- The Peel

- Posts

- DeepSeek Crashes the Party

DeepSeek Crashes the Party

DeepSeek rolled out new AI models aimed at challenging OpenAI and Google.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

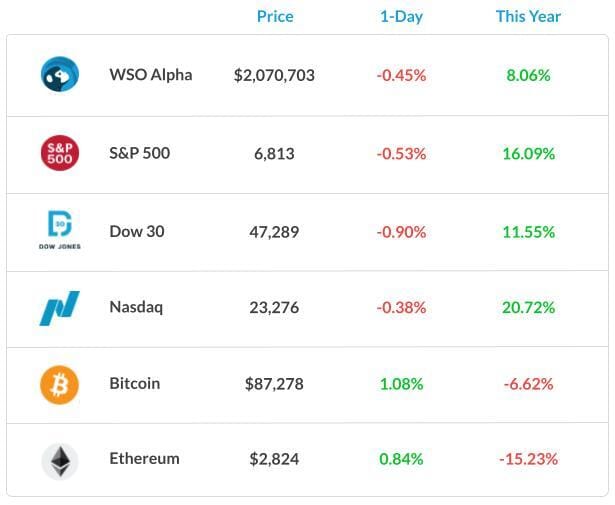

Market Summary: Stocks fall as cr*pto crash rattles risk appetite

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Jane Street

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

Former RBI Governor Raghuram Rajan warned that private credit risks are rising.

Steve Cohen’s latest pivot: moving deeper into the casino business.

Taiwan may restart a nuclear power plant in 2028, according to its energy minister.

Retail cr*pto traders are taking a hit as strategy ETFs plunge 80%.

DeepSeek rolled out new AI models aimed at challenging OpenAI and Google.

U.S. factory activity contracted at its fastest pace in four months.

SoftBank’s Masayoshi Son said he “cried” over selling Nvidia shares to fund AI bets.

DFIN’s Venue VDR: Built for Career-Making Deals

When navigating critical business transactions, speed, security, and control aren’t optional - they’re everything. That’s why DFIN rebuilt the Venue® virtual data room, to be the most modern VDR in the market, engineered to lead the industry in speed and simplicity for dealmakers who operate at the highest level.

From M&A to IPOs and all critical transactions in between, Venue was built for ease of use with an intuitive user interface and clean navigation, enabling users to self-launch new data rooms and manage multiple data rooms on demand.

Backed by DFIN’s 30+ years of financial industry expertise and 24/7 expert support, Venue isn’t just a platform - it’s your strategic advantage when the stakes are highest.

If you’re ready to accelerate deal execution, own the room with the reimagined Venue.

Market Recap

Cr*pto Market Caused a Halt in Stock Rally

December is known for a Santa Rally market; however, this year, we might be getting a different present from Santa.

Yesterday, markets took a beat again after Wall Street saw stocks falling as traders shunned riskier corners of the market amid a selloff in cr*ptocurrencies.

A rout in Japanese debt rippled through global bonds. The S&P 500 to its longest streak of monthly gains since 2021. The Russell 2000 index of small caps fell by more than 1%.

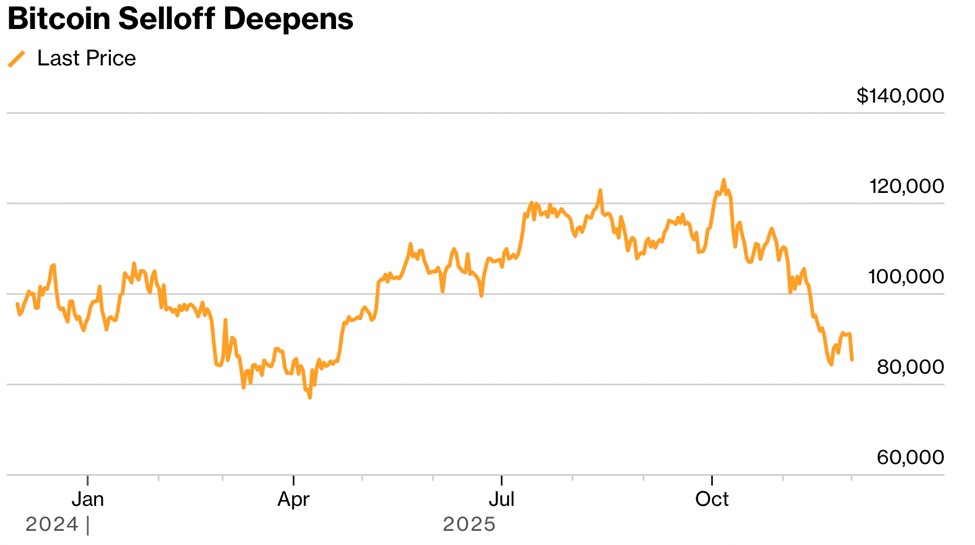

Nearly $1 billion in leveraged cr*pto positions were liquidated during a sharp price drop that brought fresh momentum to a wide-ranging industry plunge. B*tcoin sank to around $85,000.

What's Ripe

New Fortress Energy LLC (NFE) 7.4%

NFE jumped 7.4%. Regulators in Puerto Rico said late Friday they had tentatively approved a contract with the liquefied natural gas supplier, which has faced questions about its ballooning debt.

The stock is down 91% this year.

Synopsys Inc. (SNPS) 4.9%

SNPS gained 4.9% after Nvidia said it had invested $2 billion in Synopsys common stock, marking an extension of an existing strategic partnership.

What's Rotten

Coupang Inc. (CPNG) 5.4%

CPNG slipped 5.4% after the South Korean online retailer disclosed it had suffered a data breach beginning in June.

Authorities said they were investigating the hack, which exposed about 34 million accounts. Coupang shares are listed on the New York Stock Exchange.

Airbus SE (EADSY) 3.2%

EADSY stock declined 5.8% in France and 3.2% in the U.S., where it trades over the counter.

On Friday, Airbus announced a “precautionary fleet action” for A320-family jets that could be affected by solar flares. Boeing was down 1.3% after rising earlier in the session.

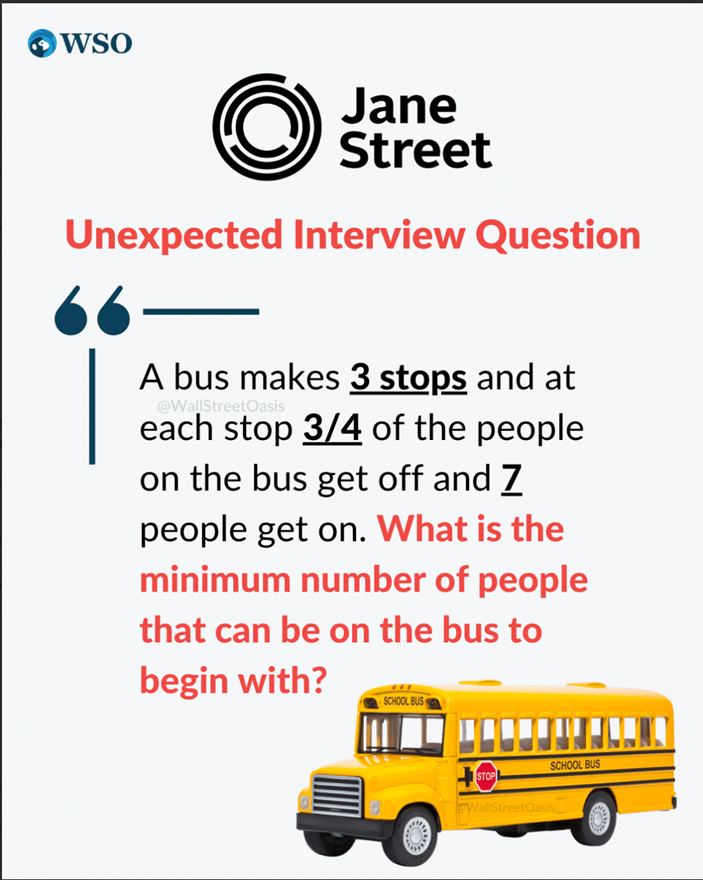

🧠 Technical Trip

Interview Q&A from Jane Street

👉 Want 1-on-1 recruiting help from Jane Street bankers & 2,000+ top mentors? Apply to WSO Academy

🌟 WSO Academy Q4 Update

🔁 One Last Thing… On-Cycle Recruiting for 2028 Grads

On-cycle recruiting for 2028 grads is officially kicking off, and we’re here to help them get ready. Make sure to check the application tracker on their dashboard, as some firms are rumored to launch applications in November.

Investment Banking (IB) – Kicks off earliest and moves fast. For 2028 US grads, networking for summer analyst roles should be happening now. Expect most top firms to launch applications in December/January (some as early as November), with most Superdays typically scheduled around February/March.

UK Students – Recruiting has already started, so make sure they book mocks with their mentors.

Equity Research – Typically starts a bit later than IB, often in winter or early spring.

Sales & Trading (S&T) – Applications can open around the same time as IB, but recruiting is often more rolling through fall and early winter.

Asset Management / Hedge Funds – Highly variable. Some structured programs recruit in the fall, but many roles are filled off-cycle and closer to graduation.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

India’s Swiggy Plans $1.1 Billion Share Sale Next Week

Zhipu Grows Revenue and Users on Path to China’s First AI IPO

KKR-Backed Musinsa Picks Citigroup, JPMorgan to Work on IPO

Intel Pledges $208 Million Malaysia Chip Investment, Anwar Says

Stablecoin Firm First Digital Eyes Listing Through SPAC Merger

Banana Brain Teaser

Previous

How many integers n are there such that 1 < 5n + 5 < 25?

Answer: 4

Today

Car X averages 25.0 miles per gallon of gasoline, and Car Y averages 11.9 miles per gallon. If each car is driven 12,000 miles, approximately how many more gallons of gasoline will Car Y use than Car X?

The stock market is a story of human over-reaction in both directions.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick