- The Peel

- Posts

- Record Run Cools Off

Record Run Cools Off

Wall Street eases from its record highs on rising economic jitters.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks ease as gold shines on rate-cut hopes

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Ares

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

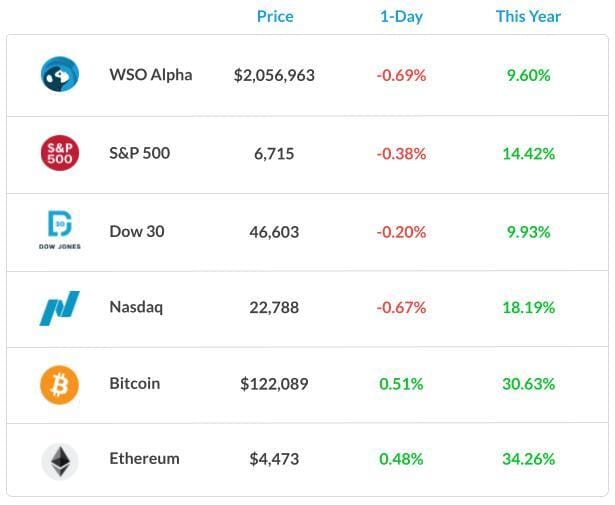

Market Snapshot

📉 Banana Bits

Wall Street edges back from its records after gold tops $4,000 per ounce.

Easy Fed risks pouring fuel on ‘everything’ rally.

Financial markets forced to adapt to French political uncertainty.

Wall Street eases from its record highs on rising economic jitters.

Dot-com fears rise as tech stocks swing $100 billion.

JPMorgan’s Dimon says AI cost savings now match the money spent.

Politics drives markets: Euro and Paris stock market slide amid French political crisis; Japanese stocks surge after Takaichi’s victory.

Market Recap

Stocks Catch Breath; Gold Steals Spotlight

U.S. stocks dipped a bit after a record run. Big tech cooled, so the S&P 500 and Nasdaq slipped, while the Dow fell a little less. It looked more like a quick pause than a big selloff. Investors are also listening for what Fed officials say next about rates.

Gold futures hit around $4,000/oz, as some investors looked for safety and expected easier Fed policy ahead. Treasury yields eased, which often helps gold and defensive stocks. That shift pulled a little money away from riskier parts of the market.

Under the surface, AI winners gave back some gains, while defensive and gold-linked names did better. Many investors are using a “barbell” approach to maintain some AI exposure while balancing it with hedges like gold. What the Fed signals about rates and its balance sheet could steer the next moves.

What's Ripe

AppLovin (APP) 7.6%

AppLovin rebounded after Monday’s 14% drop on reports of an SEC probe, as bargain hunters stepped in and the prior day’s shock went away.

The bounce was helped by commentary from Oppenheimer suggesting the inquiry may not amount to much, easing some investor fears.

AMD (AMD) 3.8%

AMD rose as investors kept bidding after Monday’s 20% spike, thanks to a multi-year deal to supply OpenAI with up to 6 gigawatts of GPUs that turbo-charges its AI revenue story.

Fresh analysts reinforced confidence that the OpenAI partnership can drive a lot of growth.

What's Rotten

Ford (F) 6.1%

Following reports that a September 16 fire at Novelis’s Oswego, NY, aluminum plant, an important supplier, will disrupt auto-grade aluminum output for months, the fallout is still being felt.

Local and industry coverage emphasized that the hot-mill outage could last until early 2026, raising concerns about the production of aluminum-intensive vehicles.

Tesla (TSLA) 4.5%

Tesla's stock price slid after the company launched cheaper versions of the Model 3 and Model Y, sparking concerns about margins and whether the trims remain compelling enough post-tax credit.

Multiple outlets noted the new prices were lower but still disappointed some analysts and customers, contributing to the negative share reaction.

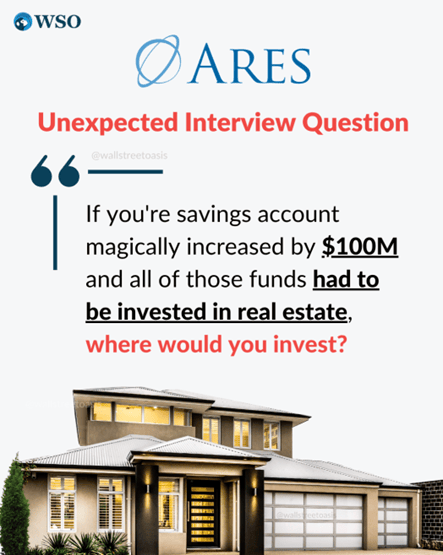

🧠 Technical Trip

Interview Q&A from Ares

👉 Want 1-on-1 recruiting help from Ares bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

SAIC inks $205 million cash deal to buy SilverEdge.

Qualtrics to buy Press Ganey Forsta for $6.75B to expand its reach in healthcare.

CoreWeave to acquire Monolith AI for industrial cloud growth.

TransDigm finalizes $765m cash acquisition of RTX’s Simmonds Precision Products.

Merck completes acquisition of Verona Pharma.

Beacon Pointe, BIP Wealth, and Raymond James unveil 850M+ deals.

📊The Daily Poll

Gold hitting $4,000 means… |

Previous Poll:

OpenAI partnering with AMD means…

Huge win for AMD: 46.0% // Tough news for Nvidia: 17.5% // Smart diversification: 14.3% // Just hype: 22.2%

Banana Brain Teaser

Previous

The present ratio of students to teachers at a certain school is 30:1. If the student enrollment were to increase by 50 students and the number of teachers were to increase by 5, the ratio of students to teachers would then be 25:1. What is the present number of teachers?

Answer: 15

Today

If a square mirror has a 20-inch diagonal, what is the approximate perimeter of the mirror, in inches?

Every property worth buying was once a problem worth solving.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick