- The Peel

- Posts

- Extreme Greed Takes Over

Extreme Greed Takes Over

💸 The “CNN Greed and Fear Index” is signalling that there is “extreme greed” within the financial markets, propelled by the bullish sentiment of investors.

In this issue of the peel:

📝 Markets rebound as Nvidia becomes the first ever company to reach a $4 trillion market valuation.

📉 Despite the resilient markets, President Donald Trump announced a 50% tariff on Brazil, and a $39 billion U.S. treasury sale pushed yields down.

💸 The “CNN Greed and Fear Index” is signalling that there is “extreme greed” within the financial markets, propelled by the bullish sentiment of investors.

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Colin Baird-Taylor, put together an impressive deep dive on MercadoLibre, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here.

Banana Bits

B*tcoin sets a new all-time high today as the cr*ptocurrency breaks the $112,000 mark.

Amazon’s “Prime Day” sales are down 41% from last year on the first day, according to Momentum Commerce.

China reportedly wants over 115,000 Nvidia chips in order to power AI data centers located in the desert.

Officials of the Fed are reportedly split on how Donald Trump’s tariffs will impact U.S inflation.

Senate Republicans are looking to put sanctions on Russia as the relationship between Putin and Trump is deteriorating.

The CEO of X, Linda Yaccarino, has stepped down from the position.

The Daily Poll

Will tariffs impact inflation long-term? |

Previous Poll:

Should BRICS countries worry about the 10% tariff threat?

Definitely: 40.3% // Maybe: 26.4% // Not really: 33.3%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

Markets Shake Off Tariff Fears

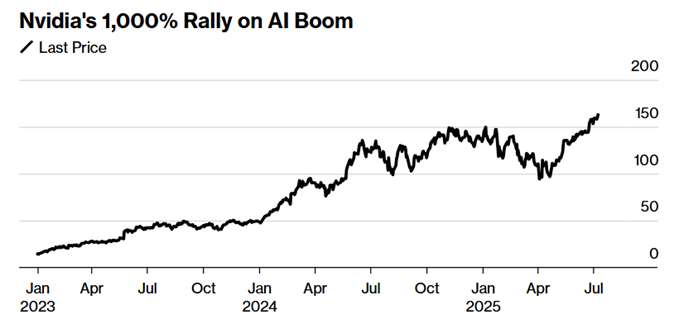

The markets marked gains yesterday, primarily driven by mega-cap tech stocks. Companies like Nvidia, Apple, and Microsoft saw gains, with Nvidia becoming the first company to ever break a $4 trillion market valuation.

President Donald Trump announced a 50% tariff on Brazil, set to go into effect August 1st, in addition to all the other country-specific tariffs. In the letter, Trump cited the treatment of former Brazilian President Jair Bolsonaro, saying authorities should drop charges against him over an alleged coup attempt.

It is almost as if the markets have become numb to tariff news, as despite substantial tariffs being announced this week, markets have essentially remained flat during the first 3 days of the week.

One could even make the argument that markets could have dropped significantly more if this kind of news had been announced in April-May, but what could be causing a numbness to tariff news?

One potential answer is that when Trump initially put his Liberation Day tariffs into place, most economists were predicting a recession and incoming inflation, but none of those predictions came to fruition.

As a result, markets have potentially become less sensitive to Trump imposing towering tariffs. Another possibility is that these tariffs have yet to go into effect, and when (if at all) they do, that is when markets could fall.

In other news, the yield of the U.S 10-year treasury fell six basis points today as a direct result of a $39 billion sale. A $22 billion offering for 30-year U.S. Treasury bonds will also be marketed today.

Fed officials are currently split on the potential inflationary effects of Trump’s tariffs. Some officials believe that tariffs will only have a “one-time” price increase and will not affect long-term inflation, while other officials argue that tariffs may have “more persistent effects” on inflation.

The Takeaway?

Even though it may be probable that markets have become less reactive to tariff announcements, that doesn’t necessarily mean that tariffs won’t have economic downsides, just that the market isn’t pricing in those downsides. Regardless, the “AI Boom” has continued to propel mega-cap tech stocks as the NASDAQ has continually outperformed the S&P 500.

Career Corner

Question

Are there any sector-specific materials or primers on telco/data infrastructure?

Answer

Check out primers and reports from consulting firms (MBB and others), which include a lot of information on telco and data infrastructure. If you have CapIQ, you can also look at broker reports.

Head Mentor, WSO Academy

What's Ripe

Rhythm Pharmaceuticals Inc. (RYTM) 36.6%

Rhythm’s stock price skyrocketed yesterday after they announced the success of “phase 2” testing of their drug Bivamelagon, a weight loss supplement. During the trials, the drug showed a 7.7% decrease in BMI, compared to a 2.2% in the placebo group.

Additionally, several banks upgraded their price targets and changed their rating to “overweight” for Rhythm after the successful trials.

Verona Pharma (VRNA) 20.6%

Verona Pharma’s stock price surged today after Merck, an extremely large pharmaceutical company, announced they were acquiring Verona at $107/share. This valuation represents a 23% premium from Verona’s stock price at Tuesday’s close, compelling investors to buy the stock.

What's Rotten

WPP PLC (WPP) 18.1%

WPP, a British communications and public relations company, saw its stock price significantly decline yesterday after it withdrew its revenue guidance for 2025. In addition to poor Q1 performance, they decreased their revenue guidance by 3-5%, and they also expect their margins to decrease by anywhere from 50-175 basis points.

Fair Isaac Corporation (FICO) 6.5%

FICO, a company best known for consumer credit risk ratings, witnessed their stock price fall yesterday after the FHFA (Federal Housing Finance Agency) announced that lenders can now choose between VantageScore 4.0 or FICO 10T for mortgage underwriting.

This change essentially introduces a new aspect of competition into FICO’s business, as previously, FICO was the only score accepted by the FHFA.

Thought Banana

Fear? Nope, it’s Extreme Greed Now

As stated above, the major financial indices are starting to become less sensitive to tariff announcements by President Donald Trump, therefore causing a bullish sentiment among investors.

Additionally, the so-called “AI Boom” is causing tech stocks to surge despite overall macroeconomic uncertainty, as is seen on a daily basis, as the tech-heavy NASDAQ is consistently outperforming the S&P 500.

CNN’s “Fear and Greed Index” now signals “extreme greed” within the financial markets, primarily propelled by bullish AI sentiment in addition to a lack of reaction to tariff news.

It is also worth noting that yesterday, a gauge that tracks the movement of mega-cap tech stocks increased by 1.1%.

Within CNN’s Index, “greed” is synonymous with a bull market, whereas “fear” is synonymous with a bear market. The index factors in variables like stock price strength, market momentum, stock price breadth, as well as put and call options into the index calculation.

The Index’s score can be attributed to the fact that indices like the NASDAQ and the S&P 500 continue to hit all-time highs despite overall macroeconomic uncertainty and potential impending inflation.

Despite potential impending inflation, CPI and PPI metrics have come in much softer than expected, oftentimes coming in lower or at par with economist expectations. This has only further urged investors to have a bullish sentiment surrounding the stock market.

The Takeaway?

While investors have been undoubtedly bullish as of late, it isn’t necessarily unjustified when considering the low CPI and PPI metrics coupled with a thriving labor market. Nevertheless, if the current macroeconomic uncertainty turns to tangible inflationary pressures, then investors will likely not be so bullish.

The Big Question: Are investors ignoring warning signs—or just betting that the Fed and AI will keep saving the day?

Banana Brain Teaser

Previous

In an electric circuit, two resistors with resistances x and y are connected in parallel. In this case, if r is the combined resistance of these two resistors, then the reciprocals of r is equal to the sum of the reciprcoals of x and y. What is r in terms of x and y?

Answer: xy/(x + y)

Today

If a two-digit positive integer has its digits reversed, the resulting integer differs from the original by 27. By how much do the two digits differ?

Send your guesses to [email protected]

You can’t predict, but you can prepare.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mithun, Colin & Patrick