- The Peel

- Posts

- Court Strikes Down Tariffs

Court Strikes Down Tariffs

A federal court ruled Trump’s tariffs to be illegal, dealing a major blow to trade.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks retreat as inflation rises, labor market softens

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Q&A from UBS

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

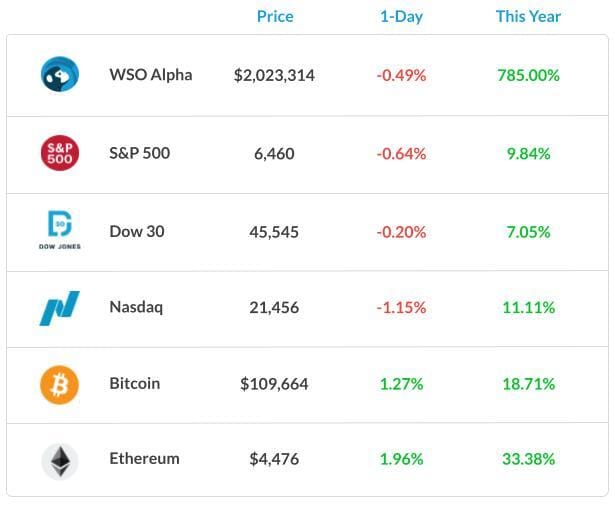

Market Snapshot

📉 Banana Bits

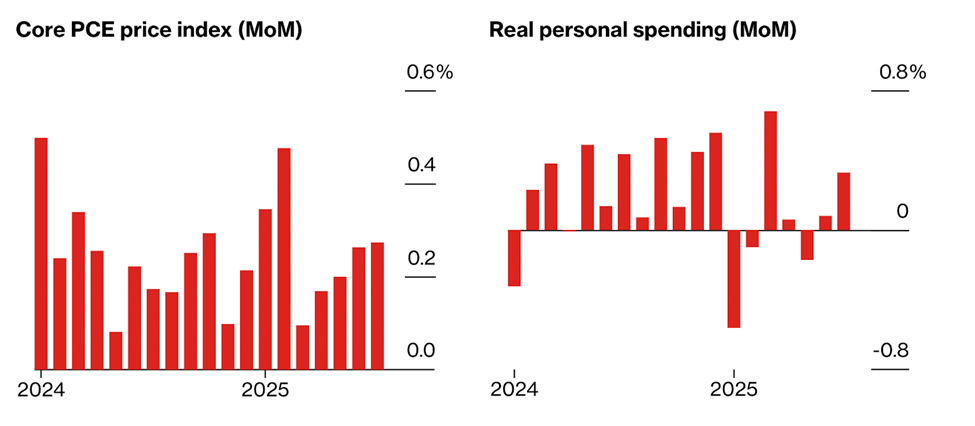

Fed’s preferred inflation metric rose 2.9% in July, the highest since February.

German inflation unexpectedly exceeds the ECB’s 2% goal.

A federal court ruled Trump’s tariffs to be illegal, dealing a major blow to trade.

Canadian economy shrinks 1.6% as trade war impacts exports.

Spirit Airlines files for Chapter 11 bankruptcy again.

India's economic growth accelerated to 7.8%.

U.S consumers remain resilient, with spending rising the most in four months.

U.S consumer sentiment fell to a three-month low.

UK home prices face downward pressures with supplies near a two-decade high.

Gold Nears Record as Traders Weigh U.S Data, Fed Future.

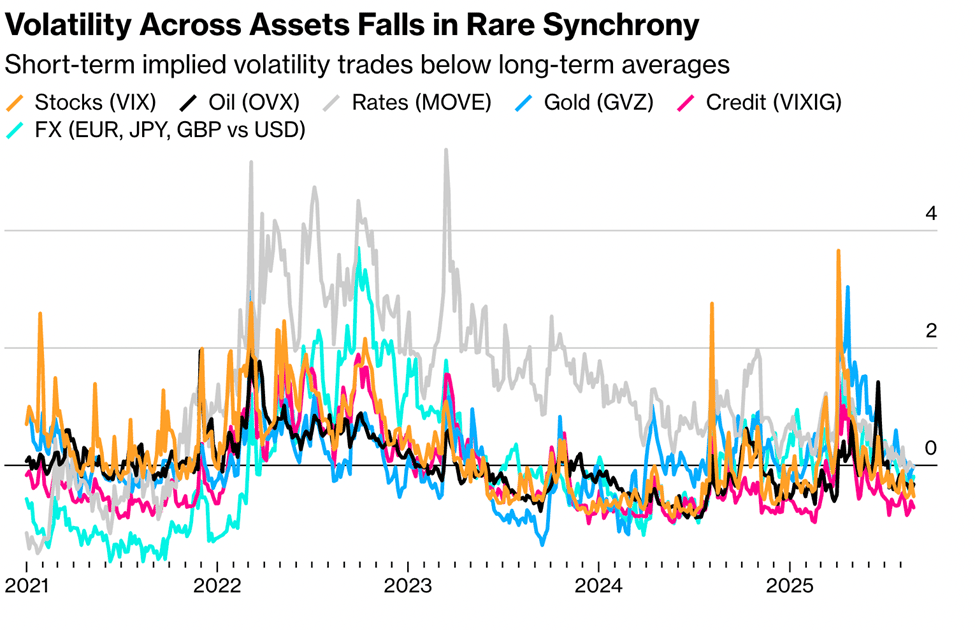

Hedge Funds Are Shorting the VIX at a Rate Not Seen Since 2022.

Citadel Securities trading revenue fell 8.3%, after a cool-down in volatility.

Market Recap

A Two-Sided Story

Stocks went for a retreat on Friday as investors took profit after an unexpected increase in the Fed’s preferred inflation metric.

Core inflation, excluding food and energy, increased to 2.9% in July, representing a 0.3% MoM. Across the board, the S&P 500 fell 0.6%, falling below the 6,500 key level.

The Nasdaq 100 lost 1.2% and treasury yields moved upward. Even blue-chip tech stocks were not spared, with Magnificent 7 stocks dropping 1.4%.

With looming tariffs across the board, the resiliency of consumers comes into question. It is just a matter of time before the retailers pass the pressure of tariffs to consumers.

According to an RBC Capital Markets Analyst, consumers will only get a pinch of tariff effects in the third quarter.

Santander's chief U.S economist believes that the near-term outlook for consumers is cloudy and expects tariff-related price hikes to work through the economy, potentially pulling back consumer spending.

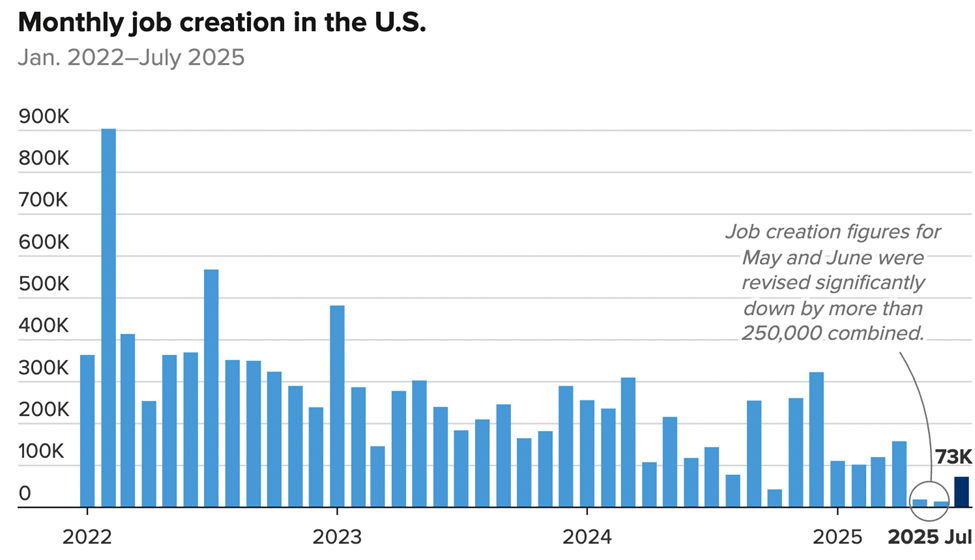

The job market could serve as an early indicator for future consumer spending, as the unemployment rate ticked up to 4.2% in July 2025. Nonfarm payrolls increased by only 73,300 jobs, a noticeable slowdown compared to previous months.

Additionally, downward revisions erased over 250,000 jobs from May and June’s original figures, signaling a softer labor market.

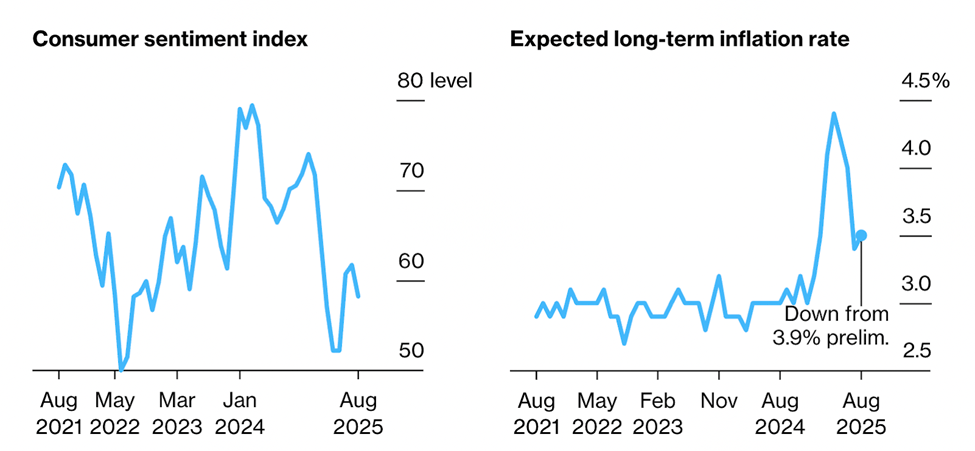

The weakening labor market coincided with a decline in consumer sentiment to a three-month low in August, and a higher consumer inflation expectation depicts growing concerns among American consumers.

An Early Santa Rally?

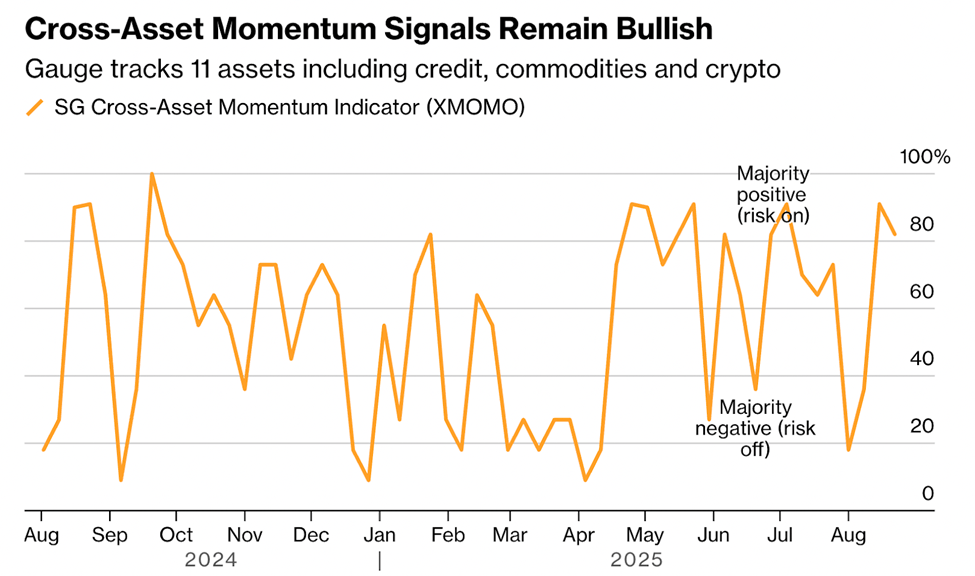

Despite the ongoing drama, rising tariff costs, persistent inflation, labor market challenges, and questions about Federal Reserve independence, we might actually be witnessing an early Christmas gift from the markets in September.

Risk appetite remains resilient, driven by simple convictions: the Fed cutting rates, continued consumer spending, and advancements in AI.

A way to dissect bullishness is Societe Generale SA’s cross-asset momentum gauge. It’s brushed up against its most bullish levels at least five times since the tariff-driven turmoil in April, including again this month.

Market volatility across major asset classes remains unusually low.

According to Cboe Global Markets, short-term implied volatility has fallen below long-term averages, maintaining levels not consistently seen for about four years. This means that the market remains complacent and relaxed despite market uncertainty.

What's Ripe

Ambarella (AMBA) 16.8%

AMBA soared 16% in Friday trading after solid earnings and blockbuster projections.

Revenue of $95.5 million, up 50% YoY and surpassing estimates of $50 million.

EPS came in at $0.15, smashing estimates of $0.05.

Alibaba (BABA) 13.5%

Alibaba stock popped 13% after beating net income estimates of $5.9 billion, compared to analyst expectations of $3.7 billion.

Despite beating net income, BABA missed the topline figure of $34.6 billion vs $35 billion due to increased competition.

The company also announced production of in-house chips.

What's Rotten

Marvell Technology (MRVL) 18.6%

MRVL dropped 18.60% on Friday, despite revenue hitting the analyst's expectation of $2.01 billion.

EPS came in at $0.67 vs $0.66.

The management calls for a revenue of $2.06 billion vs the analyst expectation of $2.11 billion, which caused it to plummet.

Dell Technologies (DELL) 8.9%

Dell Technologies’ stock fell 8.88% despite beating revenue and EPS estimates.

The management indicated that the third quarter adjusted EPS will be $2.45 below the analyst expectation of $2.55.

🧠 Technical Trip

Interview Q&A from UBS

👉 Want 1-on-1 recruiting help from UBS bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Citadel Securities and Tower make a rare investment in the Indian bourse.

Tencent Partner PlaysOut said to eye funds at $150 million value.

CK Hutchison Holdings Ltd. is considering listing its global telecom business.

Chinese Builder Seazen plans to raise funds from tokenized debt.

Cube Highways plans a $600 million India IPO.

University of Phoenix plans for IPO after scrapping sale plans.

Verisure CEO sees Stockholm as an ideal IPO pick.

PepsiCo Inc. boosted its Celsius stake to 11% after $585 million deal.

Lululemon Founder Sells $160 million of stock in Amer Sports.

Rolls-Royce mulls funding options for Reactor Unit.

Tencent-Backed Uzbek Fintech Unicorn Uzum eyes Eurobond, IPO.

Bain Capital’s Chindata Group Holdings Ltd. has attracted bidders seeking expansion.

John Malone held talks with Rupert Murdoch over the Warner Bros.-Fox merger.

📊The Daily Poll

Early Santa rally in September? |

Previous Poll:

Is the AI rally sustainable?

Yes, long runway: 29.6% // Short-term hype: 17.3% // Some names only: 30.9% // Bubble vibes: 22.2%

Banana Brain Teaser

Previous

A club collected exactly $599 from its members. If each member contributed at least $12, what is the greatest number the club could have?

Answer: 49

Today

In a weight-lifting competition, the total weight of Joe’s two lifts was 750 pounds. If twice the weight of his first lift was 300 pounds more than the weight of his second lift, what was the weight, in pounds, of his first lift?

There’s only one way to describe most investors: trend followers.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick