- The Peel

- Posts

- Nothing Escapes AI

Nothing Escapes AI

Markets are reacting sharply to anything tied to AI.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Tamed inflation leads market turnaround

What’s Ripe / Rotten: The tastiest and most disgusting stocks today

Technical Trip: Interview Q&A from Morgan Stanley

Lesson from the Library: Build clean, defensible DCF models from forecasts to valuation.

Deal Deep Dive: M&A, IPO, and transaction breakdowns

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

Alibaba led a tech selloff after briefly appearing on a Pentagon blacklist.

Japan reported weak GDP growth as consumer spending disappointed.

Markets are reacting sharply to anything tied to AI.

Bank CEOs are earning pay packages reminiscent of 2006.

Iran signaled potential deals in energy, mining, and aviation.

Inflation cooled in January, though some pressures remain sticky.

Market News

Tamed Inflation Leads Market Turnaround

Friday’s trading saw a turnaround after softer-than-expected inflation data. The consumer price index rose 0.2% in January, the smallest gain since July, and was restrained by lower energy costs.

While service costs picked up last month, prices of core goods remained stable. The core CPI rose from a year ago by the least since 2021. The overall gauge also eased on an annual basis. Treasury two-year yields dropped to their lowest level since 2022 as traders priced in higher chances that the Fed will slash rates more than twice this year.

About 370 shares in the S&P 500 rose, but the gauge closed little changed at the end of its worst week since November. A gauge of megacaps lost 1.1%. Amazon.com Inc. saw its longest slide in almost 20 years. The Russell 2000 index of small firms climbed 1.2%. Bitcoin jumped.

Another school of thought is that the market is discounting anything associated with the word “AI,” which is contradictory, as two years ago, any mention of AI would pump up the stock market.

Investors are currently concerned about AI-driven disruption to existing business models and the “crazy” capex of tech companies. The question is: How can you not be disrupted without high capex spending?

What's Ripe

Rivian Automotive Inc. (RIVN) 26.6%

RIVN soared 27% after the electric-vehicle maker reported a fourth-quarter gross profit of $120 million, when Wall Street was expecting the company to break even.

Rivian sold 9,745 cars in the fourth quarter, down from 14,183 a year earlier. For 2026, the company anticipates delivering between 62,000 and 67,000 cars, up from about 42,000 vehicles in 2025.

Coinbase Global Inc. (COIN) 16.5%

COIN jumped 16%. The cr*ptocurrency exchange operator reported fourth-quarter revenue that missed expectations and swung to a loss in the period on steep declines in the price of B*tcoin and other digital currencies.

The shares have fallen 50% over the past three months amid a brutal cr*pto selloff.

What's Rotten

Pinterest Inc. (PINS) 16.8%

PINS tumbled 17%. The social-media company’s fourth-quarter adjusted earnings met expectations, but revenue fell short.

Pinterest sees growth slowing in the first quarter, predicting less revenue that was weaker than Wall Street had forecast.

DraftKings Inc. (DKNG) 13.5%

DKNG slumped 14% after the sports-betting company missed Wall Street’s fourth-quarter earnings expectations and issued soft revenue guidance for the current year.

The results could fuel concerns about the threat prediction markets like Kalshi and Polymarket pose to sportsbooks, although DraftKings launched its own prediction market in the fourth quarter. Polymarket has a data-sharing partnership with Dow Jones, the publisher of Barron’s.

🧠 Technical Trip

Interview Q&A from Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

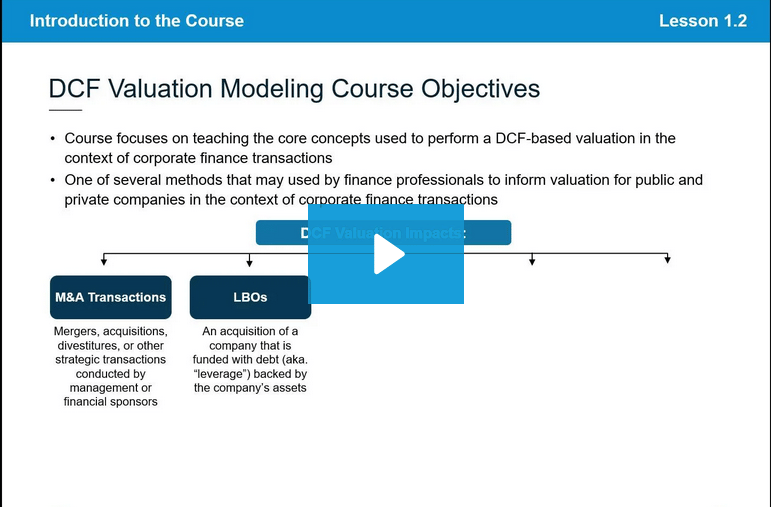

🎥 DCF Modeling Course: Valuing Cash Flow, Not Hype

Build clean, defensible DCF models from forecasts to valuation.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Digital bank Maya is weighing a U.S. IPO of up to $1B.

Warner Bros. may reopen sale talks with Paramount.

Carlyle and Sixth Street BDCs are teaming up to issue CLOs.

India’s central bank cleared lenders to fund up to 75% of M&A deals.

Anduril is in talks to raise billions at a $60B-plus valuation.

SpaceX is reportedly considering dual-class shares to retain Musk’s control in an IPO.

📊The Daily Poll

Why are markets overreacting to AI news? |

Previous Poll:

What’s the biggest impact of the US–Taiwan deal?

Tariff cuts: 35.0% // More trade: 17.4% // Tech boost: 28.6% // Supply shift: 19.0%

Student Success Corner

From Applications to Offer: How Strategic Networking Leads to Investment Banking Roles

👉 Check out more on WSO YouTube

Banana Brain Teaser

Previous

If n = (33)^43 + (43)^33, what is the units digit of n?

Answer: 0

Today

During a trip, Francine traveled x percent of the total distance at an average speed of 40 miles per hour and the rest of the distance at an average speed of 60 miles per hour. In terms of x, what was Francine’s average speed for the entire trip?

Given a 10% chance of a 100 times payoff, you should take that bet every time.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick