- The Peel

- Posts

- Meta Dominates Ad Revenue

Meta Dominates Ad Revenue

Meta continues to suck all the ad dollars away from less fortunate competitors like Snap and Pinterest. Shake Shack is cheffing up some gains while the jig is up for chip designer Arm Holdings. Moderna also got hammered, and not in a fun way.

In this issue of the peel:

The often-forgotten aspect of the U.S. economy—the one in which we actually tough grass—hasn’t been nearly as on fire as Nvidia’s market cap lately. June’s Construction and July’s Manufacturing data, unfortunately, highlight this well.

Meta continues to suck all the ad dollars away from less fortunate competitors like Snap and Pinterest. Shake Shack is cheffing up some gains while the jig is up for chip designer Arm Holdings. Moderna also got hammered, and not in a fun way.

The world’s most valuable company just dropped earnings. Find out how they did below.

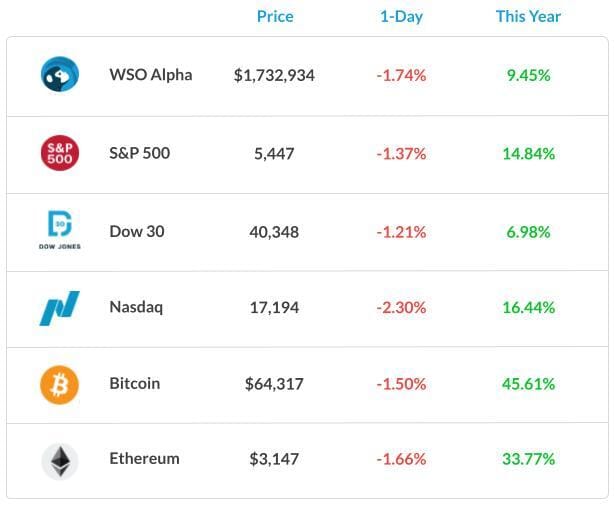

Market Snapshot

Banana Bits

Amazon takes a big swing-and-a-miss for the quarter, with shares down 6% after hours.

Snap shares cratering on earnings is becoming a quarterly routine at this point.

A multinational prisoner swap, including WSJ reporter Evan Gershkovich, results in the freedom of dozens of prisoners from Russia and the U.S.

Kid Rock shooting Bud Light with a machine gun is still hurting AB-InBev.

The Daily Poll

Will the U.S. enter a recession before the end of 2025? |

Previous Poll:

How many 25bp rate cuts (or their equivalent) will there be in 2024?

0: 8.4%, 1: 39.1%, 2: 40.1%, 3: 7.0%

Macro Monkey Says

The “Oh Sh*t” Economy

Amid all the AI hype and lack of grass-touching among much of the American populous, it’s easy to forget that the economy involves some physical aspects too.

Unfortunately, the real-world economy wasn’t growing nearly as much in June and July as the average American’s screen time.

We just got the latest on U.S. Construction and Manufacturing. Let’s get into it.

The Numbers

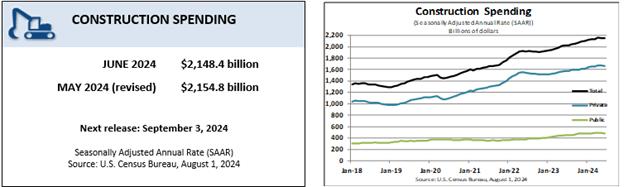

Yesterday, we got an update on total Construction Spending in June alongside the latest Institute for Supply Management (ISM) Manufacturing data for July.

As we can see above, total spending on construction fell slightly but foreshadowed 0.3% in June. Annually, construction spending grew 6.2%.

No single line item was apocalyptically terrible, but the report overall was more of an ick like when your date is rude to your waiter.

The biggest ick in the report came from the 1.2% decline in single-family residential investment. Total residential investment fell 0.4% as multifamily spending grew 0.1%.

That’s *ss for the housing market, contributing to yesterday’s tumble in equity prices on concerns about what a still-frozen market amid declining rates could portend for consumers' financial health.

Spending on construction for commercial facilities (basically any non-residential building used for business purposes that isn’t an office building) declined the fastest within private spending, down 1% monthly and 13.5% compared to June 2023.

That’s a telltale sign that businesses are becoming conservative with their spending and more mindful of their borrowing. In English, businesses are nervous.

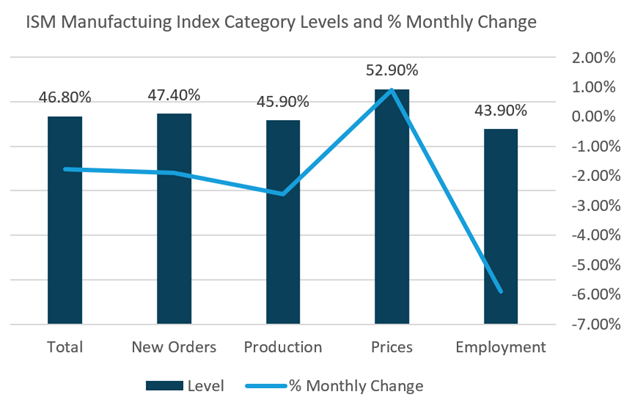

Meanwhile, the manufacturing side of the physical economy ventured further into contraction territory in July.

As we can see in the light blue line above, every single reading within the ISM Manufacturing index fell in July, with employment’s 5.9% drop paving the way lower.

Prices were the only segment to see an increase, growing 0.8%. Even worse, subindexes declined nearly across the board as well.

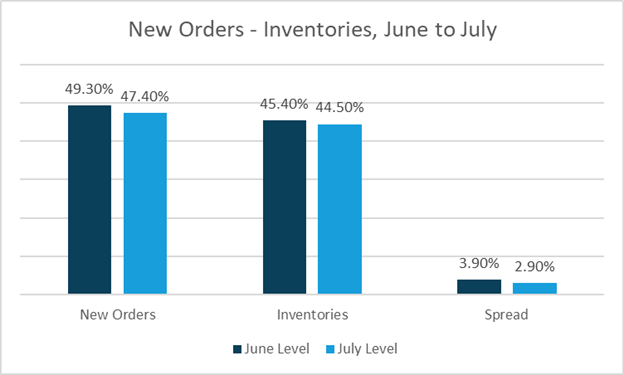

One of our most watched indicators—the spread between New Orders and Inventories—worsened as well.

Ideally, both New Orders and Inventories would move in tandem, as this would suggest that businesses are managing production and inventory offloading well.

When both fall, this suggests that demand is weakening. However, when new orders fall faster than inventories, it’s an even worse sign of demand.

New orders falling faster than Inventories suggests that demand has dried up so much that demand for future goods (new orders) is even worse than the currently depressed demand represented by worsening inventory levels.

Basically, this means that oversupply becomes a risk. Oversupply can lead to margin pressure and/or layoffs in production roles. That brings the risk of rising unemployment, falling spending, and all the other stuff that keeps Fed Chair JPow up at night.

The Takeaway?

JPow and the rest of the FOMC gang may soon come to regret not acting sooner.

The U.S. economy is clearly moving toward contraction territory at this stage. It’s not something that can’t be reversed, but combining the above data with recently observed upticks in unemployment brings only one response from macro viewers: “Oh Sh*t.”

Acting too late is arguably becoming a common theme of JPow’s Fed. Arguably, that’s better than acting early, but we have a radical proposal for the FOMC here at The Daily Peel: act on time.

Data dependency has its drawbacks when you are too much of a numbers nerd, like JPow.

Like John Tuld, the CEO of Margin Call, said when explaining why he gets paid the big bucks:

“I'm here to guess what the music might do a week, a month, a year from now. That's it. Nothing more. And standing here tonight, I'm afraid that I don't hear a thing. Just... silence. So, now that we know the music has stopped, what can we do about it?"

Hopefully, JPow can hear the music… or the fact that it’s stopping.

What's Ripe

Shake Shack (SHAK) 16.88%

Let me put y’all on some airport game: if you need a place to sit and get f*cked up, hit the bar at Shake Shack. The food line is gonna be long, but the bar line is as non-existent as bears after the firm’s latest earnings.

The burger joint with the best shakes saw net income grow 50% annually, easily beating estimates, while revenue also grew 16%.

Same-store sales grew 4%, bucking the declines felt at lower and higher-end restaurants. Fast-casual brands have been right in the sweet spot this cycle.

Meta Platforms (META) 4.82%

After changing its name to “Meta” in hopes that we’d all become metaverse-dwelling virgins like Zuck in his mid-twenties, this firm may have to become “Gen AI” soon.

That’s because Zuck is dumping $37 - $40bn in CapEx for this year, mostly going to AI-based ventures. Instagram and Facebook’s ad units are still killing it.

Some analysts are nervous about the enormous CapEx, but as long as they keep beating sales and EPS estimates by 2% and 10%, it’s smooth sailing from here.

What's Rotten

Moderna (MRNA) 21.01%

You can beat earnings estimates and literally save the entire world, and the market will still beat the f*ck outta you, just as Moderna did after their latest report.

The big dawg of biotech earned revenue of $241mn, nearly double the $132mn estimate, while losses of $3.33/sh came in lighter than the $3.39/sh expected.

COGS fell 84% annually, while sales fell just 29%. C-19 vax sales fell 37%, but other prospective vax products are keeping the ship afloat… well, kinda.

Arm Holdings (ARM) 15.72%

Like when your home run shot gets robbed at the warning track, Arm shares shot up 8.4%, leading into earnings… only to get slammed nearly as hard as Moderna.

The chip designer reported better-than-expected results across the board. However, “weak” (a.k.a. unchanged) guidance made the market throw up.

But business is still booming. Sales grew 39% annually to $939mn, driven by a 72% jump in licensing revenue.

Thought Banana

Earnings Spotlight: Apple Inc (AAPL, 1.7%)

The most valuable company in the world took a line from Lil Wayne’s playbook when it released earnings at 5 p.m. ET yesterday, saying, “And I’m sorry for the m*otherf*ckin’ wait.”

But it was better late than never to receive the latest quarterly numbers from the Kingpin of Cupertino.

Shares traded mixed in the after-hours session, so let’s see how they did.

The Numbers

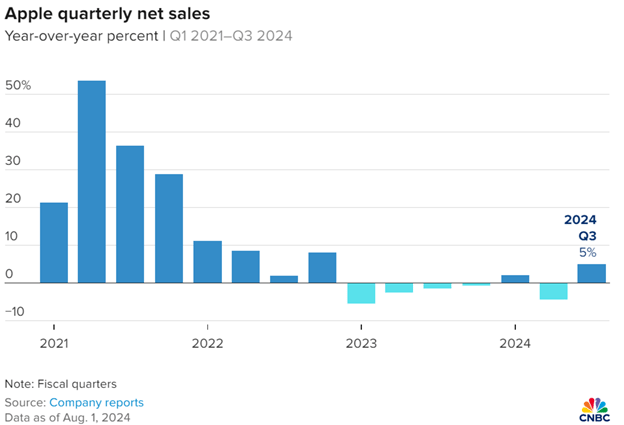

Apple's revenue grew a boomer-like 5% annually, confirming that the company may be entering a phase of exactly what Jobs and Wozniak sought to defeat: stagnancy.

Apple originated as the cool, young, innovative guy on the block (or, more accurately, in the garage) but has now become so large that the company is the block.

But I’m sure they’re fine with 5% growth compared to recent quarters…

And it’s not all anxiety at Apple. Earnings growth outpaced revenue, suggesting solid cost controls, increasing 11% for the year.

Both beat estimates as well, with EPS of $1.40/sh on $85.8bn in sales against estimates for $1.35/sh on $84.5bn.

Gross margins improved to 46.3% as well, beating estimates for 46.1%. Meanwhile, operating cash flow set a record at $29bn for the quarter.

Unusually, iPad sales led growth for the quarter, increasing 24% annually on the release of new models during the period. Crucially, CEO Tim Cook said that half of iPad buyers last quarter were purchasing their first one, suggesting there’s plenty of room to run.

A similar story unfolded for Apple’s Wearables, Home, and Accessories segment. Revenue fell 2% for the year, but this category includes the Apple Watch, of which 2/3rds of their buyers are still just getting the first ones.

Most important of all, however, is, of course, iPhone sales.

While sales of this century’s biggest game-changing technology (so far) declined 1% to $39.3bn, the smartphone remains their largest revenue segment at 46% of the pie.

The growth engine of the world’s most valuable company—its services segment—would’ve made Bill Belichick proud as it did its job.

Services revenue grew 14%, the fastest growing segment, helping contribute to margin outperformance.

Lastly, Apple shouted out the firm's constant investments in Apple Intelligence, which fired up the market's more brain-dead, hype-centric side.

The Big Question: Will analysts and traders decide whether they like Apple’s numbers or not by open? Or, will mixed trading continue on these good, but not great, results?

Banana Brain Teaser

Previous

Ada and Paul received their scores on three tests. On the first test, Ada’s score was 10 points higher than Paul’s score. If Paul’s average (arithmetic mean) score on the three tests was 3 points higher than Ada’s average score on the three tests, then Paul’s score on the third test was how many points higher than Ada’s score?

Answer: 23

Today

A grocer has 400 pounds of coffee in stock, 20 percent of which is decaffeinated. If the grocer buys another 100 pounds of coffee, of which 60 percent is decaffeinated, what percent, by weight, of the grocer’s stock of coffee is decaffeinated?

Send your guesses to [email protected]

Stay hungry, stay foolish.

How Would You Rate Today's Peel?

Happy Investing,

David, Vyom, Jasper & Patrick