- The Peel

- Posts

- Maduro Still in Charge

Maduro Still in Charge

The U.S. moved against Maduro personally while leaving his regime intact.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

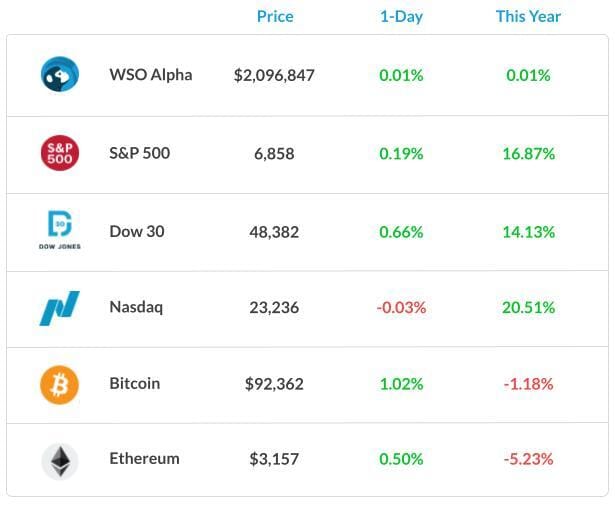

Market Summary: Markets start 2026 on a cautious note

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Morgan Stanley

Lesson from the Library: Master the accounting nuances that directly impact valuation, models, and deals.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

The U.S. moved against Maduro personally while leaving his regime intact.

Rubio says targeting oil flows gives Washington leverage over Venezuela.

OPEC+ is sticking to a steady output of oil despite rising global tensions.

U.S. hiring stayed modest, capping a sluggish year for the job market.

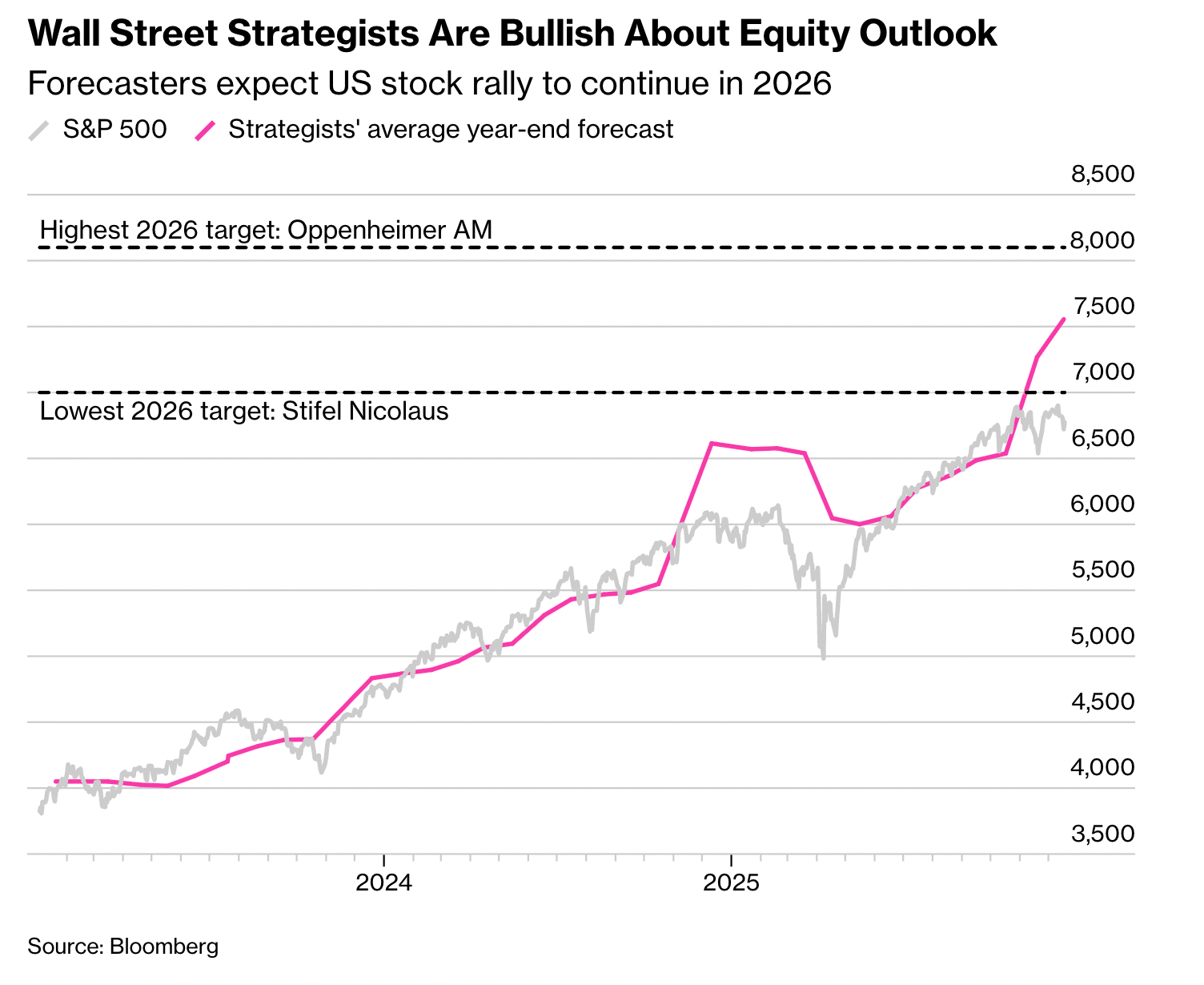

Wall Street is riding high on expectations after its best run since 2009.

Tesla has lost its top EV spot as rivals gain ground globally.

Bridgewater and D.E. Shaw ranked among 2025’s top hedge fund winners.

Market News

What A Start for the Year

The stock market opened the year with a lackluster performance as investors began 2026 cautiously, following a year of strong equity performance, while monitoring rising Treasury yields.

The benchmark S&P 500 Index closed up 0.2% after swinging between gains and losses earlier in the session. The Nasdaq 100 was down 0.2%, with both gauges dented by weakness in technology names.

Shares of Tesla Inc. fell after the company reported fourth-quarter deliveries that missed the average analyst estimate, while Amazon Inc. and Microsoft Corp. also declined. A Bloomberg measure of Magnificent Seven stocks sank by about 1%.

Over the weekend, something unexpected came over the news after the United States ousted Venezuelan President Nicolás Maduro and plans to “run” Venezuela, uncertainty over what that means and who is in charge loomed over the South American nation.

Adding to the confusion was the fact that the White House offered few details about what it would entail to run an oil-producing nation of about 30 million people. Venezuela has a current production of approximately 900,000 to 1 million barrels per day and 303 billion barrels of proven reserves, the largest in the world; however, 77% or more of these reserves are extra-heavy crude.

Providing an additional chain of thought is how prediction markets can serve as a better metric of inflation. The prediction market Kalshi Inc. just publicized the results of a study demonstrating its ability to generate more accurate inflation forecasts than the consensus of Wall Street analysts.

What's Ripe

Sable Offshore Corp. (SOC) 30.0%

SOC surged 30% after a federal court denied environmental groups’ request to halt the restart of the company’s oil pipeline in central California.

Litigation will continue in 2026, but Benchmark Equity Research said the pipeline system was now “the closest it has been to a restart.”

Baidu Inc. ADR (BIDU) 15.0%

BIDU jumped 15%. The Chinese internet company said Friday that its artificial-intelligence-chip unit Kunlunxin has confidentially filed an application to list on the Hong Kong stock exchange.

What's Rotten

AppLovin Corp. (APP) 8.2%

APP tumbled 8.2%, extending its losing streak to seven sessions and making it the worst performer in the S&P 500 on the day.

It wasn’t immediately clear what sent shares of the mobile advertising giant spiraling. The stock more than doubled in 2025.

Tesla Inc. (TSLA) 2.6%

TSLA dropped 2.6% after rising earlier in the day. The electric-vehicle maker delivered 418,227 cars in the fourth quarter, below the company-compiled consensus forecast of 422,850 vehicles.

Tesla delivered 496,000 cars in the same quarter in 2024.

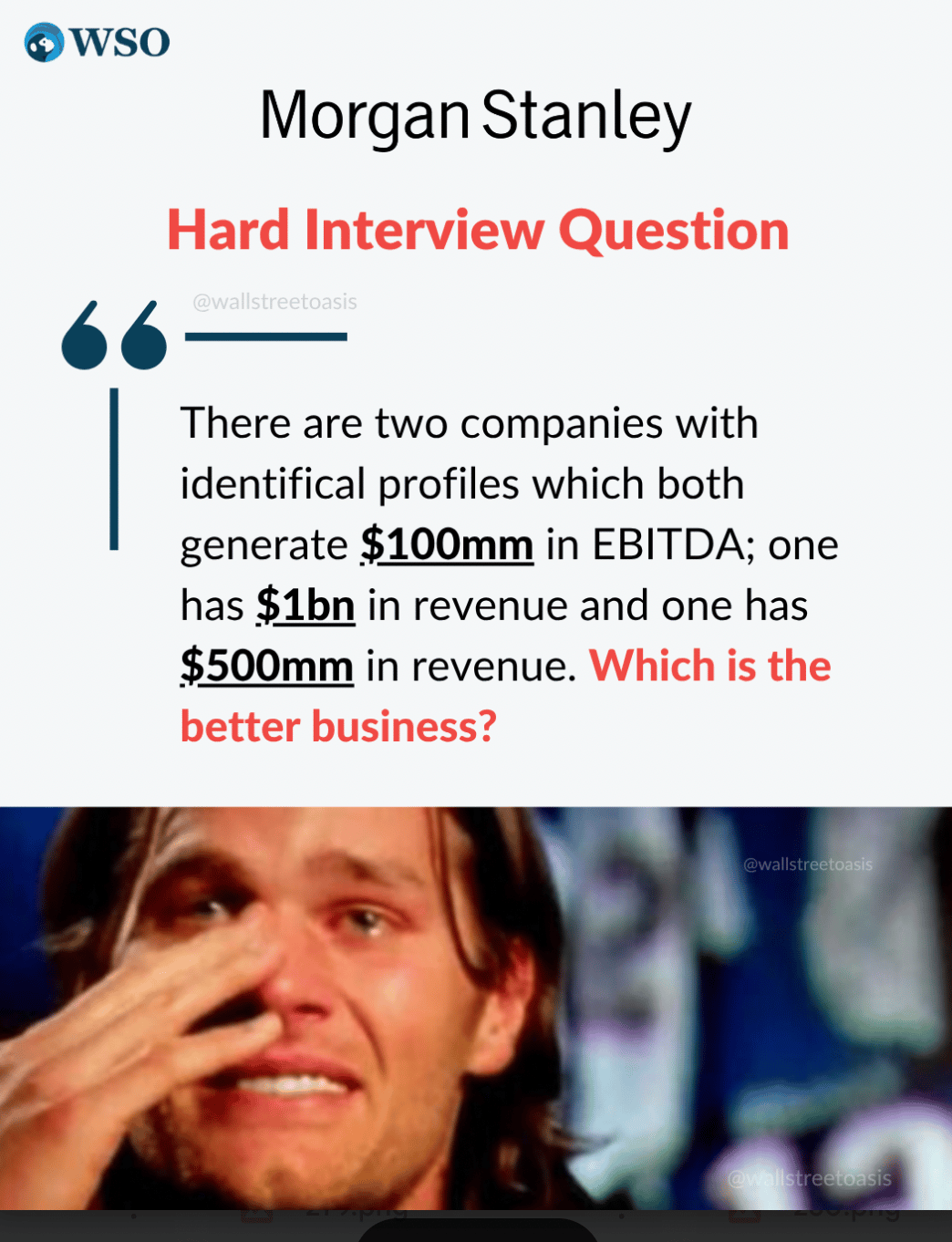

🧠 Technical Trip

Interview Q&A from Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 How PE Firms Really Add Value (vs. Textbook BS)

Inside look from our Private Equity course — no fluff, just the real playbook.

📚 Lesson from the Library

🎥 Advanced Accounting: The Details That Make or Break Models

Master the accounting nuances that directly impact valuation, models, and deals.

🌟 WSO Academy Q4 Update

🌍 Region-Specific Networking Guides

The most common theme among students is this: networking is challenging and uncomfortable. That’s why we’re continuing to build on our region-specific networking playbooks to help them tailor their approach. These templates can be found in the student resource folder.

This quarter, we’ve added new regions: Singapore and the Middle East. We’ll continue releasing market-focused networking playbooks to help them tailor their outreach.

As a reminder, we now have a 4-hour intensive networking bootcamp, which occurs monthly. Make sure they sign up! Additionally, we cover networking during Sunday office hours. They can find the office hours links (for gcals and other cals) bookmarked in the #General channel in Slack and under Events on their WSO Academy Dashboard. Many of their questions can likely be answered through the Networking Mastery Course.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Trump blocked Emcore’s chip deal with HieFo on security grounds.

Golden Gate Capital’s insurer, PHL, is sliding toward liquidation.

Baidu filed a Hong Kong IPO for its AI chip unit Kunlunxin.

AI chipmaker Biren jumped 76% in its Hong Kong debut.

KFC and Pizza Hut’s India operators agreed to merge in a $933M deal.

Sovereign wealth funds are doubling down on tech as assets hit $22.5T.

📊The Daily Poll

If the U.S. uses oil pressure on Venezuela, who feels the hit first? |

Previous Poll:

Dismantling the CFPB most directly impacts:

Consumer protections: 66.7% // Banks’ bottom lines: 12.1% // Political headlines: 18.2% // Court calendars: 3.0%

Banana Brain Teaser

Previous

From a group of 8 volunteers, including Andrew and Karen, 4 people are to be selected at random to organize a charity event. What is the probability that Andrew will be among the 4 volunteers selected and Karen will not?

Answer: 2/7

Today

Of the 150 houses in a certain development, 60 percent have air-conditioning, 50 percent have a sunporch, and 30 percent have a swimming pool. If 5 of the houses have all three of these amenities and 5 have none of them, how many of the houses have exactly two of these amenities?

Energy investing is about cash flows, not just barrels.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick