- The Peel

- Posts

- Coreweave Beats But Drops

Coreweave Beats But Drops

CoreWeave reported revenues beating expectations and raising guidance, but the stock still fell.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Recap: CPI report gave stocks the green light to rip

Technical Trip: Interview Q&A from Centerview

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Lesson from the Library: How to write a pro-level equity research report

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

CPI increased 0.2% for the month and 2.7% year-over-year, slightly below estimates of 2.8%.

Circle had a 53% quarterly revenue jump driven by strong stablecoin growth, but net losses widened due to IPO charges in June.

CoreWeave reported revenue of $1.2 billion, beating expectations of $1.1 billion and raising guidance, but the stock still fell.

Swiss shoemaker, On Holdings, grew revenue 32% and increased their FY guide as it countered rising tariffs with price hikes.

Cava got crushed after reporting $280 million in revenue, below estimates for $285 million and revising guidance downward.

Klarna is rebranding itself from a BNPL company to a traditional bank.

President Trump told Goldman CEO David Solomon to focus on being a DJ.

Market Recap

Off to the Races!

Let’s go! The market is back to its usual winning ways, with both indexes notching another record high. The S&P ended the day +1.1% while the NASDAQ finished +1.4% all thanks to the CPI report.

The report came in a tad bit lower, with yearly prices increasing 2.7% versus economists’ forecast of 2.8%. While it’s not a huge beat, it is extremely important within the context of the current tariff policy, which investors fear will spike inflation hard.

So, given that context, anything that’s not skyrocketing inflation is a massive win.

More importantly, this paves the way for the Fed to cut rates. Traders are now pricing in a 94% probability of a September cut since inflation fears seem (somewhat) allayed. That’s pretty much all but done.

Outside of that, the US and China agreed to another 90-day extension in their ongoing trade tit-for-tat, another great sign for the market.

According to Bank of America and Morgan Stanley, this report effectively confirms a rate cut, and both firms are bullish on stocks for the next 6-12 months. Based on BofA’s investor flow activity data, clients piled into equity for a second straight week last week. Inflows into single stocks hit $4.3 billion, which is the most over one week in years.

What's Ripe

American Airlines (AAL) 12.0%

American Airlines hit a major milestone, with Q2 revenue of $14.4 billion driven by strong demand for premium + international seating despite a 36% increase in storm-related disruptions.

Its partnership with Mastercard as the exclusive payments network also boosted the AAdvantage rewards program.

Intel (INTC) 5.6%

Just days after calling for the CEO’s resignation over conflicts of interest tied to China, President Trump gave praise to Lip-Bu Tan, sending shares up.

Trump praised Tan’s “amazing story” and said the meeting was very interesting, signaling a path to cooperation.

What's Rotten

Cardinal Health (CAH) 7.2%

Cardinal Health reported earnings and announced a major $1.9 billion acquisition of Solaris Health, and investors liked neither.

Although the company beat on EPS with $2.08, revenue of $60.2 billion fell short of expectations.

H&R Block (HRB) 5.4%

Despite beating on revenue ($1.1 billion versus $1.0 billion forecasted) and reporting 4.6% year-over-year rev growth, HRB missed on EPS ($2.27 versus $2.83).

The revenue growth, which did little to dazzle investors, along with the earnings miss, sent the stock down.

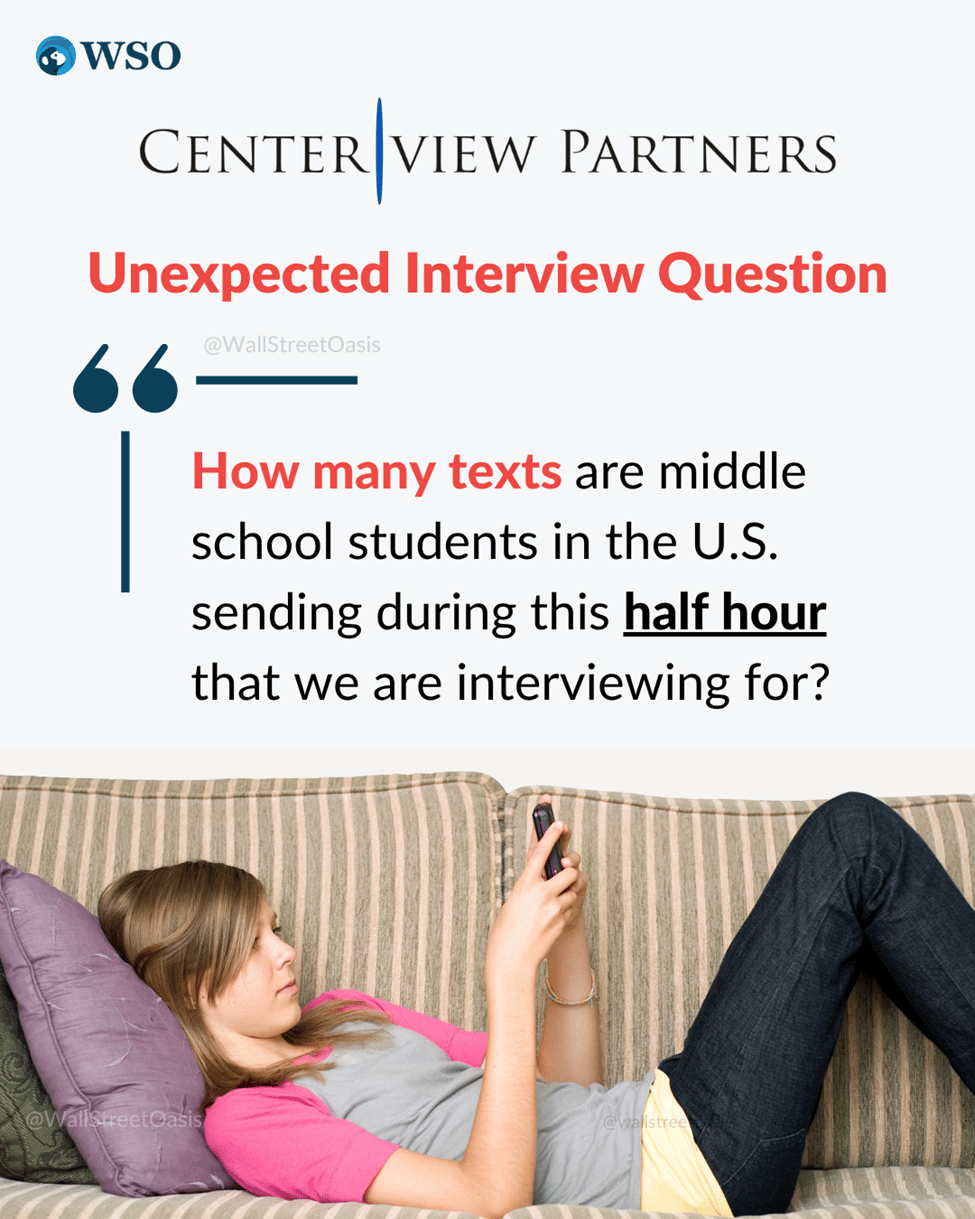

🧠 Technical Trip

Interview Q&A from Centerview

👉 Want 1-on-1 recruiting help from Centerview bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

Check out an equity research report applying insights from our Investment Banking and Investment Analysis courses.

🦈 Deal News

M&A, IPOs, And Other Notable Transactions

Perplexity offers a Hail Mary to buy Google’s Chrome browser for $34.5 billion.

Cardinal Health announced a deal to acquire Solaris Health for a reported $1.9 billion.

Bayer is paying Kumquat Biosciences ~$1.3 billion for access to a potential new cancer medicine, hoping to boost its pharma division’s growth.

Canada’s Gildan activewear is in late-stage talks for a $5 billion deal with Hanesbrands.

Ticket company StubHub updated its IPO filing to reflect a revenue jump. The company is looking to go public at a ~$13 billion valuation.

Mubadala Investment Co.’s asset management unit is teaming up with Cain International on a new venture that seeks to deploy billions of dollars into global luxury real estate.

Peabody will decide next week whether it is moving forward or not on a $3.8 billion deal for Anglo American mines.

Ecolab to acquire Ovivo unit for $1.8 billion to enhance water tech amid AI-driven cooling demand.

📊The Daily Poll

US–China 90-day trade extension is a |

Previous Poll:

Biggest market driver this week?

CPI data: 52.8% // Fedspeak: 11.2% // PPI & Jobs: 19.2% // Trump–Putin meet: 16.8%

Banana Brain Teaser

Previous

Of the 300 subjects who participated in an experiment using virtual reality to reduce their fear of heights, 40% experienced sweaty palms, 30% experienced vomiting, and 75% experienced dizziness. If all of the subjects experienced at least one of these effects and 35%$ of the subjects experienced exactly two of these effects, how many of the subjects experienced only one of these effects?

Answer: 180

Today

How many prime numbers between 1 and 100 are factors of 7,150?

History provides a crucial insight regarding market crises: they are inevitable, painful, and ultimately surmountable.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick