- The Peel

- Posts

- Democrats Sweep, Trump Weeps

Democrats Sweep, Trump Weeps

Trump took a swipe at Mamdani after Democrats swept key races.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Investors cheer as the Supreme Court questions tariffs

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Moelis

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

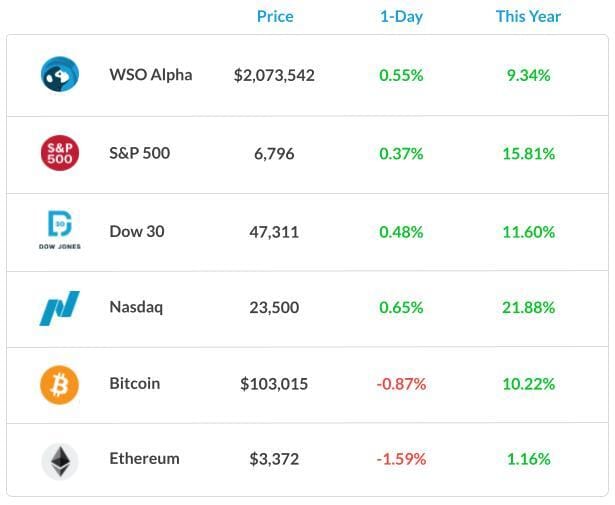

Market Snapshot

📉 Banana Bits

Trump took a swipe at Mamdani after Democrats swept key races.

Private payrolls rose by 42K in October, easing labor market worries.

Prediction markets slashed the odds of Trump’s tariffs surviving the court.

Swiss luxury execs met Trump after his 39% tariff surprise.

One big vote could make Musk a trillionaire or send him packing from Tesla.

Chinese EV maker Xpeng is rolling out robotaxis powered by its own AI chips.

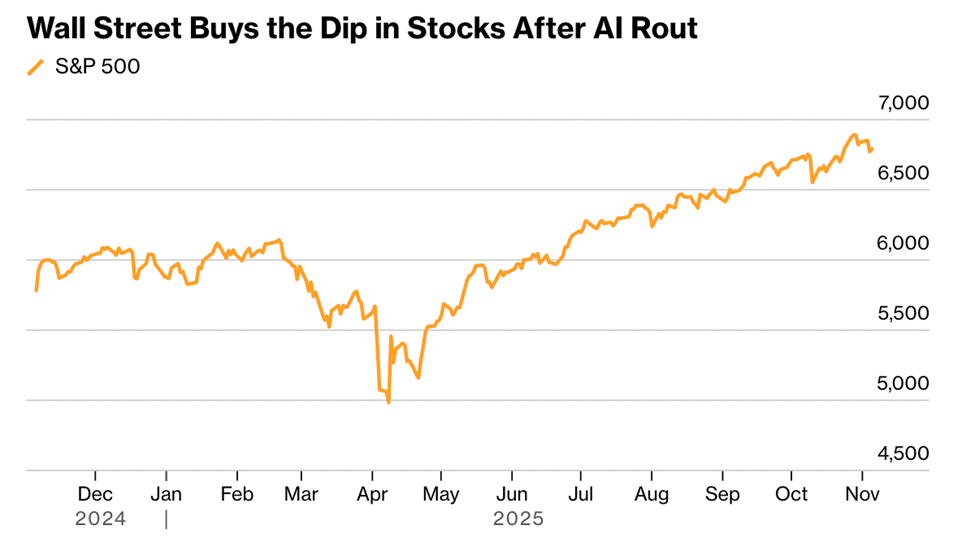

Market Recap

Happy Investors and A Sad Trump

Investors piled back into U.S. stocks after the Supreme Court seemed to express doubts about the arguments underpinning President Trump’s Sweeping Tariffs.

The Dow Jones Industrial Average rose 226 points or 0.5%, the S&P 500 rose 0.4% and the Nasdaq Composite rose 0.7%. On the other hand, Treasury yields soar as investors sell them.

The yield on the 2-year Treasury note rose to 3.63%, while the 10-year yield was up to 4.16%, the highest since Oct. 6.

Asian equities also advanced in Wednesday trading, rebounding from their steepest two-day decline since April as dip buyers returned after a brief pullback in technology shares, driven by concerns about lofty valuations. MSCI’s regional gauge rose 1.1%, with Hong Kong and Japan among the biggest gainers.

What's Ripe

Rivian Automotive, Inc. (RIVN) 23.4%

RIVN shares rose after reporting a smaller-than-expected loss, with revenue of $1.56B nearly doubling from a year ago and topping estimates by about $50M, driven by a 324% jump in software and services and a 47% rise in automotive revenue.

The company reaffirmed its FY25 outlook for 41,500–43,500 vehicle deliveries (vs. 42,544 consensus) and an adjusted EBITDA loss of $2B–$2.25B, with the midpoint slightly better than expectations.

Digital Turbine Inc. (APPS) 23.1%

APPS jumped 23% after the company beat expectations on both profit and revenue and raised its full-year outlook.

The company now sees FY2026 revenue of $540M–$550M and adjusted EBITDA of $100M–$105M, representing midpoint increases of $12.5M in revenue and $9M in EBITDA from prior guidance.

What's Rotten

Pinterest, Inc. (PINS) 21.8%

PINS shares plunged as disappointing Q3 results, coupled with below-consensus Q4 guidance, overshadowed a 17% revenue increase and growth in active users.

For Q4, the company expects revenue of $1.31B–$1.34B, with the midpoint of $1.325 coming in just below the $1.34B consensus.

Arista Networks Inc (ANET) 8.6%

ANET Shares dipped despite reporting Q3 results that beat expectations, with revenue rising 27% Y/Y.

For Q4, the company guided revenue to $2.3B–$2.4B (midpoint $2.35B vs. $2.33B consensus).

🧠 Technical Trip

Interview Q&A from Moelis

👉 Want 1-on-1 recruiting help from Moelis bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Venture Capital: Betting on the Next Big Thing

From seed to unicorn — learn how VCs spot winners and turn ideas into empires.

2025 IB Working Conditions Survey

We Want Your Input!

Are you in investment banking? Take 2 minutes to share your experience on hours, compensation, and work-life balance in our 2025 survey. Your insights help shed light on real working conditions across the industry.

All responses are 100% anonymous, so you can be honest about your experience.

📝 Click here to participate and join others who are turning their experience into a voice for change in IB.

🦈 Deal Deep Dive

M&A, IPOs, And Other Notable Transactions

Yum Brands is weighing a possible sale of Pizza Hut.

India’s PhysicsWallah sets its IPO range, aiming for a $3.2B raise.

China’s WeRide and Pony.ai stumbled in their Hong Kong debuts.

Insurtech firm Exzeo raised $168M in its US IPO.

Monro shares jumped after Carl Icahn revealed a 15% stake.

📊The Daily Poll

Do you approve of Zohran Mamdani’s win as New York City mayor? |

Previous Poll:

Crude fell on dollar strength and oversupply — your take?

Classic pullback: 24.4% // Time to buy: 22.3% // Global slowdown sign: 33.3% // Won’t last long: 20.0%

Banana Brain Teaser

Previous

At least 2/3 of the 40 members of a committee must vote in favor of a resolution for it to pass. What is the greatest number of members who could vote against the resolution and still have it pass?

Answer: 13

Today

A gym class can be divided into 8 teams with an equal number of players on each team or into 12 teams with an equal number of players on each team. What is the lowest possible number of students in the class?

The whole secret to winning big is to lose the least when you’re wrong.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick