- The Peel

- Posts

- Goldman Bets on Sponsors

Goldman Bets on Sponsors

Goldman’s CEO sees financial sponsors helping drive the next wave of dealmaking.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Market mixed as Dow reaches record high

What’s Ripe / Rotten: The tastiest and most disgusting stocks today

Technical Trip: Interview Q&A from Moelis

Lesson from the Library: Understand why investors buy and sell private equity stakes — and how secondaries power liquidity in the PE world.

Deal Deep Dive: M&A, IPO, and transaction breakdowns

The Daily Poll: See how you stack up

Mentor Spotlight: What finance recruiting is really like | Mentor advice for students

Market Snapshot

📉 Banana Bits

The Dow notched a third straight record close, while the S&P 500 and Nasdaq slipped.

Goldman’s CEO sees financial sponsors helping drive the next wave of dealmaking.

Bonds of Dealogic and Mergermarket’s owner fell on AI disruption fears.

NatWest agreed to buy Evelyn Partners in a £2.7B deal.

Alphabet’s $20B bond sale could be followed by an unusual next step.

Three IPOs totaling $428 million, including Fractal and Aye Finance, are set to launch next week.

Market News

Market Mixed as Dow Reaches Record High

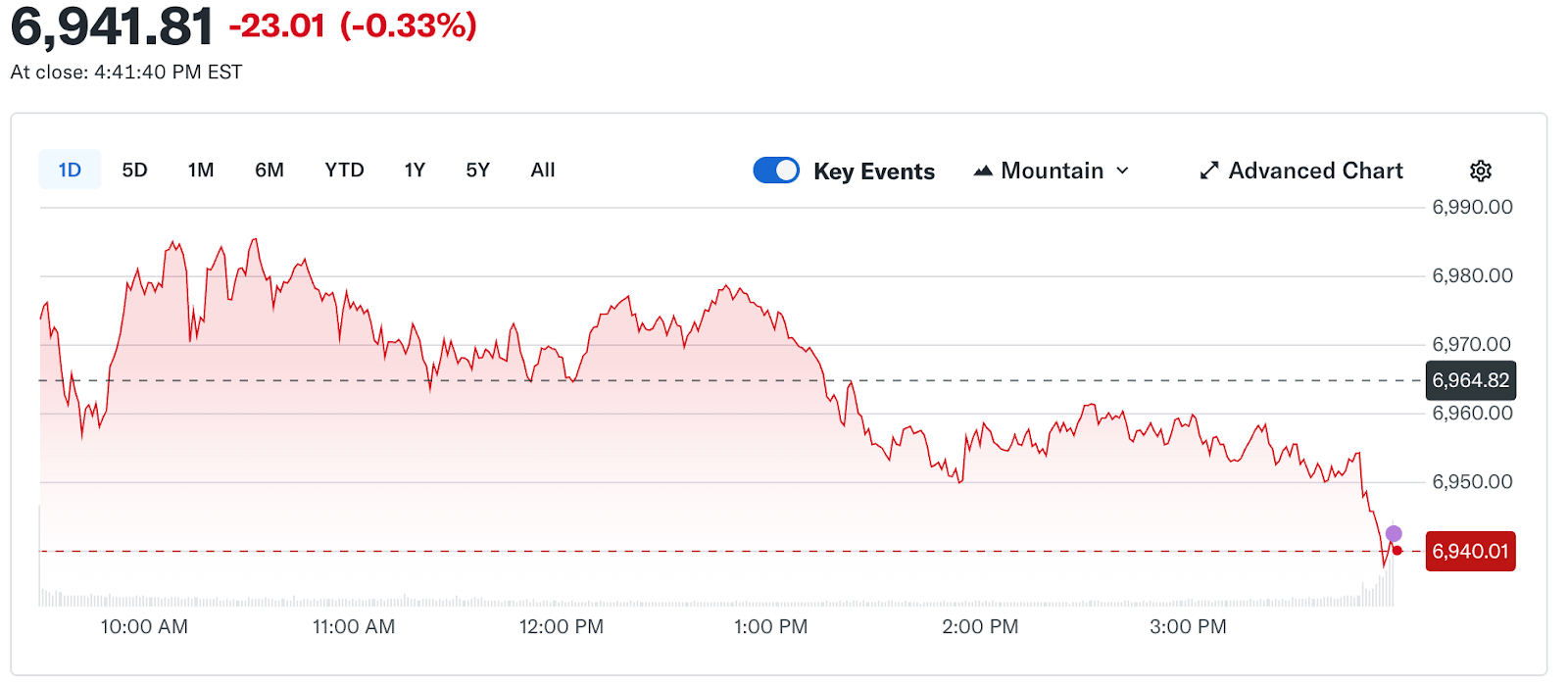

Today’s U.S. markets were mixed, with the Dow Jones Industrial Average closing at another record high, while the S&P 500 and Nasdaq finished slightly lower as investors digested weaker retail sales data and awaited additional economic reports.

This flat consumer spending figure helped push Treasury yields lower, which in turn strengthened expectations that the Federal Reserve may cut interest rates later in the year.

Some individual stocks showed big moves, with a few companies jumping on positive earnings while others, especially in tech and financial services, were held back by bigger concerns about industry competition and AI spending.

Outside the U.S., global markets showed different trends today. Canada’s main stock index, the TSX, climbed to a record high due to industrial and mining shares. In Asia, foreign investors withdrew capital from tech stocks. Overall, the mood was cautious today. Many traders are sitting on mixed signals from the data, leaving markets more volatile.

What's Ripe

Hasbro (HAS) 7.5%

Shares jumped after the company beat earnings expectations, indicating stronger profitability than Wall Street analysts had forecast.

DuPont (DD) 4.9%

DuPont’s stock rose on solid earnings results, which suggest its business is performing well even as the overall market was choppy.

What's Rotten

S&P Global (SPGI) 9.7%

S&P Global declined a lot due to disappointing profit forecasts and rising worries about competition.

Coca-Cola (KO) 1.5%

Shares fell after the company missed revenue expectations, despite solid profits.

A disappointing sales outlook usually weighs on investor sentiment.

🧠 Technical Trip

Interview Q&A from Moelis

👉 Want 1-on-1 recruiting help from Moelis bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Private Equity Secondaries: The Market Behind the Market

Understand why investors buy and sell private equity stakes — and how secondaries power liquidity in the PE world.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Lone Star completed its acquisition of Hillenbrand.

American Water and Essential Utilities shareholders approved their merger plans.

D. Boral Acquisition I Corp. priced a $250M IPO.

Wrisk bought Atto to build an integrated embedded finance platform.

📊The Daily Poll

Who’s likely to fuel the next deal boom? |

Previous Poll:

Why did U.S. consumer credit jump so much?

More spending: 39.1% // Cost pressure: 25.3% // Easy credit: 24.1% // Holiday hangover: 11.5%

🌟 Mentor Spotlight

What Finance Recruiting Is Really Like | Mentor Advice for Students

👉 Check out more on WSO YouTube

Banana Brain Teaser

Previous

For any positive integer n, the sum of the first n positive integers equals [n(n + 1)]/2. What is the sum of all the even integers between 99 and 301?

Answer: $20,200

Today

If d = 1/[(2^3) * (5 ^ 7)] is expressed as a terminating decimal, how many nonzero digits will d have?

Your best investment is in yourself; anything that improves your own talents benefits you.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick