- The Peel

- Posts

- Dip Bought, Then Vomited

Dip Bought, Then Vomited

Markets had a bumpy ride today, starting off high before the inevitable crash.

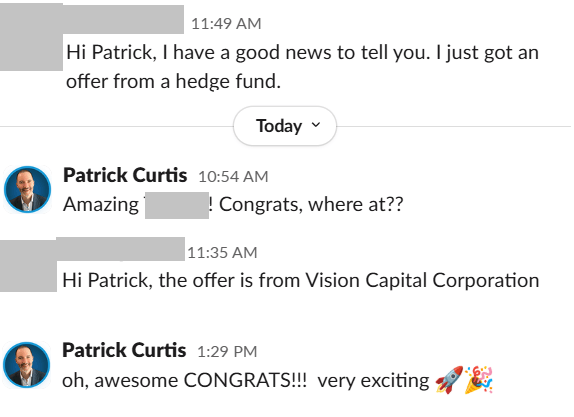

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Turbulent Tuesday

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Q&A from Citi

Lesson from the Library: Investment Banking Interview course module

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

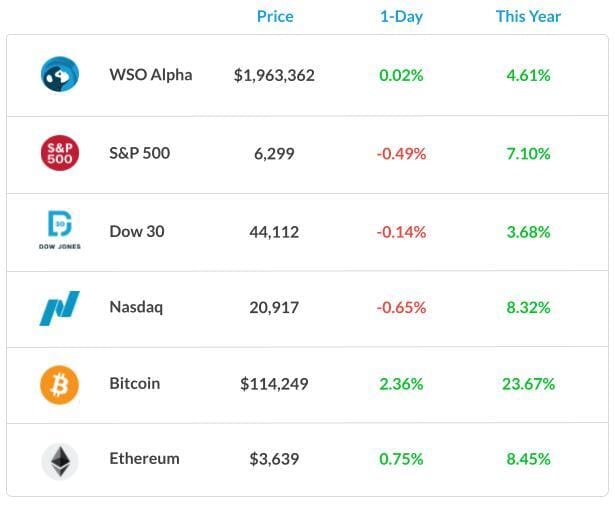

Market Snapshot

📉 Banana Bits

Markets had a bumpy ride today, starting off high before the inevitable crash.

Super Micro Computer got crushed after-hours, reporting $0.41 of EPS vs $0.44 consensus and barely avoided de-listing from NASDAQ.

Despite a revenue beat and raise for next quarter, AMD slightly missed earnings ($0.48 vs $0.49 consensus) on a tough tariff environment and softer China sales.

Rivan lost a LOT of money this quarter, even more than investors expected, due to higher-than-anticipated costs and lower credit income.

SNAP shares were down after the company’s net loss widened to $262 million from $248 million last quarter on lower advertising revenue.

A new semiconductor tariff plan is officially in the works, according to Trump.

We might see a new Fed Governor by the end of the week, with 4 candidates remaining.

Disney is set to report earnings shortly, just after ESPN announced a major deal with the NFL media.

Palantir’s stock continues to rise, and CEO Alex Karp calls out all the company’s “bitter and miserable haters.”

Market Recap

Fed Seat Shuffle Incoming

It was a bit of a tumultuous Tuesday, if you will. After some serious dip-buying on Monday, the market looked as if it was ready for another pump, based on an almost 1% gain in the first hour of trading.

It didn’t take long until everyone sobered up, digested the latest wave of corporate earnings, economic data, and tariff updates, and puked everything. Stocks included.

First is earnings. While standout names like Palantir crushed it, semiconductors had a rough go of it.

AMD got hit despite a decent fine earnings report as Trump looks ready to unveil another plan for semiconductor tariffs, leaving investors guessing as to what that will mean for China sales for the likes of AMD and Nvidia. Super Micro Computer was down 15% at one point on a bad earnings print as well.

Concurrently, we might get a new Fed Governor (not Scott Bessent) as the shortlist is cut down to 4 people to replace Adrian Kugler.

And oh yeah, on top of all that, there’s the whole Jobs report for May and June being revised down by a massive 250k+ and potential economic shi*show that everyone momentarily forgot about during Monday’s dip-buying.

Lastly, Mike Wilson, Morgan Stanley’s Chief Equity Strategist, noted several near-term risks that could lead to a 5-10% market dump, including the labor market slowdown, continued Fed holdouts, prolonged tariff-induced inflation, and a slowdown in corporate earnings growth. However, in the long term, he remains bullish on stocks and recommends buying any dips.

What's Ripe

Lemonade (LMND) 29.5%

The online insurance company posted revenue of $164 million and shrunk its losses in the quarter while raising its full-year guidance. The total value of all active policies also climbed 28%.

Significant customer demand for their products, healthy underwriting, and lower costs all contributed to the company’s quarterly performance.

Palantir (PLTR) 7.9%

Gotta love when a CEO calls out all of his haters as bitter and miserable people who have no idea what they’re talking about. Hey, when your stock crushes earnings, you’ve earned the right to talk like that.

Revenue blew past expectations, rising 48% YoY and topping $1 billion on an increase in government contracts and corporate contracts.

What's Rotten

Oddity Tech (ODD) 22.0%

Oddity Tech, the consumer beauty company, defied all odds…. In the most negative way possible. 2Q earnings were pretty much perfect. The company beat the street’s expectations for the 9th consecutive quarter, with EPS up 12% and sales up 25%, while increasing FY 25 guidance.

Still, the stock dropped 20%. Why? Heightened expectations. The company became a victim of its own success, with investors disappointed that the beat wasn’t big enough

American Eagle (AEO) 9.5%

Uh oh! Looks like we’re gonna be talking about that Sydney Sweeney ad yet again. After surging 20% on Trump praising the ad, AEO’s shares had a tough go of it today.

The decline can likely be attributed to some profit-taking, which is typical when stocks jump a lot in a short amount of time.

🧠 Technical Trip

Question

Answer: 4.0x

👉 Want 1-on-1 recruiting help from Citi bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

Lessons We’re Sharing from our course library:

This video covers key FAQs about using trading comps as a valuation method. What they are, when to use LTM vs. forward multiples, how market inefficiencies can impact results, whether to include the target company in the peer set, and whether to use median or mean multiples.

🦈 Deal News

M&A, IPOs, And Other Notable Transactions

Disney’s ESPN and the NFL are swapping assets worth $3 billion, with the latter taking a 10% stake in ESPN in exchange for ESPN purchasing the NFL’s media assets.

Coinbase is raising $2 billion in a convertible bond offering in order to repurchase stock and redeem outstanding debt.

Argentina’s state-owned oil/gas producer, YPF, is said to be acquiring TotalEnergies’ shale assets for up to $500 million.

Macquarie is set to buy 40% of Portuguese healthcare company, Luz Saude, valuing the company at ~$1 billion.

Presidio is set to merge with EQV Ventures to go public via a SPAC, valuing the combined company at $660 million.

Asset manager Brookfield bought a stake in Duke Energy’s Florida Utility for $6 billion.

📊The Daily Poll

New Fed governor incoming. What matters most? |

Previous Poll:

Apple’s best revenue in 4 years =

Bullish: 23.1% // Priced in: 20.5% // Temporary flex: 43.6% // Meh: 12.8%

Banana Brain Teaser

Previous

7 pieces of rope have an average length of 68cms and a median length of 84cms. If the length of he longest piece of rope is 14cms more than 4 times the length of the shortest piece of rope, what is the maximum possible length, in cms, of the longest piece of rope?

Answer: 134 cms

Today

A photography dealer ordered 60 Model X cameras to be sold for $250 each, which represents a 20% markup over the dealer’s initial cost of each camera. Of the cameras ordered, 6 were never sold and were returned to the manufacturer for a refund of 50% of the dealer’s initial cost. What was the dealer’s approximate profit or loss as a percent of the dealer’s initial cost for the 60 cameras?

I’d be a bum on the street with a tin cup if the markets were always efficient.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick