- The Peel

- Posts

- Deal Done Rates Steady

Deal Done Rates Steady

India held rates steady after sealing a landmark trade deal with the US.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

Get a Top Job Offer, Guaranteed (or tuition is free) | Apply Here

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Job market results intensify equity rout

What’s Ripe / Rotten: The tastiest and most disgusting stocks today

Technical Trip: Interview Q&A from Ares

Lesson from the Library: Learn how VCs source deals, evaluate startups, and back the next big thing.

Deal Deep Dive: M&A, IPO, and transaction breakdowns

The Daily Poll: See how you stack up

Student Success Corner: From applications to offer: How strategic networking leads to investment banking roles

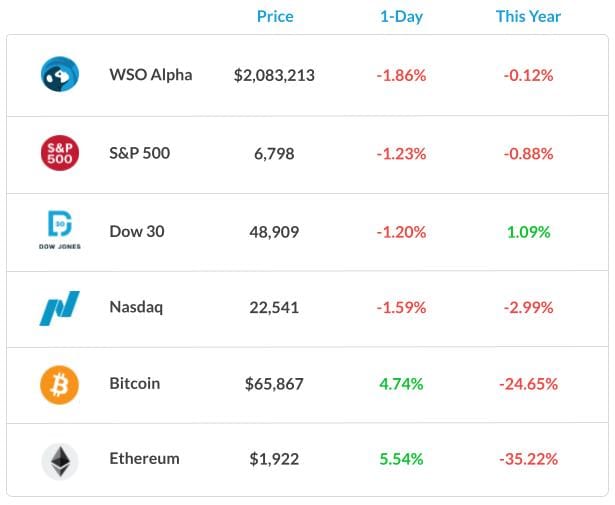

Market Snapshot

📉 Banana Bits

Emerging assets didn’t escape the tech selloff.

With few options left, Chinese speculators are piling into metals.

India held rates steady after sealing a landmark trade deal with the U.S.

Big Tech is gearing up to spend $650B as the AI arms race heats up.

The U.S. yield curve steepened to a four-year high amid market uncertainty

Market News

Job Market Results Intensify Equity Rout

The market again had a rough day in Thursday trading after U.S. job openings unexpectedly fell in December to the lowest since 2020 and layoffs edged up.

Companies announced the largest number of job cuts for any January since the depths of the Great Recession in 2009, while jobless claims rose more than forecast last week.

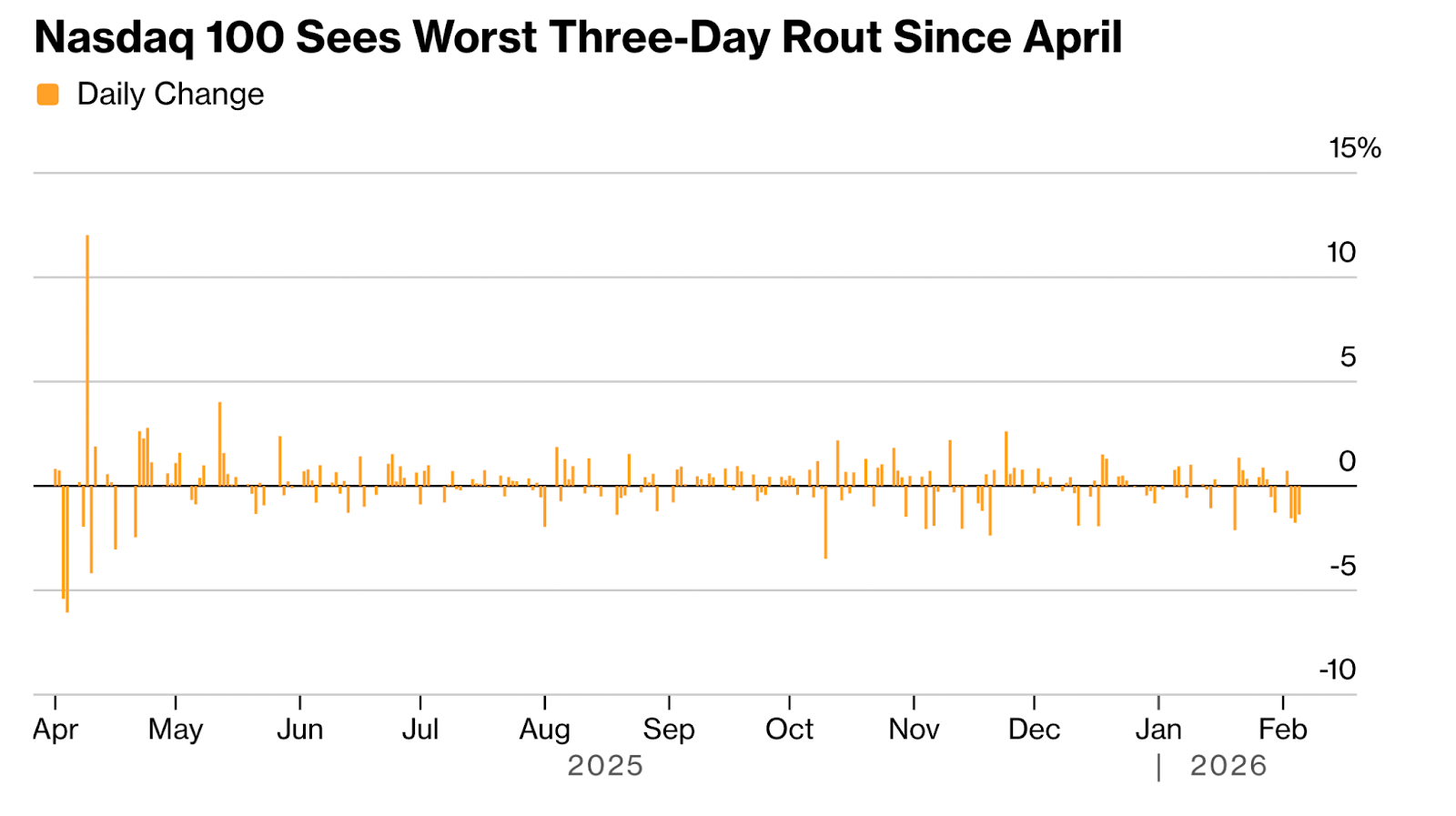

Stocks extended a slide from near-record levels, with the S&P 500 falling 1.2%. The Nasdaq 100 saw its worst three-day rout since April’s meltdown. The most-popular digital token tumbled to around $63,000 in a selloff that cut its value by nearly half since October.

Treasuries climbed, sending two-year yields to the lowest level this year. Silver plummeted about 20%.

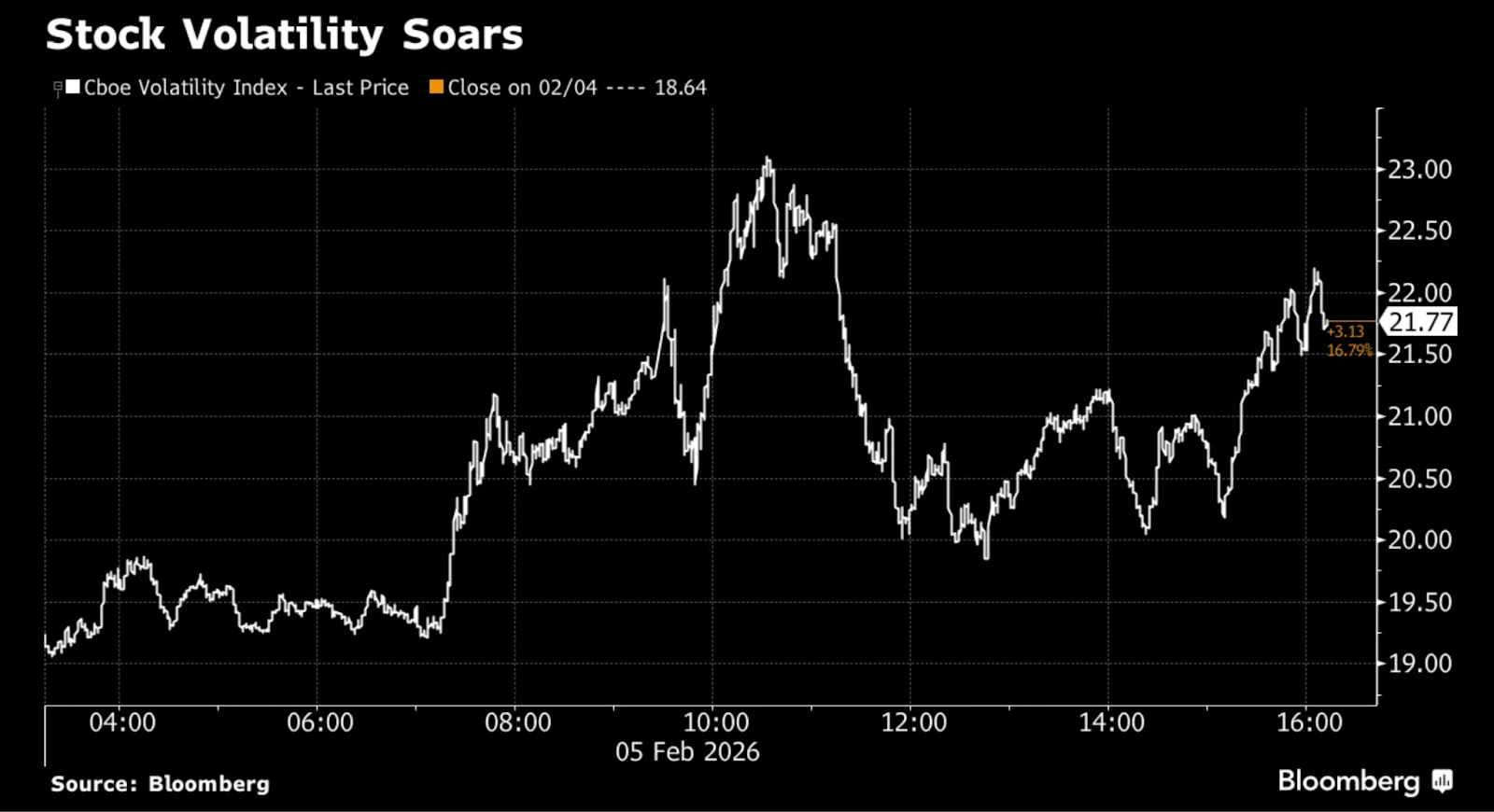

A measure of stock volatility - the VIX - jumped to around 22. The iShares Expanded Tech-Software Sector ETF sank 5%.

Anthropic is releasing a new version of its most powerful AI model designed to carry out financial research, days after a push into legal services upended legacy software makers. A gauge of chipmakers was flat.

What's Ripe

Align Technology Inc. (ALGN) 8.9%

ALGN surged 8.9%. The Invisalign maker beat fourth-quarter earnings and revenue estimates and posted an adjusted gross margin of 72% for the period, well above its previous guidance.

Arm Holdings PLC - ADR (ARM) 5.7%

ARM rose 5.7% after the British semiconductor company reported better-than-expected adjusted earnings for its fiscal third quarter.

Arm expects slower revenue growth over the current quarter, which Chief Financial Officer Jason Child said was down to seasonality.

What's Rotten

Strategy Inc. (MSTR) 17.1%

MSTR sank 17%. The world’s largest corporate holder of B*tcoin is scheduled to report quarterly earnings after the closing bell on Thursday.

Shares were sliding along with a sharp decrease in the price of the cr*ptocurrency.

Hims & Hers Health Inc. (HIMS) 3.8%

HIMS fell 3.8%. The telehealth company said it plans to sell a compounded version of the Wegovy pill at an introductory price of $49 a month.

🧠 Technical Trip

Interview Q&A from Ares

👉 Want 1-on-1 recruiting help from Ares bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

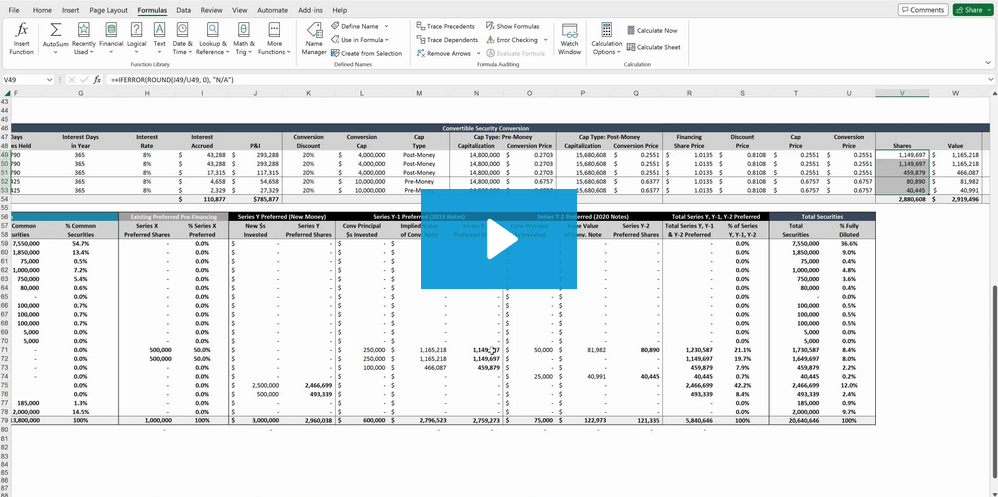

🎥 Venture Capital Course: Backing Ideas That Scale

Learn how VCs source deals, evaluate startups, and back the next big thing.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

A Dubai-based firm plans to invest $1.6B in African AI and agriculture.

Luckin Coffee’s private-equity owner tightened its grip on the chain.

SoftBank is tapping OpenAI investment upside as Japanese automakers lag.

Talks for Glencore’s takeover of Rio Tinto collapsed over valuation gaps.

Forgent Power shares jumped 7.4% following its $1.5B IPO.

KKR to Acquire Sports Investor Arctos in $1.4 billion deal.

📊The Daily Poll

Why did India keep rates unchanged after the US deal? |

Previous Poll:

What’s hurting chip companies the most right now?

Low prices: 17.9% // Too much supply: 25.7% // Weak demand: 21.8% // Margin pain: 34.6%

Student Success Corner

From Applications to Offer: How Strategic Networking Leads to Investment Banking Roles

👉 Check out more on WSO YouTube

Banana Brain Teaser

Previous

Last year, the price per share of Stock X increased by k%, and the earnings per share of Stock X increased by m%, where k is greater than m. By what percent did the ratio of price per share to earnings per share increase, in terms of k and m?

Answer: [[100(k - m)]/(100 + m)]%

Today

How many prime numbers between 1 and 100 are factors of 7,150?

The best portfolio is the one you can live with and stick to.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick