- The Peel

- Posts

- Fed Cut Odds Rise

Fed Cut Odds Rise

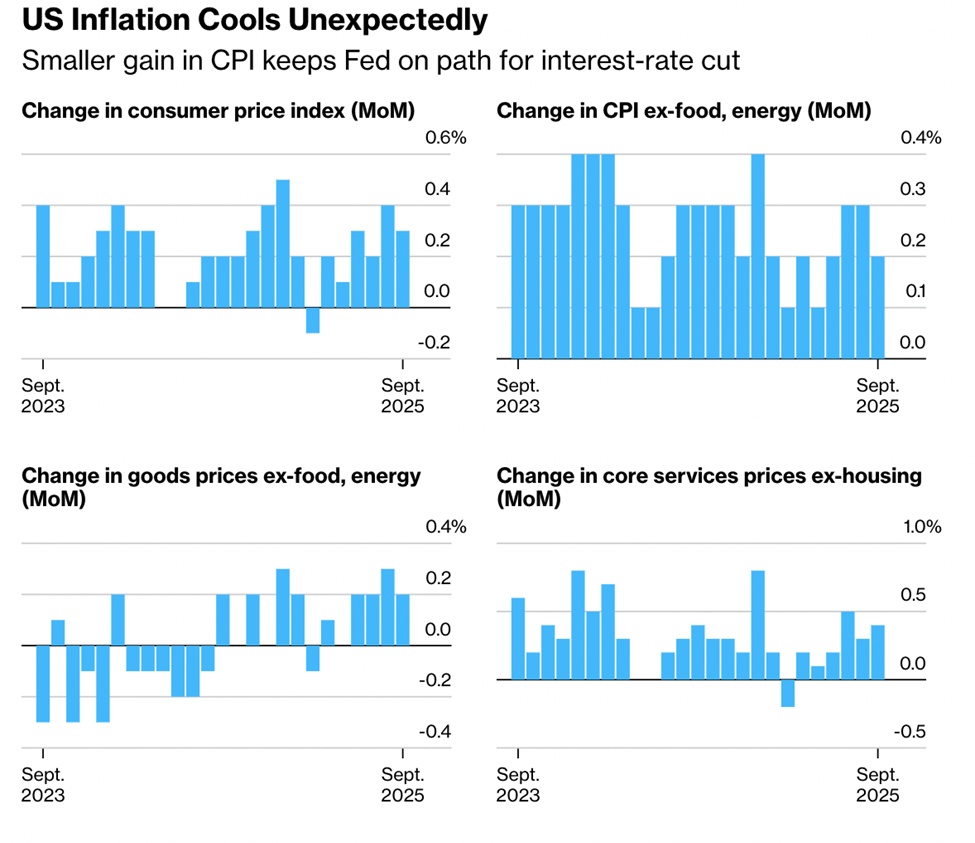

U.S. inflation comes in soft, building a case for more Fed cuts.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Markets rise as cooling prices fuel earnings optimism

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with PJT

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

U.S. inflation comes in soft, building a case for more Fed cuts.

Thailand’s Queen Mother Sirikit dies at 93, Palace says.

Chinese stocks are rallying amid hopes of a sweeping trade deal.

Time to also ride the train on Asia’s busiest earnings week.

HSBC hit with $1.1 billion litigation fee after Madoff Fraud.

A major comeback: Milei’s Party wins Argentina midterm vote.

Trump to slap an additional 10% tariff after Reagan Ad.

Stablecoin use for payments has jumped 70% since U.S. regulation.

U.S. rating cut by scope after three weeks of shutdown impasse.

The AI Paradox in M&A: What's Next for Dealmaking?

UpSlide is hosting an exclusive webinar, bringing together thought leaders from KPMG, Forvis Mazars, Nomura, and Model ML to explore the real impact of AI on M&A workflows.

They’ll cover how the largest M&A teams are using AI to reshape the dealmaking experience from analysts to MDs. Plus, they’ll share insights on:

How AI is currently used across the deal lifecycle—and where it’s falling short

What’s missing from today’s strategies—and what could unlock fundamental transformation

The long-term vision: could one prompt generate an entire pitchbook?

You’ll gain actionable insights to streamline workflows, reduce costly review loops, and prepare your team for the next wave of automation—all while having your questions answered live.

Save the date:

📅 November 5th

⌚ 10:00 am ET

⌛ 45 minutes

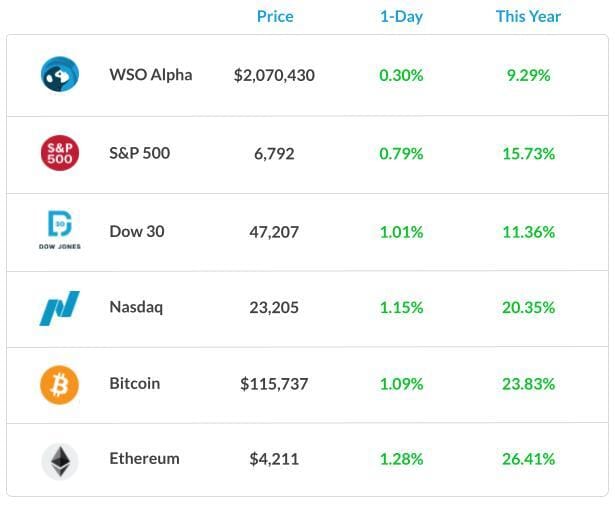

Market Recap

Indexes Hit Record High After Soft CPI

U.S. stocks on Friday closed on a high note after investors pushed major indexes to major highs.

This came after the core consumer price index, excluding the often volatile food and energy categories, increased 0.2% from August.

This was the slowest pace in three months and was held back by the smallest increase in a key measure of housing costs since early 2021, as reflected in Bureau of Labor Statistics data released Friday.

Meanwhile, investor focus is shifting toward next week’s packed earnings slate, with reports due after the close on Wednesday from heavy-hitters Alphabet Inc., Meta Platforms Inc., and Microsoft Corp., and on Thursday from Apple Inc. and Amazon.com Inc.

“Next week is critical as the big Tech/AI names start reporting,” said Citi strategist Scott Chronert. Sales and earnings growth from the roughly 30% of S&P 500 companies that have reported so far has been strong, but “the more significant test to index price action” lies ahead, he added.

What's Ripe

Ford Motor Co. (F) 12.2%

F gained 12% after the auto maker posted a third-quarter operating profit of $2.6 billion on record sales of $50.5 billion, beating Wall Street forecasts on both metrics.

The company also said it planned to boost F-series production volume by more than 50,000 trucks in 2026, creating 1,000 jobs.

Advanced Micro Devices Inc. (AMD) 7.6%

AMD gained 7.3% as Intel’s main rival. AMD also stands to benefit from stronger-than-expected PC industry sales, as its business accounts for the rest of the market for central processing units.

What's Rotten

Deckers Outdoor Corp. (DECK) 15.2%

Deck tumbled 15% The maker of Hoka sneakers and Ugg boots posted fiscal second-quarter earnings that improved from a year earlier and beat analysts’ expectations, but issued a fiscal-year forecast that disappointed.

It expects fiscal-year earnings of $6.30 to $6.39 a share on sales of about $5.35 billion. Analysts anticipate earnings of $6.33 a share on sales of $5.46 billion.

Newmont Corp. (NEM) 6.2%

NEM declined 6.2% after the gold miner posted third-quarter adjusted earnings of $1.71 a share, topping Wall Street expectations of $1.44.

The selloff on Friday could be tied to a recent drop in gold prices, with investors opting to take profits after a long rally.

🧠 Technical Trip

Interview Q&A from PJT

👉 Want 1-on-1 recruiting help from PJT bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

SoftBank-backed Lenskart IPO to raise as much as $828 million.

Novo-backed MapLight raises $258.9 million in U.S. IPO placement.

Novartis agrees to buy Avidity in $12 billion biotech deal.

Lilly to buy Adverum in a bet on Gene Therapy for eye disease.

Blackstone pays $706 million for a 10% stake in India’s Federal Bank.

Banana Brain Teaser

Previous

The total cost for Company X to produce a batch of tools is $10,000 plus $3 per tool. Each tool sells for $8. The gross profit earned from producing and selling these tools is the total income from sales minus the total production cost. If a batch of 20,000 tools is produced and sold, then Company X’s gross profit per tool is?

Answer: $4.5

Today

Machine A produces bolts at a uniform rate of 120 every 40 seconds, and Machine B produces bolts at a uniform rate of 100 every 20 seconds. If the two machines run simultaneously, how many seconds will it take for them to produce a total of 200 bolts?

Your net worth to the world is usually determined by what remains after your bad habits are subtracted.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick