- The Peel

- Posts

- Singapore Signals a Slowdown

Singapore Signals a Slowdown

Singapore expects slower growth in 2026 after a strong, tariff-resistant year.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

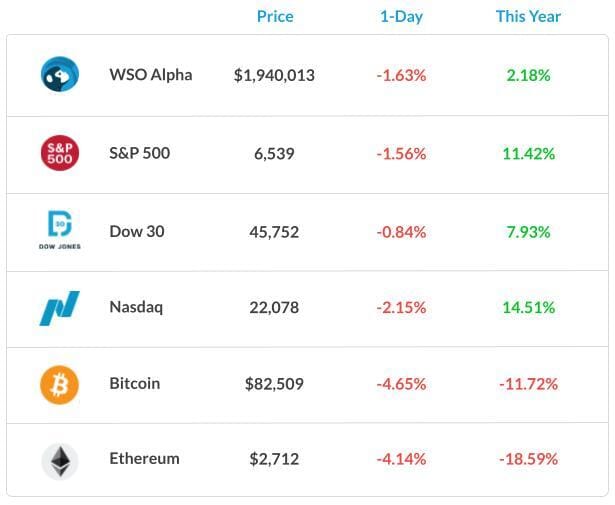

Market Summary: Markets fall as Fed doubts and jobs data weigh

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Lazard

Lesson from the Library: Decode financial statements and master the metrics that move markets.

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

Singapore expects slower growth in 2026 after a strong, tariff-resistant year.

Japan’s October data keeps the BOJ on course for slow, steady rate hikes.

UBS warns private-credit defaults could spark broader stress heading into 2026.

U.S. long-term mortgage rates climbed to 6.26%, marking a third straight increase.

Prediction markets are moving from niche to mainstream as Wall Street jumps in.

Gap’s comp sales jumped after its viral “Milkshake” denim ad with Katseye.

The finance grind leaves you zero time for second-home management. Investing in an entire second home is a logistical joke. Get smart: Pacaso offers fractional equity in a turnkey luxury home, backed by $1B in transactions. It's professionally managed LLC ownership, not a timeshare. Our model handles the maintenance, you handle the memories. Explore the Pacaso model.

Market Recap

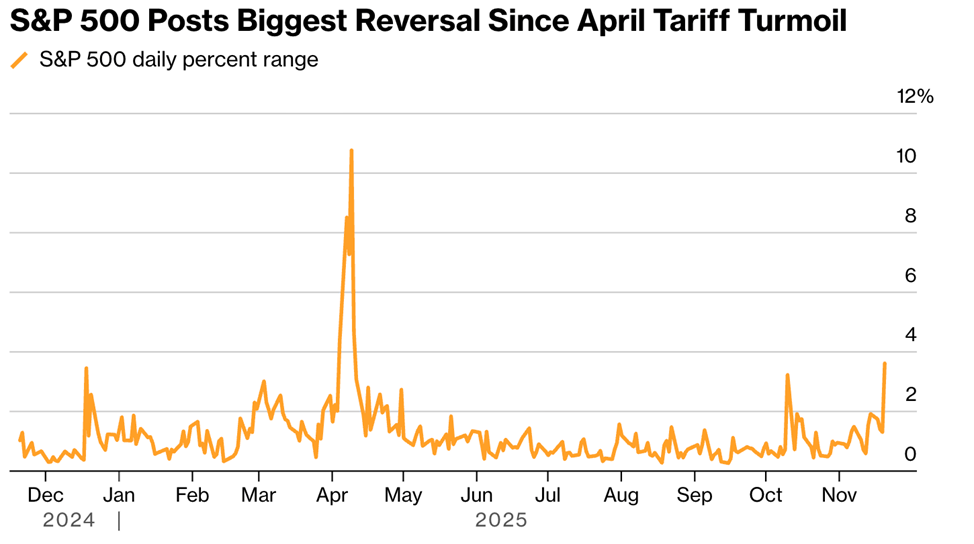

Investors Are Finding Ways To Be Worried

Just like that, the market went for a downwall after a brief rally led by Nvidia’s surprise performance. The sharp reversal in market sentiment came as lingering concerns over stretched valuations and heavy tech spending curbed a rally fueled by Nvidia’s upbeat forecast, with the AI bellwether’s shares sliding 3.2%.

Adding to the unease was persistent uncertainty over the Federal Reserve’s ability to cut interest rates next month, as recent remarks from policymakers signaled caution about easing policy too soon.

Thursday also brought the release of a long-delayed government employment report, which showed that U.S. job growth picked up in September, while the unemployment rate ticked higher.

The data suggested that the labor market was stabilizing before the government shutdown. The figures come a day after minutes from the Fed’s last policy meeting showed a divided committee on whether to cut rates again.

What's Ripe

PACS Group Inc. (PACS) 55.3%

Third-quarter revenue at the nursing home operator came in at $1.34 billion, topping the $1.11 billion analysts were anticipating, while earnings missed forecasts.

For the full year, PACS sees revenue in the range of $5.25 billion to $5.35 billion, sharply above the $4.87 billion analysts were expecting.

Exact Sciences Corp. (EXAS) 16.8%

EXAS surged 17% after Abbott Laboratories agreed to purchase the cancer screening company in a cash deal worth around $21 billion.

EXAS stockholders will receive $105 a share in the acquisition, with Abbott absorbing EXAS’s net debt of $1.8 billion

What's Rotten

Bath & Body Works Inc. (BBWI) 24.8%

BBWI slumped 25%. The maker of body lotion and scented candles posted worse-than-expected earnings and sales in its fiscal third quarter and lowered its fiscal-year guidance, citing “recent negative macro consumer sentiment weighing heavily on our consumers’ purchase intent.”

Jacobs Solutions Inc. (J) 11.0%

J pared earlier gains and turned 11% lower. Fourth-quarter adjusted earnings of $1.75 a share topped the $1.68 consensus among analysts polled by FactSet.

Gross revenue rose 6.6% to $3.15 billion, in line with expectations.

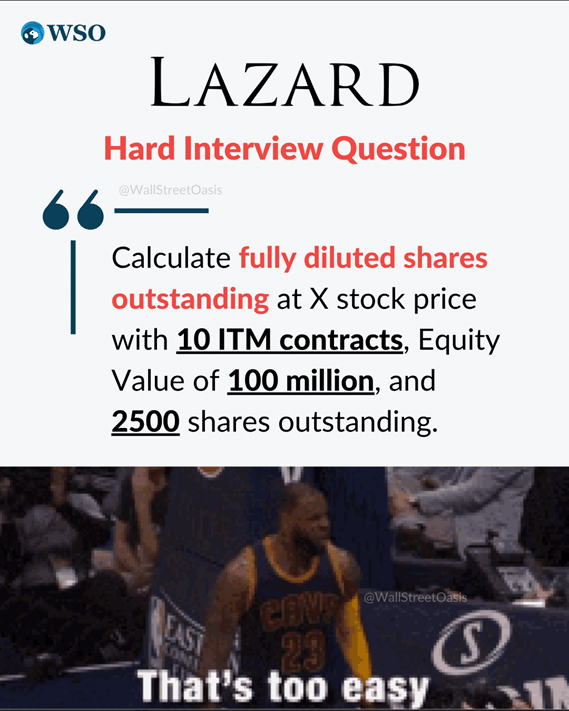

🧠 Technical Trip

Interview Q&A from Lazard

👉 Want 1-on-1 recruiting help from Lazard bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Accounting: The Language of Business

Decode financial statements and master the metrics that move markets.

🌟 Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Ari Litt, put together an impressive deep dive on DoorDash, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones.

🌟 WSO Academy Q4 Update

🌍 Region-Specific Networking Guides

The most common theme among students is this: networking is challenging and uncomfortable. That’s why we’re continuing to build on our region-specific networking playbooks to help them tailor their approach. These templates can be found in the student resource folder.

This quarter, we’ve added new regions: Singapore and the Middle East. We’ll continue releasing market-focused networking playbooks to help the students tailor their outreach.

As a reminder, we now have a 4-hour intensive networking bootcamp that meets monthly. Additionally, we cover networking during Sunday office hours. The students can find the office hours links (for GCALS and other calendars) bookmarked in the #General channel in Slack and under Events on their WSO Academy Dashboard. Many of their questions can likely be answered through the Networking Mastery Course.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Indonesia’s $52B sovereign fund plans to invest 5% overseas.

GE Healthcare is buying Intelerad in a $2.3B deal.

A firm led by Dye & Durham’s ex-CEO offered a 111% premium to acquire the company.

Missouri lender Central Bank Shares jumped 9% after its IPO.

Abbott secured 2025’s largest bridge loan to fund an acquisition.

Mercedes F1’s Toto Wolff sold part of his stake to CrowdStrike’s CEO.

Banana Brain Teaser

Previous

A glucose solution contains 15 grams of glucose per 100 cubic centimeters of solution. If 45 cubic centimeters of the solution were poured into an empty container, how many grams of glucose would be in the container?

Answer: 6.75

Today

A glass was filled with 10 ounces of water, and 0.01 ounce of the water evaporated each day during a 20-day period. What percent of the original amount of water evaporated during this period?

History is a guide to navigation in perilous times.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick