, merging rockets, chatbots, and Muskian ambition.

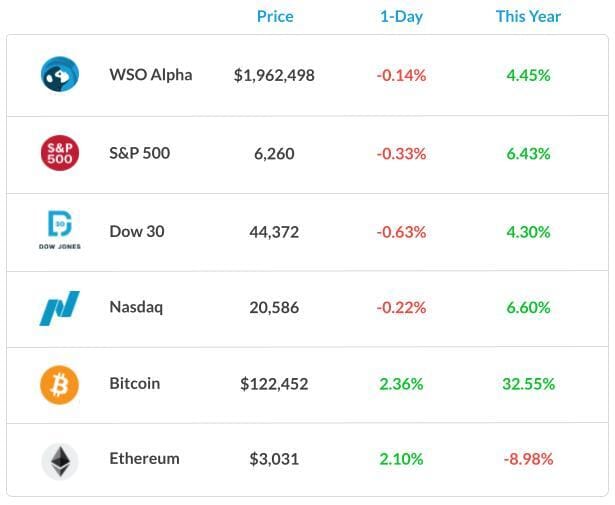

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Mitchell Ang, put together an impressive deep dive on Robinhood, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

Trump floats 30% tariffs on imports from the EU and Mexico, reviving global trade tensions ahead of the August deadline.

An endless supply of drones freezes front lines of Ukraine, shifting battlefield tactics in Europe, and resulting in a drone stalemate.

EVs dominate the used‑car boom and now lead U.S. pre-owned vehicle sales, shaking up traditional dealerships.

Private-markets tech provider, iCapital, secures $820M in new funding to expand alternative-investment platform capabilities.

Reports confirm that the fuel cutoff caused the engine failure before the major Air India accident in June this year.

Kraft Heinz plans strategic breakup into snack and meal businesses, aiming for sharper focus.

The Daily Poll

Tariffs kicking in Aug 1, what’s your take? |

Previous Poll:

Will these tariffs actually help U.S. jobs?

Yes: 17.3% // Maybe: 21.5% // Nope: 61.2%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

Recession Risk Takes a Coffee Break

The U.S. economy continues to defy expectations, proving, as Chad Moutray of the National Restaurant Association put it, “stubbornly resilient.”

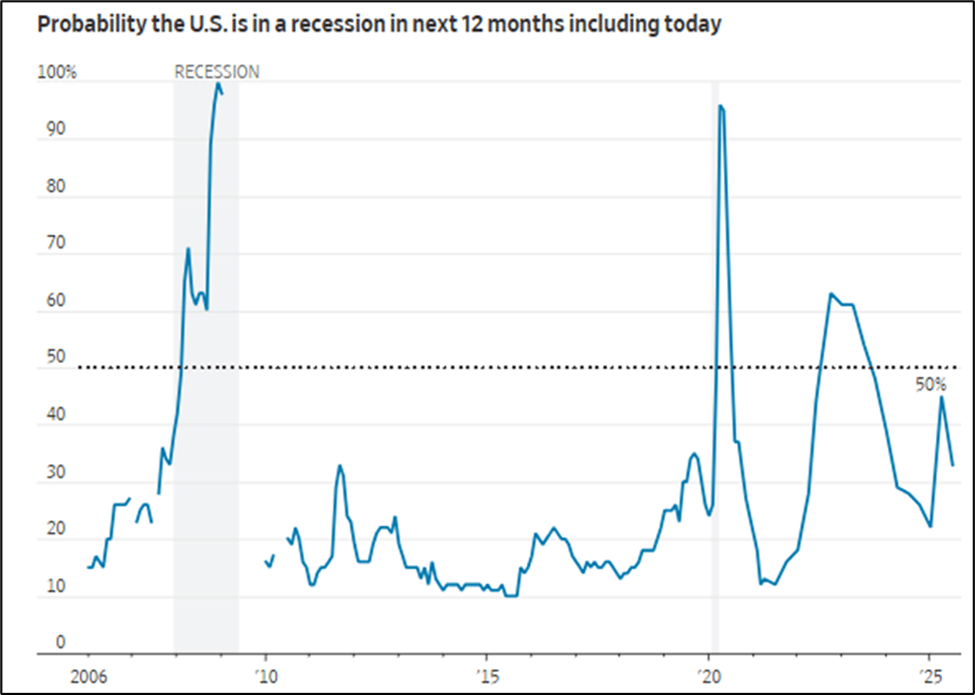

Economists in the latest Wall Street Journal survey slashed the probability of a recession in the next 12 months from 45% to 33%, citing the following positive trends:

GDP growth forecasts upgraded to 1.0% for Q4 2025 and 1.9% for 2026

Steady job growth, averaging around 150,000 new jobs per month

The unemployment rate declined to 4.1% in June

Core inflation eased to 2.8% in May — the lowest level in four years, bolstering hopes for interest rate cuts

But here’s the twist: tariff anxiety is creeping back in. This past week, former President Trump notified Brazil, Canada, Mexico, and the EU that significantly higher tariffs will take effect on August 1.

These follow April’s earlier duties, which triggered a 26% spike in goods imports in Q1 as businesses rushed to stockpile inventory. Imports then plunged after the tariffs were enacted, a pattern some Fed officials believe could delay price increases until those inventories are drawn down.

Still, the impact is likely to surface soon. Economists now estimate the CPI could rise by 0.7 percentage points in Q4 due to the new tariffs, pushing inflation to 3.0%—higher than January’s 2.7% projection, but down from April’s 3.6%. Bill Adams of Comerica Bank notes the inflationary blow will be “partially offset by softer energy and shelter costs.”

So while the recession panic has cooled, the economy now walks a finer line, balancing resilience with geopolitical risk. And it’s walking with one wary eye on Washington.

The Takeaway?

Recession risk is down to 33%, and the economy shows solid job and GDP growth, but inflationary clouds are brewing. Trump’s new tariffs targeting Brazil, Canada, and others starting August 1 have already distorted import flows.

Economists expect Q4 CPI to rise 0.7 percentage points, bringing inflation to 3%. The Fed sees price pressures emerging as firms burn through tariff-stocked inventory. The economy isn’t stumbling, but it’s watching the ground more carefully.

Career Corner

Question

I’ve been trying to find the AVERAGEIFS of values between 2 date ranges, but keep getting either DIV errors or a repeated value average that ignores my range.

Answer

You're likely running into issues because AVERAGEIFS requires proper formatting of dates, and that all your criteria ranges are the same size as your average range. Given you are getting a #DIV/0 error, you likely have either blanks in your ranges or an error in your ranges…

Syntax should look like the following:

=AVERAGEIFS(average_range, date_range, ">=start_date", date_range, "<=end_date")

Values are in column B (B2:B100)

Dates are in column A (A2:A100)

You want the average between 01/01/2024 and 03/31/2024

=AVERAGEIFS(B2:B100, A2:A100, ">=1/1/2024", A2:A100, "<=3/31/2024")

If you’re getting an error, it’s likely because, 1) You have mismatched range sizes - they need to be the same length, 2) You have text formatted dates (they need to be numbers), 3) You have improper Date criteria - you can use quotes or cell references (e.g., “>=“& A1) if dates are in cells, or 4) If your average range contains blanks or errors.

Head Mentor, WSO Academy

What's Ripe

Kratos Defense & Security Solutions Inc (KTOS) 11.8%

Shares of Kratos Defense & Security Solutions climbed 11.8% Friday following a major Pentagon memo rescinding purchasing restrictions to ramp up domestic drone production. The Department of Defense explicitly encouraged a "buy American" approach, bolstering demand for homegrown drone firms like Kratos.

This policy pivot comes amid growing concerns about military readiness and adversaries' drone capabilities, pushing KTOS to its highest level in nearly two decades.

Levi Strauss & Co (LEVI) 11.3%

Levi Strauss surged 11.3% Friday after raising its full-year revenue and earnings guidance, fueled by robust denim demand and success in its direct-to-consumer strategy.

Strength in Europe (+14% sales) and growth in women’s apparel drove optimism, while the company mitigated U.S. tariff impact by diversifying sourcing to Bangladesh and Cambodia.

What's Rotten

American Airlines Group Inc. (AAL) 5.6%

American Airlines shares slid 5.6% on Friday as airline stocks cooled off after Thursday’s sector-wide rally powered by Delta’s upbeat earnings report.

Delta’s strong guidance had briefly lifted sentiments, but after the euphoria, investors reassessed exposure, taking profits in lagging names like American Airlines and United Airlines.

United Airlines Holdings Inc. (UAL) 4.3%

United Airlines shares dropped 4.3% on Friday, retreating after Thursday’s surge following Delta’s strong earnings and reinstated guidance.

The broader airline sector cooled in reaction, as investors digested renewed regulatory concerns, particularly over a potential United–JetBlue partnership flagged by Senator Blumenthal.

Thought Banana

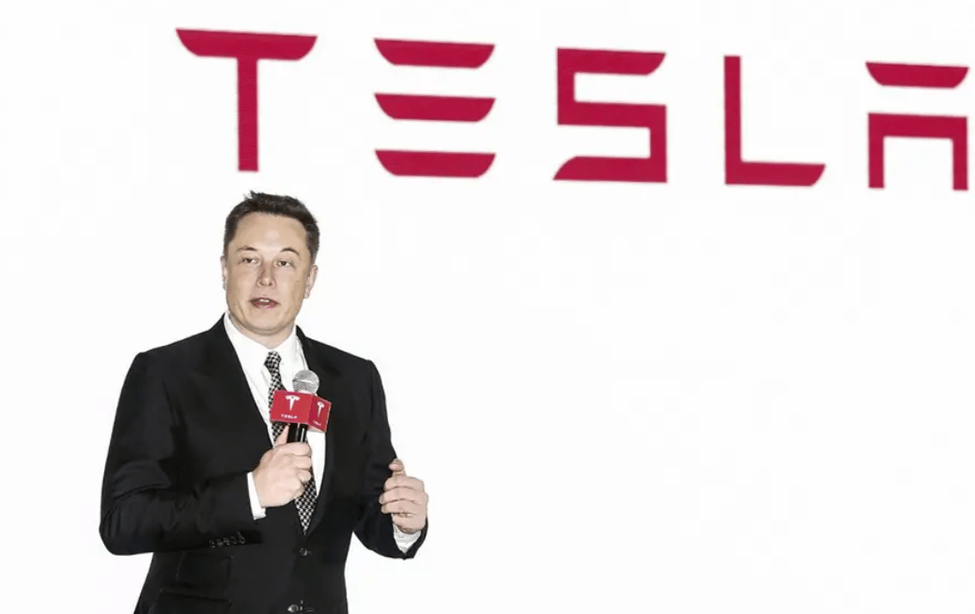

SpaceX Launches $2B AI Boost

SpaceX is boosting Elon Musk’s AI ambitions, committing a striking $2 billion investment in his xAI firm, nearly half of xAI’s $5 billion equity round organized by Morgan Stanley. The merger with X (formerly Twitter) valued the combined entity at approximately $113 billion, unlocking potential synergies across Musk’s tech empire.

What’s more futuristic than a rocket company funding a chatbot? The Grok AI—already handling customer support for SpaceX’s Starlink—could soon show up in Tesla’s Optimus robots, bringing Musk’s multi‑industry ecosystem closer to reality.

Since leaving his role in the Trump administration, Musk has turned his attention to training the latest version of Grok, which earned high marks from AI-benchmarking service Artificial Analysis for its performance following its release on Wednesday.

But this move isn’t just about vision. With SpaceX’s Starship facing delays and limited cash reserves (~$3 billion on hand), the $2 billion infusion carries real financial risks.

Still, Musk has always played fast and loose with capital, leveraging one company to super-charge another. It’s reminiscent of borrowing from SpaceX to seed Tesla or wiring loans through Twitter. Now, his two most ambitious ventures are literally paying each other back.

The Takeaway?

SpaceX is investing $2 billion in Elon Musk’s xAI, nearly half of xAI’s $5 billion equity raise, valuing the merged xAI-X entity at $113 billion. Grok AI already supports Starlink and may soon power Tesla's Optimus robots.

While this deepens Musk’s inter-company synergy, it also boosts risk: SpaceX has just ~$3 billion in cash and is funding its delayed Starship program. Can one rocket fuel another’s AI journey? Time will tell.

The Big Question: Can Grok really power the future of AI, or is it just another expensive chapter in Musk’s sci-fi playbook?

Banana Brain Teaser

Previous

For the past n days, the average daily production at a company was 50 units. If today’s production of 90 units raises the average to 55 units per day, what is the value of n?

Answer: 7

Today

Car A is 20 miles behind Car B, which is traveling in the same direction along the route as Car A. Car A is traveling at a constant speed of 58 miles per hour, and Car B is traveling at a constant speed of 50 miles per hour. How many hours will it take for Car A to overtake and drive 8 miles ahead of Car B?

Send your guesses to [email protected]

I am not a product of my circumstances. I am a product of my decisions.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mithun, Colin & Patrick