- The Peel

- Posts

- Investors Eye Trump’s Moves

Investors Eye Trump’s Moves

📉 Investors are continuing to keep a close eye on Donald Trump’s tariff announcements as the August 1st deadline looms closer.

In this issue of the peel:

💰Markets edge upwards as investors are awaiting make-or-break earnings announcements.

🤑 The premium price of the S&P 500 leaves little room for error as many Wall Street analysts expect the market to maintain its bullish form.

📉 Investors are continuing to keep a close eye on Donald Trump’s tariff announcements as the August 1st deadline looms closer.

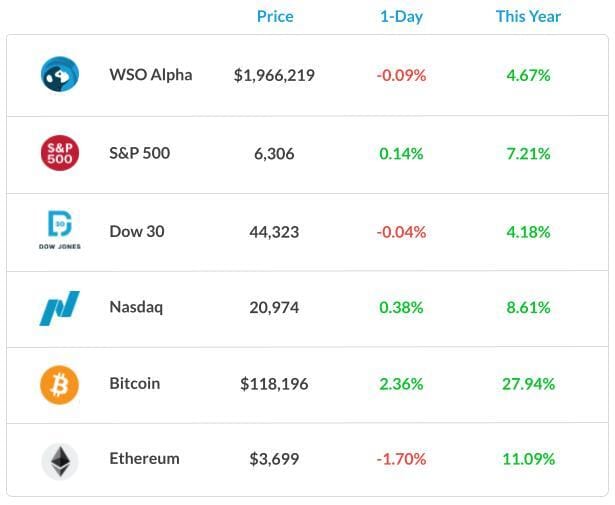

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Harsh Sharma, put together an impressive deep dive on Snowflake, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

A federal judge in Boston is questioning the legality of the Trump Administration freezing over $2 billion worth of federal research funding to Harvard.

Brazil is currently investigating allegations of insider trading resulting from Trump’s tariffs.

The European Central Bank has shifted to a “wait and see” outlook for cutting interest rates.

What is going to happen if Trump somehow manages to fire Jerome Powell?

China is ironing out plans to build a $167 billion mega-dam in Tibet.

The global economy continues to manage, even despite tariff pressures from the Trump Administration.

The Daily Poll

Will Trump stick to the August 1 deadline? |

Previous Poll:

Can Berkshire do well post-Buffett?

Yes: 57.5% // Maybe: 28.1% // No: 14.4%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

No Signs of a Slowdown

As stated in yesterday’s issue, this week is an extremely significant earnings week for Wall Street, which will undoubtedly have implications for the market's short-term performance.

Markets notched higher today after Verizon reported positive earnings, with its stock increasing 4% off the news. Investors are still eagerly awaiting Alphabet’s and Tesla’s earnings announcements, which are set to come out Thursday after market hours.

What we’re witnessing in the markets right now is that the winners are continuing to win. In other words, we’re seeing mega-cap companies with higher margins gaining more market share, another significant reason why Q2 tech earnings and the Magnificent 7 have been thriving (although Tesla might be another story).

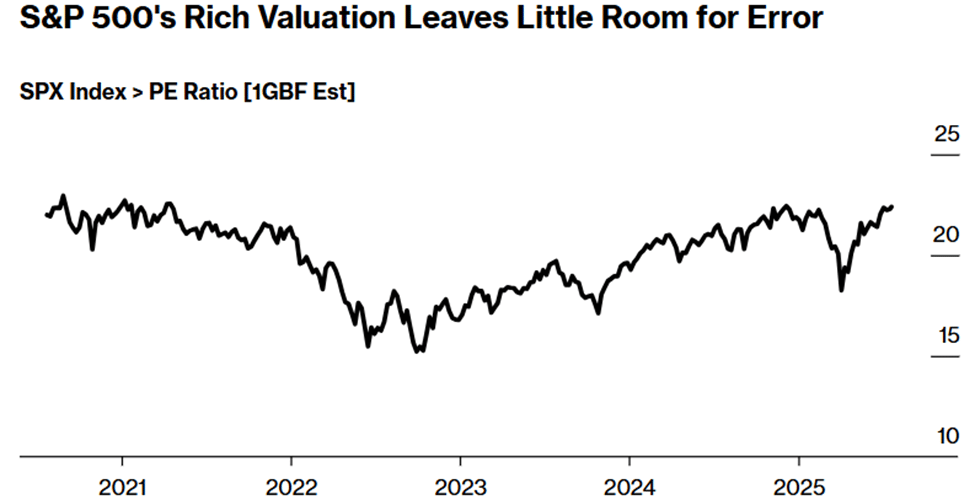

Additionally, many Wall Street analysts do not expect a correction, and most anticipate the bull market to continue throughout earnings season. However, it is worth considering that this could change if mega-cap stocks start to underperform.

Furthermore, since indices like the NASDAQ and the S&P 500 are trading at such a premium, it may indicate a lack of upside according to valuation metrics. However, the growth of these indices is propelled by large-cap tech stocks that trade at high multiples, not only due to their industry but also because of their high growth potential.

Career Corner

Question

I came across this interview question online and was wondering how you would approach answering it. "Which valuation method is the best?"

Answer

Go through the pros and cons of each (briefly, or stick to the one most relevant) and then use that to explain why you think the pros of X make it the best in Y situation (or overall, depending on the exact interview prompt).

Head Mentor, WSO Academy

Thought Banana

Tariff D-Day Looms

Starting only a few weeks ago, President Donald Trump announced sweeping tariffs on several countries, but (assumingly) to limit the market effects and allow for negotiations, he set a hard deadline of August 1 for those tariffs to go into place.

While the market and the overall U.S economy seem to be in a healthy place, this could definitely be derailed by failed trade talks or the reinstatement of Liberation Day-esque tariffs.

While this possibility is unlikely, the Trump Administration has only increased the number of countries set to receive a tariff, and next Friday’s hard deadline is fast approaching.

Additionally, if some countries are hesitant to cooperate, we know from experience that Trump isn’t afraid to enact towering tariffs, which would negatively impact the market for obvious reasons.

Overall, market movements in the short term will likely be decided by not only the Trump Administration's ability to come to mutually beneficial trade deals, but also the eagerly anticipated earnings set to unfold in the coming weeks.

The Big Question: Will August 1 bring new trade deals—or trigger another round of market-rattling tariffs?

Banana Brain Teaser

Previous

The ratio, by volume, of soap to alcohol to water in a certain solution is 2:50:100. The solution will be altered so that the ratio of soap to alcohol is doubled while the ratio of soap to water is halved. If the altered solution will contain 100 cubic centimeters of alcohol, how many cubic centimeters of water will it contain?

Answer: 800

Today

From the consecutive integers -10 to 10, inclusive, 20 integers are randomly chosen with repetitions allowed. What is the least possible value of the product of the 20 integers?

Send your guesses to [email protected]

Never invest in any idea you can’t illustrate with a crayon.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick