- The Peel

- Posts

- Q2 Earnings Start Strong

Q2 Earnings Start Strong

💰The S&P and NASDAQ continue notching record highs as Q2 earnings start off with a bang.

In this issue of the peel:

💰The S&P and NASDAQ continue notching record highs as Q2 earnings start off with a bang.

🤑 Google, Tesla, and Coca-Cola are the headliners in a busy week of earnings.

📉 Berkshire Hathaway’s stock is trailing the S&P post Buffet’s departure.

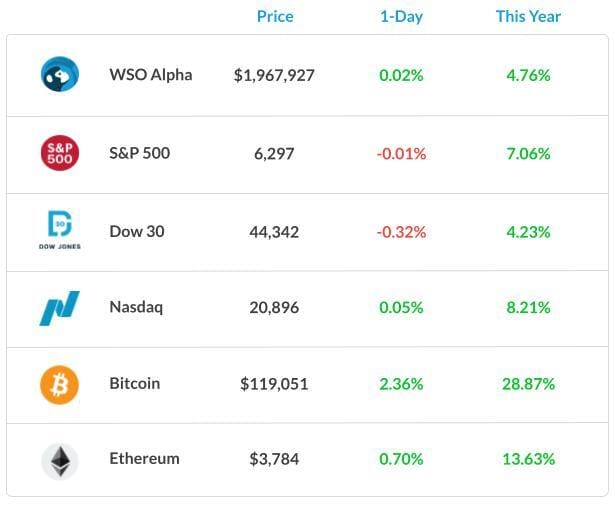

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Harsh Sharma, put together an impressive deep dive on Snowflake, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

Astronomer CEO has officially resigned after being outed in “Coldplay Gate.”

Berkshire Hathaway has been underperforming the market since Buffett called it quits.

Jerome Powell has a lot on his mind lately, from the Fed’s upcoming meeting next week to pressures from Trump to step down.

This week is a busy one for earnings reports, with Google and Tesla as the most anticipated.

See how your personal savings rate compares to other people in your age group.

Trump unveiled new 15% tariffs on several EU countries last week.

The Daily Poll

Can Berkshire do well post-Buffett? |

Previous Poll:

Would you trust a bank-issued stablecoin?

Yep: 25.7% // Only big banks: 33.3% // Nope: 41.0%

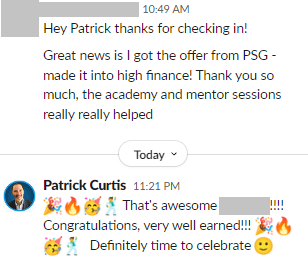

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

Busy Earnings Week

It’s shaping up to be one of the busiest earnings weeks of the season, and investors will be watching closely as some of the biggest names in tech report results.

On Wednesday, Alphabet and Tesla take center stage, and how they perform could influence market sentiment heading into August.

Alphabet is expected to post strong numbers, with analysts forecasting $2.17 in EPS on $94 billion in revenue. But beyond the headline figures, people will be listening for commentary on AI strategy and digital ad trends.

With competition heating up in the AI arms race, Alphabet’s tone on growth and innovation could set the stage for how other tech firms are viewed.

Tesla, meanwhile, enters earnings with a bit more pressure. Deliveries were down last quarter, and Wall Street is expecting EPS to come in at just $0.43, a notable drop from last year. With increased EV competition, questions surrounding demand, and Elon Musk’s recent negative spotlight, this report could be a key moment for the stock.

Other major companies reporting this week include Intel, Coca-Cola, and General Motors, all of which will provide a broader view of consumer behavior, supply chains, and the economy's health.

Markets have been mostly steady this month, but with so many names reporting, volatility could pick up. By the end of the week, we’ll likely have a clearer picture of how corporate America is faring—and where investor confidence stands.

Career Corner

Question

I was recently asked this question and would appreciate some input on how to answer it: "What are some line items that might be included in the COGS section of the income statement of a tech and/or biotech company?"

Answer

Look up the public financials of a tech company and a biotech company, and you'll see what they include in COGS (directly below revenue, above gross profit). You want to ensure that these line items are directly tied to the production of revenue.

Then research each of the line items and learn about what they are.

Head Mentor, WSO Academy

Thought Banana

Tough Times at Berkshire

Berkshire Hathaway is experiencing a period of underperformance relative to the S&P 500, coinciding with Warren Buffett's announcement of his retirement at the end of 2025.

This decline has sparked discussions about the so-called "Buffett premium,” which is the added value investors attribute to Berkshire Hathaway due to Buffett's reputation and leadership. With his impending departure, some investors are reassessing the company's valuation.

Berkshire's cautious investment approach, including significant reductions in holdings like Apple and a growing cash reserve exceeding $330 billion, has also contributed to investor concerns.

As Greg Abel prepares to take over as CEO, questions remain about how Berkshire Hathaway will navigate this transition and whether it can maintain its historical performance without Buffett at the helm.

The company's future strategies, including potential changes to its investment approach and capital allocation, will be closely watched by investors.

The Big Question: Can Berkshire Hathaway thrive without Buffett, or is the “Buffett premium” finally expiring?

Banana Brain Teaser

Previous

If 75% of a class answered the first question on a certain test correctly, 55% answered the second question on the test correctly, and 20% answered neither of the questions correctly, what % answered both correctly?

Answer: 50%

Today

The ratio, by volume, of soap to alcohol to water in a certain solution is 2:50:100. The solution will be altered so that the ratio of soap to alcohol is doubled while the ratio of soap to water is halved. If the altered solution will contain 100 cubic centimeters of alcohol, how many cubic centimeters of water will it contain?

Send your guesses to [email protected]

Given a 10% chance of a 100 times payoff, you should take that bet every time.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick