- The Peel

- Posts

- Consumer Mood Still Low

Consumer Mood Still Low

U.S. consumer sentiment stayed muted as budget worries lingered.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks closed green on Friday, pushing for a Santa rally

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Lesson from the Library: Understand how firms restructure debt, stabilize operations, and recover value under stress.

Technical Trip: Interview Question with Morgan Stanley

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

Market Snapshot

📉 Banana Bits

Japanese bonds kept sliding as a weak yen fueled rate-hike bets.

Ukraine and the U.S. are set for another round of talks this Sunday.

Interactive Brokers is applying for a national trust bank charter.

ByteDance is on pace for a $50B profit in 2025.

U.S. consumer sentiment stayed muted as budget worries lingered.

RBI minutes show rates were cut over growth concerns and low inflation.

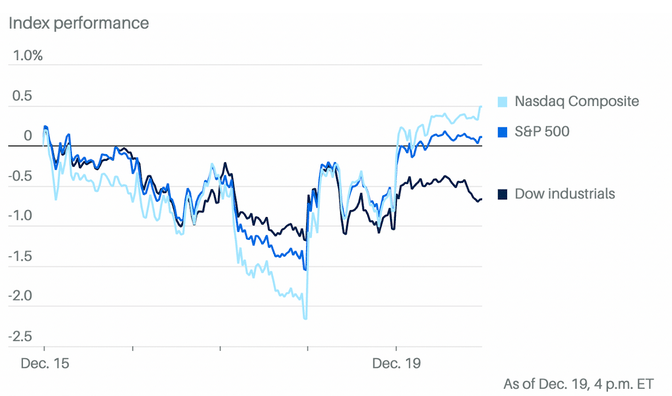

Market Recap

Stocks Closed Green on Friday, Pushing for a Santa Rally

The stock market’s late-week rally continued on Friday to help lift the S&P 500 to a slight weekly gain.

The Nasdaq Composite did even better. The S&P 500 closed 0.9% higher on the day to lock in a weekly gain of 0.1%. The index fell last week, avoiding its first back-to-back weekly declines since June 20. The tech-heavy Nasdaq rose 1.3% today, or 0.4% on the week.

The Dow Jones Industrial Average rose 183 points, or 0.4%, but dropped 0.6% on the week.

It was a quiet day for Wall Street traders. The University of Michigan’s consumer sentiment index, at 52.9, was a touch below expectations of 53.4, but Wall Street was still in a jolly mood following yesterday’s cooler-than-expected consumer price index.

U.S. stocks are looking to reverse an unusual December slump following a tame inflation reading and some positive signals about artificial-intelligence demand. That strengthens the case for a Santa Claus rally over the 2025 home stretch.

The S&P 500 SPX +0.88% remains in negative territory for the month and ended last week modestly in the red, despite a rally that added 1.7% to the benchmark on Thursday and Friday.

What's Ripe

Amicus Therapeutics Inc. (FOLD) 30.2%

FOLD jumped 30% to $14.18 after BioMarin Pharmaceutical reached an agreement to acquire the biotech peer for roughly $4.8 billion in cash.

BioMarin will pay $14.50 a share for Amicus, a 33% premium to Amicus’s closing price on Thursday of $10.89. BioMarin rose 18%.

Carnival Corp. (CCL) 9.8%

CCL surged 9.8% after the cruise company’s fiscal fourth-quarter earnings beat analysts’ estimates and it issued strong guidance for the current fiscal year.

Carnival’s first-quarter per-share earnings guidance was slightly below Wall Street expectations, but its fiscal-year outlook for $2.48 a share was higher than the consensus of $2.44.

What's Rotten

Nike Inc. (NKE) 10.5%

NKE slumped 11% after the athletic apparel retailer posted earnings for its fiscal second quarter.

The results paint a muddled picture: Although Nike topped earnings and revenue expectations, investors were disappointed about declining profit and lackluster sales in China.

KB Home (KBH) 8.5%

KBH declined 8.5% after the home builder’s quarterly earnings missed analysts’ estimates and it delivered fewer homes in its fiscal fourth quarter.

🧠 Technical Trip

Interview Q&A from Barclays

👉 Want 1-on-1 recruiting help from Barclays bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Corporate Restructuring Program: Fixing Businesses Under Pressure

Understand how firms restructure debt, stabilize operations, and recover value under stress.

🌟 WSO Academy Q4 Update

🎤 WSO Academy Speaker Series

We’ve now hosted four Speaker Series events with great guests across Investment Banking, Hedge Funds, and Asset/Wealth Management, and plenty more are in the works. Students can watch these past events on their dashboard:

Scott L. Bok – Chairman & CEO of Greenhill & Co.

Michael Harris – Vice Chairman & Global Head of Capital Markets at the New York Stock Exchange

Zach Levenick – Founder, THG Securities Advisors

John Morgan – Chief Investment Officer, Morgan Capital Family Office

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Hedge fund Infini bought Ruyi shares ahead of a penalty deadline.

Uber and Lyft teamed up with Baidu to launch robotaxi trials in the UK.

Golden Gate kicked off a $1.8B tender as PE shifts capital strategy.

A record $350B deal boom is driving optimism for Japan’s M&A market.

BioMarin is buying Amicus in a $4.8B rare-disease bet.

Lovable raised fresh funding at a $6.6B valuation after tripling revenue.

📊The Daily Poll

U.S. consumer sentiment is still sad. What's your current spending vibe? |

Previous Poll:

Would you actually shop for groceries via ChatGPT?

Yes, instantly: 16.0% // Maybe, for basics: 24.0% // Only to compare prices: 32.0% // Absolutely not: 28.0%

Banana Brain Teaser

Previous

What is the smallest integer n for which 25^n> 5^12?

Answer: 7

Today

When a certain tree was first planted, it was 4 feet tall, and the height of the tree increased by a constant amount each year for the next 6 years. At the end of the 6th year, the tree was 1/5 taller than it was at the end of the 4th year. By how many feet did the height of the tree increase each year?

The person who turns over the most rocks wins the game.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick