- The Peel

- Posts

- Israel, Hamas Reach Deal

Israel, Hamas Reach Deal

Israel and Hamas reached a deal to free hostages in Gaza, a breakthrough.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks hit records as investors ignore Fed, shutdown noise

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Morgan Stanley

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

Ray-Ban maker partners with Meta to make AI glasses.

Israel and Hamas reached a deal to free hostages in Gaza, a breakthrough.

Soaring gold helps China to build a world less dependent on U.S. markets.

German exports declined 0.5% as shipments to the U.S. sank.

Trump to undergo physical exam as health issue lingers.

Fed Minutes show debate over balance sheet runoff continues.

Asian bonds are likely to lose their attractiveness as central banks edge toward easing.

Argentine rates exceed 80% as the Peso crisis sparks a cash crunch.

Market Recap

The Invulnerable Market

The market appears to treat the Fed Minutes and the government shutdown in its second week as mere background noise, with major indexes soaring to record highs after snapping a seven-streak winning streak caused by the drop in Oracle stock.

S&P 500 climbed 0.58% driven by tech, utilities, and industrial sectors. The Nasdaq composite also soared 1.12%, while the Dow Jones fell 1.20 points at the end of the day, as investors shifted their focus to tech stocks.

While most investors view the market as sunshine and rainbows, some are cautious that the current AI bubble may be reminiscent of the 1990s, which led to the dot-com bubble in the early 2000s.

Many market observers are urging investors to rebalance their portfolios, while also acknowledging there could be further upside before the AI rally exhausts itself.

What's Ripe

Advanced Micro Devices Inc. (AMD) 11.4%

AMD has been on a winning streak for the last three days, soaring 43% over three sessions.

The boost came after the company announced a deal with OpenAI to power 6 gigawatts of AI infrastructure with its graphics processing units, and with OpenAI receiving a warrant to buy up to 160 million AMD shares.

Dell Technologies Inc. (DELL) 9.1%

Dell soared to a 52-week high in Wednesday's Trading after the company boosted its long-term financial target, driven by strong demand in AI.

What's Rotten

Penguin Solutions Inc. (PENG) 16.0%

PENG slumped 16% on Wednesday as the maker of artificial-intelligence computing infrastructure issued a weaker-than-expected outlook, signaling slowing growth in the current fiscal year.

Jefferies Financial Group Inc. (JEF) 7.9%

JEF dropped in Wednesday trading. The company disclosed it could take a multimillion-dollar hit from bankrupt auto parts supplier First Brands, as one of its asset management units had invested about $715 million in assets tied to First Brands.

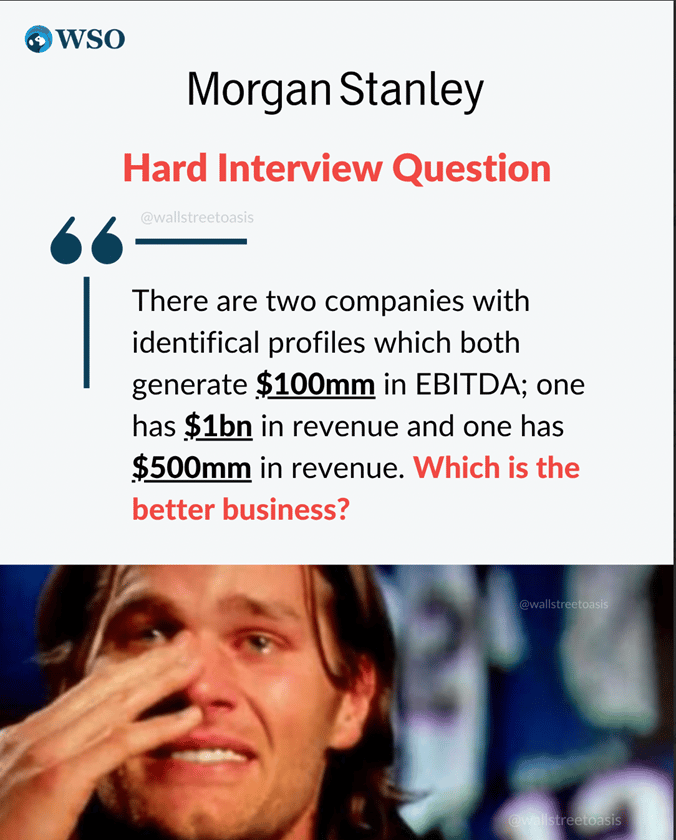

🧠 Technical Trip

Interview Q&A from Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Blackstone’s Clarion seeks £1.1 billion private credit loan.

Ottobock shares rise after the biggest German IPO of 2025.

LG India’s $1.3 billion IPO subscribed fivefold on strong bids.

AI agent startup N8n nets $2.5 billion valuation with backing from Nvidia.

HSBC to buy out Hang Seng Unit for $14 billion in Hong Kong bet.

Novo to buy Akero for up to $5.2 billion for liver disease boost.

Civitas weighs merger with Permian Basin rival SM Energy.

Blackstone billionaire James’ family office starts biotech fund.

📊The Daily Poll

Is the AI rally a bubble? |

Previous Poll:

Gold hitting $4,000 means…

Flight to safety: 41.6% // Rate cut bets: 11.6% // Market hedging: 24.7% // Pure FOMO: 22.1%

Banana Brain Teaser

Previous

If a square mirror has a 20-inch diagonal, what is the approximate perimeter of the mirror, in inches?

Answer: 57

Today

The water from one outlet, flowing at a constant rate, can fill a swimming pool in 9 hours. The water from a second outlet, flowing at a constant rate, can fill the same pool in 5 hours. If both outlets are used at the same time, approximately what is the number of hours required to fill the pool?

A budget is telling your money where to go instead of wondering where it went.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick