- The Peel

- Posts

- Dollar Hits the Floor

Dollar Hits the Floor

The dollar slumped as fresh data strengthened expectations for Fed easing, keeping yen traders alert.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks rise as rate-cut hopes outweigh weak confidence

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Lazard

Lesson from the Library: Learn the frameworks and thinking styles that help you ace every case.

Deal Dispatch: M&A, IPOs, and other transactions

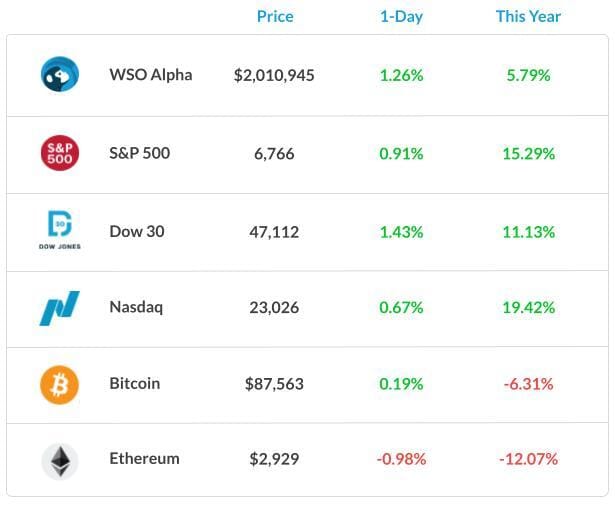

Market Snapshot

📉 Banana Bits

Consumer data is testing the Fed’s optimism on the path to cuts.

The dollar slumped as fresh data strengthened expectations for Fed easing, keeping yen traders alert.

Australian inflation and incoming U.S. releases are now front and center for markets.

The UK will extend its sugar tax to more soft drinks and milkshakes, as markets rallied ahead of the budget.

Franklin Templeton jumped into the XRP ETF race, calling the token “foundational” for global finance.

Stocks surged on rate-cut hopes, with the Dow jumping 660 points.

$6B Team Just Unleashed Cinderella on a $2T Market

Cinderella isn’t looking for her glass slipper— she’s busy smashing the $2T media market to pieces.

Elf Labs spent a decade at the US Patent & Trademark office in a historic effort to lock up 100+ historic trademarks to icons like Cinderella, Snow White, Rapunzel and more — characters that have generated billions for giant studios. Now they’re fusing their IP with patented AI/AR to build a new entertainment category the big players can’t copy.

And the numbers prove it’s working.

In just 12 months they raised $8M, closed a nationwide T-Mobile–supported telecom deal, launched patented interactive content, and landed a 200M-TV distribution partnership.

This isn’t a startup. It’s a takeover. And investors are sprinting to get in.

Lock in your ownership now

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Market Recap

U.S. Markets Climb as Investors Weigh Fed Signals

U.S. stocks moved higher today as investors grew more confident that the Federal Reserve may cut interest rates in December. The Dow led the gains today, while the S&P 500 and Nasdaq also finished in the green. Falling Treasury yields supported the move, with the 10-year dropping toward 4%.

Not all the news was positive, though. Consumer confidence fell more than expected, suggesting households are growing more worried about jobs and inflation. This raised some concerns that the economy may be slowing, even as markets hope for rate cuts.

Some tech and AI-related stocks also lagged, showing that not every sector is benefiting from today’s optimism. Investors are watching closely to see if the Fed will focus more on weak data or on keeping inflation under control.

Global markets added to this positive tone. Asian and European markets both rose, helped by the same expectations of future rate cuts. Oil prices held steady, and the U.S. dollar traded in a tight range as traders waited for more economic data. Overall, markets were positive but still sensitive to any new signs from the Fed.

What's Ripe

Kohl’s Corporation (KSS) 42.5%

This was driven by retail or earnings-related surprise or strong retail sentiment, as part of the more bullish market tone.

Alphabet Inc. (GOOGL) 1.5%

GOOGL shares climbed after news that its parent company benefits from shifts in the AI and chip supply field.

The broader market’s optimism on potential rate cuts helped lift growth-oriented names like Alphabet today.

What's Rotten

Nvidia Corporation (NVDA) 2.6%

NCDA shares fell slightly today amid concerns about its role in the AI chip race and specific news that weighed on sentiment.

Chevron Corporation (CVX) 0.8%

CVX shares are trading lower today amid insider selling and negative sentiment, despite the energy sector’s strength.

Also, with oil and energy markets remaining somewhat flat, Chevron may not have benefited as strongly from the risk-on environment today.

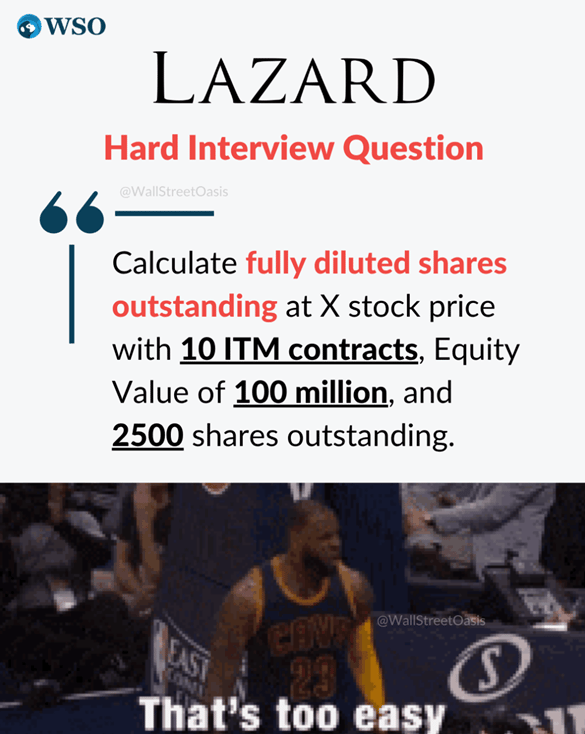

🧠 Technical Trip

Interview Q&A from Lazard

👉 Want 1-on-1 recruiting help from Lazard bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

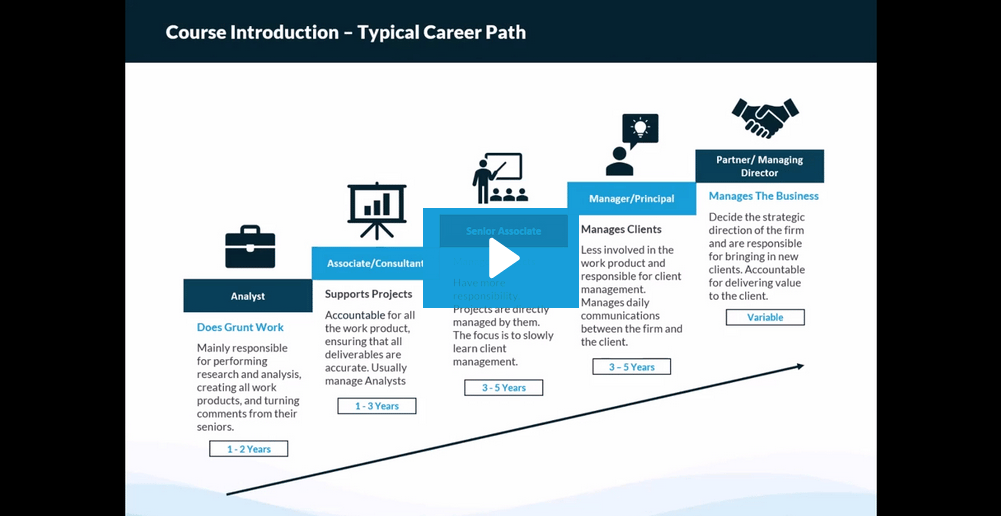

🎥 Consulting Case Interview Course: Crack the Consulting Playbook

Learn the frameworks and thinking styles that help you ace every case.

🌟 WSO Academy Q4 Update

🌍 Region-Specific Networking Guides

The most common theme among students is this: networking is challenging and uncomfortable. That’s why we’re continuing to build on our region-specific networking playbooks to help them tailor their approach.

This quarter, we’ve added new regions: Singapore and the Middle East. We’ll continue releasing market-focused networking playbooks to help them tailor their outreach.

As a reminder, we now have a 4-hour intensive networking bootcamp, which occurs monthly. Make sure you sign up! Additionally, we cover networking during Sunday office hours. Students can find the office hours links (for GCALS and other calendars) bookmarked in the #General channel in Slack and under Events on their WSO Academy Dashboard. Many of their questions can likely be answered through the Networking Mastery Course.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Paxos is acquiring Fordefi in a push to expand institutional DeFi services.

Talen Energy completed its Freedom and Guernsey acquisitions.

S&P Global closed its $1.8B purchase of With Intelligence to strengthen its private-markets data business.

Bed Bath & Beyond’s merger is slated for 2026, with more than 40 store closures confirmed.

Sompo Holdings’ growth is being driven by strong earnings, integrations, and its Aspen deal.

India’s Q3 M&A rose 37% to $26B, led by Tata Motors’ $4.45B Iveco acquisition.

Banana Brain Teaser

Previous

If y = kx + 3; and k is constant. If y = 17 when x = 2, what is the value of y when x = 4?

Answer: 31

Today

The average of 10, 30, and 50 is 5 more than the average of 20, 40, and x. What is the value of x?

I’d be a bum on the street with a tin cup if the markets were always efficient.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick