- The Peel

- Posts

- Record Run Rolls On

Record Run Rolls On

July’s retail sales data, released on Friday, painted a still-healthy picture for the U.S consumer, rising last month, meeting expectations.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Recap: The market is running on good vibes

Technical Trip: Interview Q&A from Goldman Sachs

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

Samsung is creeping up on Apple, with its market share surging from 23% to 31% during the quarter.

University of Michigan’s consumer sentiment index fell to 58.6 in August from 61.7 last month due to worries over inflation.

July’s retail sales data, released on Friday, painted a still-healthy picture for the U.S consumer, rising 0.5% last month, meeting expectations.

Applied Materials’ stock led market declines on Friday after the company revised next quarter’s guidance for EPS to $2.11 from $2.39 estimated.

All heads will turn to Wyoming this week as the Fed hosts its annual Jackson Hole Meeting.

Walmart, Home Depot, Target, and Alibaba are some of the biggest names on the earnings calendar this week.

Market Recap

Record Run Continues

Markets were pretty steady this week. Despite the drop on Friday, the S&P 500 and NASDAQ were both up over 1% for the week and notched another record high.

The big story was inflation data: CPI came in a touch lower than expected at 2.8% YoY versus 2.7%. However, PPI came in hot and briefly spooked investors. (0.9% YoY versus 0.3%). Stocks dipped initially, but retail buyers were right there, ready to buy the dip and push equities right back up.

On top of all this, retail sales numbers were fine, not too strong, not too weak, which suggests consumers are still spending and the market is pricing in a >90% chance of a September rate cut, which is sending markets higher as well.

So what does all that mean? Right now, the market seems confident the economy can handle higher input costs, but if producer prices stay elevated, it could eventually hit profits or lead to higher prices for all of us. For now, though, dip buyers are still alive and well.

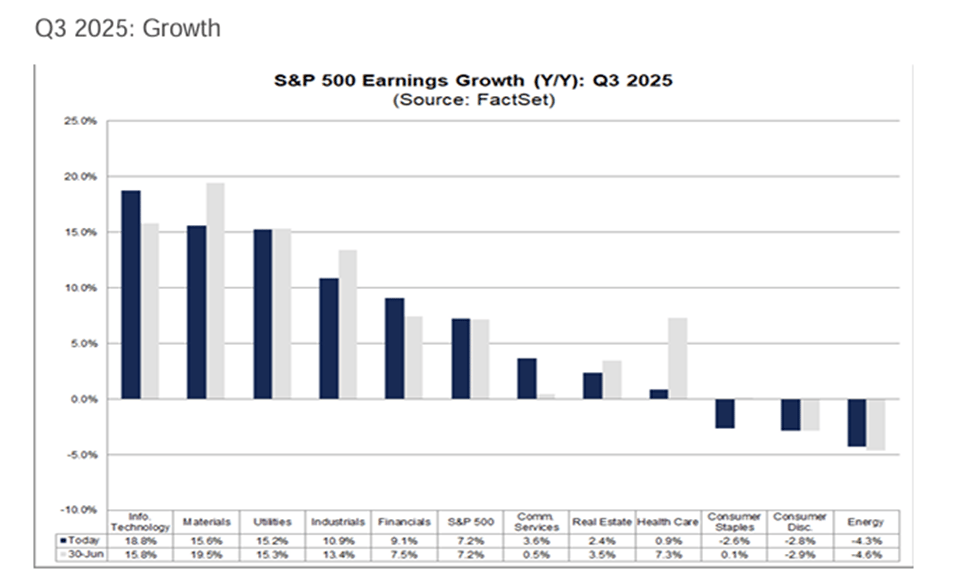

In other news, earnings season is wrapping up, and the numbers are helping the bullish case. Of the 459 S&P 500 companies that have reported, 69% beat revenue estimates and 81% beat earnings. Tech and communications names (think Meta and Alphabet) are leading the pack with strong growth.

Looking ahead to this week, the economic calendar is lighter, but there are still some important events. Mainly, the Fed’s Jackson Hole Meeting, Jobless Claims, and a wave of big earnings reports (Home Depot, Target, Walmart, Alibaba, Zoom, etc.).

Technically, all three major indexes hit fresh all-time highs this week, which keeps the trend leaning bullish. But only about 60% of S&P 500 stocks are trading above their 200-day moving averages, so it’s not like everything is ripping. Big mega-cap names are still doing most of the heavy lifting.

Bottom line: Markets are still trending up, but breadth is a little thin, so it feels like a “stock picker’s” environment. The vibe is cautiously bullish; just keep an eye on inflation and how it filters into company profits.

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

What's Ripe

Nextracker (NXT) 12.2%

Nextracker just secured a sweet contract, supplying 1.5 gigawatts of solar tracking gear for utility-scale solar projects in Brazil.

This also came after they crushed earnings and increased their revenue outlook, along with rolling out an AI and robotics initiative, combining solar + tech.

Lyft (LYFT) 8.2%

Lyft is making some changes, teaming up with Baidu to bring autonomous robotaxis to Europe starting in Germany and the UK in 2026. They also acquired FreeNow for nearly $200 million, giving them access to 9 European countries and 180+ cities.

Lyft's co-founders are also stepping off the board, wrapping up a two-year transition, which investors were cheerful about.

What's Rotten

Applied Materials (AMAT) 14.1%

Despite bearing on topline and bottom-line ($2.48 EPS versus $2.36 expected), the company disappointed by lowering next quarter’s guide to $2.11 from $2.39 estimated.

CEO Gary Dickerson said the current macroeconomic and policy environment is “creating increased uncertainty and lower visibility.” Its China business is particularly affected by the uncertainty.

KLA Corp (KLAC) 8.4%

Think of Applied Materials as the big sibling to KLA in the chip equipment game. When the company lowered its guidance, the entire sector got spooked.

Because KLA makes similar equipment and serves overlapping customers, investors started to rethink demand, so KLA’s stock fell along with its rivals. It’s not that KLA did anything wrong this time; it’s just caught in the same storm.

🧠 Technical Trip

Interview Q&A from Goldman Sachs

👉 Want 1-on-1 recruiting help from Goldman Sachs bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Advent International offered to buy Swiss chipmaker U-Blox for $1.3 billion.

Echo Investment Unit Inks €565 million Polish Real Estate Sale.

Winklevosses’ Gemini Files for IPO with the company valued at $7.1 billion.

Blackstone-Backed Engineering Firm Legence filed for a U.S IPO valued at up to $5 billion, potentially.

Transit Tech Firm Via, which was valued at $3 billion, filed for an IPO in the U.S.

Banana Brain Teaser

Previous

A positive number x is multiplied by 2, and this product is then divided by 3. If the positive square root of the result of these two operations equals x, what is the value of x?

Answer: 2/3

Today

An empty pool being filled with water at a constant rate takes 8 hours to fill to 3/5 of its capacity. How much more time will it take to finish filling the pool?

Maybe you’re right 5 or 6 times out of 10. But if your winners go up 4- or 10- or 20-fold, it makes up for the ones where you lost 50%, 75%, or 100%.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick