- The Peel

- Posts

- Real Estate Tax Shift Ahead

Real Estate Tax Shift Ahead

🏠 President Trump is considering scrapping the capital gains tax for home sellers.

In this issue of the peel:

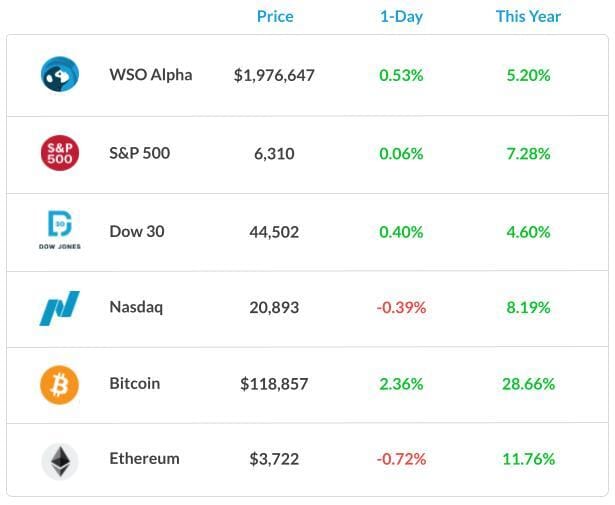

💰Markets were meekly up today but did enough to close at another record high.

🏠 President Trump is considering scrapping the capital gains tax for home sellers.

💾 Private market investors have thrown over $100bn in AI startups so far this year.

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Harsh Sharma, put together an impressive deep dive on Snowflake, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

Bezos reportedly met with Trump last week, and we smell a potential deal being cooked up.

Microsoft is going scorched earth on Google and raiding all of their DeepMind employees.

The S&P squeezed out another record-breaking performance yesterday.

Companies are leaving California in droves, with In-N-Out Burger being the latest.

Los Angeles Times is planning for an IPO, adding to the list of public newspaper companies.

President Trump is considering doing away with capital gains tax for people selling homes.

The Daily Poll

Scrap capital gains tax on homes? |

Previous Poll:

Will Trump stick to the August 1 deadline?

Yes: 26.4% // Maybe: 9.6% // He’ll delay: 64.0%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

AI Gold Rush

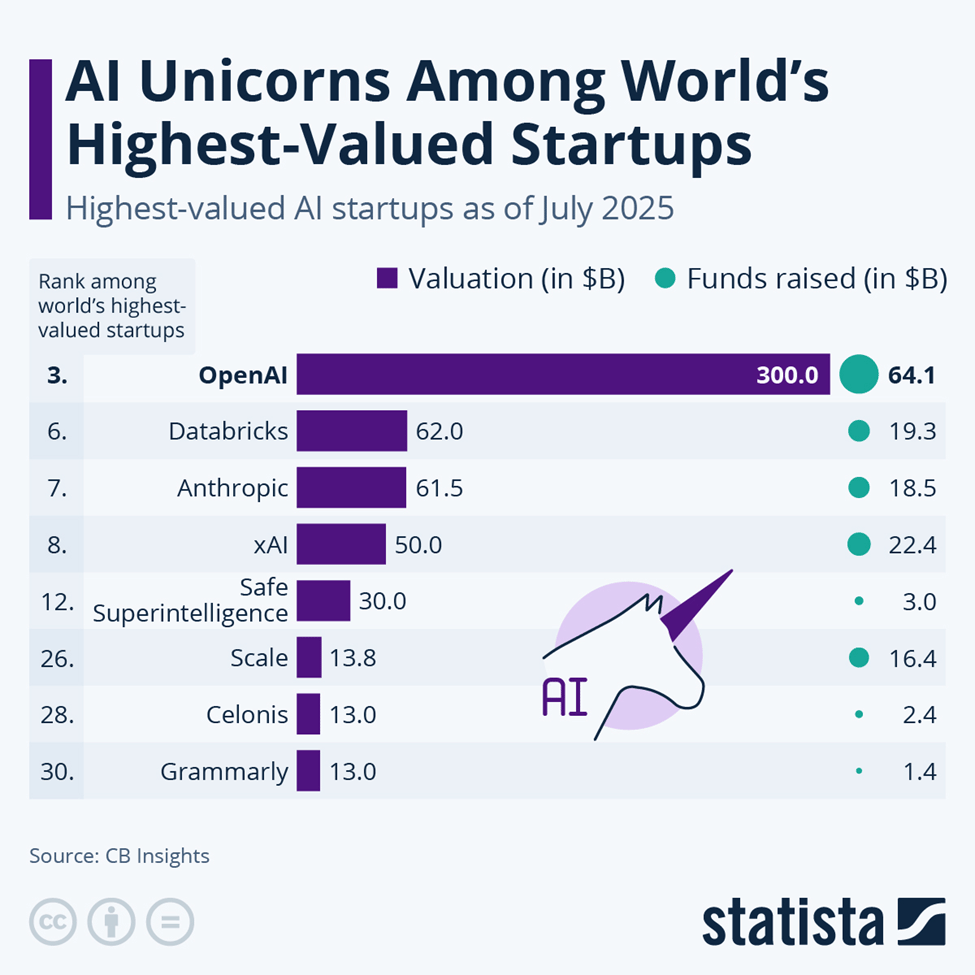

Wondering if AI is in a bubble that will pop anytime soon? The answer is a definite “no” based on private investment data so far.

In the first half of 2025 alone, investors have thrown a casual $104bn into AI startups, according to new data from PitchBook. For context, that’s literally more than the GDP of some small countries, and it's only July.

To be fair, investment has been top-heavy, and a lot of that cash has gone to a handful of big names. OpenAI competitors like Anthropic and Mistral, along with infrastructure players like CoreWeave, are also raking in the billions.

In fact, the top 10 deals made up nearly 40% of all the funding, suggesting that VCs aren’t just betting on AI; they're doubling down on the same companies.

But while the fundraising headlines are loud, the exit signs are... a little quieter. IPOs and acquisitions? Not so hot.

With markets still uncertain and many AI companies far from profitability, investors may be waiting a while before seeing real returns. Still, when the tech is moving this fast, patience might be the smartest play.

For now, the AI hype train is full steam ahead. Startups are burning cash, models are getting bigger, and VCs are acting like it’s 2021 all over again.

Will it end in glory or a few billion-dollar flameouts? Hard to say, but if you're building anything with “AI” in the name, now’s probably a good time to knock on some doors requesting money.

Career Corner

Question

How long are these calls even supposed to be? My first few were all like 25-30min and felt pretty dragged out. Just had one that was 15 min on the nose and felt way more natural.

Answer

It depends on the person. Did it feel rushed? It doesn’t seem so; so, think you are okay. No need to overthink it. That person is likely busy. Mondays can be easily distracting for people as they return from the weekend.

Head Mentor, WSO Academy

Thought Banana

The Great Tax Escape

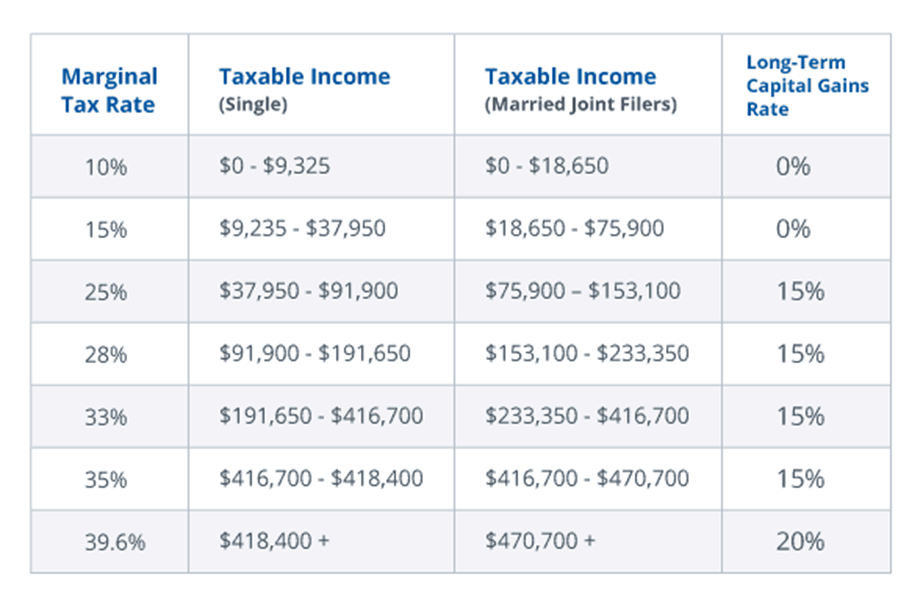

President Donald Trump is floating the idea of eliminating capital gains taxes on home sales, which should make homeowners everywhere perk up a little

Right now, if you sell your primary home and pocket a big profit, you will probably owe the tax man a slice of that gain, unless you qualify for exclusions ($250K for individuals, $500K for married couples).

Trump’s plan? Ditch the tax altogether. In theory, this would let homeowners keep more of the upside when they sell, especially in high-appreciation markets like California or New York, where gains often exceed the current exclusion limits.

For the average homeowner, this could be a massive win. It makes moving less of a financial hit and may encourage more people to list their homes (especially those who’ve been sitting on big unrealized gains).

For a housing market squeezed by low inventory, that could ease some of the pressure and bring prices back down to earth.

But there’s a flip side. Critics argue it could also juice demand and push prices even higher, especially if more investors jump in. And scrapping capital gains taxes means less revenue for the government, which might not sit well in the current deficit-heavy environment.

So will it happen? Hard to say. But as a homeowner, I’m selfishly all for this :)

The Big Question: Is this a smart move for homeowners or a short-term win with long-term consequences for the economy?

Banana Brain Teaser

Previous

From the consecutive integers -10 to 10, inclusive, 20 integers are randomly chosen with repetitions allowed. What is the least possible value of the product of the 20 integers?

Answer: (-10)^20

Today

Of the final grades received by the students in a certain math course, 1/5 are A’s, ¼ are B’s, and ½ are C’s, and the remaining 10 grades are D’s. What is the number of students in the course?

Send your guesses to [email protected]

In this world nothing can be said to be certain, except death and taxes.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick