- The Peel

- Posts

- Iran Trade Faces Tariffs

Iran Trade Faces Tariffs

Trump vowed to slap a 25% tariff on countries trading with Iran.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: A slew of job cuts hit the market

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with JPMorgan

Lesson from the Library: Go beyond basics — learn deferred taxes, NOLs, stock-compensation and complex accounting used in real-world models.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

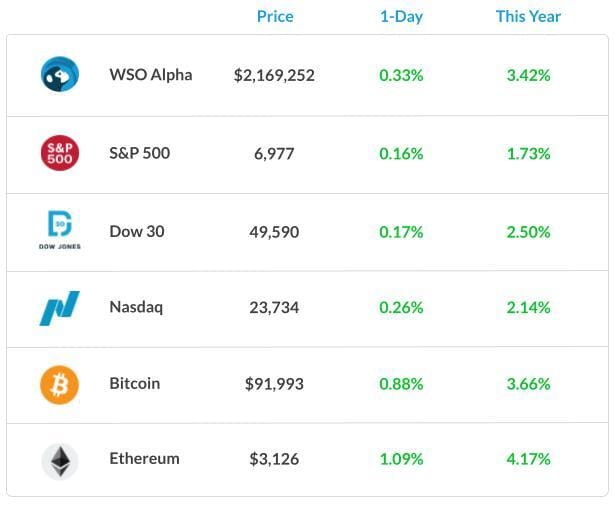

Market Snapshot

📉 Banana Bits

The Senate cleared a bill allowing cr*pto rewards for everyday users.

Japan’s snap-election bets pushed stocks to records while sinking the yen and bonds.

Gold steadied after its surge on fears over Fed independence.

Trump vowed to slap a 25% tariff on countries trading with Iran.

Prediction markets are booming, and some are betting on the risk of insider trading.

Market News

A Slew of Job Cuts Hit the Market

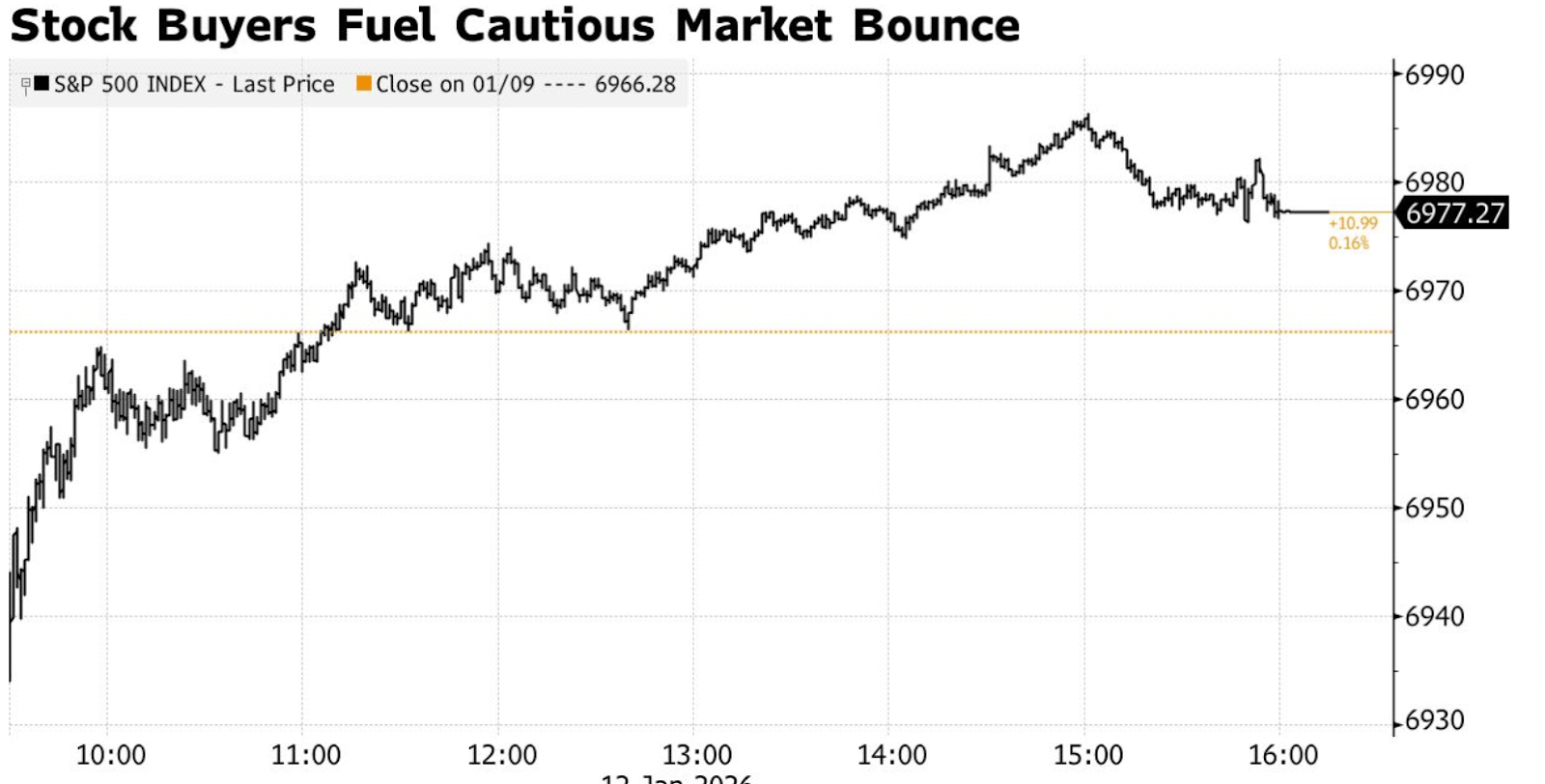

Wall Street just brushed off the risk on the Fed’s drama with Trump, with the S&P 500 bouncing from lows to inching up record highs.

The S&P 500 edged up to around 6,980. The yield on 10-year Treasuries advanced two basis points to 4.19%. A dollar gauge slid 0.2%. Gold hit fresh highs.

Banking stocks fell in Monday trading after Trump announced a 10% cap on credit card rates, which sent Capital One Financial Corp., American Express Co., and JPMorgan Chase & Co. sinking.

One corporate news to be cautious about is the slew of job cuts announced on Monday, with BlackRock, Meta, and Citibank trimming hundreds to thousands of jobs.

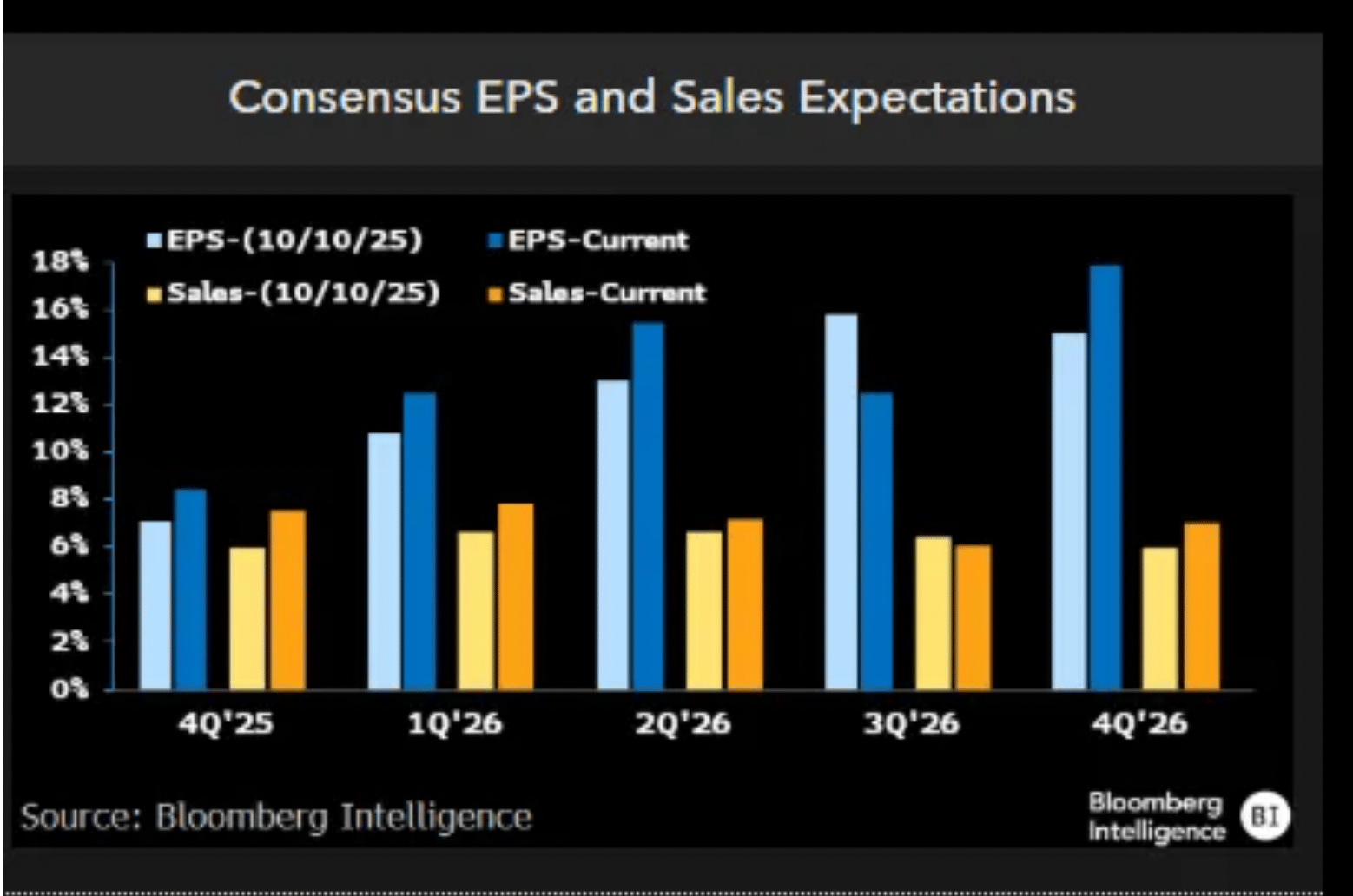

What Wall Street is most anticipating right now is how companies will weather the 4th quarter of 2025. Based on current estimates, S&P 500 constituents are expected to deliver earnings growth of 8.4% in the fourth quarter and 14.6% in 2026. Excluding the “Magnificent Seven” megacaps, profit growth is projected at 4.6% and 13.3%, respectively.

What's Ripe

Beam Therapeutics Inc. (BEAM) 22.3%

BEAM soared 23%. The biotechnology company said it had received positive updates from regulators, which may lead to the Food and Drug Administration’s approval of its lead genetic-disease program and liver-targeting therapy.

Akamai Technologies Inc. (AKAM) 3.6

AKAM rose 3.6% to $91.27 after the cybersecurity and cloud-computing company was double-upgraded to Overweight from Underweight at Morgan Stanley. The price target went to $115 from $83.

Analysts say the technology company’s overall growth picture is “brightening” as its cybersecurity and cloud infrastructure businesses continue to grow.

What's Rotten

Abercrombie & Fitch Co (ANF) 17.7

ANF plunged 18% after the retailer narrowed its guidance for the current quarter. Abercrombie projects net sales growth of around 5% and net income of $3.50 to $3.60 a share for the fiscal fourth quarter.

The company had previously guided for sales growth of 4% to 6% and per-share earnings of $3.40 to $3.70.

Capital One Financial Corp. (COF) 6.4%

COF tumbled 6.4% after President Trump imposed a 10% cap on Credit Card Rates

Peers such as American Express dropped 4.3%, Bread Financial Holdings sank 11%, and Synchrony Financial fell 8.4%

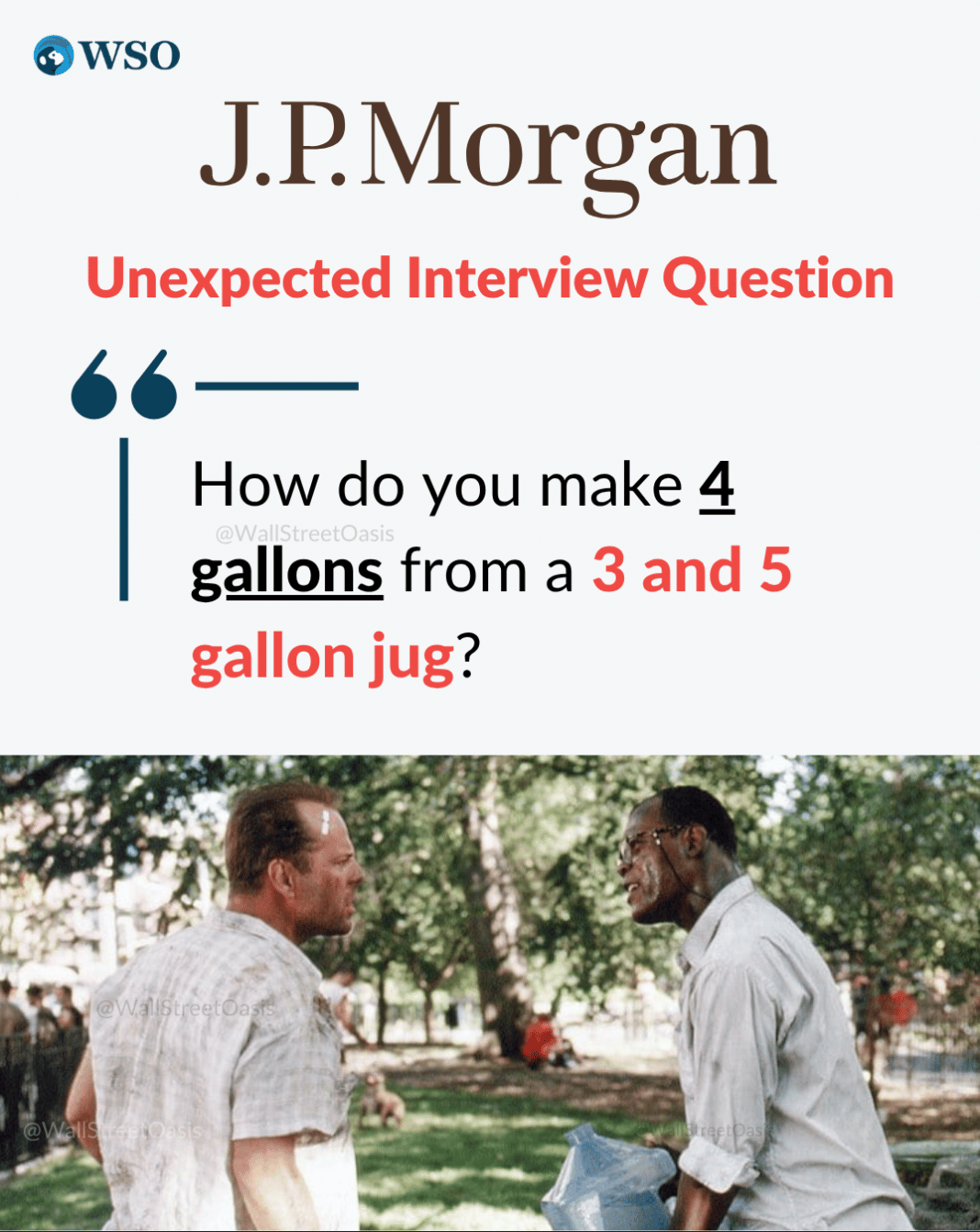

🧠 Technical Trip

Interview Q&A from JPMorgan

👉 Want 1-on-1 recruiting help from JPMorgan bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Advanced Accounting: Mastering the Real Numbers

Go beyond basics — learn deferred taxes, NOLs, stock-compensation and complex accounting used in real-world models.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Aware Super bought into a €2.6B European mall platform.

AbbVie pledged $100B in U.S. investment to sidestep tariffs.

Teneo is snapping up two more international firms in an M&A push.

The Golden State Warriors’ parent was valued at $11B in a stake sale.

Apple and Google confirmed a multiyear AI deal tied to Siri.

Cr*pto wallet firm BitGo and its backers are seeking $201M in a U..S IPO.

📊The Daily Poll

If Trump's 25% tariffs over Iran trade actually lands, what breaks first? |

Previous Poll:

Capping card rates at 10% would hit hardest:

Bank profits: 41.1% // Credit access: 35.6% // Risk pricing: 15.1% // Politics first: 8.2%

Banana Brain Teaser

Previous

If a two-digit positive integer has its digits reversed, the resulting integer differs from the original by 27. By how much do the two digits differ?

Answer: 3

Today

For the past n days, the average (arithmetic mean) daily production at a company was 50 units. If today’s production of 90 units raises the average to 55 units per day, what is the value of n?

The best investors have a disciplined process and the flexibility to break it when necessary.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick