- The Peel

- Posts

- Crude Cools Again

Crude Cools Again

Oil dipped on a stronger dollar and oversupply worries.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Teach Weakness Leads Broad Market Pullback

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Morgan Stanley

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

📉 Banana Bits

Wall Street slipped as bank CEOs warned of a possible pullback.

Retail traders had their worst day since April as tech momentum cracked.

AMD’s outlook disappointed investors after its AI-fueled surge.

Uber expects steady growth, driven by strong ride and delivery demand.

Oil dipped on a stronger dollar and oversupply worries.

B*tcoin crashed below $100K, deepening the ongoing crypto correction.

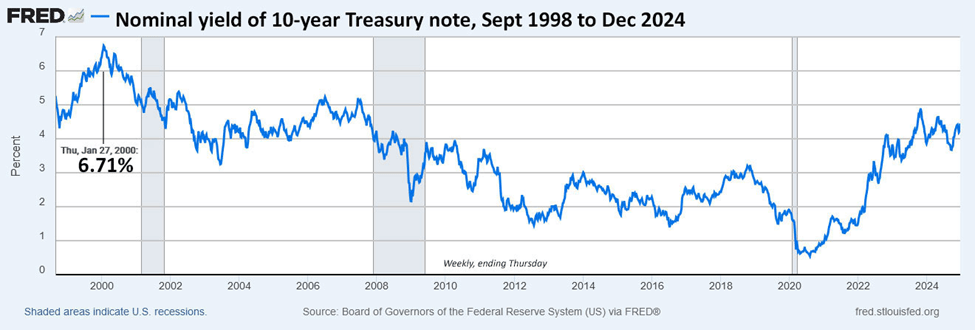

Deutsche Bank’s latest report has it betting against the 10-year Treasury.

Market Recap

Teach Weakness Leads Broad Market Pullback

U.S. stocks fell today, mainly because big tech companies sold off. The Nasdaq dropped about 2%, the S&P 500 fell 1.2%, and the Dow lost 0.5%.

Investors became more cautious after several big-bank CEOs warned that the market could pull back soon. Many traders also took profits from this year’s big AI stock gains, causing a broad market decline.

Bond and oil markets moved in different directions. The 10-year Treasury yield remained around 4.1%, showing little change, while oil prices fell to about $60 per barrel amid concerns about excess supply and weaker demand. Market volatility rose, prompting investors to become a bit more nervous and move money to safer assets.

Among individual companies, Uber shares dropped even though it reported solid earnings, and Palantir also fell. AMD beat earnings expectations after the market closed, but investors remained cautious. In cr*pto, B*tcoin briefly fell below $100,000, adding to the risk-off mood.

What's Ripe

Sanmina Corporation (SANM) 16.6%

SANM beat Q4 earnings and revenue estimates and provided much stronger Q1 2026 guidance, particularly on growth and valuation.

It highlighted the strategies for acquiring ZT Systems and the growing demand from communications networks, strengthening its growth story.

Yum! Brands (YUM) 7.30%

YUM reported Q3 earnings and revenue that beat expectations, showing growth in key brands like Taco Bell and KFC.

It announced a formal strategic review of its Pizza Hut brand, which investors interpreted as a possible value-unlocking move.

What's Rotten

Palantir Technologies (PLTR) 8.0%

Despite reporting strong revenue growth and raising its guidance, shares fell as investors questioned the sustainability of its growth and high valuation.

The market was scared by the disclosure of a large position against Palantir by hedge-fund manager Michael Burry, which added to worries.

Nvidia Corporation (NVDA) 4.0%

The stock dropped around 4% despite being one of the major beneficiaries of the AI boom, and investors are increasingly cautious about whether the sector’s elevated valuations are justified.

Broad concerns about a possible market pullback and comments from large bank CEOs warning of a 1-15% correction weighed on tech names like Nvidia.

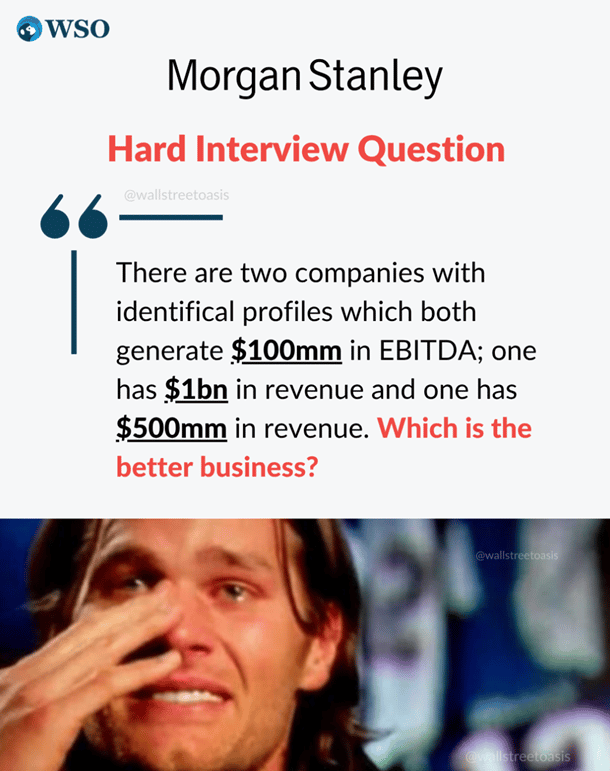

🧠 Technical Trip

Interview Q&A from Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Venture Capital: From Idea to IPO

Discover how VCs pick winners, fund innovation, and turn bold ideas into billion-dollar exits.

2025 IB Working Conditions Survey

We Want Your Input!

Are you in investment banking? Take 2 minutes to share your experience on hours, compensation, and work-life balance in our 2025 survey. Your insights help shed light on real working conditions across the industry.

All responses are 100% anonymous, so you can be honest about your experience.

📝 Click here to participate and join others who are turning their experience into a voice for change in IB.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Daikin Applied bought Chilldyne to expand its data-center footprint.

Prosperity Bancshares shareholders approved its next bank acquisition.

Kenvue shares jumped 12% amid takeover buzz from Kimberly-Clark.

Qiagen’s CEO exits as it acquires Parse Biosciences for $225 M.

Australian Gold & Copper tightened its grip on South Cobar with new buys.

📊The Daily Poll

Crude fell on dollar strength and oversupply — your take? |

Previous Poll:

KPMG will rate staff on AI usage; genius or gimmick?

Smart future-proofing: 22.6% // Feels forced: 61.3% // Productivity flex: 16.1%

Banana Brain Teaser

Previous

After driving to a riverfront parking lot, Bob plans to run south along the river, turn around, and return to the parking lot, running north along the same path. After running 3.23 miles south, he decides to run for only 50 minutes more. If Bob runs at a constant rate of 8 minutes per mile, how many miles farther south can he run and still be able to return to the parking lot in 50 minutes?

Answer: 1.5

Today

At least 2/3 of the 40 members of a committee must vote in favor of a resolution for it to pass. What is the greatest number of members who could vote against the resolution and still have it pass?

The most important rule in trading is to play great defense, not great offense.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick