- The Peel

- Posts

- No Elon at Table

No Elon at Table

A beef yet to be resolved, Musk will not attend Trump’s dinner at the White House.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks hit records as weak jobs data fuels rate-cut hopes

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Q&A from Morgan Stanley

Deal Dispatch: M&A, IPOs, and other transactions

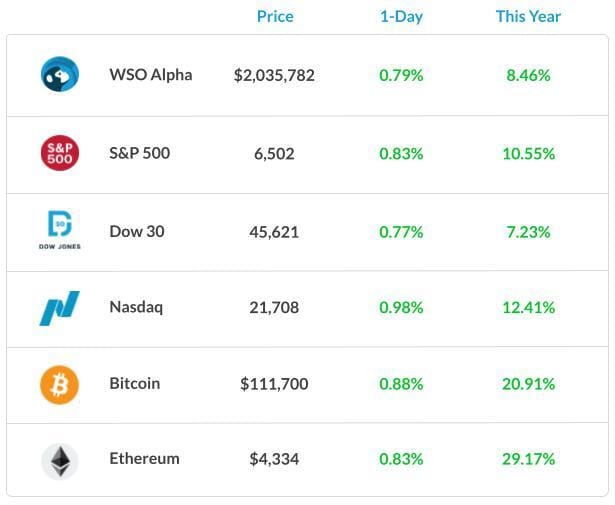

Market Snapshot

📉 Banana Bits

Trump requested the Supreme Court to fire the FTC Commissioner.

Backfire? New York AG appeals reversal of Trump’s $500 million fraud penalty.

U.S jobless claims rise, private payrolls growth slows

Friday’s jobs report could confirm a slowing job market. But will investors’ optimism fade?

A beef yet to be resolved, Musk will not attend Trump’s dinner at the White House.

Surging Bond yields have led to gold surging to a fresh high.

Oil hit a two-week low amid OPEC+ plans to raise production.

Lululemon says the closure of the De Minimis hole will crush margin.

House buyers are in “rate watch” as the 30-year mortgage drops to 6.5%.

Broadcom CEO Forecasts Big AI Revenue Gain as He Takes On Nvidia.

Market Recap

A Slowing Job Market

The market surged across the board on Thursday as soft U.S data ignited optimism for a September rate cut.

The S&P 500 rose 1% to a fresh all-time high, while two-year U.S Treasuries fell to the lowest level in about a year. The market movement on Thursday is also highly anticipated for a tick up in unemployment figures and a slowdown in hiring numbers that is set to be released on Friday.

The market is clearly wishing for a weak job market, but according to Steve Sosnick at Interactive Brokers, we should be careful what we wish for.

Investors are pricing in too much for a Goldilocks moment, an environment of a decelerating job market, but not too dire, where inflation is under control and healthy GDP growth is sustained.

However, this situation could turn completely in a different direction, which may lead to stagflation or stagnation.

Worries over inflation, deteriorating U.S fiscal health, threats to the Fed’s independence, and ongoing geopolitical instability have put Treasuries into jeopardy. Instead, gold has become the investor's top pick.

The gold and treasury assets held by foreign central banks have diverged sharply this year, highlighted by the surge in gold prices to an all-time high, while bond yields are surging to levels never seen before.

While there have been jitters regarding the lucrativeness of U.S treasuries, it didn’t experience significant sell-offs compared to peers such as European or Japanese bonds.

What's Ripe

Ciena Corp. (CIEN) 23.3%

Cien stock soared 23% on Thursday trading after the company posted EPS of $0.67 vs $0.53 on revenue of $1.22 billion vs $1.18 billion.

The company also provided a positive outlook for the fourth quarter with a revenue of around $1.24 to $1.32 billion, above estimates of $1.21 billion.

The management also plans to cut four to five percent of its workforce amid restructuring.

Gap Inc. (GAP) 5.9%

Gap rises after CEO Richard Dickson plans to expand beyond clothing.

The management is betting on cosmetics and accessories to drive the company’s next growth stage.

What's Rotten

Lululemon Athletica Inc. (LULU) 16.8%

Lululemon’s second-quarter earnings of $3.10 a share were ahead of the consensus estimates for $2.86 a share.

The drop came after same-store sales were 1% way below the analyst estimate of 3.7%.

The management also provided weak guidance of EPS of $12.77 to $12.97 for the year, compared with a prior forecast of $14.58 to $14.78.

GitLab Inc. (Gitlab) 7.4%

Gitlab dropped 7.35% despite beating Wall Street’s quarterly earnings and revenue estimates.

The drop came after the management provided weaker-than-expected revenue guidance.

🧠 Technical Trip

Q&A from Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Deep Dive

M&A, IPOs, And Other Notable Transactions

BlackRock to Lead Private Credit Deal to Refinance Syndigo Debt.

Banks Ready $38 Billion of Debt for Oracle-Tied Data Centers.

StubHub, Netskope to Begin IPO Marketing as Soon as Monday.

Paramount Bolsters Movie Slate With Deal for Legendary’s Films.

White House lambasts $2 trillion Norwegian wealth fund’s Caterpillar exit.

Oil Juniors PRIO, Brava, BW Eye Petronas’ Stake in Brazil Field.

Goldman to Buy $1 Billion of T. Rowe Stock as Firms Team Up.

Macquarie Buys Stake in Portugal Hospital Group for €310 Million.

Carlyle raises $20bn to scoop up aging private equity stakes.

📊The Daily Poll

Trump asking SCOTUS to fire the FTC Commissioner is… |

Previous Poll:

Fed’s Sept 25bp cut odds = 90%. You say…

Done deal: 51.8% // Too soon: 28.6% // Not enough: 5.3% // Still uncertain: 14.3%

Banana Brain Teaser

Previous

A certain rectangular window is twice as long as it is wide. If its perimeter is 10ft, then its dimensions in feet are?

Answer: 5/3 and 10/3

Today

A certain country had a total annual expenditure of $1.2 × (10)^ 12 last year. If the population of the country was 240 million last year, what was the per capita expenditure?

Courage taught me no matter how bad a crisis gets... any sound investment will eventually pay off.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, Mitchell, & Patrick