- The Peel

- Posts

- JPM Near Record High

JPM Near Record High

JPMorgan is near record highs as CPI cools, though analysts are cautious ahead of Q4 earnings.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

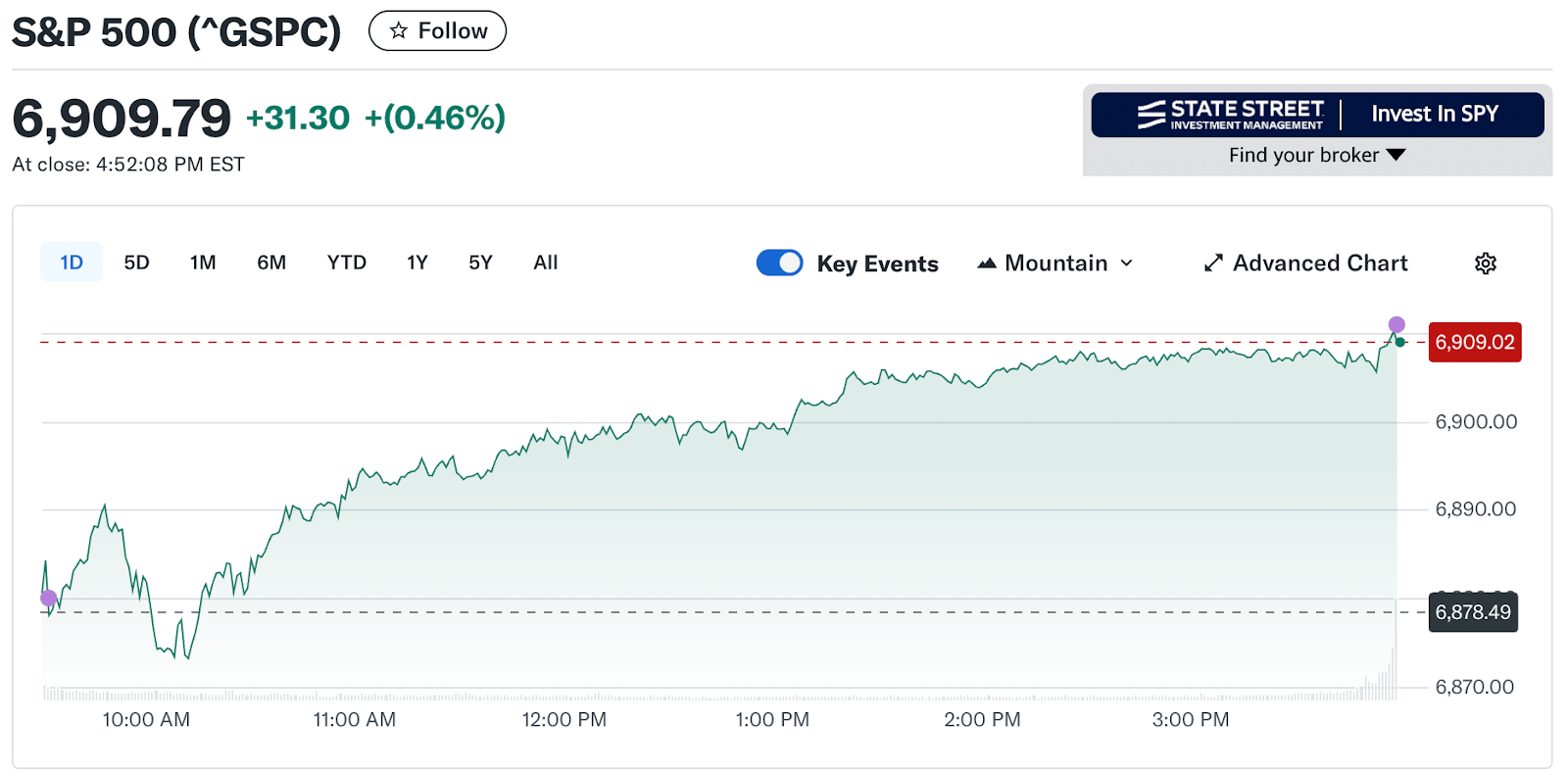

Market Summary: Stocks rise as investors grow more confident

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Bank of America

Lesson from the Library: Model acquisitions, cash flows, returns, and full deal structures like a real estate pro.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

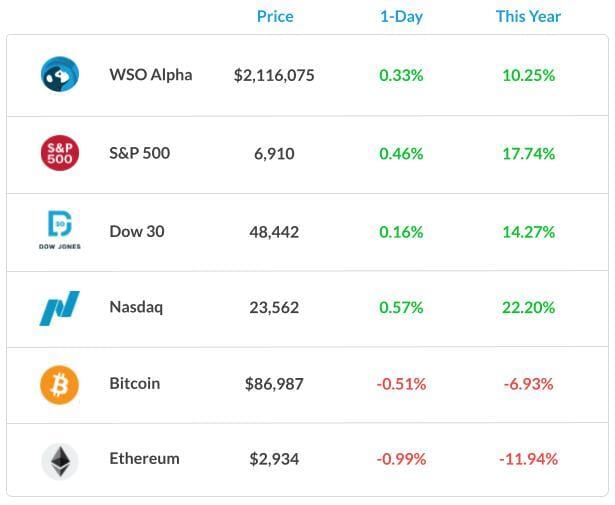

Market Snapshot

📉 Banana Bits

Stocks climbed after a friendly inflation print, with Micron helping steady AI names.

JPMorgan is near record highs as CPI cools, though analysts are cautious ahead of Q4 earnings.

Tampa Bay’s middle-market M&A scene is still holding strong.

Cboe shares outperformed peers on a busy trading day.

The S&P 500 closed at a fresh record, extending its winning streak to four sessions.

Gold opened at a new record above $4,480.

Market Recap

Stocks Rise as Investors Grow More Confident

U.S. stocks ended higher today as investors felt more confident after signs that inflation is easing.

The S&P 500, Dow, and Nasdaq all posted gains, driven by strong performance in big tech and growth stocks. Lower Treasury yields also supported the market by making stocks more attractive than bonds. Overall, the trading day was steady and positive, without much volatility.

Markets outside the U.S. were mostly higher also.

European stocks rose, led by healthcare and industrial companies, while Asian markets also moved up, hoping that U.S. interest rates could come down in the future. Gold prices went up as some investors looked for safety. The U.S. dollar stayed stable during the session.

What's Ripe

Novo Nordisk (NVO) 7.3%

Shares rose today after the company’s oral weight-loss drug, Wegovy, received FDA approval, marking a major competitive win in obesity treatment.

The broader market also climbed, helping healthcare leaders like Novo Nordisk push higher on strong sector sentiment.

Sony Group Corp. (SONY) 2.1%

Sony’s stock went up over 2% today, ending a multi-day losing streak and showing investor interest being renewed.

What's Rotten

Starfighters Space Inc. (FJET) 59.0%

FJET went significantly down after its recent post-IPO surge cooled off. Some of the excitement around the stock cooled off, leading to selling and a pullback in the share price.

Netskope Inc. (NTSK) 5.9%

Netskope stock slid, mainly because of fresh earnings context and analyst caution. As a new public company, its price has been very volatile.

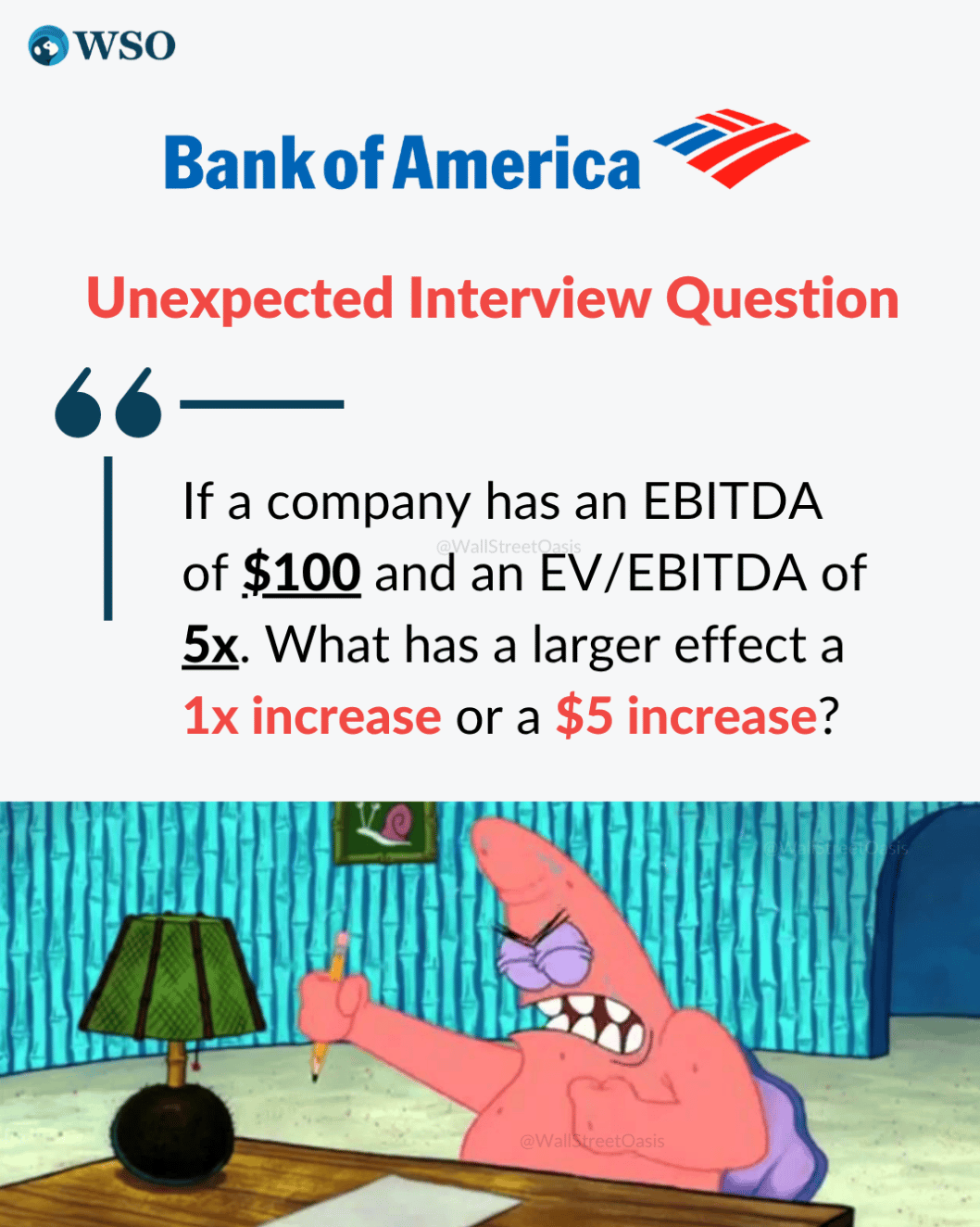

🧠 Technical Trip

Interview Q&A from Bank of America

👉 Want 1-on-1 recruiting help from Bank of America bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Master Real Estate Modeling: Build Deals from the Ground Up

Model acquisitions, cash flows, returns, and full deal structures like a real estate pro.

🌟 WSO Academy Q4 Update

🎯 More Structured Technical Preparation

One of the most common questions we hear is: “What should I study first?” Next quarter, we plan on updating our curriculum to make that answer clearer and guided.

✅ Instead of just spending 5 hours per week studying, assignments will be organized by topic and sequenced in such a way that they build skills in the right order

✅ For each stage, assignments will link directly to the specific section of their course, depending on their track, so that they know exactly what to study and when

✅ This removes guesswork and ensures they’re building a strong foundation before moving to advanced topics

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Slovenia’s ACP completed its purchase of 80% of Mikrocop.

O’Melveny advised Samsung Biologics on a U.S. acquisition from GSK.

ServiceNow agreed to buy cybersecurity firm Armis for $7.75B.

Inszone expanded in Michigan by acquiring Voyage Benefits.

A Warner Bros bidding war is keeping dealmakers busy through the holidays.

📊The Daily Poll

Dealmakers fighting over Warner Bros during the holidays feels: |

Previous Poll:

Gold is printing new highs. Your move:

Buy the fear: 21.4% // Hold what I have: 40.5% // Chase risk instead: 16.7% // Not touching this: 21.4%

Student Success Corner

Breaking Into Investment Banking: Vamshi’s Journey from UChicago to Private Equity Success

👉 Check out more on WSO YouTube

Banana Brain Teaser

Previous

There are 8 books on a shelf, of which 2 are paperbacks, and 6 are hardbacks. How many possible selections of 4 books from this shelf include at least one paperback?

Answer: 55

Today

Three grades of milk are 1%, 2%, and 3% fat by volume. If x gallons of the 1% grade, y gallons of the 2% grade, and z gallons of the 3% grade are mixed to give x + y + z gallons of a 1.5% grade, what is x in terms of y and z?

In venture, the biggest risk is not that you lose—it’s that you miss the next Google.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick