- The Peel

- Posts

- Jobless Rates Climb

Jobless Rates Climb

🛩️ SUBTITLE Markets recorded slight gains as investors await the highly anticipated CPI data set to be released on Wednesday.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Mixed signals keep investors cautious

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Lesson from the Library: Discover how VCs pick winners, fund innovation, and turn bold ideas into billion-dollar exits.

Technical Trip: Interview Question with Morgan Stanley

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

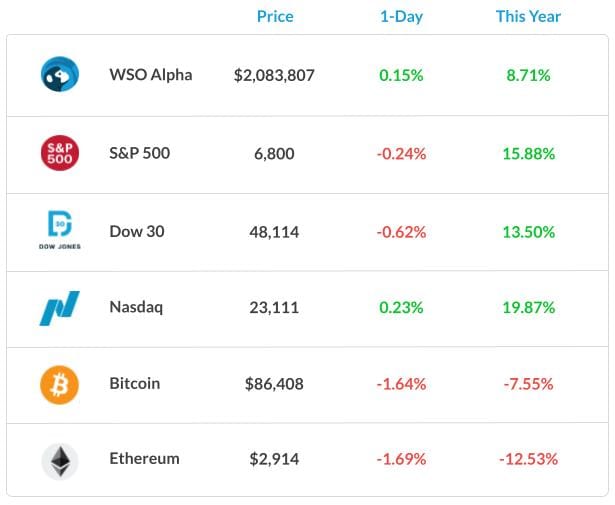

Market Snapshot

📉 Banana Bits

Wall Street finished mixed, with the Nasdaq up while the Dow and S&P 500 slipped.

Fund managers are the most bullish in over three years heading into 2026, per BofA.

The U.S. job market stalled in 2025, raising fears it could crack next year.

Oracle is under the spotlight as AI spending and massive lease commitments draw scrutiny.

Jobless rates climbed in both the U.S. and the UK, boosting pressure for rate cuts.

The U.S. economy softened in December, hit by tariffs, inflation, and weaker sales.

Market Recap

Mixed Signals Keep Investors Cautious

Today’s market was mainly influenced by mixed economic data and investor caution ahead of major U.S. employment figures.

Major U.S. indexes, including the Dow and S&P 500, fell slightly after data showed the unemployment rate rose unexpectedly. This was unusual because job growth slightly exceeded estimates, leaving traders unsure about the Fed’s next move on interest rates.

The Nasdaq saw a small gain as some tech names showed resilience, but energy and healthcare sectors weighed on broader indexes.

Global markets also showed a cautious tone, with Asian and European equities sliding as investors awaited more clearer direction from U.S. data and central banks.

The weaker jobs report and slowing activity in key sectors added to concerns about economic momentum going into 2026. Overall, markets are trading in a tentative range as participants think about mixed signals from data and policy outlooks.

What's Ripe

Circle Internet Group (CRCL) 10.0%

Circle went up nearly 10% on the day after Visa confirmed support for U.S. bank transactions via USDC, Circle’s stablecoin.

Tesla Inc. (TSLA) 3.1%

Tesla stock went up and hit a new record price as investors reacted to strong sentiment around its robo-taxi development.

The stock also benefited from broader rotation into select growth/tech names even as the overall market was mixed.

What's Rotten

Humana (HUM) 6.0%

Humana went down after reaffirming a weaker outlook for 2025 and announcing a top executive's retirement.

Pfizer (PFE) 3.4%

Pfizer fell after its 2026 earnings outlook disappointed investors, which put pressure on the stock.

Healthcare and defensive sectors lagged amid the general risk-off tone from mixed economic data.

🧠 Technical Trip

Interview Question with Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Venture Capital: From Idea to IPO

Discover how VCs pick winners, fund innovation, and turn bold ideas into billion-dollar exits.

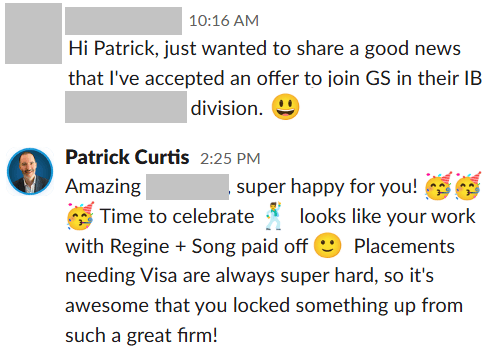

🌟 WSO Academy Q4 Update

📚 New Course Development

Every quarter, we’re releasing new courses. Below is a streamlined list of the most relevant completed courses and key upcoming ones.

Completed:

✅ GMAT Test Prep

✅ SIE Test Prep

✅ S&T Interview Course

✅ Project Finance Interview Guide

✅ Capital Markets Interview Guide

✅ Infrastructure Investment Banking Interview Guide

✅ Real Estate Investment Banking Interview Guide

✅ Quant Interview Guide

✅ M&A Investment Banking Interview Questions

Coming Soon:

🕐 Full Quant Finance Course

🕐 Renewable Energy Interview Guide

🕐 CFA Level 1 and Level 2 Training

🕐 Industrials Interview Guide

🕐 Financial Sponsors Group Interview Guide

🕐 Power & Utilities Interview Guide

🕐 Transportation Interview Guide

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

California Pizza Kitchen struck a buyout deal and named new leadership.

Better Being announced a strategic transaction to fuel its next growth phase.

Trucordia acquired Global Financial & Insurance Services.

Crux Capital launched Veridian Service Partners after acquiring two pool-service firms.

Citi and LSEG entered a new data partnership.

Amber River’s board is weighing final bids for the UK wealth manager.

📊The Daily Poll

What breaks first if jobs weaken further? |

Previous Poll:

BOJ signaling a hike means?

End of easy money: 20.0% // Yen strength ahead: 40.0% // Gradual tightening 36.7% // Still just talk: 3.3%

Banana Brain Teaser

Previous

A certain fruit stand sold apples for $0.70 each and bananas for $0.50 each. If a customer purchased both apples and bananas from the stand for a total of $6.30, what total number of apples and bananas did the customer purchase?

Answer: 11

Today

60% of the members of a study group are women, and 45% of those women are lawyers. If one member of the study group is to be selected at random, what is the probability that the member selected is a woman lawyer?

I’d be a bum on the street with a tin cup if the markets were always efficient.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick