- The Peel

- Posts

- Layoffs Break Records

Layoffs Break Records

Job cuts in October hit their highest level in 22 years.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks fall as labor data weakens and shutdown persists

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Jane Street

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

Nancy Pelosi is calling it a career after decades in Congress.

GTA VI got delayed again; now dropping in November 2026.

A judge ordered Trump’s team to fully pay SNAP benefits by Friday.

Job cuts in October hit their highest level in 22 years.

China’s exports unexpectedly slipped in October.

Up to 40 U.S. airports could face flight cuts amid the shutdown threat.

Market Recap

Labor Market Data Lead to Stocks Declining

The stock market fell again on Thursday as Wall Street continues to sell riskier technology and consumer discretionary stocks in the wake of weaker labor market data.

The Dow Jones Industrial Average fell 397 points or 0.8%. The S&P 500 dropped 1.1%. On the other hand, the Nasdaq Composite dropped 1.9%. Today, investors have an appetite for bonds. The yield on the 2-year Treasury note dropped to 3.56%, while the 10-year yield was down to 4.09%. The 30-year dropped to 4.69%.

With the government still shut down, Wall Street is turning to private data providers for economic updates. The latest was Revlio Labs, a workforce intelligence firm, which estimated the U.S. lost 9,100 nonfarm jobs in October.

What was shaking the market was the report from Gray & Christmas, which showed a 183% monthly rate of 153,074 job cuts in October.

What's Ripe

Datadog Inc. (DDOG) 23.1%

DDOG surged 23%. The software maker posted better-than-anticipated earnings and revenue in the third quarter.

For the current fourth quarter, Datadog guided for revenue of $914 million at the midpoint of its range.

Snap Inc. (SNAP) 9.7%

SNAP jumped 9.7% after the social-media platform narrowed its loss in the third quarter.

The company said Perplexity would pay it $400 million over one year to integrate its artificial intelligence-powered search engine into Snapchat.

What's Rotten

Celsius Holdings Inc. (CELH) 24.8%

CELH sank 25%. The energy-drink company said a transition of a large portion of its newly acquired Alani Nu business into PepsiCo’s distribution network will impact reported results.

CarMax Inc. (KMX) 24.3%

KMX tumbled 24% after the nation’s largest seller of used cars said its current CEO, Bill Nash, will step down and depart the board, effective Dec. 1.

Board member David McCreight will serve as interim president and CEO, while a search for a permanent CEO is underway.

🧠 Technical Trip

Q&A with Jane Street

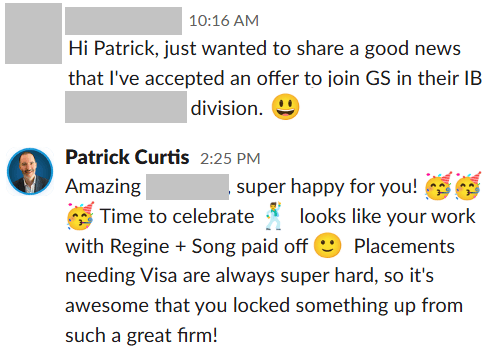

👉 Want 1-on-1 recruiting help from Jane Street bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

LRT Group acquired LTL carrier XGS to expand logistics reach.

Trump struck deals with Eli Lilly and Novo Nordisk to lower drug prices.

Sweetgreen sold its Spyce robotics unit to Wonder for $186M.

BillionToOne hit a $4.4B valuation after a strong Nasdaq debut.

Aquarian sealed a $4.1B deal to acquire Brighthouse.

Billion-dollar IPOs are lagging far behind private rounds in the US.

📊The Daily Poll

October saw the worst layoffs in 22 years — what’s that signal? |

Previous Poll:

Do you approve of Zohran Mamdani’s win as New York City mayor?

Yes: 51.1% // No: 48.9%

Banana Brain Teaser

Previous

A gym class can be divided into 8 teams with an equal number of players on each team or into 12 teams with an equal number of players on each team. What is the lowest possible number of students in the class?

Answer: 24

Today

What is the smallest integer n for which 25^n> 5^12?

The whole secret to winning big is to lose the least when you’re wrong.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick