- The Peel

- Posts

- Dollar Has a Rough Week

Dollar Has a Rough Week

The dollar wrapped up its worst week since June as markets eye fresh data.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Investors have finally found the shine in commodities

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Ares

Lesson from the Library: Discover how VCs pick winners, fund innovation, and turn bold ideas into billion-dollar exits.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

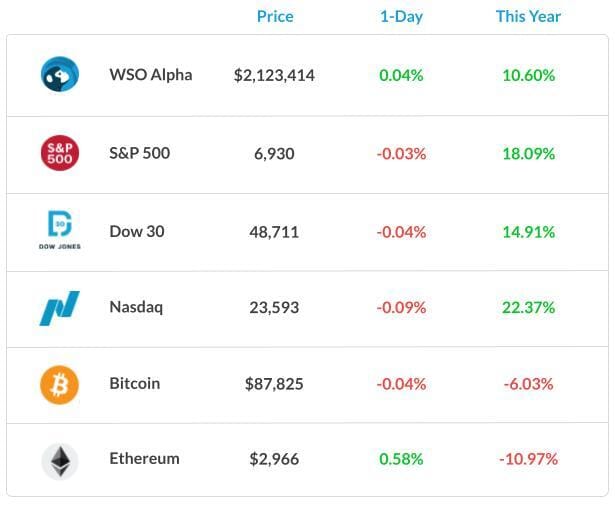

Market Snapshot

📉 Banana Bits

BOJ policymakers debated further rate hikes even after December’s move.

Trump met Zelenskiy following what he called a “Productive” call with Putin.

The dollar wrapped up its worst week since June as markets eye fresh data.

China Vanke secured approval for a second bond grace-period extension.

Japan is eyeing record defense spending as GDP, and the yen test the 2% line.

China launched state-backed venture funds to support tech startups.

Coupang will pay $1.1B in compensation after a major data breach.

Market News

Investors Have Finally Found The Shine in Commodities

While market activity after the Christmas break remains muted, as expected amid a slowdown in transactions, the equity gauge posted its best week in a month.

Most megacaps fell, but Nvidia Corp. rose on a licensing deal with artificial-intelligence startup Groq. Bond market action was muted, with Treasuries set for a monthly loss, yet on pace for their best year since 2020 after three Federal Reserve rate cuts.

The dollar churned at the end of its worst week since June. With a couple of trading days left in the year, investors are wondering whether we are entering the Santa Claus Rally, the last 5 trading days of the year.

On the other hand, the main street is optimistic that the main gauges will hit new highs before the year ends, with Steve Sosnick at Interactive Brokers projecting the S&P 500 to reach 7,000.

On the other hand, Oil fell as investors assessed a step forward in Ukraine peace talks, which could lead to a deal that allows more Russian oil into global markets.

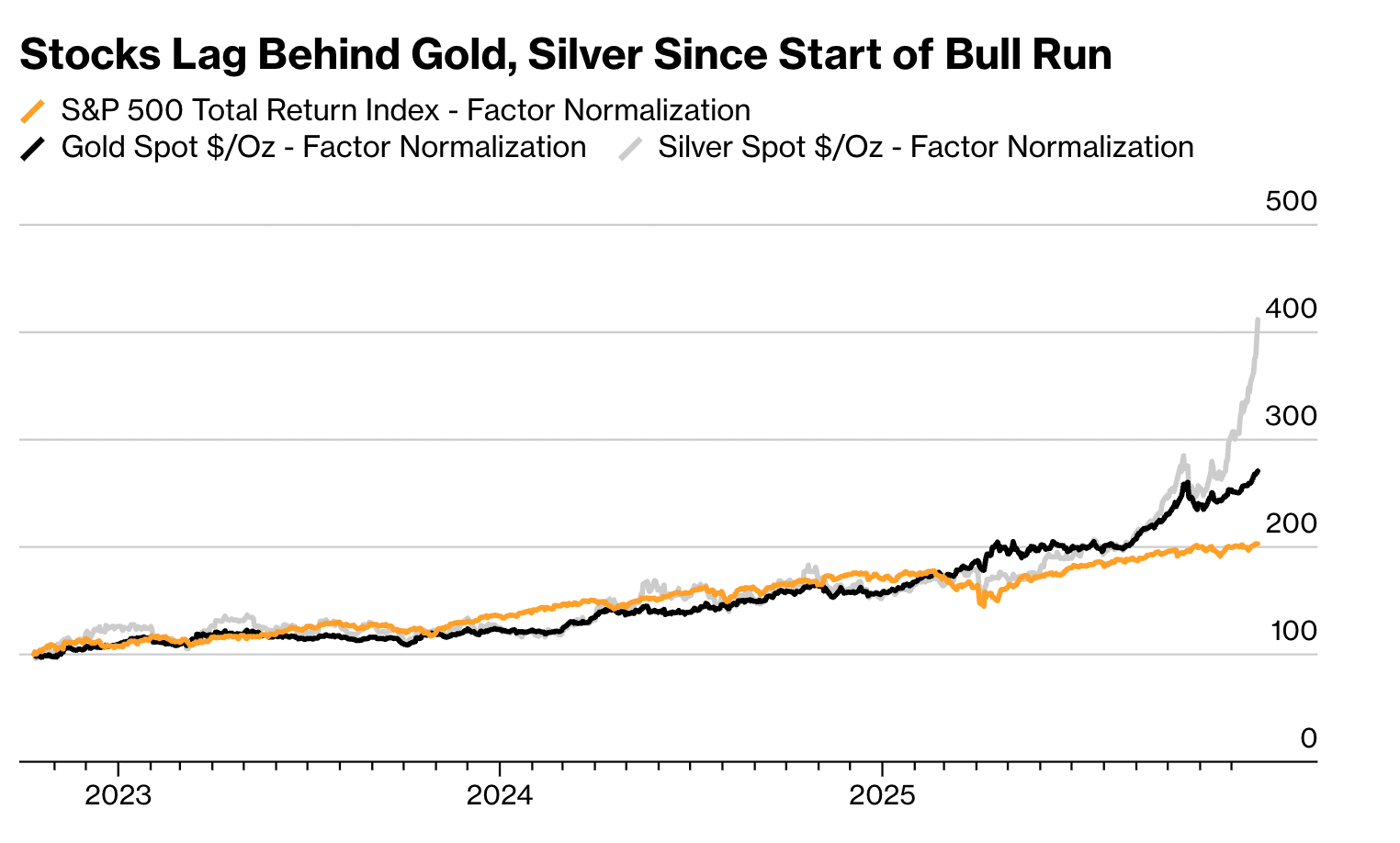

China vowed to prevent the yuan’s exchange rate from overshooting. What was unusual about this bull run was the astronomical surge in commodities relative to equities. Elevated central bank purchases, inflows into exchange-traded funds, and Fed policy easing have supported the surge.

Lower borrowing costs are a tailwind for precious metals, which don’t pay interest, and traders are betting on more rate cuts in 2026.

What's Ripe

Coupang Inc. (CPNG) 6.5%

CPNG gained 6.5% following the retailer's announcement of findings from an internal investigation into a cybersecurity breach.

A former employee downloaded personal information for approximately 3,000 customers, but the data were deleted without being transferred to a third party, Coupang said.

NVIDIA Corp. (NVDA) 1.0%

The chip maker entered into a nonexclusive agreement to license technology from Groq, an artificial-intelligence chip start-up, Groq announced on Christmas Eve.

What's Rotten

Sable Offshore Corp. (SOC) 13.5%

SOC tumbled 14%. Environmental groups filed a lawsuit in federal court on Wednesday, aiming to block the restart of oil pipelines near Santa Barbara, California.

Sable Offshore had received an emergency special permit from a Department of Transportation office earlier in the week approving the company’s restart plan.

Moderna Inc. (MRNA) 4.7%

MRNA stock dropped 4.7%. No particular piece of news seemed to be the culprit. The drugmaker has struggled since 2021, when it emerged as a leader in Covid-19 vaccines, and 2025 has been no exception.

The stock is down 25% this year to its lowest levels since before the pandemic.

🧠 Technical Trip

Interview Q&A from Ares

👉 Want 1-on-1 recruiting help from Ares bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Venture Capital: From Idea to IPO

Discover how VCs pick winners, fund innovation, and turn bold ideas into billion-dollar exits.

🌟 WSO Academy Q4 Update

🌍 Region-Specific Networking Guides

The most common theme among students is this: networking is challenging and uncomfortable. That’s why we’re continuing to build on our region-specific networking playbooks to help them tailor their approach. These templates are available in the student resource folder.

This quarter, we’ve added new regions: Singapore and the Middle East. We’ll continue releasing market-focused networking playbooks to help them tailor their outreach.

As a reminder, we now have a 4-hour intensive networking bootcamp, which occurs monthly. Make sure they sign up! Additionally, we cover networking during Sunday office hours. Students can find the office hours links (for gcals and other cals) bookmarked in the #General channel in Slack and under Events on their WSO Academy Dashboard. Many of their questions can likely be answered through the Networking Mastery Course.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

The Packer family office CEO sold a Sydney home for A$85M.

UK pension funds are considering a stake in Brookfield’s Center Parcs.

A Thailand–Cambodia ceasefire has begun after weeks of clashes.

ServiceNow’s $12B deal spree is drawing comparisons to the CEO’s SAP days.

Coforge agreed to buy Encora in a $2.35B all-stock deal.

📊The Daily Poll

What’s Japan risking most if it keeps hiking? |

Previous Poll:

Lower jobless claims right now suggest the economy is:

Holding together: 30.5% // Delaying the inevitable: 25.5% // Genuinely strong: 16.9% // Misleading: 27.1%

Banana Brain Teaser

Previous

How many odd numbers between 10 and 1,000 are the squares of integers?

Answer: 14

Today

A furniture dealer purchased a desk for $150 and then set the selling price equal to the purchase price plus a markup that was 40 percent of the selling price. If the dealer sold the desk at the selling price, what was the amount of the dealer’s gross profit from the purchase and the sale of the desk?

Wealth is the ability to fully experience life.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick