- The Peel

- Posts

- JP Morgan Kicks Off Earnings

JP Morgan Kicks Off Earnings

🏦 JP Morgan kicked off earnings week with a solid report despite a continued Investment Banking slump.

In this issue of the peel:

🏦 JP Morgan kicked off earnings week with a solid report despite a continued Investment Banking slump.

📈 CPI came in basically in line with expectations and a bit higher than last month.

🎢 The market continues to waver as Trump wheels and deals tariffs with various countries.

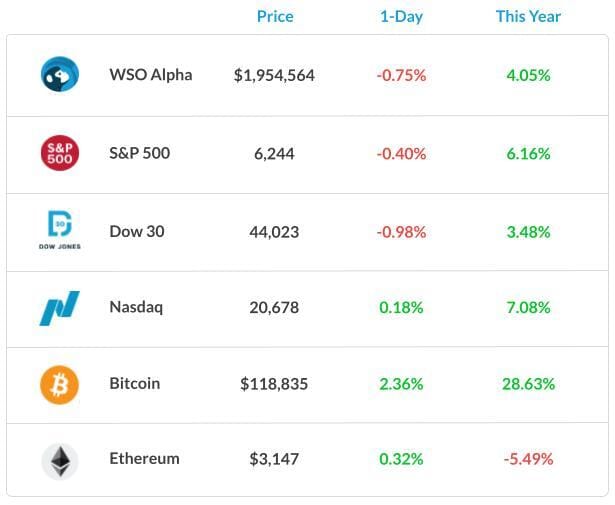

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Harsh Sharma, put together an impressive deep dive on Snowflake, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

Earnings reports from big banks are rolling in, and they show a tale of two tales.

ASML shares got crushed after the semiconductor giant said it “can’t confirm” if it will grow in 2026.

CPI slowly picked up last month, but the market’s reaction was muted.

Investors are digesting PPI data to go along with yesterday’s CPI report.

Nvidia is set to resume sales in China, sending its stock and the entire chip sector soaring yesterday.

Trump says no “TACO trade this time as he promises there will be no deals struck before the August 1 deadline.

Are You Ready to Make the Leap to Private Equity?

Landing a role in private equity requires tenacity, dedication, and hours of research, preparation, and skill development. So, how can an ambitious investment banking analyst or associate successfully make the leap with so much competition?

The best way to set yourself up for success is to prepare well before contacting potential employers and get yourself in the ‘PE mindset.’ Though the fields may look similar, investment banking and private equity require you to think differently about success.

This guide provides a strategic roadmap to help you build the knowledge, skills, and mindset that private equity firms seek. And if your interview is just days away, it can double as a last-minute crash course.

Get your free copy of the eBook to learn how to successfully transition from investment banking to private equity.

Macro Monkey Says

Big Bank Earnings Rolling In

Earnings season is here, and the big banks are starting to roll out. JPMorgan and Wells Fargo reported yesterday, with Goldman Sachs and Bank of America set to take the earnings stage today.

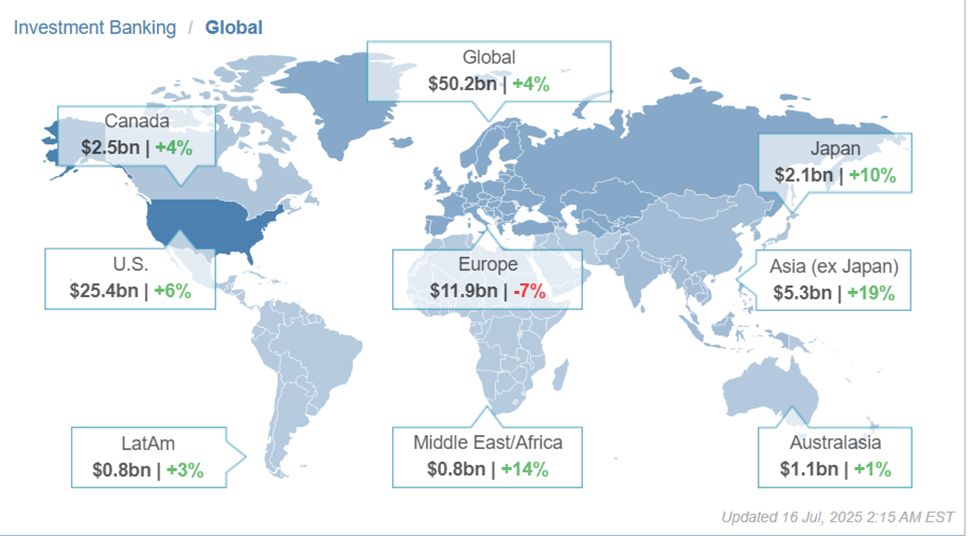

One thing’s clear: trading desks are pulling their weight. Investment banking is a different story. While earnings have improved across the street, the IB division is still nursing a hangover from 2021’s deal boom.

JPM: Overall revenue came in at $45.68bn versus $44.06bn estimated. Investment Banking revenue was up 7% YoY to $2.5bn for the quarter, but IB dealflow is still in a multi-year slump. Trading revenue jumped 14% to $5.7bn.

Citigroup: Overall revenue came in at $21.57bn versus $20.98bn estimated. A boost in dealmaking pushed IB revenue up 18% and market volatility helped the trading division to shine.

Bank of America: Overall revenue came in a bit light at $26.61bn versus $26.72bn estimated. Similarly, the trading division was the unexpected star of the show yet again.

Thought Banana

The TACO Trade Is Over

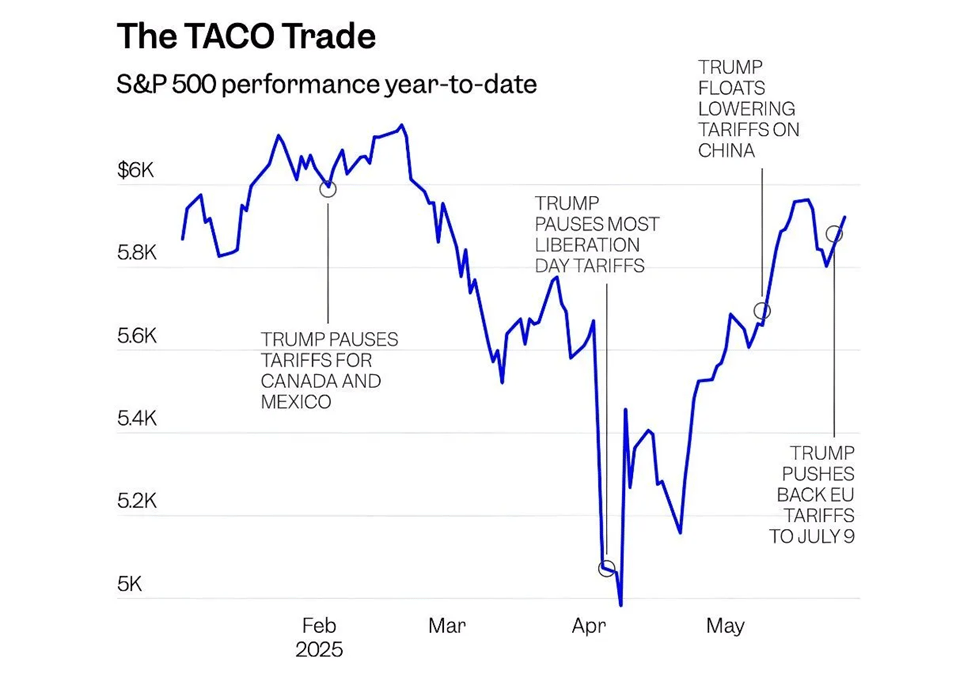

Wall Street loves a cheeky pun. The TACO trade, which is not a new Wall Street lunch special, stands for “Trump Always Chickens Out.”

The moniker originated after Liberation Day in April, which triggered a bear market. The market rebounded strongly after the US began negotiating deals with various countries.

From that point on, whenever the President brought up tariffs, the market shrugged them off and continued to rally on the premise that there would be no follow-through.

But not this time. As President Trump floats a new round of tariffs set to hit on August 1, there will be no deals, no negotiations, and no backpedaling. Markets seem to be taking it seriously.

So, will Trump finally sink his teeth into the TACO trade? Or is this just another serving of heat without the bite? Investors are keeping the antacids nearby, just in case.

The Big Question: Will August 1 mark the return of real tariff pain—or just more market indigestion?

Banana Brain Teaser

Previous

J and M were each paid x dollars in advance to do a certain job together. J worked on the job for 10 hours and M worked 2 hours less than John. If M gave J y dollars of her payment so that they would have received the same hourly wage, what was the dollar amount, in terms of y, that J was paid in advance?

Answer: 9y

Today

If n = 4p, where p is a prime number greater than 2, how many different positive even divisors does n have, including n?

Send your guesses to [email protected]

I made a killing in the stock market. My broker and I are both broke.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin & Patrick