- The Peel

- Posts

- CPI Data Under Fire

CPI Data Under Fire

November’s CPI report raised fresh doubts about U.S. inflation data.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Wall Street rallies after softer November CPI

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Rothschild & Co.

Lesson from the Library: Decode financial statements and master the metrics that move markets.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

The U.S. appealed Harvard’s court win over a $2B funding freeze.

Japan raised rates to their highest level since 1995 as inflation bites.

Trump signed an order easing cannabis rules, lifting the industry.

November’s CPI report raised fresh doubts about U.S. inflation data.

ECB officials say the rate-cutting cycle is likely done.

The suspect in the Brown–MIT shooting, Neves Valente, was found dead.

TikTok says it has signed deals for a new U.S. joint venture.

Market Recap

Stocks Jump as CPI Cools

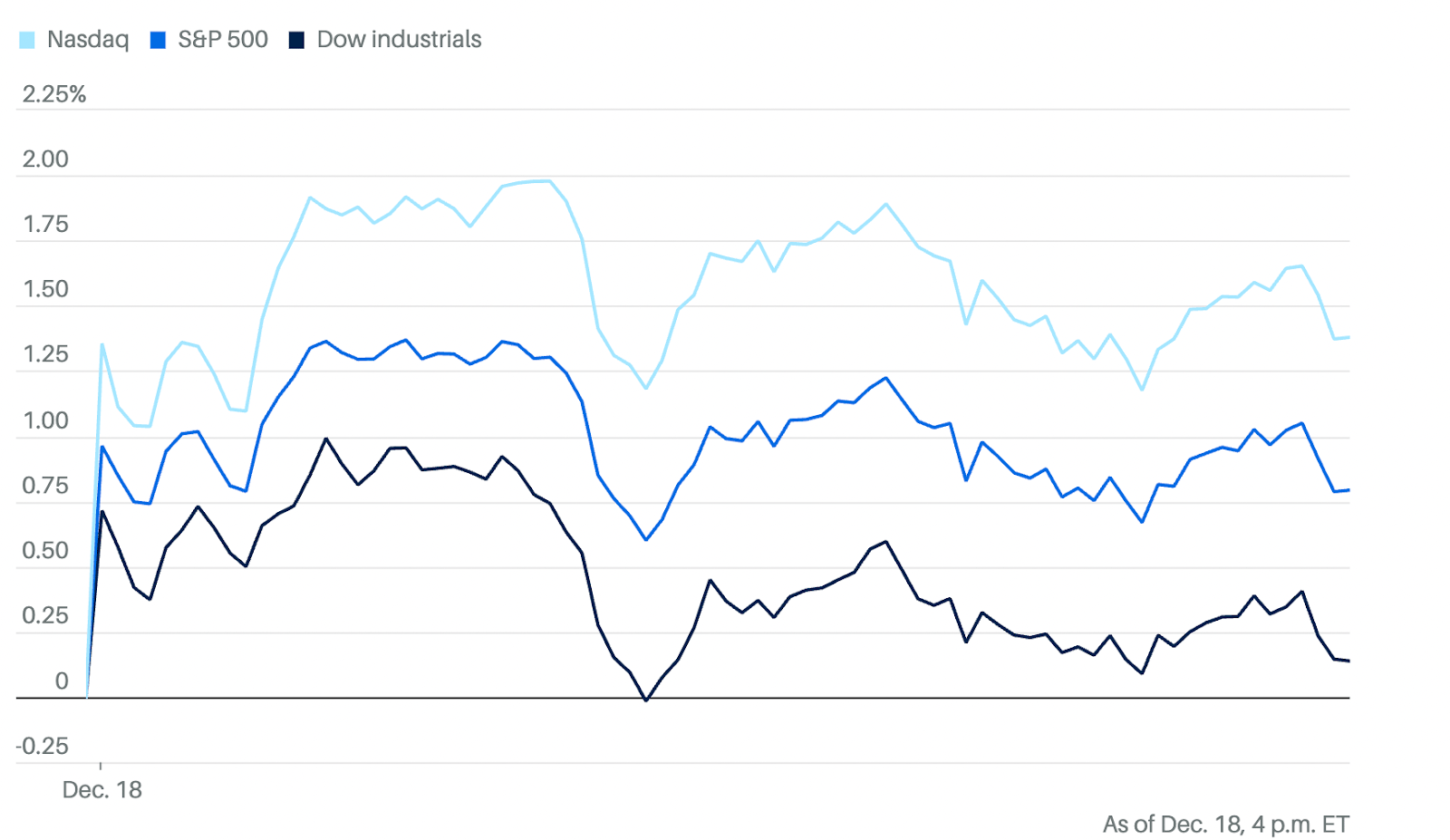

The stock market experienced midday volatility but closed solidly higher following the November consumer price index report.

The Dow Jones Industrial Average rose 67 points, or 0.1%. The S&P 500 was up 0.8%. The Nasdaq Composite was up 1.4%. The S&P and Dow each snapped four-day losing streaks.

The S&P slid multiple times, but it ultimately held onto a solid portion of its gains. The Dow also turned lower around noon ET before closing higher.

The consumer price index for November rose at a 2.7% annual rate, while the core CPI marked a 2.6% annual uptick. That represented a surprise slowdown in inflation, though the government shutdown’s impact on data collection made the release noisier than usual.

What's Ripe

Micron Technology Inc. (MU) 10.2%

MU surged 10%. The memory-chip maker crushed Wall Street’s first-quarter earnings targets and issued strong guidance.

The results could reassure investors who are jumpy about bloated artificial-intelligence valuations, although concerns remain about Big Tech companies’ huge spending commitments.

Lululemon Athletica Inc. (LULU) 3.5%

LULU jumped 3.5%. Elliott Investment Management has built a stake of over $1 billion in the athletic apparel retailer and supports former Ralph Lauren executive Jane Nielsen as a CEO candidate

What's Rotten

Insmed Inc. (INSM) 16.1%

INSM slumped 16% after the pharmaceutical company ended development of a sinus drug following a failed study. Insmed said a mid-stage trial for its drug brensocatib failed to meet its main goals.

The company was testing to see if Insmed improved symptoms in patients with the inflammatory condition chronic rhinosinusitis without nasal polyps.

CarMax Inc. (KMX) 4.2%

KMX declined 4.2%. The used-car dealer posted quarterly earnings and sales that topped analysts’ expectations but said it plans to reduce margins on used cars.

🧠 Technical Trip

Interview Q&A from Rothschild & Co.

👉 Want 1-on-1 recruiting help from Rothschild & Co. bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Accounting: The Language of Business

Decode financial statements and master the metrics that move markets.

🌟 WSO Academy Q4 Update

🌍 Region-Specific Networking Guides

The most common theme among students is this: networking is challenging and uncomfortable. That’s why we’re continuing to build on our region-specific networking playbooks to help them tailor their approach. These templates are available in the student resource folder.

This quarter, we’ve added new regions: Singapore and the Middle East. We’ll continue releasing market-focused networking playbooks to help them tailor their outreach.

As a reminder, we now have a 4-hour intensive networking bootcamp, which occurs monthly. Make sure they sign up! Additionally, we cover networking during Sunday office hours. Students can find the office hours links (for gcals and other cals) bookmarked in the #General channel in Slack and under Events on their WSO Academy Dashboard. Many of their questions can likely be answered through the Networking Mastery Course.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

ICICI Prudential AMC jumped after its $1.2B India IPO.

Goldman and JPMorgan see India’s IPO boom running into 2026.

NYSE owner ICE is in talks to invest in MoonPay at a ~$5B valuation.

OpenAI signed deals with colleges, gaining early ground in education.

IPO plans for Fannie Mae and Freddie Mac remain uncertain under Trump.

Trump Media is targeting nuclear fusion via a merger with TAE.

Elliott is said to have built a $1B-plus stake in Lululemon.

📊The Daily Poll

Would you actually shop for groceries via ChatGPT? |

Previous Poll:

What best explains Venezuela’s inflation spiral?

Sanctions pressure: 32.1% // Policy mismanagement: 14.3% // Structural collapse: 32.1% // Long-term inevitability: 21.5%

Banana Brain Teaser

Previous

Working simultaneously at their respective constant rates, Machines A and B produce 800 nails in x hours. Working alone at its constant rate, Machine A produces 800 nails in y hours. In terms of x and y, how many hours does it take Machine B, working alone at its constant rate, to produce 800 nails?

Answer: [(xy)/(y - x)]

Today

What is the smallest integer n for which 25^n> 5^12?

Most people overestimate what they can do in one year and underestimate what they can do in ten.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick