- The Peel

- Posts

- No Firing, Just Rebounding

No Firing, Just Rebounding

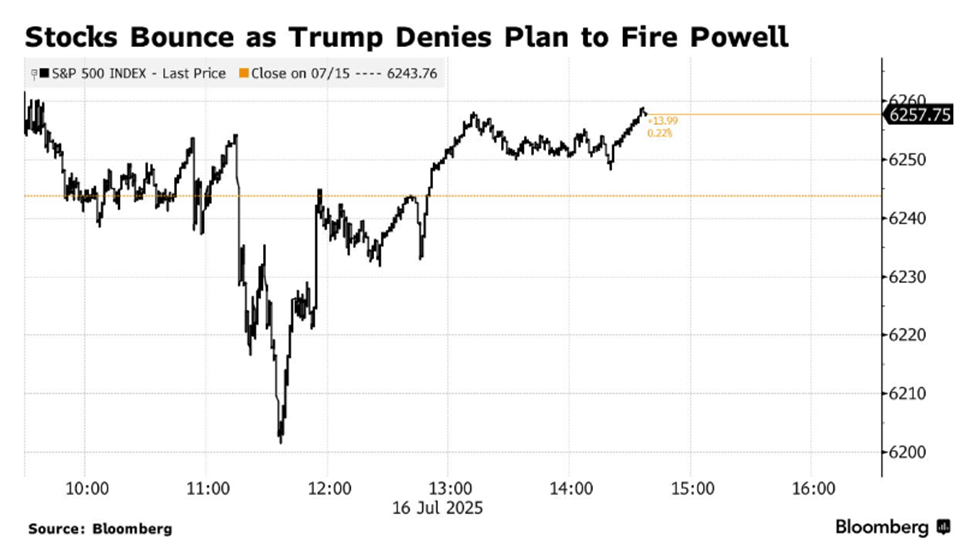

🏦 Markets rebound as President Donald Trump denies any plans to fire Fed Chair Jerome Powell

In this issue of the peel:

🏦 Markets rebound as President Donald Trump denies any plans to fire Fed Chair Jerome Powell.

📈 The gap between 5-year and 30-year U.S. Treasury yields is reportedly the highest since 2021, as the yields of longer-term bonds continue to climb.

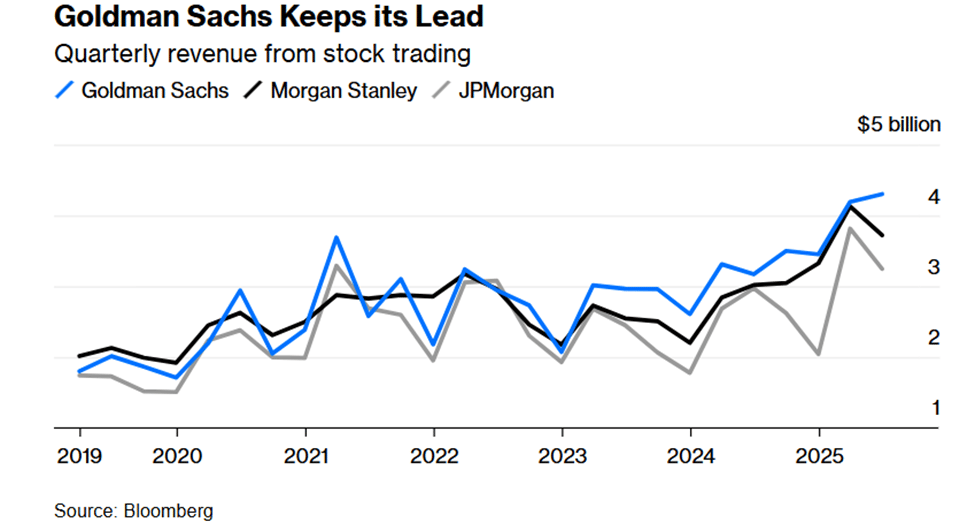

🎢 Goldman Sachs beat earnings big-time yesterday as the investment bank hit significant strides in revenue growth.

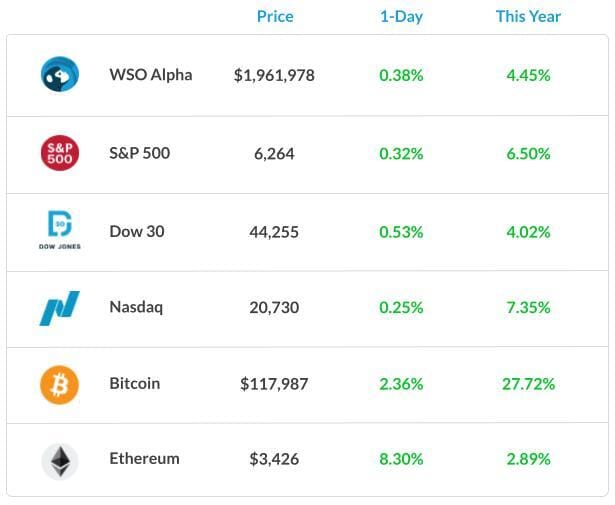

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Harsh Sharma, put together an impressive deep dive on Snowflake, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

President Donald Trump signs a bill that toughens the repercussions for trafficking Fentanyl.

The U.S DOJ has rejected statements from Salvadorian officials that suggest the Trump Administration kept legal authority over Venezuelan Migrants.

President Donald Trump said he plans to send tariff letters to over 150 countries.

Canada is reducing the amount of tariff-free foreign steel imports that can be brought into the country to aid domestic producers.

Why Inflation in the UK Keeps Climbing and the Implications for Interest Rates.

Barclays was fined $56 million after dealing with “risky” customers.

The Daily Poll

Should the Fed stay fully independent? |

Previous Poll:

Will CPI come in above expectations?

Yes: 58.9% // Maybe: 14.4% // No: 26.7%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

No Firing? Markets Chill

Jerome Powell, the Chair of the Fed, has been under fire the past few months by the Trump Administration and the GOP as a direct result of the Fed adopting a “wait and see” strategy.

This strategy essentially means that the Fed is going to hold rates until they know tariff-induced inflation is not coming, so that a rate cut will not exacerbate the effects on inflation.

What is unique about the Fed is that they operate independently of the government, apart from the fact that the president appoints the Chair of the Fed. Therefore, Trump theoretically does not have the power to fire anyone in the Fed, let alone Powell.

However, when reports came out yesterday that Trump was planning on firing Powell, that caused modest market volatility because that would then mean that the U.S government and the Fed are not two separate entities.

Despite this, after Trump denied the rumors, markets proceeded to rebound.

If Trump were somehow to find some legal loophole to fire Jerome Powell, the U.S economy would then be faced with a much more significant problem: the erosion of the Fed’s credibility.

CEO of J.P. Morgan, Jamie Dimon, even said that the Fed’s continued independence from the U.S government is “absolutely critical.” This isn’t only true for the Fed’s credibility, but we would likely see markets as well as the dollar plunge as a result of the firing of Powell.

The Takeaway?

The value and overall credibility of the Fed is primarily dependent upon its independence from the federal government, and a forced removal of Powell will have significant repercussions on the U.S economy.

Career Corner

Question

I am applying for an Equity Research role (that I believe fits me well, despite focusing on IB). The position is 1 week old and has over 100 applicants; would I stand out if I wrote an interest statement as asked by LinkedIn?

Answer

I don’t have a strong view on these LinkedIn applications, but I assume marking as your top choice can’t hurt. However, it is also important to network!

That will likely have a bigger impact than whether or not you check this box. And strong interview prep with a strong stock pitch will go a long way! (Also, as an aside, you can’t trust the number of applications on LinkedIn; some submissions are completely unqualified, and some are bots.)

Head Mentor, WSO Academy

Thought Banana

Goldman Sachs Hits New Highs

Yesterday, Goldman Sachs announced their Q2 earnings for 2025, and absolutely crushed the estimates of analysts. This continued the trend from Tuesday of big banks beating expectations, with J.P. Morgan and Citigroup performing well.

In addition to reporting record-high equity trading revenue, Goldman also announced that their investment banking revenue from deal fees increased 70% YoY from Q2 2024.

The current market conditions are perfect for success for Goldman. A mix of high volatility, hedge funds with a significant appetite for borrowing, as well as good relationships with electronic trading firms like Jane Street.

Goldman is now also a top broker at 125 of the world’s 150 biggest stock-trading clients. Goldman also reported revenue of $4.3 billion in equities trading.

Despite the fact that other banks have had a successful earnings season, Goldman is still in the lead as far as quarterly revenue from stock trading goes.

The Takeaway?

Despite the seemingly uncertain macroeconomic outlook, the big U.S banks have managed to capitalize on the current economic climate, and that trend will likely continue.

The Big Question: Can big banks keep winning while the broader economy sends mixed signals?

Banana Brain Teaser

Previous

If n = 4p, where p is a prime number greater than 2, how many different positive even divisors does n have, including n?

Answer: 4

Today

A store currently charges the same price for each towel that it sells. If the current price of each towel were to be increased by $1, 10 fewer of the towels could be bought for $120, excluding sales tax. What is the current price of each towel?

Send your guesses to [email protected]

Someone is sitting in the shade today because they planted a tree a long time ago.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin & Patrick