- The Peel

- Posts

- Markets Tread Carefully

Markets Tread Carefully

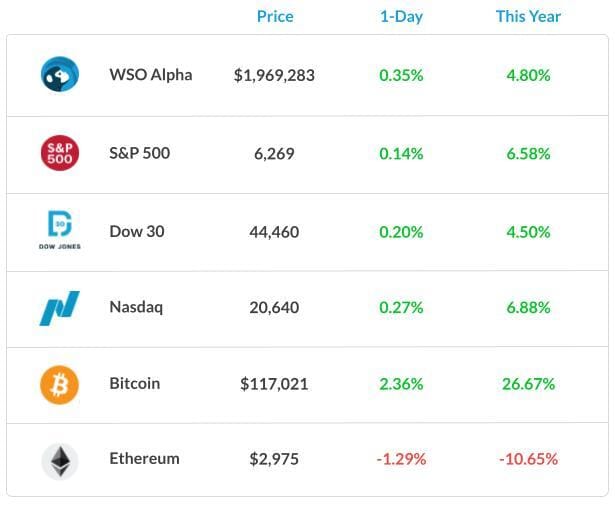

🛩️ Markets recorded slight gains as investors await the highly anticipated CPI data set to be released on Wednesday.

In this issue of the peel:

📉 Donald Trump threatens Russia with a 100% tariff if they do not “end hostilities” with Ukraine.

🛩️ Markets recorded slight gains as investors await the highly anticipated CPI data set to be released on Wednesday.

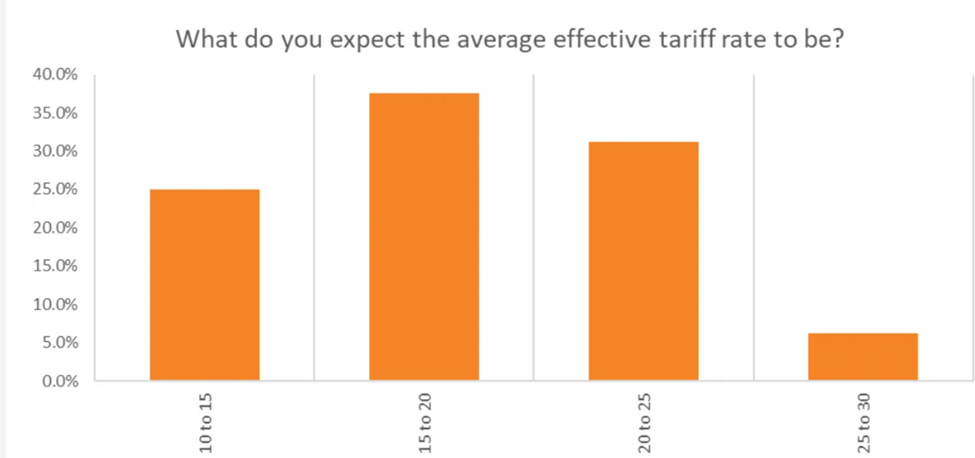

🤖 Investors expect the average tariff rate for countries to be about 17%, but that could very well change if trade negotiations fall through.

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Mitchell Ang, put together an impressive deep dive on Robinhood, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

B*tcoin hits an all-time high of $120,000, aided by the Trump Administration’s pro-cr*pto agenda.

Japanese bonds continue to tank as the rising yields are attributed to growing concerns surrounding fiscal deficits.

Jersey Mike’s is planning to sell $400 million worth of asset-backed securities to pay Blackstone, the PE firm that owns the majority stake in the company.

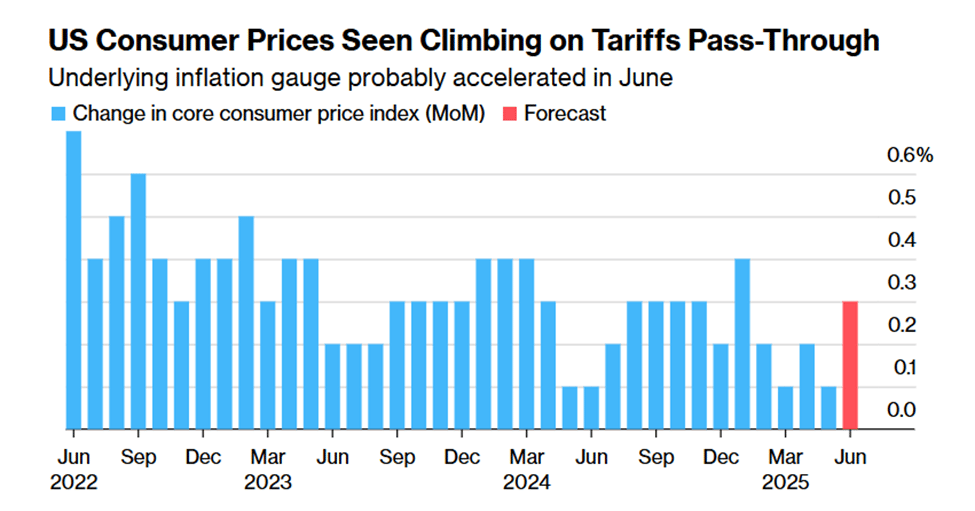

U.S inflation is projected to increase based on economists’ expectations as CPI will be released on Wednesday.

Some companies are racing to build copper mines in the U.S to avoid the high tariffs Donald Trump imposed last week.

The Daily Poll

Will CPI come in above expectations? |

Previous Poll:

Tariffs kicking in Aug 1, what’s your take?

Price spike ahead: 28.1% // Already priced in: 20.2% // Just noise: 28.1% // Panic incoming: 23.6%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

Tiny Gains, Same Old Tariffs

Over the weekend, President Donald Trump declared a 30% tariff rate on Mexico and the European Union, in addition to announcing that he would declare a 100% tariff on Russia in conjunction with sanctions if they did not reach a ceasefire deal with Ukraine.

It seems that Donald Trump has announced so many tariffs at this point that the market has become almost numb to these announcements, especially since they are set to go into effect on Aug 1.

In that case, what kind of tariff rate can the investor expect, given the fact that it is difficult to decipher whether Trump is bluffing or if his true intentions are to set that as a tariff rate?

According to a 22V research survey, investors are expecting (and therefore pricing in) a universal 17% tariff rate across the globe. While Trump was threatening Mexico and the EU with 30% rates, the actual tariff rate is likely to be less than that as a simple product of negotiations.

Furthermore, the fact that investors are pricing in (approximately) a 17% tariff rate also implies that the market could have quite a negative reaction if trade negotiations do end up falling through, which is quite a plausible scenario given the fast approaching August 1st deadline.

On top of that, Donald Trump also emphasized how he would not be postponing the tariffs beyond Aug 1, potentially amplifying the negative effects that failed trade negotiations could have.

Moreover, the market movements in the next few days will likely have less to do with trade and tariff news and likely more to do with the incoming CPI report set to come out Wednesday.

The Takeaway?

As investors grow increasingly numb to tariff news, it will likely exacerbate the effects of either failed or successful trade negotiations. Furthermore, all parties want to come to a mutually beneficial trade agreement, so it is unlikely that sweeping tariffs of gigantic proportions will be enacted.

Career Corner

Question

I saw this interview question online and was wondering how you would go about answering. "Which valuation method is the best?"

Answer

Go through the pros and cons of each (briefly, or stick to the one most relevant) and then use that to explain why you think the pros of X make it the best in Y situation (or overall, depending on the exact interview prompt).

Head Mentor, WSO Academy

What's Ripe

Nebius Group (NBIS) 17.3%

Nebius Group, an AI infrastructure company, saw its stock price rise yesterday after Goldman Sachs and other banks increased their price targets for Nebius after increased growth prospects. This has been a part of a greater overall bullish sentiment surrounding AI stocks.

Oklo Inc. (OKLO) 11.3%

Oklo, a nuclear technology company, witnessed its share price increase after the UK and the Czech Republic announced plans to build small modular reactors, bolstering sentiment across the nuclear technology sector, including Oklo. The recent surge in nuclear technology stocks is also partially attributable to the support of the U.S government.

What's Rotten

Newegg Commerce Inc. (NEGG) 26.4%

Newegg Commerce’s stock price plunged yesterday after concerns arose surrounding the sustainability of their margins, in addition to their declining revenue growth rate. Some investors also sold NEGG to walk away with their profits after the stock increased 121% in the past 5 days, despite yesterday’s losses.

Waters Corporation (WAT) 13.8%

Waters Corporation’s stock price fell yesterday after they announced the acquisition of another life sciences company, Becton Dickinson. Investors were concerned because the valuation of BD was around $17.5 billion, compared to Waters’ market cap of about $22 billion.

Investors were also concerned that Waters would have to issue a significant amount of debt to finance the deal.

Thought Banana

Inflation Drop or Drama?

Despite President Donald Trump firing out tariff announcements on all cylinders, markets were relatively calm yesterday in preparation for today’s CPI announcement, which could have broad implications on the future inflationary outlook for the U.S.

The past few CPI reports have come in on par with or below economists’ expectations, being relatively muted thus far. Despite that fact, many economists still believe that the inflationary effects of tariffs will eventually bleed through to consumers, therefore raising prices.

Despite that prediction, there isn’t any tangible evidence that producers have passed on some of their increased costs to consumers. Something else to note is that many industries aren’t affected by tariffs, so those industries will have no incentive to lower their prices.

The options market is also indicating that the S&P 500 will swing about 0.6% in either direction based on the CPI data, which is less than the average 0.9% implied swing, according to Citigroup.

If inflation does end up rising more than economists’ expectations, you will also likely see a slight change in the Fed’s strategy, depending on the degree to which the CPI is reported above expectations.

Regardless, if CPI comes in above expectations, the Fed will likely continue to hold rates for much longer than initially anticipated. Additionally, if CPI comes in red hot, soaring above expectations, the Fed may even consider hiking rates, though that is extremely unlikely.

The Takeaway?

While economists continue to project the inflationary impact of tariffs, and while the CPI report could go either way, we think it is quite probable that CPI comes in at par with or below economists’ expectations.

On the other hand, if CPI does beat the odds and come in above expectations, that could mean a bearish sentiment among investors, causing a modest selloff.

The Big Question: Are markets underestimating the delayed impact of Trump’s tariffs on consumer prices?

Banana Brain Teaser

Previous

Car A is 20 miles behind Car B, which is traveling in the same direction along the route as Car A. Car A is traveling at a constant speed of 58 miles per hour, and Car B is traveling at a constant speed of 50 miles per hour. How many hours will it take for Car A to overtake and drive 8 miles ahead of Car B?

Answer: 3.5 hours

Today

J and M were each paid x dollars in advance to do a certain job together. J worked on the job for 10 hours and M worked 2 hours less than John. If M gave J y dollars of her payment so that they would have received the same hourly wage, what was the dollar amount, in terms of y, that J was paid in advance?

Send your guesses to [email protected]

I’d be a bum on the street with a tin cup if the markets were always efficient.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mithun, Colin & Patrick