- The Peel

- Posts

- Dollar Slips on Fed Heat

Dollar Slips on Fed Heat

The dollar slid the most in nearly three weeks after the Fed received subpoenas.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

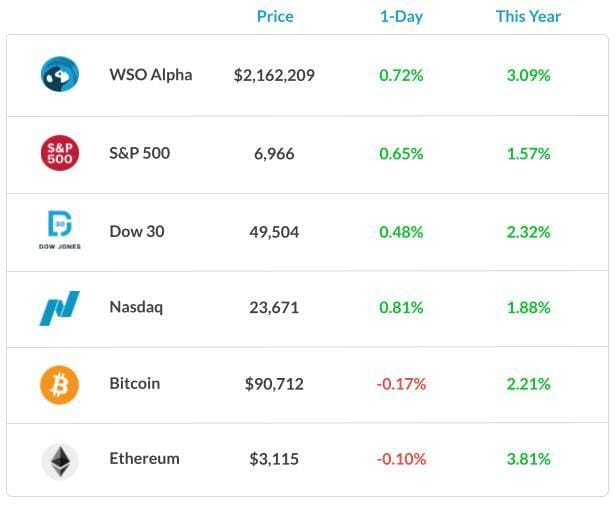

Market Summary: Markets rally to records despite tariff uncertainty

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with PJT

Lesson from the Library: Understand how private equity stakes are traded — and why secondaries matter.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

U.S. job growth slowed in December even as the unemployment rate dipped.

The dollar slid the most in nearly three weeks after the Fed received subpoenas.

Gold hit a fresh record as investors weighed Fed independence and Iran tensions.

Asia is pulling ahead in the global AI race as tech stocks kick off 2026 strong.

U.S. inflation is expected to pick up after a murky November CPI.

Walmart will join the Nasdaq 100 on Jan. 20, replacing AstraZeneca.

Market News

Wall Street Brushes Aside

Wall Street brushed aside concerns about the Trump administration’s tariff regime, sending U.S. stocks to all-time highs in the first trading week of the new year. Bonds remained under pressure.

The S&P 500 rose 0.6% Friday to a record, while the Nasdaq 100 jumped 1%. Stocks dipped briefly after the Supreme Court failed to weigh in on the fate of President Donald Trump’s import levies, leaving consumer names such as Mattel Inc. and Deckers Outdoor Corp. out of the rally.

Small-cap and blue-chip benchmarks hit new peaks as equity gains broadened beyond just big tech names. Friday’s U.S. jobs report reinforced Wall Street’s bets that the Federal Reserve will leave interest rates on hold for the near term. The yield on two-year Treasuries rose around 4 basis points to 3.53%.

What's Ripe

UWM Holdings Corp. (UWMC) 13.8%

UWM Holdings and Rocket Cos. advanced 14% and 9.7%, respectively, as the mortgage lenders got a boost from President Donald Trump’s plan to buy $200 billion in mortgage bonds in a bid to make housing more affordable.

House-flipper Opendoor Technologies surged 13%, while home builders PulteGroup, Lennar, and D.R. Horton were up 7.3%, 8.9%, and 7.8%, respectively.

Vistra Corp. (VST) 10.5%

VST stock surged 11% and Oklo jumped 7.9% after the nuclear energy companies unveiled separate agreements to provide power to Meta Platforms in order to support the hyperscaler’s data-center campus in Ohio.

What's Rotten

AXT Inc. (AXTI) 11%

Shares dropped after the semiconductor wafer maker cut its Q4 2025 revenue outlook to $22.5M–$23.5M, well below the prior $27M–$30M range and the $28.77M consensus. The company cited fewer-than-expected export control permits for indium phosphide from China’s Ministry of Commerce.

EO Morris Young said they are working to secure additional permits in early 2026 and remain on track to more than double indium phosphide capacity in the second half of the year.

He added that the recent capital raise will support further capacity expansion amid strong long-term data center demand.

iHeartMedia (IHRT) 3.5%

Shares plunged to their lowest level since Nov. 4 after Goldman Sachs downgraded the stock to sell from neutral.

Analyst Stephen Laszczyk cited the stock’s sharp +123% run-up in 2025 and mounting concerns that shifting audio consumption and weaker ad trends are limiting the company’s ability to sustain growth across its multi-platform audio business.

With $5.1B in debt maturing through 2031 and free cash flow running below expectations this year, Laszczyk cut his price target to $3.50.

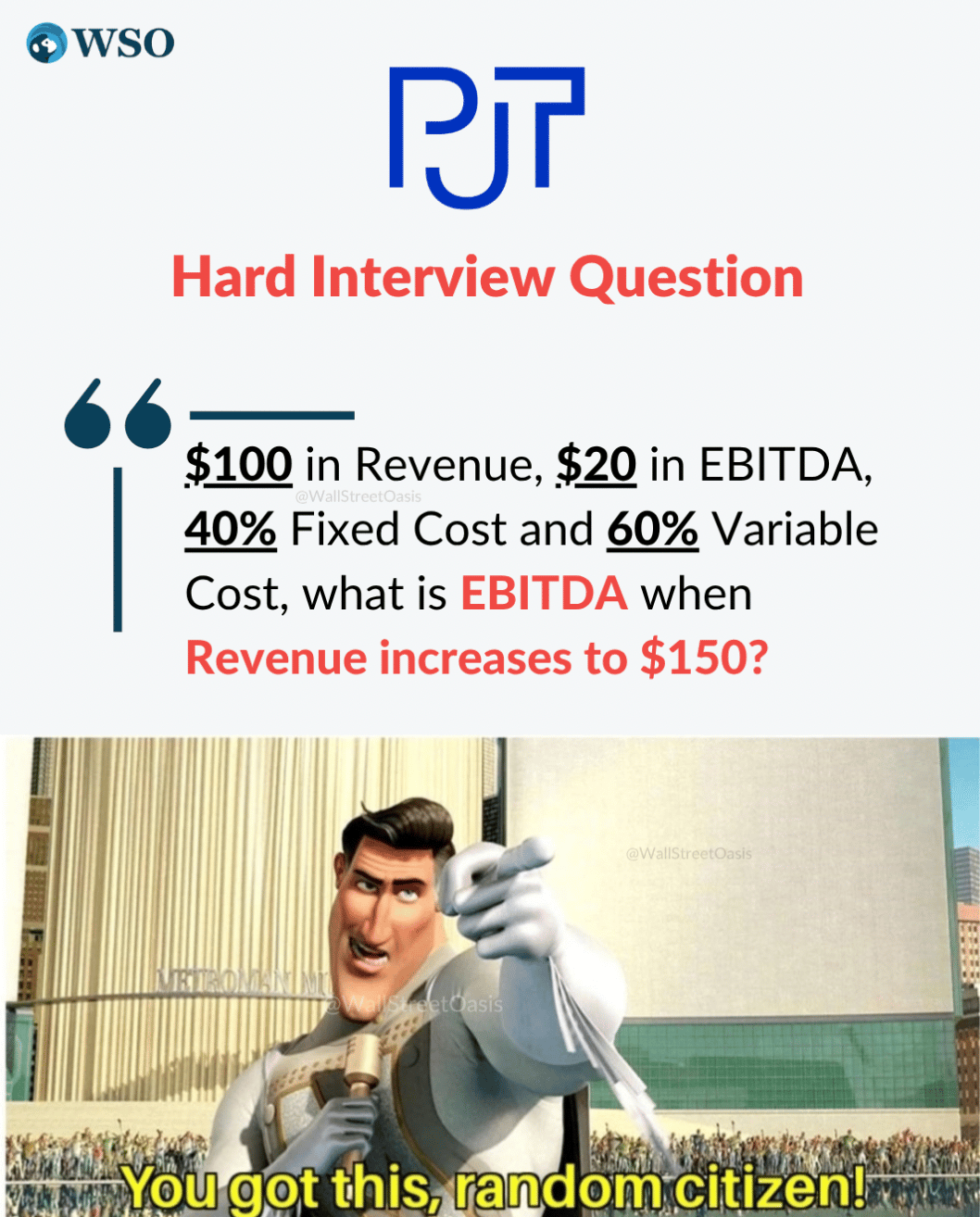

🧠 Technical Trip

Interview Q&A from PJT

👉 Want 1-on-1 recruiting help from PJT bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

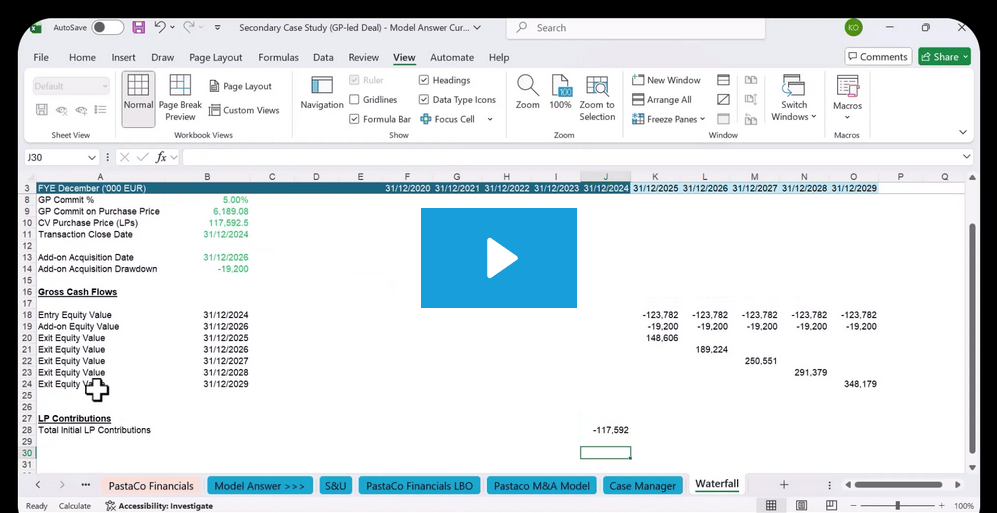

🎥 PE Secondaries Course: Liquidity Inside Private Equity

Understand how private equity stakes are traded — and why secondaries matter.

🌟 WSO Academy Q4 Update

🌍 Region-Specific Networking Guides

The most common theme among students is this: networking is challenging and uncomfortable. That’s why we’re continuing to build on our region-specific networking playbooks to help them tailor their approach. These templates can be found in the student resource folder.

This quarter, we’ve added new regions: Singapore and the Middle East. We’ll continue releasing market-focused networking playbooks to help them tailor their outreach.

As a reminder, we now have a 4-hour intensive networking bootcamp, which occurs monthly. Make sure they sign up! Additionally, we cover networking during Sunday office hours. They can find the office hours links (for gcals and other cals) bookmarked in the #General channel in Slack and under Events on their WSO Academy Dashboard. Many of their questions can likely be answered through the Networking Mastery Course.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Thailand’s B.Grimm bought a 25% stake in a U.S. hydropower firm for $230M.

Allegiant agreed to buy Sun Country in a $1.5B merger.

Veradermics filed for an IPO to fund its hair-growth drug.

EquipmentShare and Motive are weighing marketing IPOs next week.

OpenAI and SoftBank invested $1B in SB Energy, a Stargate partner.

Andreessen Horowitz raised $15B in its largest fundraise ever.

📊The Daily Poll

Capping card rates at 10% would hit hardest: |

Previous Poll:

Food-driven inflation tends to spill into:

Consumer sentiment: 44.4% // Wage pressure: 19.0% // Policy nerves: 3.2% // Everything slowly: 33.4%

Banana Brain Teaser

Previous

In an electric circuit, two resistors with resistances x and y are connected in parallel. In this case, if r is the combined resistance of these two resistors, then the reciprocal of r is equal to the sum of the reciprocals of x and y. What is r in terms of x and y?

Answer: xy((x + y)

Today

If a two-digit positive integer has its digits reversed, the resulting integer differs from the original by 27. By how much do the two digits differ?

The stock market is filled with individuals who know the price of everything and the value of nothing.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick