- The Peel

- Posts

- Consumer Confidence Falls

Consumer Confidence Falls

U.S. consumer confidence declines again as Americans worry about prices and the job market.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Markets mixed as shutdown fears ease

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Certerview Partners

Deal Dispatch: M&A, IPOs, and other transactions

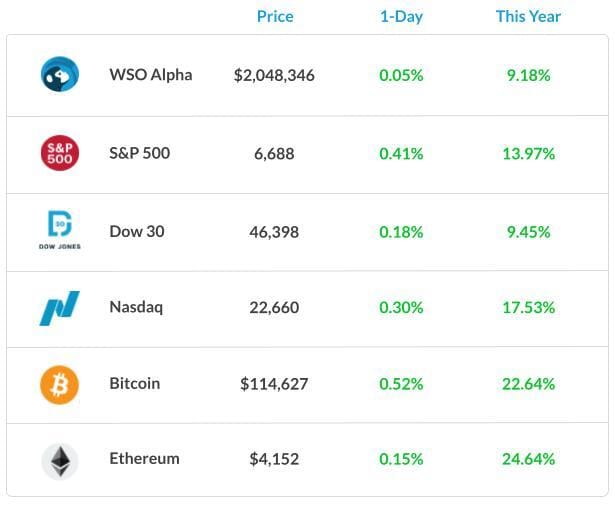

Market Snapshot

📉 Banana Bits

Morning Bid: Shutdown talks go to the wire as Q3 ends.

Dow scores record amid shutdown risk; Nvidia breaks out.

FTSE 100 heads for best quarter since 2022.

U.S. consumer confidence declines again as Americans worry about prices and the job market.

Stocks down, volatility up as D.C. shutdown looms.

Demand for UK Government debt falls as political risks spook the bond market.

Bitcoin price heads lower. What political uncertainty means for cr*ptos.

"Blueflame’s IC memo analysis automation saved me over 10 hours this weekend—I actually got to play golf." That’s what a partner at a $20B+ private equity firm said after using Blueflame’s AI.

We love hearing how Blueflame AI is helping our clients reclaim time to do what they love. Set up a personalized demo with our team to learn more.

Market Recap

Markets End Q3 Mixed Amid Shutdown Jitters

Stocks closed mixed today as investors weighed the impact of political uncertainty against strong corporate momentum.

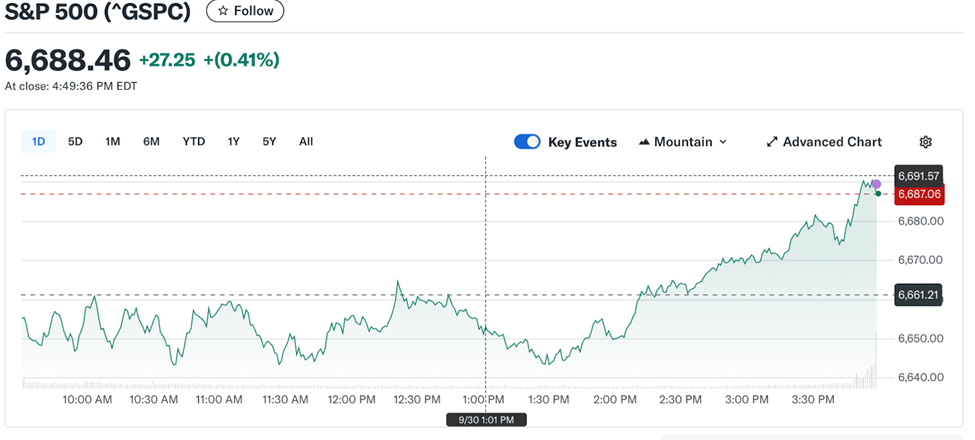

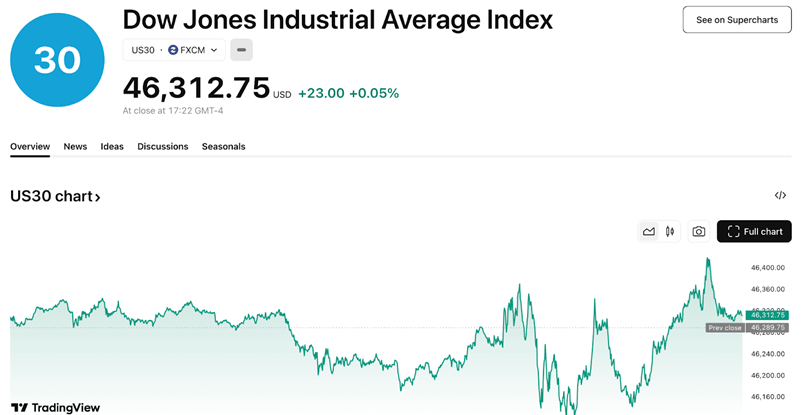

The Dow increased by about 0.2%, while the S&P 500 rose 0.4% and the Nasdaq gained 0.3%. Markets initially struggled with fear of a shutdown, but they recovered thanks to late-day buying.

Bond markets saw more interest as long-term Treasuries attracted safe-haven flows. The 10-year Treasury yield decreased to around 4.15% which reflects how investors are attempting to be more cautious. This happened even as economic data showed resilience in consumer spending.

Despite many political events, September finished off as one of the strongest months for equities in recent years. Investor optimism has been fueled by enthusiasm for technology and AI stocks. Analysts are now shifting focus towards Q4 earnings developments.

What's Ripe

Pfizer. (PFE) 6.8%

The tariff relief removed a major problem for its international operations.

The discounted drug platform initiative adds a long-term catalyst beyond just the tariff news.

Nvidia (NVDA) 2.6%

Continued strength in AI and semiconductors is fueling a lot of investor enthusiasm in the industry.

The breakout signals growing technical momentum.

What's Rotten

Spotify (SPOT) 4.2%

A leadership transition creates uncertainty about the future strategy and direction of the company.

The market is likely pricing it down due to concerns around disruptions to the company’s core operations.

Samsung 0.15%

Its shares slipped slightly as investors rotated out of large-cap tech following a very strong September for the company.

Concerns still remain around geopolitical risks, particularly U.S. limits on advanced chip sales to China, which could affect future earnings streams.

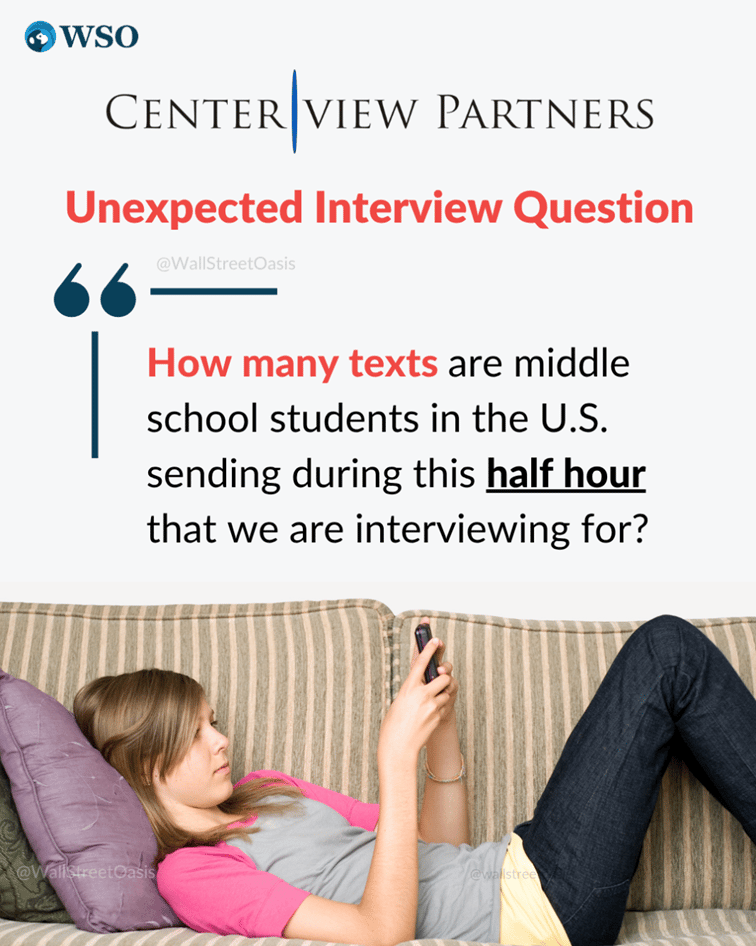

🧠 Technical Trip

Interview Question with Certerview Partners

👉 Want 1-on-1 recruiting help from Certerview Partners bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

HNI’s $2.2B acquisition of Steelcase advances financing step.

Stout acquires Appraisers & Planners, Inc.

Prada gets EU approval for Versace acquisition.

EA to be acquired by PIF, Silver Lake, and Affinity Partners for $55B.

Iron Horse Acquisitions completes business combination with China Food Investment.

Banana Brain Teaser

Previous

If p is the product of the integers from 1 to 30, inclusive, what is the greatest integer k for which 3^k is a factor of p?

Answer: 14

Today

A pharma company received $3 million in royalties on the first $20 million sales of the generic equivalent of one of its products and then $9 million in royalties on the next $108 million in sales. By approximately what percent did the ratio of royalties to sales decrease from the first $20 million in sales to the next $108 million in sales?

Know your circle of competence, and stick within it.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick