- The Peel

- Posts

- NYC Gets a New Boss

NYC Gets a New Boss

Mamdani took charge of New York City after a historic election win.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

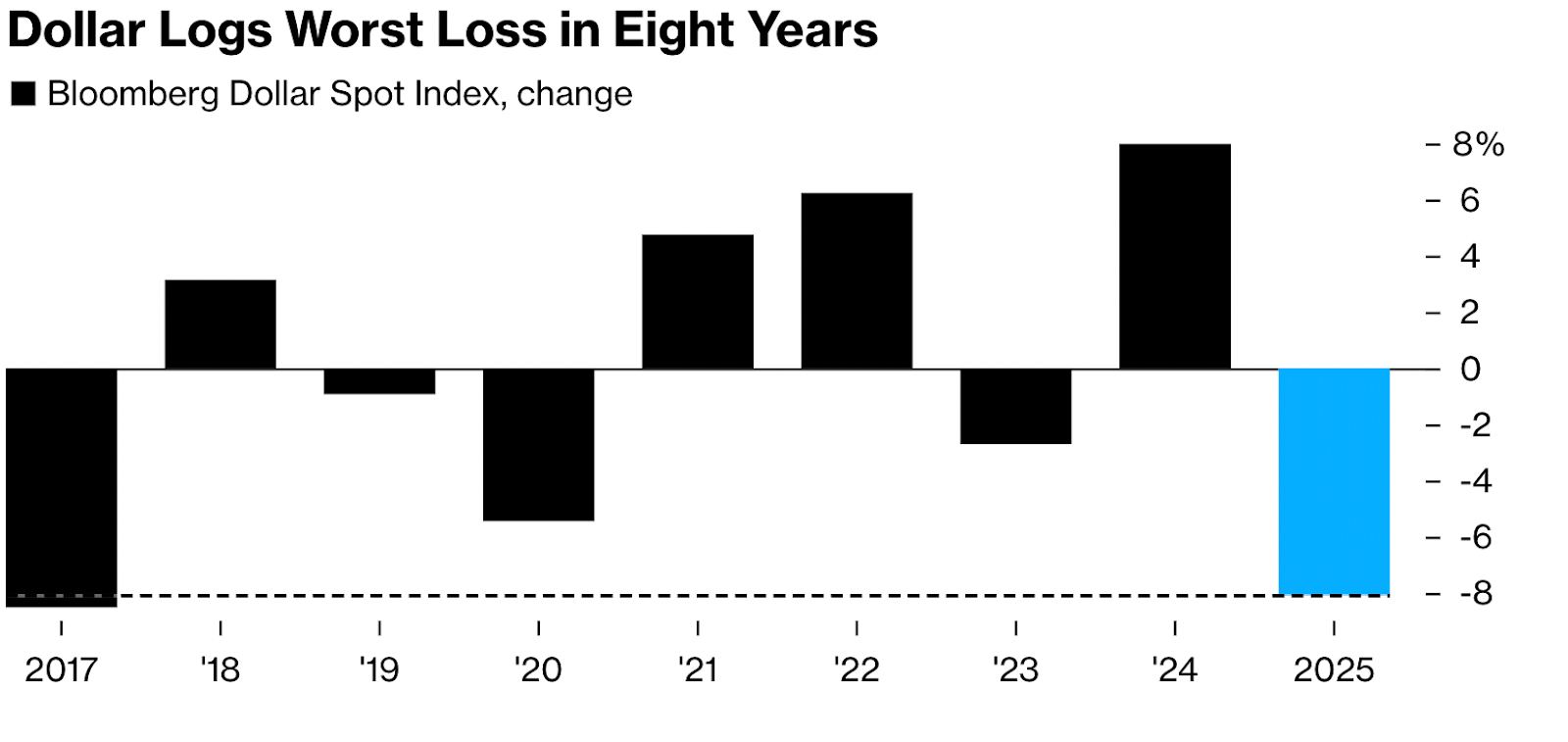

Market Summary: Dollar losing its power at its fastest rate since 2017

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Evercore

Lesson from the Library: Go beyond basics — learn deferred taxes, NOLs, stock-compensation, and complex accounting used in real-world models.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

📉 Banana Bits

Trump delayed a planned tariff hike on furniture and kitchen cabinets.

Sovereign wealth funds are piling into tech as assets swell to $15T.

Mamdani took charge of New York City after a historic election win.

Trump’s media firm plans to issue a new cr*ptocurrency to shareholders.

The stakes are rising as Trump moves to dismantle the CFPB.

U.S. jobless claims dipped to 199,000 during Christmas week.

Singapore logged a stronger-than-expected 4.8% growth in 2025.

Market News

Dollar Losing Its Power at Its Fastest Rate Since 2017

Despite the early December run, the last few trading days of 2025 were lackluster for investors.

Stocks and bonds slipped along with gold and silver on the last day of 2025. The S&P 500 extended a stretch of post-Christmas losses, paring the benchmark’s advance for 2025 to roughly 16%.

The Nasdaq 100 declined 0.8% on Wednesday, its fourth consecutive day of losses. Even so, both indexes have posted double-digit gains for three consecutive years, notching their longest winning streak since 2021.

Given the blockbuster growth of major indexes this year, it was not a smooth ride for investors, with traders weathering swings triggered by a range of factors, including U.S. trade policies, geopolitical tensions, concerns over elevated valuations, and uncertainty about the path of central bank monetary policy.

With all the joy and ride of equities, the Dollar got a beating this year, with the currency suffering its worst performance since 2017. The Bloomberg Dollar Spot Index fell about 8% this year, and traders are betting on further weakness.

After tumbling in the wake of President Donald Trump’s tariff rollout in April, the greenback failed to rebound much in part on expectations that Trump will name a dovish successor to Fed Chair Jerome Powell, whose term ends next year.

What's Ripe

Vanda Pharmaceuticals Inc. (VNDA) 25.5%

VNDA jumped 25% after the Food and Drug Administration approved Nereus as a treatment to prevent vomiting induced by motion.

The drug would compete against Dramamine, a cheap over-the-counter medicine.

Nike Inc. (NKE) 4.1%

NKE gained 4.1% to $63.71. Nike President and CEO Elliott Hill purchased 16,388 shares of the athletic apparel maker at an average price of $61.10 on Dec. 29, according to a regulatory filing.

What's Rotten

Corcept Therapeutics Inc. (CORT) 50.4%

CORT sank 50%. The company said that while the Food and Drug Administration acknowledged the company’s Grace trial for relacorilant met its primary endpoint and that data from Corcept’s Gradient trial provided confirmatory evidence, the FDA concluded “it could not arrive at a favorable benefit-risk assessment for relacorilant without Corcept providing additional evidence of effectiveness.”

Relacorilant is a treatment for patients with hypertension secondary to hypercortisolism.

Hecla Mining Co (HL) 1.5%

HL, the largest U.S. silver producer, fell 1.5%. The price of the white metal dropped 9% after exchange operator CME Group increased margin requirements for the second time in a week.

🧠 Technical Trip

Interview Q&A from Evercore

👉 Want 1-on-1 recruiting help from Evercore bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Advanced Accounting: Mastering the Real Numbers Behind the Deals

Go beyond basics — learn deferred taxes, NOLs, stock-compensation, and complex accounting used in real-world models.

🌟 WSO Academy Q4 Update

🎯 More Structured Technical Preparation

One of the most common questions we hear is: “What should I study first?” Next quarter, we plan on updating our curriculum to make that answer clearer and guided.

✅ Instead of just spending 5 hours per week studying, assignments will be organized by topic and sequenced in such a way that you build skills in the right order

✅ For each stage, assignments will link directly to the specific section of your course, depending on your track, so that you know exactly what to study and when

✅ This removes guesswork and ensures you’re building a strong foundation before moving to advanced topics

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Apollo is selling Coinstar to an Alaska-based buyer, with bonds set to be repaid.

America’s Test Kitchen is under contract for Food52’s assets.

Chinese AI firms are fueling Hong Kong’s busiest IPO month since 2019.

Musk’s xAI bought property to expand its “Colossus” data center.

Michael Burry said he’s not shorting Tesla.

📊The Daily Poll

Dismantling the CFPB most directly impacts: |

Previous Poll:

If global markets outperform the U.S. in 2025, the smart shift is toward:

International equities: 53.9% // EM selectively: 7.7% // Staying U.S.-heavy: 15.4% // Waiting it out: 23%

Banana Brain Teaser

Previous

An investor purchased 100 shares of Stock X at $6.05 per share and sold them all a year later at $24 per share. If the investor paid a 2% brokerage fee on both the total purchase price and the total selling price, which of the following is closest to the investor’s percent gain on this investment?

Answer: 280%

Today

From a group of 8 volunteers, including Andrew and Karen, 4 people are to be selected at random to organize a charity event. What is the probability that Andrew will be among the 4 volunteers selected and Karen will not?

Being too early is indistinguishable from being wrong.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick