- The Peel

- Posts

- Jobless Claims Surprise Lower

Jobless Claims Surprise Lower

Jobless claims dropped more than expected, signaling a steady labor market.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Santa rally lifts stocks as tariff fears fade

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Evercore

Lesson from the Library: Go beyond basics—learn deferred taxes, NOLs, stock compensation, and complex accounting used in real-world models.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

📉 Banana Bits

BOJ’s Ueda hinted at more rate hikes as confidence in inflation grows.

U.S. mortgage rates fell for a second week, pushing 30-year loans to 6.18%.

Jobless claims dropped more than expected, signaling a steady labor market.

China’s central bank struck a cautious tone while backing growth.

Ukraine and the U.S. are exploring land compromises to move peace talks forward.

Consumer confidence slid to its lowest level since April.

The Trump administration plans to start garnishing pay for defaulted student loans in January.

Market News

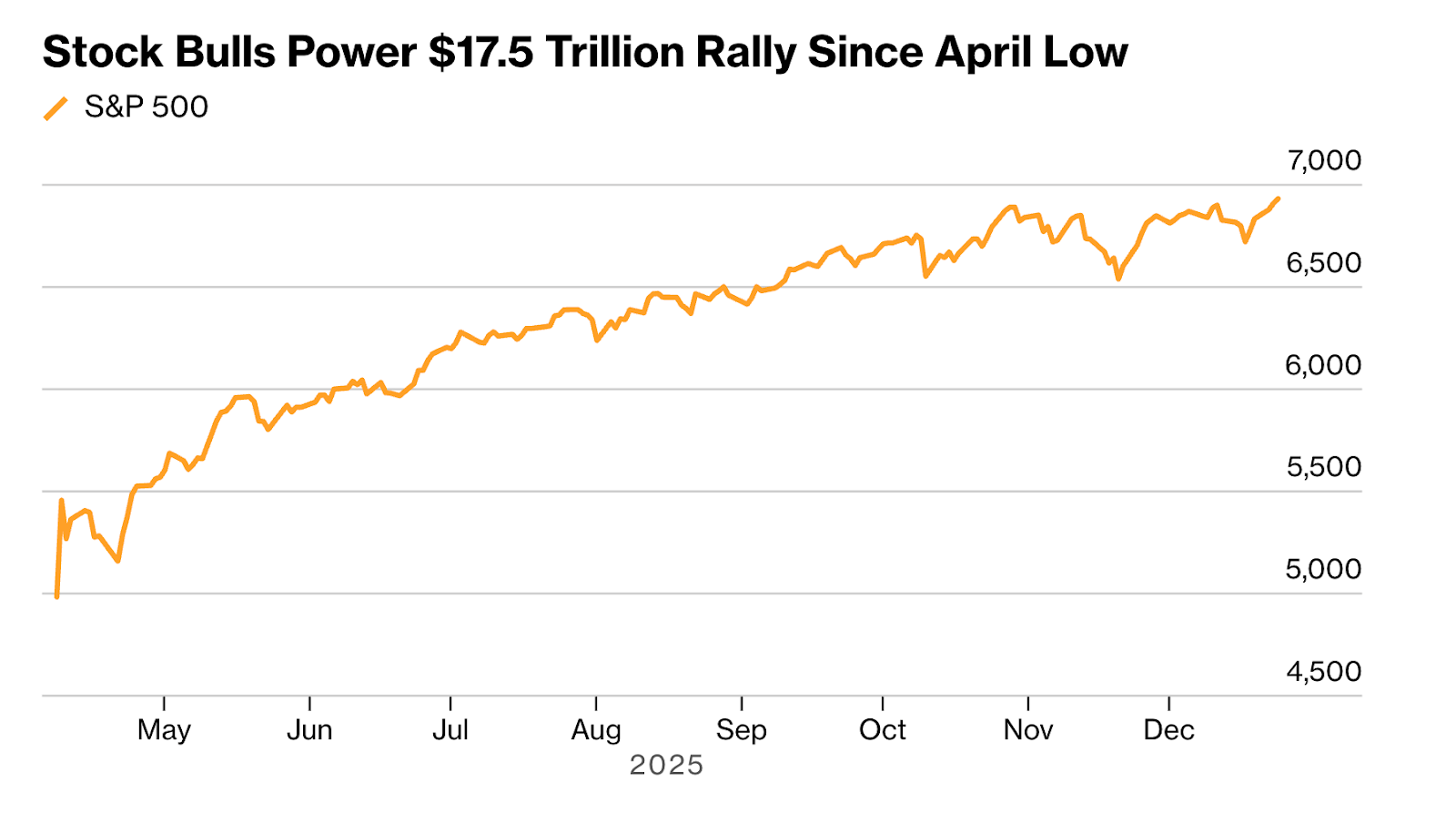

Santa Rally Sends Tariff Chaos to the Back Seat

Investor Christmas spirit sent the market to all-time highs before Christmas, with more signs that the jobs market is not deteriorating quickly, supporting bets on a soft economic landing.

Investors hoping for a “Santa Claus Rally,” which typically includes the last five trading days of the year and the first two of the new one, saw the S&P 500 rise in a shortened session ahead of the holiday.

Treasury yields edged lower, and the dollar barely budged. This is in sharp contrast to April, when markets were in chaos following the tariff announcements. Since then, every dip has been bought by investors, and bulls are in the driver's seat, leading the market to all-time highs.

What's Ripe

Dynavax Technologies Corp. (DVAX) 38.2%

DVAX stock spiked 39% to $15.42 after Sanofi announced an agreement to acquire the vaccine maker for $15.50 a share.

The all-cash deal values Dynavax, which markets a hepatitis B vaccine in the U.S., at $2.2 billion. U.S.-listed Sanofi depositary receipts were down 0.2%.

UiPath Inc. (PATH) 7.5%

PATH soared 8% after the software company was set to join the S&P MidCap 400 index before trading starts on Jan. 2, S&P Dow Jones Indices said after Tuesday’s close.

UiPath is replacing Synovus Financial, which is being acquired by Pinnacle Financial Partners in a deal expected to close soon.

What's Rotten

Intel Corporation (INTC) 0.5%

INTC shares plunged amid reports that Nvidia has halted testing of Intel’s advanced 18A chip manufacturing process, signaling it may not move forward with producing chips on the technology despite earlier evaluations.

Tesla Inc. (TSLA) 0.03%

TSLA dropped to $482.46 a day after the National Highway Traffic Safety Administration opened an investigation into an alleged door-release defect on the 2022 Tesla Model 3.

The electric-vehicle maker’s shares hit a record on Monday, trading just short of the $500 level, but then gave up some gains the following session.

🧠 Technical Trip

Interview Q&A from Evercore

👉 Want 1-on-1 recruiting help from Evercore bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Advanced Accounting: Mastering the Real Numbers

Go beyond basics—learn deferred taxes, NOLs, stock compensation, and complex accounting used in real-world models.

🌟 WSO Academy Q4 Update

📚 New Course Development

Every quarter, we’re releasing new courses. Here’s a list of what we’ve released so far (including new courses over the past few months) and courses currently in development:

Completed:

✅ GMAT Test Prep (Link)

✅ SIE Test Prep (Link)

✅ S&T Interview Course (Link)

✅ Project Finance Interview Guide (Link)

✅ Capital Markets Interview Guide (Link)

✅ Infrastructure Investment Banking Interview Guide (Link)

✅ Real Estate Investment Banking Interview Guide (Link)

✅ Quant Interview Guide (Link)

✅ M&A Investment Banking Interview Questions (Link)

Coming Soon:

🕐 Full Quant Finance Course

🕐 Renewable Energy Interview Guide

🕐 CFA Level 1 and Level 2 Training

🕐 Industrials Interview Guide

🕐 Financial Sponsors Group Interview Guide

🕐 Power & Utilities Interview Guide

🕐 Transportation Interview Guide

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Nvidia struck a tech licensing deal with AI startup Groq.

Jiangxi Copper agreed to buy SolGold in a $1B deal.

Honda will acquire LG’s battery assets in Ohio for $2.9B.

Haier sold 49% of its India unit to Bharti and Warburg Pincus.

BP plans to sell a majority stake in its Castrol business for $6B.

Saudi VC firms are leaning into M&A as IPO routes get tougher.

📊The Daily Poll

Lower jobless claims right now suggest the economy is: |

Previous Poll:

Dealmakers fighting over Warner Bros during the holidays feels:

Aggressive: 15.4% // Inevitable: 15.4% // Slightly desperate: 23.1% // Peak M&A energy: 46.1%

Student Success Corner

From Italy to Saudi Arabia: Claudio’s Global Finance Journey & Lessons in Mentorship

👉 Check out more on WSO YouTube

Banana Brain Teaser

Previous

Three grades of milk are 1%, 2%, and 3% fat by volume. If x gallons of the 1% grade, y gallons of the 2% grade, and z gallons of the 3% grade are mixed to give x + y + z gallons of a 1.5% grade, what is x in terms of y and z?

Answer: y + 3z

Today

How many odd numbers between 10 and 1,000 are the squares of integers?

The way to make money is to buy when blood is running in the streets.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick